Name

EMA黄金交叉回调策略EMA-Pullback-Strategy

Author

ChaoZhang

Strategy Description

EMA黄金交叉回调策略是一种基于EMA指标的量化交易策略。该策略使用三条不同周期的EMA曲线构建交易信号,并结合价格回调机制设定止损止盈,实现自动化交易。

该策略使用三条EMA曲线,分别是:

- EMA1:用于判断价格回调支撑/阻力位,周期较短,默认为33周期。

- EMA2:用于过滤掉部分反转信号,周期为EMA1的5倍,默认为165周期。

- EMA3:用于判断总体趋势方向,周期为EMA1的11倍,默认为365周期。

交易信号的产生遵循以下逻辑:

多头信号:价格上穿EMA1constitutes后发生回调,在EMA1上方形成更高低点,回调幅度未触及EMA2。满足条件后,在再次上穿EMA1时做多。

空头信号:价格下穿EMA1后发生回调,在EMA1下方形成更低高点,回调幅度未触及EMA2。满足条件后,在再次下穿EMA1时做空。

止损方式为回调最低价/最高价。止盈设置为止损的2倍。

该策略具有以下优势:

- 使用EMA指标构建交易信号,可靠性较高。

- 结合价格回调机制,可有效避免被套。

- 停损点设置在之前高低位,有效控制风险。

- 按照止盈止损比例设置止盈点,满足盈亏比要求。

- 可根据市场调整EMA参数,适应不同周期。

该策略也存在一定风险:

- EMA指标存在滞后,可能错过趋势反转点。

- 回调范围过大超过EMA2 may generate false signals。

- 趋势行情中止损可能被突破。

- 参数设置不当可能导致过于频繁交易或漏失机会。

可以通过调整EMA周期、回调限制范围等方法优化参数。也可以结合其他指标过滤信号。

该策略还可从以下几个方面进行优化:

- 增加趋势指标判断,避免逆势交易。例如加入MACD。

- 添加交易量指标,避免虚假突破。例如加入OBV。

- 优化EMA周期参数,或采用自适应EMA。

- 结合词袋模型等机器学习方法动态优化参数。

- 加入模型预测,设置自适应止损止盈。

EMA黄金交叉回调策略通过构建三EMA交易系统,结合价格回调特性设定止盈止损,实现了自动化交易。该策略有效控制了交易风险,且可根据市场通过调整参数进行优化。总体来说,该策略逻辑合理,可实际应用。未来可从趋势判断、参数优化、风险控制等方面进行进一步优化。

||

The EMA pullback strategy is a quantitative trading strategy based on the EMA indicator. It constructs trading signals using three EMA curves with different periods and sets stop loss and take profit based on price pullbacks to automate trading.

The strategy uses three EMA curves:

- EMA1: for judging price pullback support/resistance level, with a relatively short period, default to 33 periods.

- EMA2: for filtering some reversal signals, with a period of 5 times of EMA1, default to 165 periods.

- EMA3: for determining overall trend direction, with a period of 11 times of EMA1, default to 365 periods.

Trading signals are generated according to the following logic:

Long signal: Price crosses above EMA1, pulls back below EMA1 forming higher lows, with pullback not reaching EMA2. Enter long when price crosses back above EMA1.

Short signal: Price crosses below EMA1, pulls back above EMA1 forming lower highs, with pullback not reaching EMA2. Enter short when price crosses back below EMA1.

Stop loss is set at the lowest/highest pullback price for long/short. Take profit is set at 2 times the stop loss.

The strategy has the following advantages:

- Trading signals constructed using reliable EMA indicator.

- Price pullback avoids being trapped effectively.

- Stop loss set at previous high/low controls risk effectively.

- Take profit satisfying risk-reward ratio.

- EMA parameters adjustable for different cycles.

The strategy also has some risks:

- EMA has lagging effect, may miss trend reversal points.

- Pullback range too large exceeding EMA2 may generate false signals.

- Stop loss may be broken in trending markets.

- Improper parameter settings lead to over-trading or missing opportunities.

Risks can be mitigated by adjusting EMA periods, pullback limit etc. Other indicators can also be added to filter signals.

The strategy can also be optimized in the following aspects:

- Add trend indicator to avoid counter-trend trading, e.g. MACD.

- Add trading volume indicator to avoid false breakout, e.g. OBV.

- Optimize EMA periods or use adaptive EMA.

- Dynamically optimize parameters using machine learning models like bag-of-words.

- Add model prediction for adaptive stop loss and take profit.

