Name

霍尔移动平均线过滤策略Hull-Filter-Moving-Average-Strategy

Author

ChaoZhang

Strategy Description

该策略使用短期和长期两个霍尔移动平均线进行交易信号的生成和过滤。短期霍尔移动平均线用于信号的生成,而长期霍尔移动平均线用于过滤信号,只有短期霍尔平均线和长期霍尔平均线同向变化的时候才会产生交易信号。

该策略同时使用ATR指标来设置止损和止盈位。每次开仓时,会根据ATR的值来动态设置当前头寸的止损位和止盈位。

短期霍尔移动平均线用于捕捉价格的短期趋势和转折点。当短期霍尔移动平均线的方向发生转变时,说明价格的短期趋势发生了改变。

长期霍尔移动平均线用于判断价格的总体走势。例如,当长期霍尔移动平均线的方向为上升时,说明价格处于总体上升趋势中。

只有当短期霍尔移动平均线发生转折,并且其转折方向与长期霍尔移动平均线的总体走势方向一致时,才会产生交易信号。也就是说,只在价格短期趋势转变的同时,总体走势也在同一方向变化时,才对这一短期信号进行交易。这可以有效过滤掉短期市场噪音造成的错误信号。

在开仓建立头寸后,会根据ATR指标的大小来设定止损位和止盈位。ATR指标能反映市场的波动程度和风险水平。止损位置会放置在价格低点之下,而止盈位置会放置在价格高点之上,并且都会与ATR值挂钩,根据市场波动程度来调整止损止盈的范围。

该策略结合了短期信号和长期过滤,能有效识别价格中期的趋势,并及时捕捉转折点。相比单一的移动平均线等指标,可以减少被市场噪音欺骗的可能性。

动态调整止损止盈位置,可以根据市场波动程度来设置合理的止损止盈位,在保证盈利的同时避免过于激进,减小亏损风险。

借助霍尔移动平均线的优点,可以更加灵活和准确的判断价格走势,相比普通移动平均线具有更强的跟踪性能。

该策略依赖短期和长期两个霍尔移动平均线的交叉作为信号,如果两个移动平均线之间产生假交叉,可能会造成错误的入场。这时就需要根据长短期市场结构来决定是否过滤该信号。

在震荡行情中,价格可能在一个较小的交易范围内来回震荡,这会增加信号错误率和增加无谓交易的可能。这时可以通过扩大交易信号过滤条件来避免无谓交易。

止损止盈设置依赖于ATR指标,如果ATR指标反映的市场波动不准确,止损止盈位置也会失效。这时可以考虑结合其他波动率指标来修正ATR值。

可以考虑结合其他短期指标来辅助信号判断,例如RSI等超买超卖指标,从而提高过滤效果。

可以增加或优化长短期霍尔移动平均线之间的过滤逻辑关系,使过滤规则更加严格,避免出现错误信号。

可以研究不同的参数设置对策略稳定性和盈利情况的影响。例如移动平均线参数、ATR参数等的不同组合可以产生不同的交易绩效。

本策略综合利用了短期霍尔移动平均线捕捉信号、长期霍尔移动平均线进行信号过滤和ATR指标设定止损止盈的方法,形成了一套较为完整的中期趋势跟踪策略体系。该策略能有效发现中期价格转折点,避免被短期市场噪音干扰,是建立趋势交易体系的重要选股工具。通过参数优化和辅助条件添加,本策略可以进一步增强信号判断准确性,从而获得更好的绩效表现。

||

This strategy uses short-term and long-term Hull moving averages to generate and filter trading signals. The short-term Hull moving average is used to generate signals, while the long-term Hull moving average is used for filtering signals. Trades are only taken when the short-term Hull moving average changes direction and the long-term Hull moving average is moving in the same overall direction.

The strategy also uses the ATR indicator to dynamically set stop loss and take profit levels when entering trades.

The short-term Hull moving average captures short-term price trends and turning points. When it changes direction, it signals a shift in the short-term price trend.

The long-term Hull moving average determines the overall price trend. For example, when it is rising, prices are in an overall upward trend.

Trades are only taken when the short-term Hull moving average turns direction, and its new direction aligns with the direction of the long-term Hull moving average. This filters out signals that go against the overall trend and may just be short-term market noise.

After entering positions, stop loss and take profit levels are set based on the ATR indicator value. The ATR reflects market volatility and risk levels. The stop loss is placed below price lows while take profit targets price highs, with ranges tied to the current ATR reading.

Combining short-term signals and long-term filters effectively identifies mid-term trends and turning points, avoiding false signals from market noise.

