Name

移动均线多时标交叉优化策略Multi-Timeframe-Moving-Average-Crossover-Optimization-Strategy

Author

ChaoZhang

Strategy Description

该策略是基于著名指标CM_Ultimate_MA_MTF改写而成的,可以在多个时间尺度上绘制移动平均线,实现不同时间周期MA的交叉操作。策略同时具有追踪止损功能。

- 根据用户选择,通过不同类型的MA指标在主图周期及更高周期上分别绘制MA线。

- 当快周期的MA线上穿慢周期MA线时,做多;当快周期MA线下穿慢周期MA线时,做空。

- 添加追踪止损机制,进一步控制风险。

- 多时间尺度MA交叉,可以提高信号质量,减少假信号。

- 不同类型MA的组合,可以发挥各自指标的优势,提高稳定性。

- 追踪止损有助于及时止损,降低大幅亏损的概率。

- MA指标滞后,可能错过短线操作机会。

- 需要适当优化MA周期参数,否则可能产生过多假信号。

- 止损点设置不合理可能造成不必要止损。

- 可以测试不同参数的MA组合,寻找最佳参数。

- 可以加入其他指标过滤,提高信号质量。

- 可以优化止损策略,使之更符合市场特点。

该策略整合了移动平均线的多时间框架分析和追踪止损方法,旨在提高信号质量和控制风险水平。通过参数优化和加入其他指标,可以进一步增强策略效果。

||

This strategy is based on the famous CM_Ultimate_MA_MTF indicator and rewritten into a trading strategy. It can plot moving averages across multiple timeframes and generate crossover signals between MAs of different periods. The strategy also incorporates a trailing stop loss mechanism.

- Plot MA lines of different types on the main chart timeframe and higher timeframes based on user configuration.

- Go long when faster MA crosses above slower MA; go short when faster MA crosses below slower MA.

- Add trailing stop loss to further control risks.

- MA crossovers across timeframes can improve signal quality and reduce false signals.

- Combination of different MA types utilizes strengths of individual indicators for better stability.

- Trailing stop loss helps to limit losses in a timely manner.

- Lagging nature of MA may miss short-term opportunities.

- Poor optimization of MA periods may generate excessive false signals.

- Improper stop loss placement may cause unnecessary exit.

- Test combinations of MA parameters to find optimum setup.

- Add other indicators for signal filtration and quality improvement.

- Optimize stop loss strategy to suit market profile.

The strategy integrates multi-timeframe analysis and trailing stop approaches of moving averages to improve signal quality and risk control. Further enhancement can be achieved through parameter tuning and adding complementary indicators.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Use Current Chart Resolution? |

| v_input_2 | D | Use Different Timeframe? Uncheck Box Above |

| v_input_3 | 20 | Moving Average Length - LookBack Period |

| v_input_4 | true | 1=SMA, 2=EMA, 3=WMA, 4=HullMA, 5=VWMA, 6=RMA, 7=TEMA |

| v_input_5 | true | Change Color Based On Direction? |

| v_input_6 | 2 | Color Smoothing - 1 = No Smoothing |

| v_input_7 | false | Optional 2nd Moving Average |

| v_input_8 | 50 | Moving Average Length - Optional 2nd MA |

| v_input_9 | true | 1=SMA, 2=EMA, 3=WMA, 4=HullMA, 5=VWMA, 6=RMA, 7=TEMA |

| v_input_10 | true | Change Color Based On Direction 2nd MA? |

| v_input_11 | false | You Can Turn On The Show Dots Parameter Below Without Plotting 2nd MA to See Crosses |

| v_input_12 | false | If Using Cross Feature W/O Plotting 2ndMA - Make Sure 2ndMA Parameters are Set Correctly |

| v_input_13 | false | Show Dots on Cross of Both MA's |

| v_input_14 | true | Use Trailing Stop? |

| v_input_15 | 200 | Stop Loss Trail Points |

| v_input_16 | 400 | Stop Loss Trail Offset |

Source (PineScript)

