Name

短期趋势追踪反转策略Trend-Tracking-Reversal-Strategy

Author

ChaoZhang

Strategy Description

趋势追踪反转策略是一种基于15分钟NQ期货的短期趋势交易策略。它通过趋势滤波和反转形态识别来寻找交易机会。该策略简单而有效,适合短线活跃型交易者。

该策略主要基于以下几点原理运作:

-

使用8周期的EMA作为主要的趋势过滤指标,EMA上方看多,EMA下方看空。

-

识别特定的K线反转形态作为入场信号,包括长阳线后短阴线看多信号和长阴线后短阳线看空信号,这些形态提示趋势可能开始反转。

-

入场点设置为反转K线的高点或低点附近,止损点设置为反转K线本身的高低点,实现高效的风险回报比。

-

利用K线实体关系判断反转信号的有效性,如阴线开盘价高于上一根K线实体,实体完全包含等规则来过滤噪音。

-

只在特定的交易时段运作策略,避开市场主要合约换月等特殊时间段,防止异常行情导致不必要的损失。

该策略具有以下几点主要优势:

-

策略信号简单有效,容易掌握实施。

-

基于趋势和反转判断,避免被黄牛市场和熊市场双重杀伤。

-

风险控制到位,止损设置合理,有利于资金管理。

-

数据需求量小,适合各类软件和平台使用。

-

交易频率较高,适合热衷短线活跃型交易的投资者。

该策略也存在一些风险,主要问题在于:

-

反转形态机会不足,信号较少。可以适当放宽反转判断规则。

-

假突破问题时有发生。可以加入更多过滤指标进行联合判断。

-

夜盘和非主流时间存在不稳定性。可以设置只在美国交易时段运作。

-

参数优化空间有限。可以尝试机器学习等技术寻找更优参数。

该策略还有一定的优化空间,主要方向包括:

-

测试更长周期的EMA参数,改进趋势判断。

-

增加股票大盘指数作为额外的趋势过滤指标。

-

利用机器学习等技术自动优化入场和止损点位。

-

增加基于波动率的仓位和止损动态调整机制。

-

尝试多品种套利,进一步分散单一品种的系统性风险。

趋势追踪反转策略整体而言是一个非常实用的短线策略思路,简单参数少,实操容易上手,0014能很好控制个人风险,适合炒股论坛的活跃型短线交易者。该策略有一定的优化空间,投入一定研发精力可以使其甚至适合中长线资金进行程序化运作,具有很好的发展潜力。

||

The Trend Tracking Reversal strategy is a short-term trend trading strategy based on 15-minute NQ futures. It identifies trading opportunities through trend filtering and reversal pattern recognition. This simple yet effective strategy suits active short-term traders.

The strategy mainly operates on the following principles:

-

Use an 8-period EMA as the main trend filter, with long signals above EMA and short signals below EMA.

-

Identify specific candlestick reversal patterns as entry signals, including long green candles followed by short red candles for long signals, and long red candles followed by short green candles for short signals. These patterns suggest a potential trend reversal.

-

Entry points are set near the high/low of the reversal candle, with stop loss levels at the high/low of the reversal candle itself, allowing efficient risk/reward ratios.

-

Validate reversal signals using candlestick relationship rules e.g. the open price of the red candle is above the last green candle's body, body fully engulfs etc to filter noise.

-

Only operate the strategy during specific trading hours, avoiding volatile periods around major contract rollovers etc, to prevent unnecessary losses from abnormal price action.

The main advantages of this strategy include:

-

Simple and effective signal logic that is easy to grasp and execute.

-

Trend and reversal based, avoiding whipsaws from raging bull and bear markets.

-

Good risk control with reasonable stop loss placement for capital preservation.

-

Low data needs fit various platforms and tools.

-

High trading frequency suits active short-term trading style.

There are some risks to note:

-

Insufficient reversal opportunities and limited signals. Relax reversal criteria to allow more signals.

-

Occasional false breakouts. Add more filters for combinational logic.

-

Volatility in overnight and non-main sessions. Restrict strategy operation to US trading hours.

-

Limited optimization flexibility. Consider machine learning for better parameter tuning.

There is room for optimization:

-

Test longer EMA periods to improve trend definition.

-

Add equity index filters as supplemental trend filters.

-

Use machine learning techniques to auto-tune entry and stop loss levels.

-

Introduce volatility adjusted position sizing and dynamic stops.

-

Explore cross-asset arbitrage to diversify single-asset systemic risks.

