Name

超趋势增强旗形发现者An-Enhanced-Flag-Pattern-Recognition-Strategy-Integrating-with-SuperTrend

Author

ChaoZhang

Strategy Description

概述:该策略顺势突破旗形模式与著名的超趋势指标巧妙结合,实现了一种独特的旗形识别方法。它不仅可以发现传统的旗形,还能利用超趋势指标判断趋势方向以及潜在止损位置。

策略原理:

- 旗形识别

- 通过动态追踪最高价和最低价,识别出旗杆和整理区

- 根据用户设定的参数判断整理区域的深度/拉升幅度、旗形长度是否符合要求

- 一旦旗形形成,用相应颜色的线段标记出来

- 超趋势集成

- 应用简单有效的超趋势指标,实时显示图表上的趋势动向

- 结合旗形的方向判断,可以确认旗形方向的正确性

- 同时超趋势线也为交易提供潜在的止损位置

综上,这种旗形与超趋势的 Zero-Lag 整合,实现了一种易于使用的趋势跟踪策略,可谓融会贯通,旗形识别与超趋势止损完美结合。

策略优势:

-

融合传统技术分析与趋势跟随 这种旗形与超趋势的整合,兼顾了图形识别与动量跟随,是一种独特的混合策略。

-

提供潜在的止损位置 超趋势为每笔交易提供清晰的止损位置,有助于策略的风险管理。

-

方便使用 该策略提供了一系列可调参数,使用者可以根据自己的交易偏好进行定制。操作简单,易于掌握。

-

全面支持多空双向交易 策略同时支持看涨与看跌操作,适用于任何市场环境,可谓非常全面。

策略风险:

-

旗形败坏 当旗形整理超过设定参数或向原趋势方向延伸时,会出现旗形败坏,导致错误信号。

-

超趋势滞后识别转折点 超趋势线存在一定程度的滞后性,在趋势转折点时可能出现较大滑点。

-

参数优化 不同参数设置会对策略表现产生较大影响,需要通过优化找到最佳参数组合。

-

交易方向偏向 如果仅选择单边交易,则会限制策略的应用范围。建议采用双边交易。

策略优化方向:

- 测试不同的超趋势参数组合,找到最佳参数;

- 优化旗形参数,使旗形识别更准确可靠;

- 尝试结合其他指标,如平均线、K线模型等,丰富策略;

- 增加止损策略、仓位管理等模块,提高策略的稳定性。

总结: 该超趋势增强旗形识别策略,是一种独特的旗形与超趋势的混合趋势策略。它兼顾了图形识别的先导性与超趋势动量跟随的时效性,实现了传统技术分析与数字化量化的完美结合。易于使用的设定使其可以广泛应用于多种交易品种,而可调参数也让交易者可以按照自己的偏好进行个性化定制。总体而言,这是一种融会贯通,实用性极强的旗形识别策略。

||

Overview: This strategy ingeniously combines the flag pattern breakout method with the renowned SuperTrend indicator to achieve a unique flag recognition approach. It can not only identify traditional flag patterns, but also utilize the SuperTrend indicator to determine the trend direction and set potential stop loss levels.

Strategy Logic:

- Flag Pattern Recognition

- Dynamically track highs and lows to identify flagpoles and consolidations

- Check if consolidation depth/rally and flag length meet the required criteria based on user-defined inputs

- Visualize identified flag patterns with corresponding color lines

- SuperTrend Integration

- Apply the simple yet effective SuperTrend indicator to display the prevailing trend direction on the chart

- Confirm flag pattern direction combined with SuperTrend

- Provide potential stop loss levels for trades

The seamless integration of flag patterns and the zero-lag SuperTrend creates an easy-to-use trend following strategy, harmoniously combining flag recognition and SuperTrend stop loss.

Advantages:

-

Blend of Traditional and Modern Techniques The fusion of classical chart pattern analysis and modern trend following techniques makes this a truly unique hybrid strategy.

-

Built-in Risk Management

The SuperTrend sets clear stop loss levels for each trade, enhancing the risk management capabilities. -

Easy-to-use The strategy offers a range of customizable parameters for traders to tune it to their preferences and trading style. Simple yet powerful.

-

Comprehensive Dual Direction Trading Simultaneous support for long and short trades makes this strategy universally applicable across all market environments.

Risks:

-

Failed Flags Flags may fail when the consolidation extends beyond the defined parameters, resulting in bad signals.