Dynamic stop loss and take profit based on ATR sets reasonable ranges based on current volatility, balancing profit taking and loss prevention.

The Hull moving average has flexibility and accuracy advantages over standard moving averages, with better trend tracking.

The strategy relies on crosses between the Hull moving averages to generate signals. False crosses can result in bad trades, requiring analysis of overall market structure.

In ranging, choppy markets with price oscillating in a trading range, signal errors and unnecessary trades may pile up. This can be avoided by filtering signals with wider conditions during such markets.

Stop loss and take profit reliance on ATR means inaccurate volatility reads will result in bad placement. Other volatility measures can augment ATR to correct this.

Additional short-term indicators like RSI can improve signal accuracy through convergence.

The filter logic between the Hull moving averages can be enhanced to have more strict entry requirements, avoiding false signals.

Parameter tuning research can uncover stability and profitability improvements from changes to moving average lengths, ATR periods, etc.

This strategy combines short-term signal generation, long-term signal filtering, and ATR-based stop loss/take profit in a robust mid-term trend following framework. It capably identifies mid-term inflection points while filtering out short-term noise. With parametric optimizations and added filters, it can achieve even better performance.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | Source: close |

| v_input_2 | 50 | Period of signal HMA |

| v_input_3 | 200 | Period of filter HMA |

| v_input_4 | 0 | Strategy Direction: all |

| v_input_5 | 2 | Stop Loss Factor |

| v_input_6 | 3 | Take Profit Factor |

| v_input_7 | 14 | ATR Period (SL/TP) |

| v_input_8 | 2010 | Backtest Start Year |

| v_input_9 | true | Backtest Start Month |

| v_input_10 | true | Backtest Start Day |

| v_input_11 | 2030 | Backtest Stop Year |

| v_input_12 | 12 | Backtest Stop Month |

| v_input_13 | 31 | Backtest Stop Day |

Source (PineScript)

