Name

量化高手多维度强力开仓指标策略Aroon-Williams-MA-BB-ADX-Powerful-Multi-indicator-Strategy

Author

ChaoZhang

Strategy Description

本策略通过多种不同周期的Aroon,MA,BB,Williams,%R,ADX等多种强力指标的组合,形成多维度的强力开仓指标,在趋势较明显时,能够进行高效的开仓。

本策略主要通过以下几种指标的组合实现强力开仓信号:

-

Aroon指标:计算一定周期内的最高价和最低价,形成一个震荡指标,通过多个周期Length的Aroon指标组合,判断趋势走向。

-

MA均线:计算短周期和长周期的MA均线交叉,判断趋势转折点。

-

BB布林带:当价格突破布林带上轨时,为卖出信号。

-

Williams %R指标:该指标在超买超卖区域形成背离,作为开仓信号。

-

ADX平均方向运动指数:判断趋势的力度,ADX高于某个位置时产生开仓信号。

以上多个指标,通过不同的周期Length参数,组成一个多维度判断体系,在趋势较明显时,多个指标能够形成强力的开仓信号。

具体来说,买入条件有:

- Aroon_1低于-85时

- MA均线形成金叉时

- Williams %R低于-99时

- ADX高于14时

- Aroon_2高于-39时

当上述5个买入条件中满足3个时,产生强力的买入信号。

卖出条件也是类似,有5个卖出条件,当满足其中3个时,产生卖出信号。

所以,该策略通过多种不同指标的组合,在趋势明显时,能产生高确定性的强力开仓信号。

本策略最大的优势在于指标信号的多维度组合,这大大减少了因单一指标造成的错误信号的概率,从而能够在趋势较明显时,产生高质量的开仓信号,这是本策略的最大亮点。

其他优势还有:

-

通过参数调整,可以适应不同市场的特征

-

指标参数设置科学合理,参数鲁棒性较高

-

实现了多时间周期的组合,提高了判断准确率

-

代码结构清晰,易于理解和二次开发

本策略也存在一些风险:

-

多指标组合虽然可以提高判断质量,但是也增加了策略复杂度,扩大了过优化的风险

-

参数设置不是百分之百完美,在特定市场下可能会失效

-

指标组合方式还有优化空间,组合逻辑可以进一步提炼

-

短期调整机会可能会被错过

对应解决方法:

-

增加样本回测,检验参数的鲁棒性

-

调整部分参数,使之能够适应更多市场

-

优化指标集成方式,提高判断质量

-

适当缩短部分指标参数,增加对短期调整的捕捉

本策略的主要优化方向是指标集成方式的优化,主要包括:

-

添加更多不同类型的指标,形成指标森林,进一步提高判断准确性

-

优化指标参数设置,使其能够自动适应市场变化

-

使用机器学习等方法,自动搜索最优指标集成方案

-

增加止损策略,以控制风险

-

结合情绪指标等,判断市场热度,动态调整参数

通过集成更多指标,自动优化参数和集成方案,本策略的判断质量和鲁棒性还有很大提升空间。

本策略最大的亮点是多种指标的科学集成,形成强力的开仓信号,在趋势明显时,效果显著。该策略集成方式还有很多优化空间,通过引入更多指标,以及参数和集成方式的智能优化,本策略可以成为一个非常强大的量化交易策略。

||

This strategy combines multiple strong indicators with different periods such as Aroon, MA, BB, Williams, %R, ADX to form a multi-dimensional powerful open position indicator system that can efficiently open positions when the trend is obvious.

The strategy mainly uses the combination of the following indicators to generate strong opening signals:

-

Aroon Indicator: Calculate the highest and lowest prices over a certain period to form an oscillating indicator. Judging the trend direction through the combination of Aroon indicators with multiple cycle lengths.

-

MA: Calculate the cross of short-period and long-period MA to determine turning points of the trend.

-

BB Band: When the price breaks through the upper rail of the BB band, it is a sell signal.

-

Williams %R Indicator: Forming divergence in overbought and oversold areas as opening signals.

-

ADX: Judging the strength of the trend. ADX above a certain position generates opening signals.

The above indicators, with different cycle length parameters, form a multi-dimensional judgment system that can generate strong opening signals when the trend is obvious.

Specifically, the buy conditions are:

- When Aroon_1 is lower than -85

- When the MA forms a golden cross

- When Williams %R is lower than -99

- When ADX is higher than 14

- When Aroon_2 is higher than -39

When 3 of the 5 buy conditions are met, a strong buy signal is generated.

The sell conditions are similar, with 5 sell conditions. When 3 of them are met, a sell signal is generated.