-

SuperTrend Lagging The SuperTrend line has some lag in catching trend reversals. Larger slippage may occur around turning points.

-

Parameter Dependence

The strategy performance varies significantly with different parameter settings. Extensive optimization is needed to find the optimum parameters. -

Directional Bias Selecting only one directional trading limits the scope of application. Two-way trading is recommended.

Enhancement Opportunities:

- Test different combinations of SuperTrend parameters to find the optimal set.

- Refine flag criteria to improve pattern recognition accuracy.

- Incorporate other indicators like moving averages, candlestick patterns etc. to create a more versatile strategy.

- Introduce protective stops, position sizing etc. to make the strategy more robust.

Conclusion:

The SuperTrend Enhanced Flag Finder strategy uniquely merges the predictive power of chart pattern analysis with the timeliness of SuperTrend momentum following. The tunable parameters provide tremendous customizability for traders to tailor it to their personal preferences and trading assets, while the easy-to-use design makes it accessible for broad applications. Overall an ingeniously integrated, highly practical flag pattern recognition strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_string_1 | 0 | Trading Direction: Both |

| v_input_1 | 10 | (?SuperTrend Criteria)Supertrend Length |

| v_input_float_1 | 4 | Supertrend Factor |

| v_input_float_2 | 5 | (?Bull Flag Criteria)Max Flag Depth |

| v_input_int_1 | 7 | Max Flag Length |

| v_input_int_2 | 3 | Min Flag Length |

| v_input_float_3 | 3 | Prior Uptrend Minimum |

| v_input_int_3 | 13 | Max Flag Pole Length |

| v_input_int_4 | 7 | Min Flag Pole Length |

| v_input_float_4 | 5 | (?Bear Flag Criteria)Max Flag Rally |

| v_input_int_5 | 7 | Max Flag Length |

| v_input_int_6 | 3 | Min Flag Length |

| v_input_float_5 | 3 | Prior Downtrend Minimum |

| v_input_int_7 | 13 | Max Flag Pole Length |

| v_input_int_8 | 7 | Min Flag Pole Length |

| v_input_bool_1 | true | (?Bull Flag Display Options)Show Bull Flags |

| v_input_bool_2 | true | Show Bull Flag Breakouts |

| v_input_color_1 | green | Bull Line Color |

| v_input_int_9 | 2 | Bull Line Width |

| v_input_bool_3 | true | (?Bear Flag Display Options)Show Bear Flags |

| v_input_bool_4 | true | Show Bear Flag Breakdowns |

| v_input_color_2 | red | Bear Flag Line Color |

| v_input_int_10 | 2 | Bear Flag Line Width |

Source (PineScript)