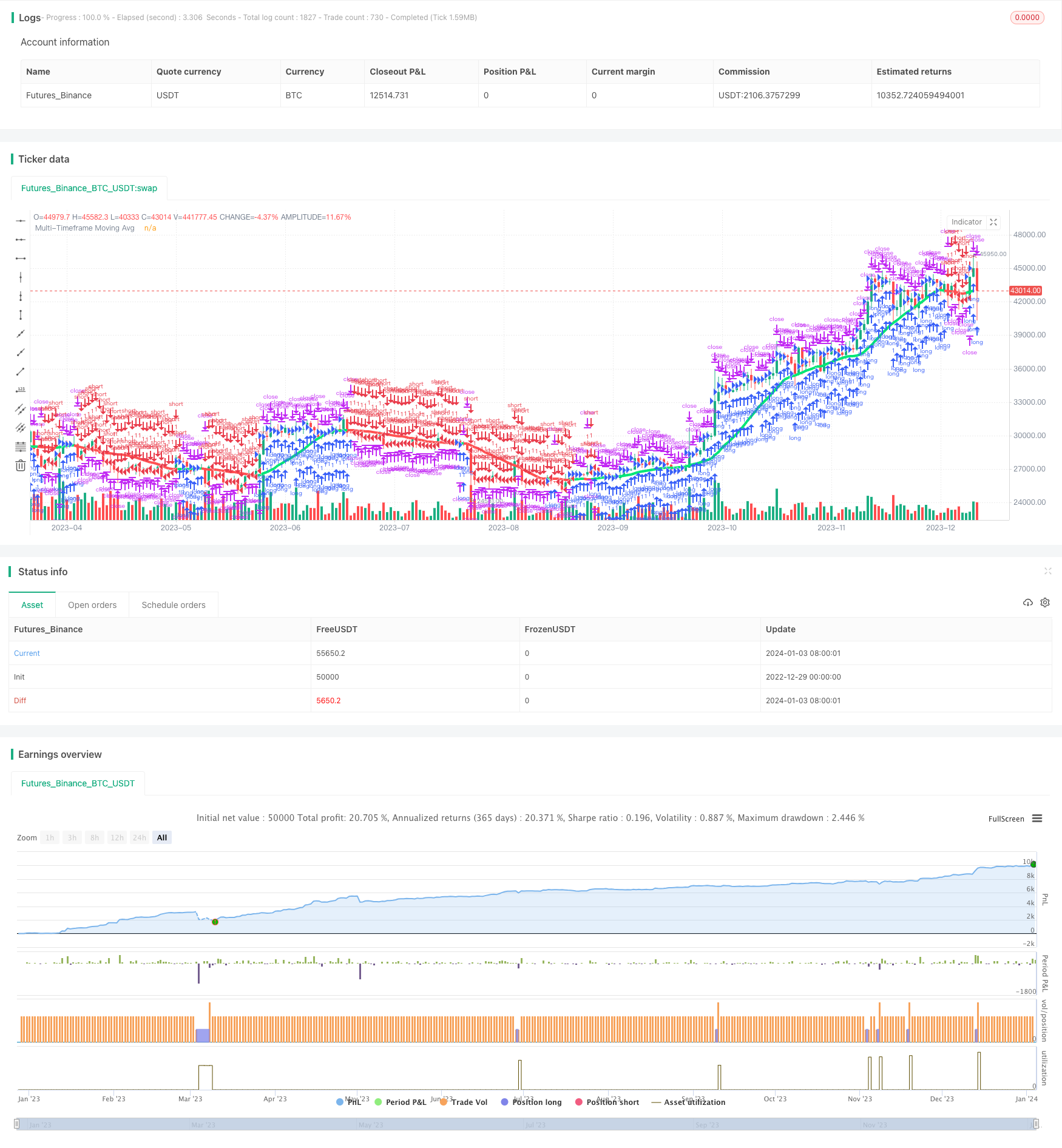

/*backtest

start: 2022-12-29 00:00:00

end: 2024-01-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "Ultimate Moving Average Strategy", shorttitle = "UMA Strategy", overlay = true)

//Created by user ChrisMoody 4-24-2014

//Converted to strategy by Virtual_Machinist 7-11-2018

//Plots The Majority of Moving Averages

//Defaults to Current Chart Time Frame --- But Can Be Changed to Higher Or Lower Time Frames