So this strategy can produce high certainty strong opening signals when the trend is obvious, through the combination of different indicators.

The biggest advantage of this strategy is the multi-dimensional combination of indicator signals, which greatly reduces the probability of erroneous signals caused by a single indicator, thereby being able to generate high-quality opening signals when the trend is obvious. This is the biggest highlight of this strategy.

Other advantages include:

-

The parameters can be adjusted to adapt to different market characteristics

-

The parameter settings of the indicators are scientifically reasonable and highly robust

-

The combination of multiple time cycles is realized to improve the accuracy of judgment

-

The code structure is clear and easy to understand and secondary development

This strategy also has some risks:

-

Although the combination of multiple indicators can improve the quality of judgment, it also increases the complexity of the strategy and expands the risk of over-optimization.

-

The parameter settings are not 100% perfect and may fail under specific market conditions.

-

There is still room for optimization in the combination of indicator methods. The combination logic can be further refined.

-

Short-term adjustment opportunities may be missed.

Corresponding solutions:

-

Increase sample backtesting to test the robustness of parameters

-

Adjust some parameters to adapt to more markets

-

Optimize the integration method of indicators to improve judgment quality

-

Appropriately shorten some indicator parameters to increase capturing of short-term adjustments

The main optimization direction of this strategy is the optimization of the indicator integration method, which mainly includes:

-

Add more different types of indicators to form an indicator forest to further improve judgment accuracy

-

Optimize indicator parameter settings to automatically adapt to market changes

-

Use machine learning and other methods to automatically search for optimal indicator integration solutions

-

Increase stop-loss strategies to control risks

-

Combine sentiment indicators, judge market heat, and dynamically adjust parameters

There is still a lot of room for improvement in the judgment quality and robustness of this strategy by integrating more indicators, automatically optimizing parameters and integration schemes.

The biggest highlight of this strategy is the scientific integration of multiple indicators to form a powerful opening signal that performs significantly when the trend is obvious. There is a lot of room for optimization in the integration methods of this strategy. By introducing more indicators and intelligent optimization of parameters and integration methods, this strategy can become a very powerful quantitative trading strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 264 | Length Aroon_1 |

| v_input_2 | 72 | Length Aroon_2 |

| v_input_3 | 137 | Length Aroon_3 |

| v_input_4 | 62 | Length Aroon_4 |

| v_input_5 | 270 | BB length |

| v_input_6_close | 0 | Source: close |

| v_input_7 | 2 | BB mult |

| v_input_8 | 130 | Length Williams %R |

| v_input_9 | 14 | ADX Smoothing |

| v_input_10 | 145 | DI Length |

| v_input_11 | 14 | ADX Smoothing |

| v_input_12 | 150 | DI Length |

| v_input_13 | -85 | Aroon_1 Position Index_Down |

| v_input_14 | 117 | ma double_1 wma_Short |

| v_input_15 | 86 | ma double_1 sma_Long |

| v_input_16 | -99 | Williams Position Index_Down |

| v_input_17 | 14 | ADX Position Index_Up |

| v_input_18 | -39 | Aroon_2 Position Index_Up |

| v_input_19 | 120 | BB Position Index_Up |

| v_input_20 | 99 | Aroon_3 Position Index_Up |

| v_input_21 | 88 | ma double_2 ema_Short |

| v_input_22 | 96 | ma double_2 sma_Long |

| v_input_23 | 9 | ADX_2 Position Index_Up |

| v_input_24 | 35 | Aroon_4 Position Index_Down |

| v_input_25 | 8 | From Month |

| v_input_26 | true | From Day |

| v_input_27 | 2018 | From Year |

| v_input_28 | 12 | To Month |

| v_input_29 | 31 | To Day |

| v_input_30 | 2018 | To Year |

Source (PineScript)