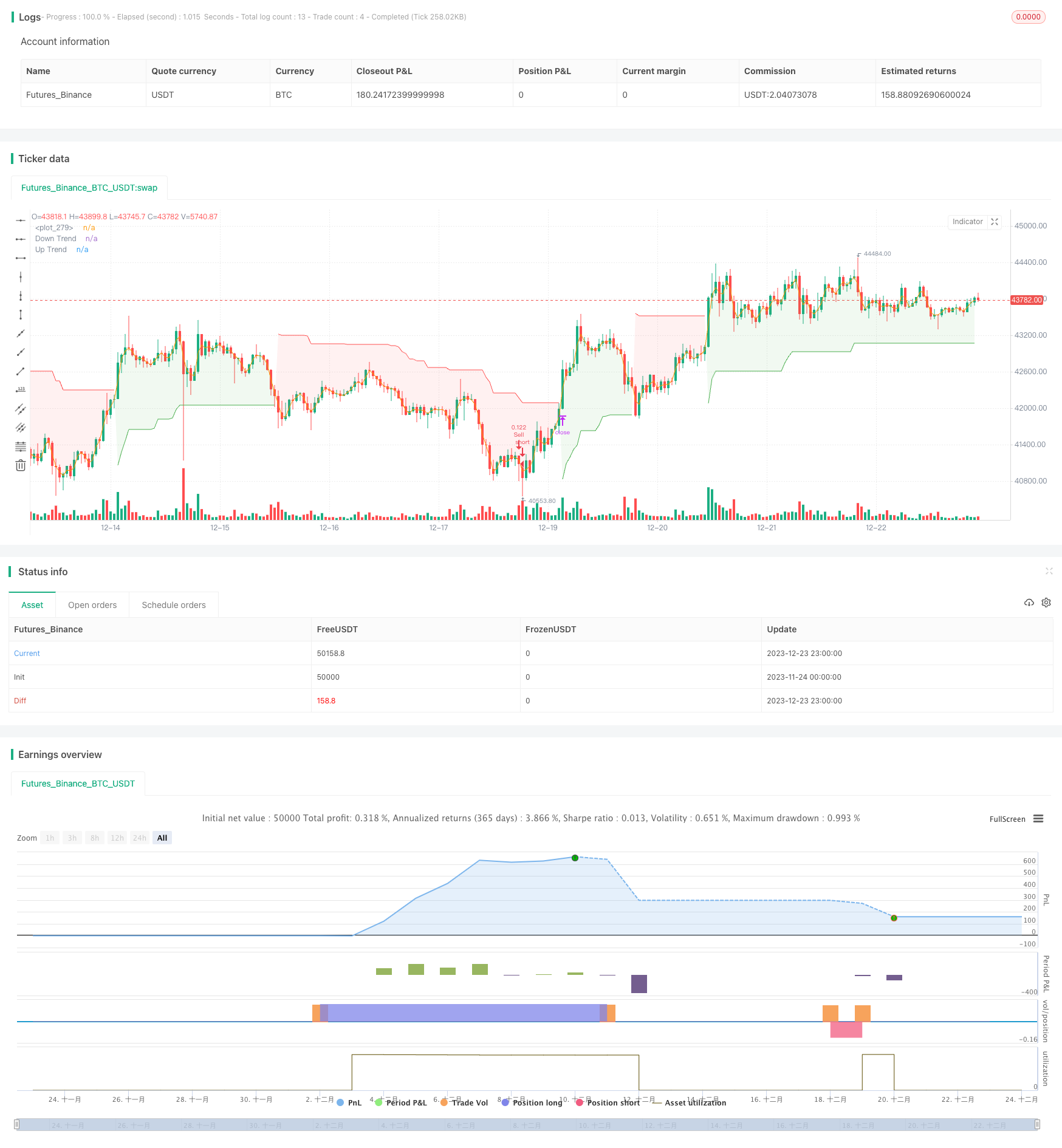

/*backtest

start: 2023-11-24 00:00:00

end: 2023-12-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Amphibiantrading

//@version=5

strategy("TrendGuard Flag Finder - Strategy [presentTrading]", overlay = true, precision=3, default_qty_type=strategy.cash,

commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1,

currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital= 10000)

//inputs

//user controlled settings for the indicator, separated into 4 different groups

// Add a button to choose the trading direction

tradingDirection = input.string("Both","Trading Direction", options=["Long", "Short", "Both"])

// Supertrend parameters

SupertrendPeriod = input(10, "Supertrend Length",group ='SuperTrend Criteria')

SupertrendFactor = input.float(4.0, "Supertrend Factor", step = 0.01,group ='SuperTrend Criteria')

// Flag parameters

var g1 = 'Bull Flag Criteria'

max_depth = input.float(5, 'Max Flag Depth', step = .25, minval = 2.0, group = g1, tooltip = 'Maximum pullback allowed from flag high to flag low')

max_flag = input.int(7, 'Max Flag Length', group = g1, tooltip = 'The maximum number of bars the flag can last')

min_flag = input.int(3, 'Min Flag Length', group = g1, tooltip = 'The minimum number of bars required for the flag')

poleMin = input.float(3.0, 'Prior Uptrend Minimum', group = g1, tooltip = 'The minimum percentage gain required before a flag forms')

poleMaxLen = input.int(13, 'Max Flag Pole Length', minval = 1, group = g1, tooltip = 'The maximum number of bars the flagpole can be')

poleMinLen = input.int(7, 'Min Flag Pole Length', minval = 1, group = g1, tooltip = 'The minimum number of bars required for the flag pole')

var g2 = 'Bear Flag Criteria'

max_rally = input.float(5, 'Max Flag Rally', step = .25, minval = 2.0, group = g2, tooltip = 'Maximum rally allowed from flag low to flag low')

max_flagBear = input.int(7, 'Max Flag Length', group = g2, tooltip = 'The maximum number of bars the flag can last')

min_flagBear = input.int(3, 'Min Flag Length', group = g2, tooltip = 'The minimum number of bars required for the flag')