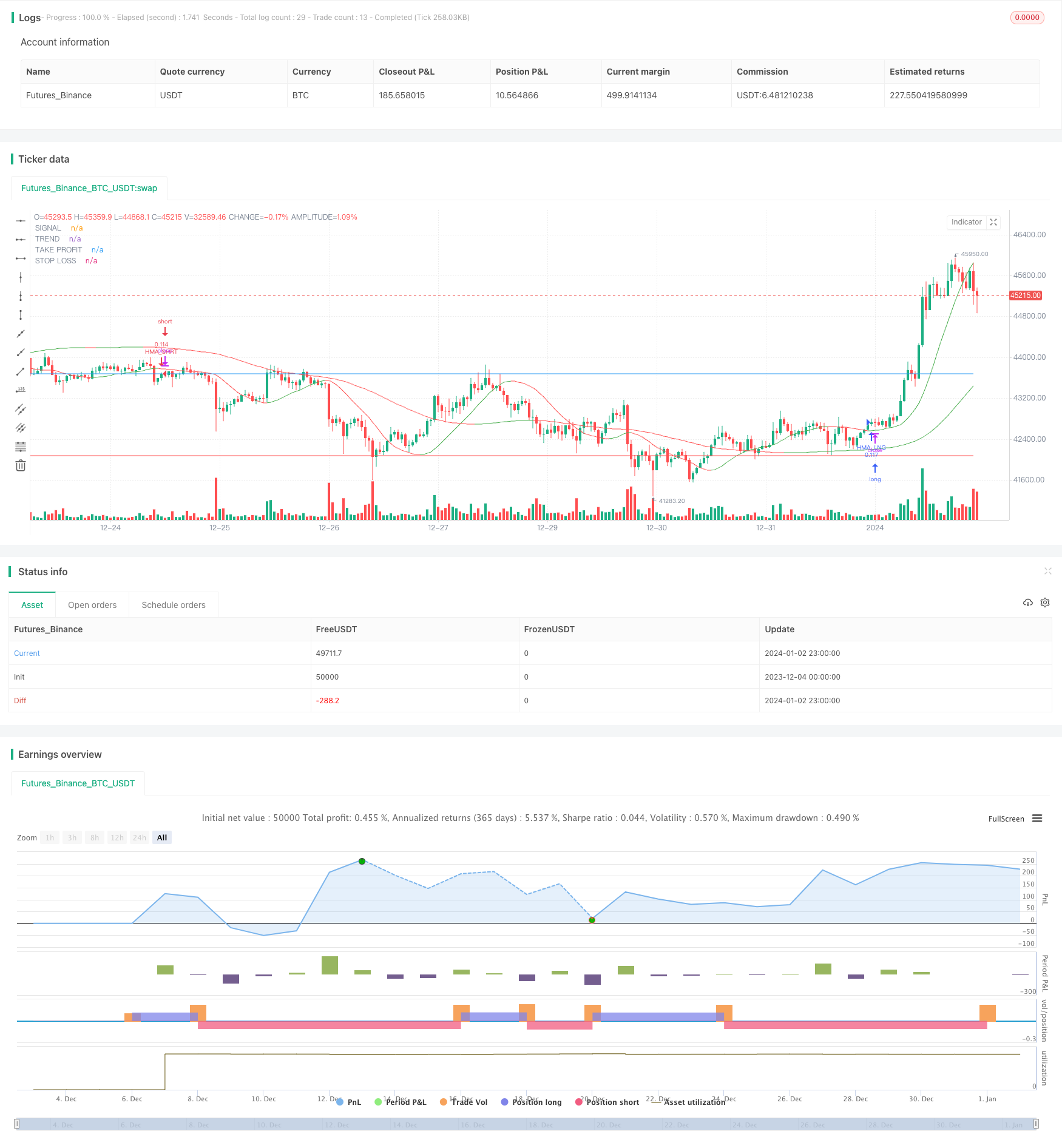

/*backtest

start: 2023-12-04 00:00:00

end: 2024-01-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Hull Filtered Strategy", overlay=true, pyramiding=0, default_qty_type= strategy.percent_of_equity, default_qty_value = 10, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0)

// Parameters for Hull Moving Averages

src = input(close, title="Source")

signal_period = input(50, title="Period of signal HMA")

filter_period = input(200, title="Period of filter HMA")

strat_dir_input = input(title="Strategy Direction", defval="all", options=["long", "short", "all"])

// Set allowed trading directions

strat_dir_value = strat_dir_input == "long" ? strategy.direction.long : strat_dir_input == "short" ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(strat_dir_value)

// stop loss and take profit

sl_factor = input(2,title="Stop Loss Factor")

tp_factor = input(3,title="Take Profit Factor")

atr_period = input(14, title="ATR Period (SL/TP)")

// Testing Start dates

testStartYear = input(2010, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

//Stop date if you want to use a specific range of dates

testStopYear = input(2030, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(31, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

// -----------------------------------------------------------------------------

// Global variables

// -----------------------------------------------------------------------------

var float tp = na

var float sl = na

var float position = na

// -----------------------------------------------------------------------------

// Functions

// -----------------------------------------------------------------------------

testWindow() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

// -----------------------------------------------------------------------------

// The engine

// -----------------------------------------------------------------------------

hma_signal = hma(src, signal_period)

hma_filter = hma(src, filter_period)

// Used to determine exits and stop losses

atr_e = atr(atr_period)

// if hma_filter increases hma_trend is set to 1, if it decreases hma_trend is set to -1. If no trend is available, hma_trend is set to ß0

trend = hma_filter > hma_filter[1] ? 1 : hma_filter < hma_filter[1] ? -1 : 0

signal = hma_signal > hma_signal[1] ? 1 : hma_signal < hma_signal[1] ? -1 : 0

// -----------------------------------------------------------------------------

// signals

// -----------------------------------------------------------------------------

if signal[0] == 1 and signal[1] != 1 and trend == 1 and testWindow()

sl := close - sl_factor*atr_e

tp := close + tp_factor*atr_e

strategy.entry("HMA_LNG", strategy.long)

strategy.exit("LE", "HMA_LNG", profit=100*tp_factor*atr_e, loss=100*sl_factor*atr_e)

if signal[0] == -1 and signal[1] != -1 and trend == -1 and testWindow()

sl := close + sl_factor*atr_e

tp := close - tp_factor*atr_e

strategy.entry("HMA_SHRT", strategy.short)

strategy.exit("SE", "HMA_SHRT", profit=100*tp_factor*atr_e, loss=100*sl_factor*atr_e)

if strategy.position_size != 0

sl := sl[1]

tp := tp[1]

// -----------------------------------------------------------------------------

// PLOT

// -----------------------------------------------------------------------------

hma_s = plot(hma_signal, title="SIGNAL", color = signal == 1 ? color.green : color.red)

hma_l = plot(hma_filter, title="TREND", color = trend == 1 ? color.green : color.red)

plot(tp, title="TAKE PROFIT", color= strategy.position_size != 0 ? color.blue: na, linewidth=1)

plot(sl, title="STOP LOSS", color= strategy.position_size != 0 ? color.red: na, linewidth = 1)

Detail

https://www.fmz.com/strategy/437645

Last Modified

2024-01-04 15:16:34