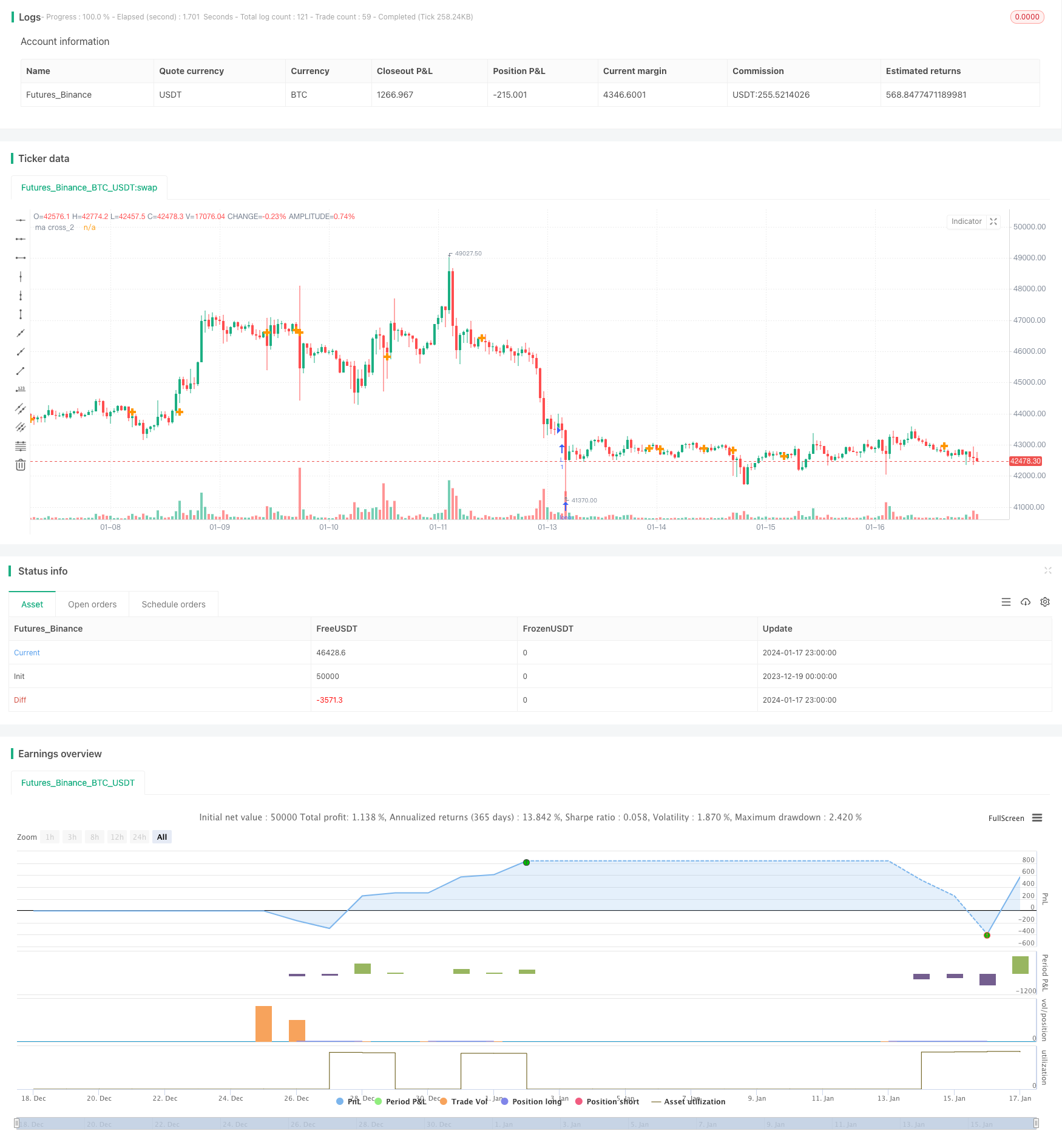

/*backtest

start: 2023-12-19 00:00:00

end: 2024-01-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="Aroon+Williams+MA2+ADX+Aroon Str.", shorttitle="Aroon+Williams+MA2+ADX+Aroon Str.", overlay=true)

//https://cafe.naver.com/watchbot/1945

//<<빙썸 매각 기념>> 바이낸스 이오스 복합지표

//Aroon_1

length_1 = input(264, minval=1, title="Length Aroon_1")

upper_1 = 100 * (highestbars(high, length_1+1) + length_1)/length_1

lower_1 = 100 * (lowestbars(low, length_1+1) + length_1)/length_1

midp_1 = 0

oscillator_1 = upper_1 - lower_1

//osc_1 = plot(oscillator_1, color=red)

//Aroon_2

length_2 = input(72, minval=1, title="Length Aroon_2")

upper_2 = 100 * (highestbars(high, length_2+1) + length_2)/length_2

lower_2 = 100 * (lowestbars(low, length_2+1) + length_2)/length_2

midp_2 = 0

oscillator_2 = upper_2 - lower_2

//osc_2 = plot(oscillator_2, color=red)

//Aroon_3

length_3 = input(137, minval=1, title="Length Aroon_3")

upper_3 = 100 * (highestbars(high, length_3+1) + length_3)/length_3

lower_3 = 100 * (lowestbars(low, length_3+1) + length_3)/length_3

midp_3 = 0

oscillator_3 = upper_3 - lower_3

//osc_3 = plot(oscillator_3, color=red)