poleMinBear = input.float(3.0, 'Prior Downtrend Minimum', group = g2, tooltip = 'The minimum percentage loss required before a flag forms')

poleMaxLenBear = input.int(13, 'Max Flag Pole Length', minval = 1, group = g2, tooltip = 'The maximum number of bars the flagpole can be')

poleMinLenBear = input.int(7, 'Min Flag Pole Length', minval = 1, group = g2, tooltip = 'The minimum number of bars required for the flag pole')

var g3 = 'Bull Flag Display Options'

showF = input.bool(true, 'Show Bull Flags', group = g3)

showBO = input.bool(true,'Show Bull Flag Breakouts', group = g3)

lineColor = input.color(color.green, 'Bull Line Color', group = g3)

lineWidth = input.int(2, 'Bull Line Width', minval = 1, maxval = 5, group = g3)

var g4 = 'Bear Flag Display Options'

showBF = input.bool(true, 'Show Bear Flags', group = g4)

showBD = input.bool(true,'Show Bear Flag Breakdowns', group = g4)

lineColorBear = input.color(color.red, 'Bear Flag Line Color', group = g4)

lineWidthBear = input.int(2, 'Bear Flag Line Width', minval = 1, maxval = 5, group = g4)

//variables

//declare starting variables used for identfying flags

var baseHigh = high, var startIndex = 0, var flagLength = 0, var baseLow = low

var lowIndex = 0, var flagBool = false, var poleLow = 0.0, var poleLowIndex = 0

var line flagHLine = na, var line flagLLine = na, var line flagPLine = na

// bear flag variables

var flagLowBear = high, var startIndexBear = 0, var flagLengthBear = 0, var flagHigh = low

var highIndex = 0, var flagBoolBear = false, var poleHigh = 0.0, var polehighIndex = 0

var line flagBearHLine = na, var line flagBearLLine = na, var line flagBearPLine = na

//find bull flag highs

// check to see if the current bars price is higher than the previous base high or na and then sets the variables needed for flag detection

if high > baseHigh or na(baseHigh)

baseHigh := high

startIndex := bar_index

flagLength := 0

baseLow := low

lowIndex := bar_index

// check to see if the low of the current bar is lower than the base low, if it is set the base low to the low

if high <= baseHigh and low < baseLow

baseLow := low

lowIndex := bar_index

// moves the base low from the base high bar_index to prevent the high and low being the same bar

if high <= baseHigh and lowIndex == startIndex

baseLow := low

lowIndex := bar_index

//find bear flag lows

// check to see if the current bars price is lower than the previous flag low or na and then sets the variables needed for flag detection

if low < flagLowBear or na(flagLowBear)

flagLowBear := low

startIndexBear := bar_index

flagLengthBear := 0

flagHigh := high

highIndex := bar_index

// check to see if the high of the current bar is higher than the flag high, if it is set the flag high to the high

if low >= flagLowBear and high > flagHigh

flagHigh := high

highIndex := bar_index

// moves the flag high from the flag low bar_index to prevent the high and low being the same bar

if low >= flagLowBear and highIndex == startIndexBear

flagHigh := high

highIndex := bar_index

//calulations bullish

findDepth = math.abs(((baseLow / baseHigh) - 1) * 100) //calculate the depth of the flag

poleDepth = ((baseHigh / poleLow)- 1) * 100 // calculate the low of the flag pole to the base high

lower_close = close < close[1] // defines a lower close

//calculations bearish

findRally = math.abs(((flagHigh / flagLowBear) - 1) * 100) //calculate the rally of the flag

poleDepthBear = ((flagLowBear / poleHigh)- 1) * 100 // calculate the high of the flag pole to the low high

higher_close = close > close[1] // defines a higher close

//start the counters

// begins starting bars once a high is less than the flag high

if high < baseHigh and findDepth <= max_depth or (high == baseHigh and lower_close)

flagLength += 1

else

flagLength := 0

// begins starting bars once a low is higher than the flag low

if low > flagLowBear and findRally <= max_rally or (low == flagLowBear and higher_close)

flagLengthBear += 1

else

flagLengthBear := 0

// check for prior uptrend / downtrend to meet requirements

// loops through all the bars from the minimum pole length to the maximum pole length to check if the prior uptrend requirements are met and sets the variables to their new values