The Trend Tracking Reversal Strategy offers a very practical short-term strategy framework that is simple to implement with limited parameters and good personal risk control. It suits active short-term traders on day trading forums. With further R&D, it can potentially be applicable for medium-long term algorithmic trading, demonstrating strong versatility and development potential.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 0930-1415 | Trading Session |

| v_input_2 | 1515-1558 | Close All Open Trades |

| v_input_color_1 | orange | EMA Color |

| v_input_int_1 | 8 | EMA Length |

| v_input_string_1 | 0 | Sell Entry Shape: Arrow |

| v_input_string_2 | 0 | Buy Entry Shape: Arrow |

| v_input_3 | timestamp(2018-12-24T00:00:00) | (?ALL STRATEGY SETTINGS BELOW)startDate |

| v_input_4 | timestamp(2029-02-26T00:00:00) | finishDate |

| v_input_5 | true | (?TP/SL CONDITION INPUTS HERE)Enter RR |

Source (PineScript)

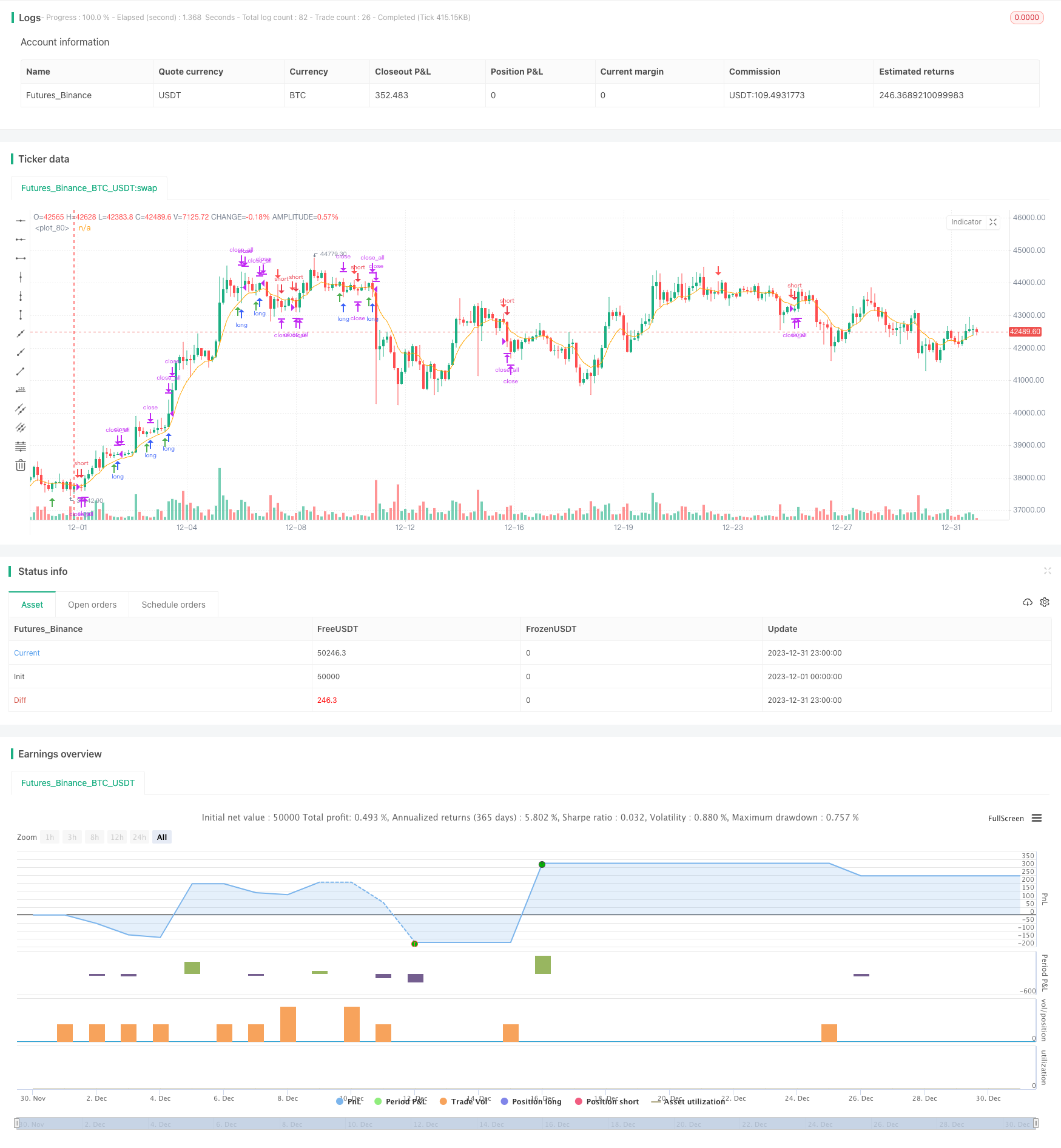

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © bdrex95

//@version=5

// Rob Reversal Strategy - Official

// Using Rob Reversal Indicator: Original

// Description

// This indicator is based on the strategy created by Trader Rob on the NQ 15m chart.

//

// Timeframe for trading is 8:30am-1:15pm Central.

//

// Above the EMA line, look for a long position. You will have a short candle, then a long candle that opens below the short candle. It will have a lower high and a lower low. Once the long candle closes, your entry will be 1 tick above the wick (green line) and stop loss will be at the bottom of the bottom wick (red line).