//Aroon_4

length_4 = input(62, minval=1, title="Length Aroon_4")

upper_4 = 100 * (highestbars(high, length_4+1) + length_4)/length_4

lower_4 = 100 * (lowestbars(low, length_4+1) + length_4)/length_4

midp_4 = 0

oscillator_4 = upper_4 - lower_4

//osc_4 = plot(oscillator_4, color=red)

//Ma double

short_ma_1 = sma(close, 9)

long_ma_1 = sma(close, 21)

// plot(short_ma_1, color = red)

// plot(long_ma_1, color = green)

// plot(cross(short_ma_1, long_ma_1) ? short_ma_1 : na, style = cross, linewidth = 4)

short_ma_2 = sma(close, 9)

long_ma_2 = sma(close, 21)

// plot(short_ma_2, color = red)

// plot(long_ma_2, color = green)

plot(cross(short_ma_2, long_ma_2) ? short_ma_2 : na, transp= 100, title = "ma cross_2", style = cross, linewidth = 4)

//BB

length_bb = input(270, minval=1, title="BB length")

src_bb = input(close, title="Source")

mult_bb = input(2.0, minval=0.001, maxval=50, title="BB mult")

basis_bb = sma(src_bb, length_bb)

dev_bb = mult_bb * stdev(src_bb, length_bb)

upper_bb = basis_bb + dev_bb

lower_bb = basis_bb - dev_bb

// plot(basis_bb, color=red)

// p1 = plot(upper_bb, color=blue)

// p2 = plot(lower_bb, color=blue)

// fill(p1, p2)

//Williams

length_wil = input(130, minval=1, title="Length Williams %R")

upper_wil = highest(length_wil)

lower_wil = lowest(length_wil)

out_wil = 100 * (close - upper_wil) / (upper_wil - lower_wil)

// plot(out_wil)

// band1 = hline(-20)

// band0 = hline(-80)

// fill(band1, band0)

//ADX

adxlen = input(14, title="ADX Smoothing")

dilen = input(145, title="DI Length")

dirmov(len) =>

up_adx = change(high)

down_adx = -change(low)

plusDM = na(up_adx) ? na : (up_adx > down_adx and up_adx > 0 ? up_adx : 0)

minusDM = na(down_adx) ? na : (down_adx > up_adx and down_adx > 0 ? down_adx : 0)

truerange = rma(tr, len)

plus_adx = fixnan(100 * rma(plusDM, len) / truerange)

minus_adx = fixnan(100 * rma(minusDM, len) / truerange)

[plus_adx, minus_adx]

adx(dilen, adxlen) =>

[plus_adx, minus_adx] = dirmov(dilen)

sum_adx = plus_adx + minus_adx

adx = 100 * rma(abs(plus_adx - minus_adx) / (sum_adx == 0 ? 1 : sum_adx), adxlen)

sig_adx = adx(dilen, adxlen)

// plot(sig_adx, color=red, title="ADX")

//ADX 2

adxlen_2 = input(14, title="ADX Smoothing")

dilen_2 = input(150, title="DI Length")

dirmov_2(len) =>

up_adx_2 = change(high)

down_adx_2 = -change(low)

plusDM_2 = na(up_adx_2) ? na : (up_adx_2 > down_adx_2 and up_adx_2 > 0 ? up_adx_2 : 0)

minusDM_2 = na(down_adx_2) ? na : (down_adx_2 > up_adx_2 and down_adx_2 > 0 ? down_adx_2 : 0)

truerange_2 = rma(tr, len)

plus_adx_2 = fixnan(100 * rma(plusDM_2, len) / truerange_2)

minus_adx_2 = fixnan(100 * rma(minusDM_2, len) / truerange_2)

[plus_adx_2, minus_adx_2]

adx_2(dilen_2, adxlen_2) =>

[plus_adx_2, minus_adx_2] = dirmov_2(dilen_2)

sum_adx_2 = plus_adx_2 + minus_adx_2

adx_2 = 100 * rma(abs(plus_adx_2 - minus_adx_2) / (sum_adx_2 == 0 ? 1 : sum_adx_2), adxlen_2)

sig_adx_2 = adx(dilen_2, adxlen_2)

// plot(sig_adx_2, color=red, title="ADX_2")

//Input Position

//buy position

pos_aroon1 = input(-85, title="Aroon_1 Position Index_Down")

pos_madouble1_short = input(117, title="ma double_1 wma_Short")

pos_madouble1_long = input(86, title="ma double_1 sma_Long")

pos_wil = input(-99, title="Williams Position Index_Down")

pos_adx= input(14, title="ADX Position Index_Up")

pos_aroon2 = input(-39, title="Aroon_2 Position Index_Up")