if high == baseHigh

for i = poleMinLen to poleMaxLen

if ((high / low[i]) - 1) * 100 >= poleMin

flagBool := true

poleLow := low[i]

poleLowIndex := bar_index[i]

break

// loops through all the bars from the minimum pole length to the maximum pole length to check if the prior downtrend requirements are met and sets the variables to their new values

if low == flagLowBear

for i = poleMinLenBear to poleMaxLenBear

if math.abs(((low / high[i]) - 1) * 100) >= poleMinBear

flagBoolBear := true

poleHigh := high[i]

polehighIndex := bar_index[i]

break

// reset variables if criteria for a flag is broken

// if the depth of the bull flag is greater than the maximum depth limit or the flag lasts longer than the maximum length everything is reset to beging looking for a new flag

if findDepth >= max_depth or flagLength > max_flag

flagBool := false

flagLength := 0

baseHigh := na

startIndex := na

lowIndex := na

baseLow := na

// if the rally of the bear flag is greater than the maximum rally limit or the flag lasts longer than the maximum length everything is reset to beging looking for a new flag

if findRally >= max_rally or flagLengthBear > max_flagBear

flagBoolBear := false

flagLengthBear := 0

flagLowBear := na

startIndexBear := na

highIndex := na

flagHigh := na

// reset the variables and begin looking for a new bull flag if price continues higher before the minimum flag length requirement is met

if high > baseHigh[1] and flagLength < min_flag

baseHigh := high

flagLength := 0

startIndex := bar_index

lowIndex := bar_index

baseLow := low

// reset the variables and begin looking for a new bear flag if price continues lower before the minimum bear flag length requirement is met

if low < flagLowBear[1] and flagLengthBear < min_flagBear

flagLowBear := low

flagLengthBear := 0

startIndexBear := bar_index

highIndex := bar_index

flagHigh := high

//define the flags

// if all requirements are met a bull flag is true, flagBool is true, flag length is less than maximum set length and more than miminum required. The prior run up also meets the requirements for length and price

flag = flagBool == true and flagLength < max_flag and findDepth < max_depth and flagLength >= min_flag and startIndex - poleLowIndex <= poleMaxLen

// if all requirements are met a bear flag is true, flagBoolBear is true, flag length is less than maximum set length and more than miminum required. The prior downtrend also meets the requirements for length and price

bearFlag = flagBoolBear == true and flagLengthBear < max_flagBear and findRally < max_rally and flagLengthBear >= min_flagBear and startIndexBear - polehighIndex <= poleMaxLen

//define flags, breakouts, breadowns

// a breakout is defined as the high going above the flag high and the length of the flag is greater than the minimum requirement. The flag boolean must also be true

breakout = high > baseHigh[1] and flagLength >= min_flag and flagBool == true

//a breakdown is defined as the depth of the flag being larger than user set parameter or the length of the flag exceeded the maximum flag length

breakdown = findDepth >= max_depth or flagLength > max_flag

// a separate variable to have breakouts only plot once using a plotshape

plotBO = flag[1] and high > baseHigh[1] and flagLength[1] >= min_flag and flagBool == true

// a bear flag breakout is defined as the low going below the flag low and the length of the flag is greater than the minimum requirement. The flag boolean must also be true

breakoutBear = low < flagLowBear[1] and flagLengthBear >= min_flagBear and flagBoolBear == true

//a breakdown is defined as the rally of the flag being larger than user set parameter or the length of the flag exceeded the maximum flag length

breakdownBear = findRally >= max_rally or flagLengthBear > max_flagBear

// a separate variable to have breakouts only plot once using a plotshape

plotBD = bearFlag[1] and low < flagLowBear[1] and flagLengthBear[1] >= min_flagBear and flagBoolBear == true

// // if a bul flag is detected and the user has bull flags selected from the settings menu draw it on the chart

// if flag and showF

// //if a flag was detected on the previous bar, delete those lines and allow for new lines to be drawn

// if flag[1]

// line.delete(flagHLine[1]), line.delete(flagLLine[1]), line.delete(flagPLine[1])

// //draw new lines

// flagHLine := line.new(startIndex, baseHigh, bar_index, baseHigh, color=lineColor, width = lineWidth)

// flagLLine := line.new(startIndex, baseLow, bar_index, baseLow, color=lineColor, width = lineWidth)

// flagPLine := line.new(poleLowIndex +1, poleLow, startIndex , baseLow, color=lineColor, width = lineWidth)