//

// Below the EMA line, look for a short position. You will have a long candle, then a short candle that opens above the long candle. It will have a higher high and a higher low. Once the short candle closes, your entry will be 1 tick below the wick (green line) and stop loss will be at the top of the top wick (red line).

//

strategy("Trader Rob Reversal Strategy NQ 15min", shorttitle="Official Rob Rev Strat", overlay=true)

//--- Session Input ---

sess = input(defval = "0930-1415", title="Trading Session")

t = time(timeframe.period, sess)

sessionOpen = na(t) ? false : true

flat_time = input(defval = "1515-1558", title="Close All Open Trades")

ft = time(timeframe.period, flat_time)

flatOpen = na(ft) ? false : true

// Calculate start/end date and time condition

startDate = input(timestamp('2018-12-24T00:00:00'),group = "ALL STRATEGY SETTINGS BELOW")

finishDate = input(timestamp('2029-02-26T00:00:00'),group = "ALL STRATEGY SETTINGS BELOW")

time_cond = true

emaColor = input.color(color.orange, title="EMA Color")

emaLength = input.int(8, title="EMA Length")

emaInd = ta.ema(close, emaLength)

rr = input(1.0,"Enter RR",group = "TP/SL CONDITION INPUTS HERE")

sellShapeInput = input.string("Arrow", title="Sell Entry Shape", options=["Arrow", "Triangle"])

buyShapeInput = input.string("Arrow", title="Buy Entry Shape", options=["Arrow", "Triangle"])

sellShapeOption = switch sellShapeInput

"Arrow" => shape.arrowdown

"Triangle" => shape.triangledown

buyShapeOption = switch buyShapeInput

"Arrow" => shape.arrowup

"Triangle" => shape.triangleup

O = open

C = close

H = high

L = low

sellEntry = (C[1] > O[1]) and (C < O) and (H[1] < H) and (C < H[1]) and (C > L[1]) and (L > L[1]) and (C < emaInd) and sessionOpen and time_cond

buyEntry = (C[1] < O[1]) and (C > O) and (H[1] > H) and (L[1] > L) and (C < H[1]) and (C > L[1]) and (C > emaInd) and sessionOpen and time_cond

sellEntry_index = ta.valuewhen(sellEntry,bar_index,0)

sellEntry_hi = ta.valuewhen(sellEntry,high,0)

sellEntry_low = ta.valuewhen(sellEntry,low,0)

buyEntry_index = ta.valuewhen(buyEntry,bar_index,0)

buyEntry_hi = ta.valuewhen(buyEntry,high,0)

buyEntry_lo = ta.valuewhen(buyEntry,low,0)

plotshape(buyEntry, color = color.green, location = location.belowbar, style = buyShapeOption, size = size.small)

plotshape(sellEntry, color = color.red, location = location.abovebar, style = sellShapeOption, size = size.small)

plot(emaInd, color=emaColor)

// Risk Management

entry_price_long = (buyEntry_hi + syminfo.mintick)

entry_price_short = (sellEntry_low - syminfo.mintick)

long_sl_price = (buyEntry_lo-syminfo.mintick)

short_sl_price = (sellEntry_hi + syminfo.mintick)

long_tp_price = ((entry_price_long - long_sl_price)*rr) + entry_price_long

short_tp_price = entry_price_short - ((short_sl_price - entry_price_short)*rr)

long_sl_ticks = (entry_price_long - long_sl_price) / syminfo.mintick

short_sl_ticks = (short_sl_price - entry_price_short) / syminfo.mintick

long_tp_ticks = (long_tp_price - entry_price_long) / syminfo.mintick

short_tp_ticks = (entry_price_short - short_tp_price) / syminfo.mintick

// Positions

if (buyEntry)

strategy.entry("Long", strategy.long,stop = H + syminfo.mintick)

if strategy.position_size > 0

strategy.exit("Long Ex","Long", loss = long_sl_ticks, profit = long_tp_ticks, comment_loss = "SL Long", comment_profit = "TP Long")

if (sellEntry)

strategy.entry("Short", strategy.short,stop = L - syminfo.mintick)

if strategy.position_size < 0

strategy.exit("Short Ex","Short",loss = short_sl_ticks, profit = short_tp_ticks, comment_loss = "SL Short", comment_profit = "TP Short")

// Cancel order if close beyond ema

if (C < emaInd)

strategy.cancel("Long")

if (C > emaInd)

strategy.cancel("Short")

// Go flat at close (for futures funded account)

if strategy.position_size > 0 and flatOpen

strategy.close_all(comment = "EOD Flat")

if strategy.position_size < 0 and flatOpen

strategy.close_all(comment = "EOD Flat")

//END

Detail

https://www.fmz.com/strategy/438935

Last Modified

2024-01-16 14:44:35