The EMA pullback strategy constructs a trading system using three EMAs and sets stop loss and take profit based on price pullbacks to automate trading. It effectively controls trading risks and can be optimized by adjusting parameters based on market conditions. Overall the strategy has sound logic and can be applied in actual trading. Future improvements can be made in aspects like trend determination, parameter optimization and risk control.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 2.06 | Take Profit Stop Loss ratio |

| v_input_2 | 0.008 | lowest risk per trade |

| v_input_3 | 0.02 | highest risk per trade |

| v_input_4 | 33 | EMA1 for pullback level Period |

| v_input_5 | 165 | EMA2 for pullback limit Period |

| v_input_6 | 365 | EMA3 for trend Period |

| v_input_7 | true | Start Date |

| v_input_8 | true | Start Month |

| v_input_9 | 2018 | Start Year |

Source (PineScript)

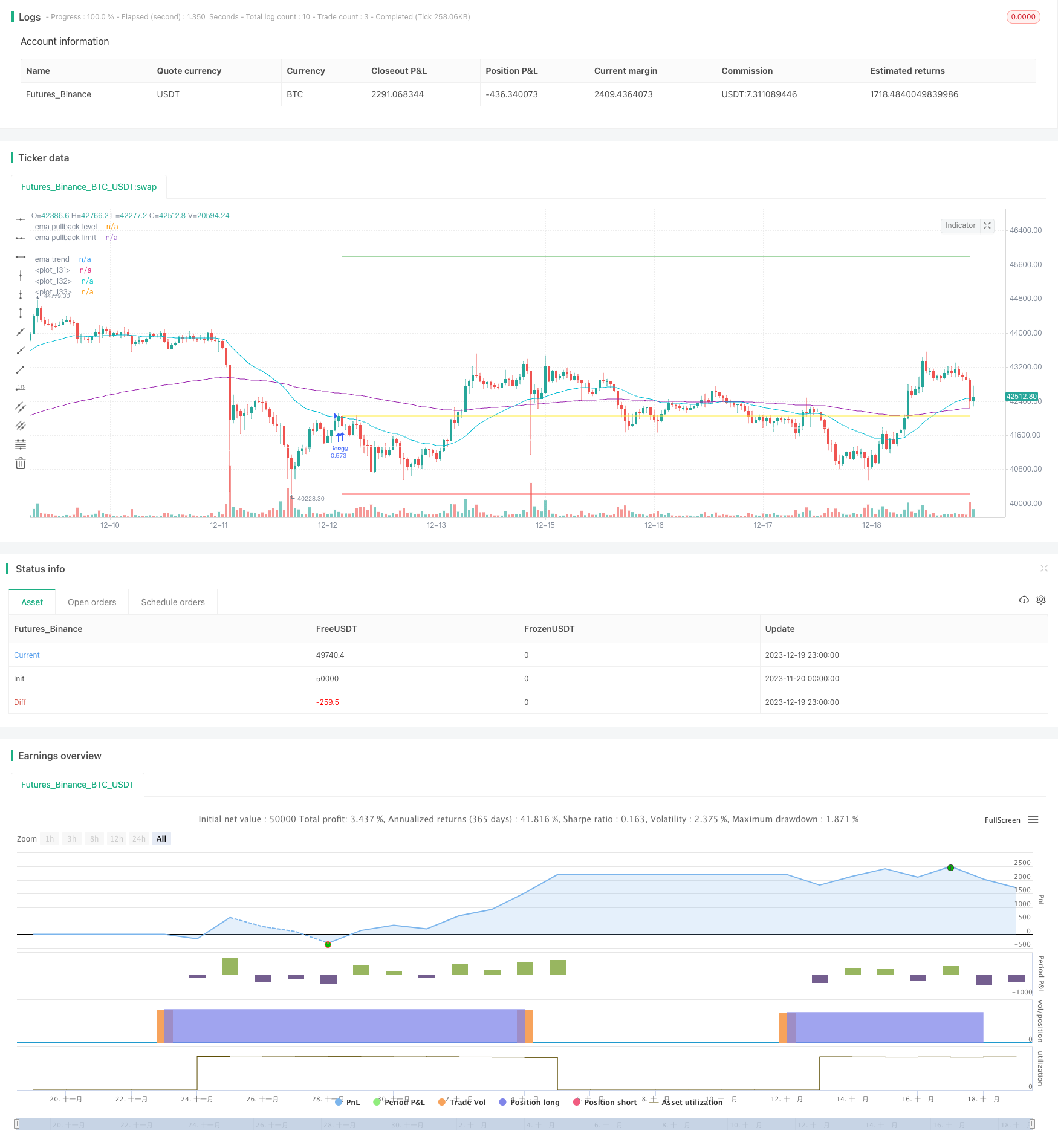

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// created by Space Jellyfish

//@version=4

strategy("EMA pullback strategy", overlay = true, initial_capital=10000, commission_value = 0.075)

target_stop_ratio = input(title="Take Profit Stop Loss ratio", type=input.float, defval=2.06, minval=0.5, maxval=100)

riskLimit_low = input(title="lowest risk per trade", type=input.float, defval=0.008, minval=0, maxval=100)

riskLimit_high = input(title="highest risk per trade", type=input.float, defval=0.02, minval=0, maxval=100)