// // if a bear flag is detected and the user has bear flags selected from the settings menu draw it on the chart

// if bearFlag and showBF

// //if a bear flag was detected on the previous bar, delete those lines and allow for new lines to be drawn

// if bearFlag[1]

// line.delete(flagBearHLine[1]), line.delete(flagBearLLine[1]), line.delete(flagBearPLine[1])

// //draw new lines

// flagBearHLine := line.new(startIndexBear, flagHigh, bar_index, flagHigh, color=lineColorBear, width = lineWidthBear)

// flagBearLLine := line.new(startIndexBear, flagLowBear, bar_index, flagLowBear, color=lineColorBear, width = lineWidthBear)

// flagBearPLine := line.new(polehighIndex + 1, poleHigh, startIndexBear , flagHigh, color=lineColorBear, width = lineWidthBear)

//reset variables if a breakout occurs

if breakout // bull flag - high gets above flag high

flagLength := 0

baseHigh := high

startIndex := bar_index

lowIndex := bar_index

baseLow := low

if breakoutBear // bear flag - low gets below flag low

flagLengthBear := 0

flagLowBear := low

startIndexBear := bar_index

highIndex := bar_index

flagHigh := high

//reset the variables and highs from a failed bull flag. This allows stocks below previous highs to find new flags

highest = ta.highest(high, 10) // built in variable that finds the highest high lookingback the past 10 bars

if breakdown or flagLength == max_flag

flagBool := false

baseHigh := highest

startIndex := bar_index

lowIndex := bar_index

baseLow := low

//reset the variables and lows from a failed bear flag. This allows stocks above previous lows to find new flags

lowest = ta.lowest(low, 10) // built in variable that finds the lowest low lookingback the past 10 bars

if breakdownBear or flagLengthBear == max_flagBear

flagBoolBear := false

flagLowBear := lowest

startIndexBear := bar_index

highIndex := bar_index

flagHigh := high

// if a flag breakdowns remove the lines from the chart

// if (breakdown and flag[1])

// line.delete(flagHLine)

// line.delete(flagLLine)

// line.delete(flagPLine)

// if (breakdownBear and bearFlag[1])

// line.delete(flagBearHLine)

// line.delete(flagBearLLine)

// line.delete(flagBearPLine)

//plot breakouts

// use a plotshape to check if there is a breakout and the show breakout option is selected. If both requirements are met plot a shape at the breakout bar

plotshape(plotBO and showBO and showF, 'Breakout', shape.triangleup, location.belowbar, color.green)

// use a plotshape to check if there is a breakout and the show breakout option is selected. If both requirements are met plot a shape at the breakout bar

plotshape(plotBD and showBD and showBF, 'Breakout', shape.triangledown, location.abovebar, color.red)

// Define entry and exit conditions based on the indicator

bullishEntryFlag = plotBO and showBO and showF

bearishEntryFlag = plotBD and showBD and showBF

// Calculate Supertrend

[supertrend, direction] = ta.supertrend(SupertrendFactor, SupertrendPeriod)

bodyMiddle = plot((open + close) / 2, display=display.none)

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color = color.green, style=plot.style_linebr)

downTrend = plot(direction < 0? na : supertrend, "Down Trend", color = color.red, style=plot.style_linebr)

fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps=false)

fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps=false)

// Define entry and exit conditions based on the indicator

bullishEntryST = direction < 0

bearishEntryST = direction > 0

// Entry

bullishEntry = bullishEntryFlag and bullishEntryST

bearishEntry = bearishEntryFlag and bearishEntryST

// Modify entry and exit conditions based on the selected trading direction

if (bullishEntry and (tradingDirection == "Long" or tradingDirection == "Both"))

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", "Buy", stop=supertrend)

if (bearishEntry and (tradingDirection == "Short" or tradingDirection == "Both"))

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=supertrend)

// Exit conditions

if (strategy.position_size > 0 and bearishEntry and (tradingDirection == "Long" or tradingDirection == "Both")) // If in a long position and bearish entry condition is met

strategy.close("Buy")

if (strategy.position_size < 0 and bullishEntry and (tradingDirection == "Short" or tradingDirection == "Both")) // If in a short position and bullish entry condition is met

strategy.close("Sell")

Detail

https://www.fmz.com/strategy/436482

Last Modified

2023-12-25 11:16:38