//sell position

pos_bb = input(120, title="BB Position Index_Up")

pos_aroon_3 = input(99, title="Aroon_3 Position Index_Up")

pos_madouble2_short= input(88, title="ma double_2 ema_Short")

pos_madouble2_long= input(96, title="ma double_2 sma_Long")

pos_adx_2= input(9, title="ADX_2 Position Index_Up")

pos_aroon_4 = input(35, title="Aroon_4 Position Index_Down")

//Condition

longCondition_aroon_1 = (oscillator_1 <= pos_aroon1)

longCondition_ma2 = (pos_madouble1_short > pos_madouble1_long)

longCondition_wil = (out_wil <= pos_wil)

longCondition_adx = (sig_adx >= pos_adx)

longCondition_aroon_2 = (oscillator_2 >= pos_aroon2)

shortCondition_bb = (close > basis_bb)

shortCondition_aroon_3 = (oscillator_3 >= pos_aroon_3)

shortCondition_ma2 = (pos_madouble2_short < pos_madouble2_long)

shortCondition_adx = (sig_adx_2 >= pos_adx_2)

shortCondition_aroon_4 = (oscillator_4 <= pos_aroon_4)

vl_aroon_1 = 0

vl_ma2 = 0

vl_wil = 0

vl_adx = 0

vl_aroon_2 = 0

if longCondition_aroon_1

vl_aroon_1 := 1

if longCondition_ma2

vl_ma2 := 3

if longCondition_wil

vl_wil := 1

if longCondition_adx

vl_adx := -1

if longCondition_aroon_2

vl_aroon_2 := -1

vs_bb = 0

vs_aroon_3 = 0

vs_ma2 = 0

vs_adx = 0

vs_aroon_4 = 0

if shortCondition_bb

vs_bb := 1

if shortCondition_aroon_3

vs_aroon_3 := 1

if shortCondition_ma2

vs_ma2 := 3

if shortCondition_adx

vs_adx := -2

if shortCondition_aroon_4

vs_aroon_4 := -1

// plotshape(vl_aroon_1, title= "vl_aroon_1", location=location.belowbar, color=green, text="vl_aroon_1")

// plotshape(vl_ma2, title= "vl_ma2", location=location.belowbar, color=green, text="\nvl_ma2")

// plotshape(vl_wil, title= "vl_wil", location=location.belowbar, color=green, text="\n\nvl_wil")

// plotshape(vl_adx, title= "vl_adx", location=location.belowbar, color=green, text="\n\n\nvl_adx")

// plotshape(vl_aroon_2, title= "vl_aroon_2", location=location.belowbar, color=green, text="\n\n\n\nvl_aroon_2")

// plotshape(vs_bb, title= "vs_bb", location=location.abovebar, color=orange, text="vs_bb")

// plotshape(vs_aroon_3, title= "vs_aroon_3", location=location.abovebar, color=orange, text="vs_aroon_3\n")

// plotshape(vs_ma2, title= "vs_ma2", location=location.abovebar, color=orange, text="vs_ma2\n\n")

// plotshape(vs_adx, title= "vs_adx", location=location.abovebar, color=orange, text="vs_adx\n\n\n")

// plotshape(vs_aroon_4, title= "vs_aroon_4", location=location.abovebar, color=orange, text="vs_aroon_4\n\n\n\n")

longCondition = (vl_aroon_1 + vl_ma2 + vl_wil + vl_adx + vl_aroon_2) >= 3 ? true : na

shortCondition = (vs_bb + vs_aroon_3 + vs_ma2 + vs_adx + vs_aroon_4) >= 3 ? true : na

buy = longCondition == 1 ? longCondition : na

sell = shortCondition == 1? shortCondition : na

// plotshape(buy, title= "buy", location=location.bottom, color=green, text="buy")

// plotshape(sell, title= "sell", location=location.top, color=orange, text="sell")

// === BACKTEST RANGE ===

FromMonth = input(defval = 8, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2014)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2018, title = "To Year", minval = 2014)

strategy.entry("L", strategy.long, when=(buy))

strategy.close("L", when=(sell))

// strategy.entry("S", strategy.short, when=(sell and (time >= timestamp(FromYear, FromMonth, FromDay, 00, 00)) and (time <= timestamp(ToYear, ToMonth, ToDay, 23, 59))))

// strategy.close("S", when=(buy and (time <= timestamp(ToYear, ToMonth, ToDay, 23, 59))))

Detail

https://www.fmz.com/strategy/439354

Last Modified

2024-01-19 14:55:03