//give up the trade, if the risk is smaller than limit, adjust position size if risk is bigger than limit

ema_pullbackLevel_period = input(title="EMA1 for pullback level Period", type=input.integer, defval=33, minval=1, maxval=10000)

ema_pullbackLimiit_period = input(title="EMA2 for pullback limit Period", type=input.integer, defval=165, minval=1, maxval=10000)

ema_trend_period = input(title="EMA3 for trend Period", type=input.integer, defval=365, minval=1, maxval=10000)

startDate = input(title="Start Date", type=input.integer, defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer, defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer, defval=2018, minval=2008, maxval=2200)

inDateRange = (time >= timestamp(syminfo.timezone, startYear, startMonth, startDate, 0, 0))

ema_pullbackLevel = ema(close, ema_pullbackLevel_period)

ema_pullbackLimit = ema(close, ema_pullbackLimiit_period)

ema_trendDirection = ema(close, ema_trend_period)

//ema pullback

float pricePullAboveEMA_maxClose = na

float pricePullAboveEMA_maxHigh = na

float pricePullBelowEMA_minClose = na

float pricePullBelowMA_minLow = na

if(crossover(close, ema_pullbackLevel))

pricePullAboveEMA_maxClose := close

pricePullAboveEMA_maxHigh := high

else

pricePullAboveEMA_maxClose := pricePullAboveEMA_maxClose[1]

pricePullAboveEMA_maxHigh := pricePullAboveEMA_maxHigh[1]

if(close > pricePullAboveEMA_maxClose)

pricePullAboveEMA_maxClose := close

if(high > pricePullAboveEMA_maxHigh)

pricePullAboveEMA_maxHigh := high

if(crossunder(close, ema_pullbackLevel))

pricePullBelowEMA_minClose := close

pricePullBelowMA_minLow := low

else

pricePullBelowEMA_minClose :=pricePullBelowEMA_minClose[1]

pricePullBelowMA_minLow:=pricePullBelowMA_minLow[1]

if(close < pricePullBelowEMA_minClose)

pricePullBelowEMA_minClose := close

if(low < pricePullBelowMA_minLow)

pricePullBelowMA_minLow := low

long_strategy = crossover(close, ema_pullbackLevel) and pricePullBelowEMA_minClose < ema_pullbackLimit and ema_pullbackLevel>ema_trendDirection

short_strategy = crossunder(close, ema_pullbackLevel) and pricePullAboveEMA_maxClose > ema_pullbackLimit and ema_pullbackLevel<ema_trendDirection

var open_long_or_short = 0// long = 10000, short = -10000, no open = 0

//check if position is closed

if(strategy.position_size == 0)

open_long_or_short := 0

else

open_long_or_short := open_long_or_short[1]

float risk_long = na

float risk_short = na

float stopLoss = na

float takeProfit = na

float entry_price = na

float entryContracts = 0

risk_long := risk_long[1]

risk_short := risk_short[1]

//open a position determine the position size

if (strategy.position_size == 0 and long_strategy and inDateRange)

risk_long := (close - pricePullBelowMA_minLow) / close

if(risk_long < riskLimit_high)

entryContracts := strategy.equity / close

else

entryContracts := (strategy.equity * riskLimit_high / risk_long)/close

if(risk_long > riskLimit_low)

strategy.entry("long", strategy.long, qty = entryContracts, when = long_strategy)

open_long_or_short := 10000

if (strategy.position_size == 0 and short_strategy and inDateRange)

risk_short := (pricePullAboveEMA_maxHigh - close) / close

if(risk_short < riskLimit_high)

entryContracts := strategy.equity / close

else

entryContracts := (strategy.equity * riskLimit_high / risk_short)/close

if(risk_short > riskLimit_low)

strategy.entry("short", strategy.short, qty = entryContracts, when = short_strategy)

open_long_or_short := -10000

//take profit / stop loss

if(open_long_or_short == 10000)

stopLoss := strategy.position_avg_price*(1 - risk_long)

takeProfit := strategy.position_avg_price*(1 + target_stop_ratio * risk_long)

entry_price := strategy.position_avg_price

strategy.exit("Long exit","long", limit = takeProfit , stop = stopLoss)

if(open_long_or_short == -10000)

stopLoss := strategy.position_avg_price*(1 + risk_short)

takeProfit := strategy.position_avg_price*(1 - target_stop_ratio * risk_short)

entry_price := strategy.position_avg_price

strategy.exit("Short exit","short", limit = takeProfit, stop = stopLoss)

plot(ema_pullbackLevel, color=color.aqua, title="ema pullback level")

plot(ema_pullbackLimit, color=color.purple, title="ema pullback limit")

plot(ema_trendDirection, color=color.white, title="ema trend")

plot(entry_price, color = color.yellow, linewidth = 1, style = plot.style_linebr)

plot(stopLoss, color = color.red, linewidth = 1, style = plot.style_linebr)

plot(takeProfit, color = color.green, linewidth = 1, style = plot.style_linebr)

//

Detail

https://www.fmz.com/strategy/436103

Last Modified

2023-12-21 11:48:54