Name

Keltner通道突破回抽策略Keltner-Channel-Pullback-Strategy

Author

ChaoZhang

Strategy Description

[trans]

本策略基于Keltner通道指标设计了一个回抽交易策略。该策略通过比较价格与Keltner通道上下轨的关系,判断价格可能反转的时机,采取适当的做多做空操作。

本策略使用Keltner通道指标判断价格趋势。Keltner通道由均线和平均真实波幅(ATR)构成。通道上轨等于均线加上ATR的N倍;下轨等于均线减去ATR的N倍。当价格从下向上突破通道下轨时,认为多头力量增强,可以做多;当价格从上向下突破通道上轨时,认为空头力量增强,可以做空。

另外,本策略判断回抽机会的依据是价格重新触碰或突破通道边界。比如,价格上涨突破下轨后,在没有触碰上轨的情况下再次下跌触碰下轨,这就是一个做多回抽的机会。策略会在这个时候开仓做多。

这是一个利用价格回抽特性进行交易的策略。它的优势在于:

- 使用Keltner通道判断价格趋势方向,可以有效过滤噪音。

- adopt回抽策略,可以在反转前进入场内,捕捉较大行情。

该策略的主要风险在于:

- 市场长期单边行情时,回抽机会可能不多,无法获利。

- 回抽信号判断不准确时,可能导致亏损。

对策:

- 优化参数,调整通道宽度,适应市场环境。

- 加大仓位管理,降低单笔损失。

该策略可以从以下几个方面进行优化:

- 基于交易量的突破过滤,避免虚假突破。

- 根据波动率调整仓位大小。

- 更新止损方式,移动止损以锁定更多利润。

本策略整合了趋势判断和回抽交易的方法,在捕捉反转行情方面具有独特优势。通过参数调整和功能扩展,可以进一步增强策略的稳定性和盈利能力。

||

This strategy designs a pullback trading strategy based on the Keltner Channel indicator. It judges the timing of potential price reversals by comparing the price with the upper and lower rails of the Keltner Channel, and takes appropriate long and short positions.

This strategy uses the Keltner Channel indicator to judge price trends. The Keltner Channel consists of a moving average and average true range (ATR). The upper rail equals the moving average plus N times ATR; the lower rail equals the moving average minus N times ATR. When the price breaks through the lower rail of the channel from bottom up, it is considered that the bullish power is enhanced and long positions can be taken; when the price breaks through the upper rail from top down, it is considered that the bearish power is enhanced and short positions can be taken.

In addition, the basis for the strategy to judge pullback opportunities is that the price touches or breaks through the channel boundary again. For example, after the price rises to break through the lower rail, if it falls again to touch the lower rail without touching the upper rail, it is an opportunity to take a long pullback. The strategy will open long positions at this time.

This is a trading strategy that utilizes the pullback characteristics of prices. Its advantages are:

- Using Keltner Channel to judge the direction of price trends can effectively filter out noise.

- Adopting pullback strategy can enter the market ahead of reversals and capture larger trends.

The main risks of this strategy are:

- In long term one-way markets, there may be fewer pullback opportunities, unable to profit.

- Inaccurate judgment of pullback signals may lead to losses.

Countermeasures:

- Optimize parameters to adjust channel width to adapt to market conditions.

- Increase position management to reduce single loss.

The strategy can be optimized in the following aspects:

- Breakthrough filtering based on trading volume to avoid false breakthroughs.

- Adjust position size based on volatility.

- Update stop loss methods with moving stops to lock in more profits.

This strategy integrates trend judgment and pullback trading methods, and has unique advantages in capturing reversal trends. By adjusting parameters and expanding functions, the stability and profitability of the strategy can be further enhanced.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 200 | Keltner EMA Period Length |

| v_input_2 | 200 | Keltner ATR Period Length (the same as EMA length in classic Keltner Channels) |

| v_input_3 | 8 | Keltner band width (in ATRs) |

| v_input_4 | false | Close trade on EMA touch? (less drawdown, but less profit and higher commissions impact) |

| v_input_5 | false | Enter on border touch from inside? (by default from outside, which is less risky but less profitable) |

| v_input_6 | 50 | Stop loss in ticks (leave zero to skip) |

| v_input_7 | true | Trade size |

Source (PineScript)