//2nd MA Capability with Show Crosses Feature

//inputs

src = close

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="D")

len = input(20, title="Moving Average Length - LookBack Period")

atype = input(1,minval=1,maxval=7,title="1=SMA, 2=EMA, 3=WMA, 4=HullMA, 5=VWMA, 6=RMA, 7=TEMA")

cc = input(true,title="Change Color Based On Direction?")

smoothe = input(2, minval=1, maxval=10, title="Color Smoothing - 1 = No Smoothing")

doma2 = input(false, title="Optional 2nd Moving Average")

len2 = input(50, title="Moving Average Length - Optional 2nd MA")

atype2 = input(1,minval=1,maxval=7,title="1=SMA, 2=EMA, 3=WMA, 4=HullMA, 5=VWMA, 6=RMA, 7=TEMA")

cc2 = input(true,title="Change Color Based On Direction 2nd MA?")

warn = input(false, title="***You Can Turn On The Show Dots Parameter Below Without Plotting 2nd MA to See Crosses***")

warn2 = input(false, title="***If Using Cross Feature W/O Plotting 2ndMA - Make Sure 2ndMA Parameters are Set Correctly***")

sd = input(false, title="Show Dots on Cross of Both MA's")

useStop = input(defval = true, title = "Use Trailing Stop?")

slPoints = input(defval = 200, title = "Stop Loss Trail Points", minval = 1)

slOffset = input(defval = 400, title = "Stop Loss Trail Offset", minval = 1)

res = useCurrentRes ? timeframe.period : resCustom

//hull ma definition

hullma = wma(2*wma(src, len/2)-wma(src, len), round(sqrt(len)))

//TEMA definition

ema1 = ema(src, len)

ema2 = ema(ema1, len)

ema3 = ema(ema2, len)

tema = 3 * (ema1 - ema2) + ema3

avg = atype == 1 ? sma(src,len) : atype == 2 ? ema(src,len) : atype == 3 ? wma(src,len) : atype == 4 ? hullma : atype == 5 ? vwma(src, len) : atype == 6 ? rma(src,len) : tema

//2nd Ma - hull ma definition

hullma2 = wma(2*wma(src, len2/2)-wma(src, len2), round(sqrt(len2)))

//2nd MA TEMA definition

sema1 = ema(src, len2)

sema2 = ema(sema1, len2)

sema3 = ema(sema2, len2)

stema = 3 * (sema1 - sema2) + sema3

avg2 = atype2 == 1 ? sma(src,len2) : atype2 == 2 ? ema(src,len2) : atype2 == 3 ? wma(src,len2) : atype2 == 4 ? hullma2 : atype2 == 5 ? vwma(src, len2) : atype2 == 6 ? rma(src,len2) : tema

out = avg

out_two = avg2

out1 = request.security(syminfo.tickerid, res, out)

out2 = request.security(syminfo.tickerid, res, out_two)

ma_up = out1 >= out1[smoothe]

ma_down = out1 < out1[smoothe]

col = cc ? ma_up ? lime : ma_down ? red : aqua : aqua

col2 = cc2 ? ma_up ? lime : ma_down ? red : aqua : aqua

circleYPosition = out2

plot(out1, title="Multi-Timeframe Moving Avg", style=line, linewidth=4, color = col)

plot(doma2 and out2 ? out2 : na, title="2nd Multi-TimeFrame Moving Average", style=circles, linewidth=4, color=col2)

plot(sd and cross(out1, out2) ? circleYPosition : na,style=cross, linewidth=5, color=yellow)

// Strategy conditions

longCond = ma_up

shortCond = ma_down

// entries and base exit

strategy.entry("long", strategy.long, when = longCond)

strategy.entry("short", strategy.short, when = shortCond)

if (useStop)

strategy.exit("XL", from_entry = "long", trail_points = slPoints, trail_offset = slOffset)

strategy.exit("XS", from_entry = "short", trail_points = slPoints, trail_offset = slOffset)

// not sure needed, but just incase..

strategy.exit("XL", from_entry = "long", when = shortCond)

strategy.exit("XS", from_entry = "short", when = longCond)

Detail

https://www.fmz.com/strategy/437747

Last Modified

2024-01-05 12:05:42