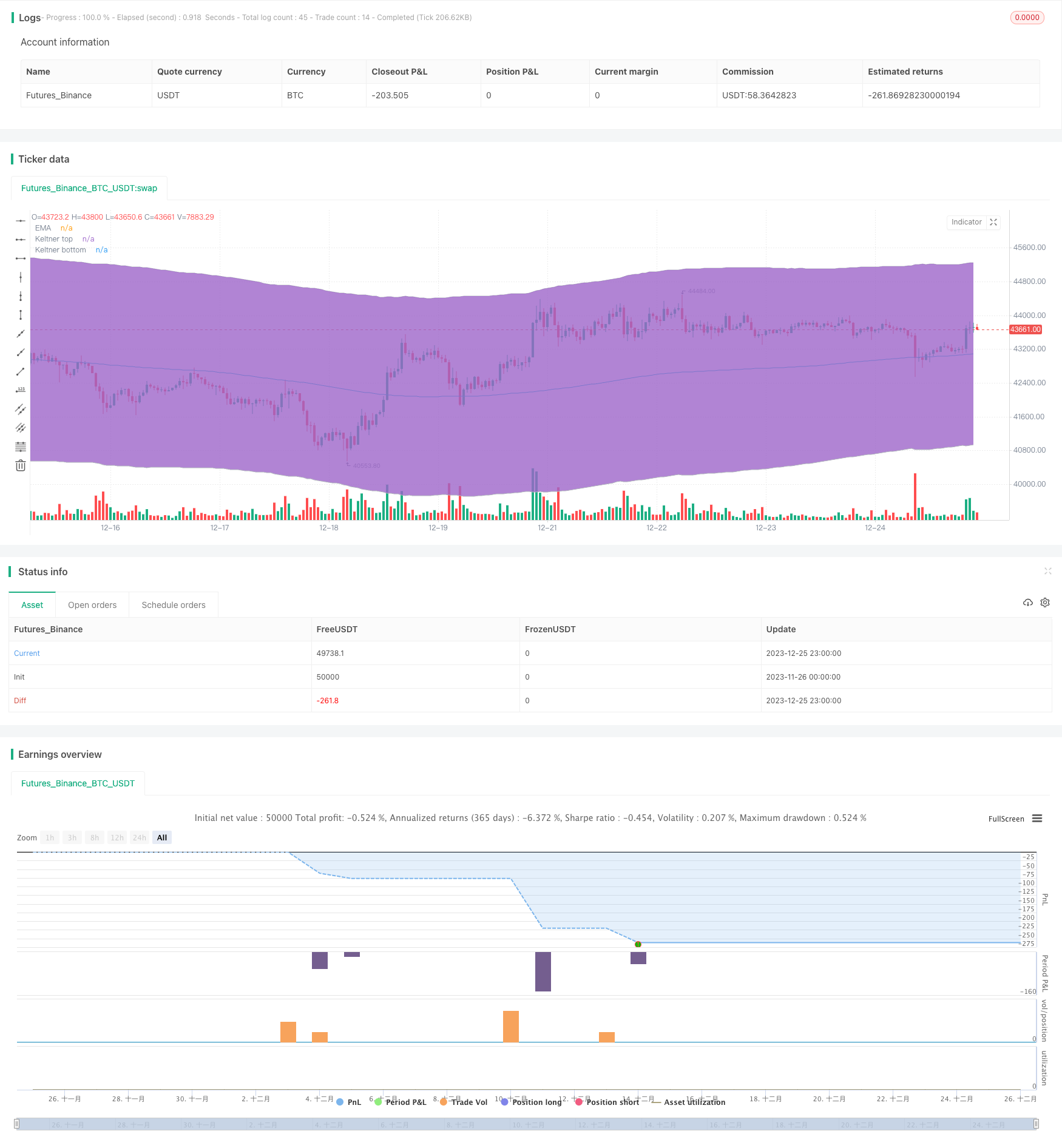

/*backtest

start: 2023-11-26 00:00:00

end: 2023-12-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Keltner bounce from border. No repaint. (by Zelibobla)", shorttitle="Keltner border bounce", overlay=true)

price = close

// build Keltner

keltnerLength = input(defval=200, minval=1, title="Keltner EMA Period Length")

keltnerATRLength = input(defval=200, minval=1, title="Keltner ATR Period Length (the same as EMA length in classic Keltner Channels)")

keltnerDeviation = input(defval=8, minval=1, maxval=15, title="Keltner band width (in ATRs)")

closeOnEMATouch = input(type=bool, defval=false, title="Close trade on EMA touch? (less drawdown, but less profit and higher commissions impact)")

enterOnBorderTouchFromInside = input(type=bool, defval=false, title="Enter on border touch from inside? (by default from outside, which is less risky but less profitable)")

SL = input(defval=50, minval=0, maxval=10000, title="Stop loss in ticks (leave zero to skip)")

EMA = sma(price, keltnerLength)

ATR = atr(keltnerATRLength)

top = EMA + ATR * keltnerDeviation

bottom = EMA - ATR * keltnerDeviation

buyEntry = crossover(price, bottom)

sellEntry = crossunder(price, top)

plot(EMA, color=aqua,title="EMA")

p1 = plot(top, color=silver,title="Keltner top")

p2 = plot(bottom, color=silver,title="Keltner bottom")

fill(p1, p2)

tradeSize = input(defval=1, minval=1, title="Trade size")

if ( enterOnBorderTouchFromInside and crossunder(price, bottom) )

strategy.entry("BUY", strategy.long, qty=tradeSize, comment="BUY")

else

if( crossover(price, bottom) )

strategy.entry("BUY", strategy.long, qty=tradeSize, comment="BUY")

if( crossover(price,EMA) and closeOnEMATouch )

strategy.close("BUY")

if( 0 != SL )

strategy.exit("EXIT BUY", "BUY", qty=tradeSize, loss=SL)

strategy.exit("EXIT SELL", "SELL", qty=tradeSize, loss=SL)

if( enterOnBorderTouchFromInside and crossover(price, bottom) )

strategy.entry("SELL", strategy.long, qty=tradeSize, comment="SELL")

else

if ( crossunder(price, top) )

strategy.entry("SELL", strategy.short, qty=tradeSize, comment="SELL")

if( crossunder(price, EMA) and closeOnEMATouch )

strategy.close("SELL")

Detail

https://www.fmz.com/strategy/436758

Last Modified

2023-12-27 14:49:39