Name

每日均成本策略结合EMA触碰信号Daily-DCA-Strategy-with-Touching-EMAs

Author

ChaoZhang

Strategy Description

这个Pine脚本策略在TradingView平台上实现了一种每日均成本策略,同时结合了EMA指标的触碰信号来确定入场点。策略遵循均成本投资法则,每天以固定金额进行买入,以分散风险。同时,通过EMA的触碰信号来指导具体的入场时机。

该策略主要具有以下几个特点:

-

每日均成本投资法则

- 每天以固定金额进行买入,无论市场涨跌

- 长期分散投资,降低单笔投资的风险

-

EMA指标确定入场点

- 当收盘价上穿5日、10日、20日等EMA时,触发买入

- EMA线作为支持,能较好避开短期调整

-

动态止损机制

- 当收盘价跌破20日简单移动均线时,止损清仓

- 避免亏损进一步扩大

-

最大仓位限制

- 最大允许300笔交易,控制仓位规模和风险

- 防止过度投资导致的资金不足

具体来说,策略每天投入固定金额,按当日收盘价计算可以购买的股票数量。在这个基础上,如果当天的收盘价上穿5日、10日、20日等EMA中的任意一条时,就会触发买入信号。一旦累积的仓位达到最大限制的300笔时,就不会有新的买入操作。另外,如果收盘价跌破20日SMA,或者到达提前设定的退出日期,就会清仓止损。该策略还在价格图上绘制不同周期的EMA线,方便直观分析。

该策略具有以下几个优势:

-

分散投资,降低单笔投资风险

- 每天进行小额、固定金额投资,无论涨跌

- 不会出现 reunrung 追高的问题

-

EMA结合,避开短期调整

- EMA上穿作为买入信号,避开回撤期间的买入

- 回撤期间继续分批买入,分散风险

-

动态止损,控制亏损

- 设定止损线,可以及时止损

- 防止出现大额亏损

-

最大仓位限制,控制风险

- 最大仓位可以预先设定,防止过度投资

- 在ETP承担能力范围内进行投资

-

直观的EMA显示,易于判定

- 价格图上绘制不同EMA周期的线

- 一目了然,便于操作员监控

-

高度可定制化

- 可以自定义投入金额、EMA周期、止损线等

- 根据个人风险偏好进行调整

该策略也存在一些风险需要注意:

-

系统性风险难以规避

- 遇到黑天鹅事件,可能面临较大亏损

- 分散投资可以降低风险,无法完全规避

-

固定投资金额带来的风险

- 每天固定金额投入,价格剧烈上涨时可能后悔

- 可以采用动态调整投入金额的优化

-

EMA无法对极端行情作出反应

- EMA对突发事件反应迟缓,无法及时止损

- 可以考虑与KD、BOLL等指标结合,识别极端行情

-

仓位限制也限制了盈利空间

- 仓位有上限,无法无限增持

- 需要综合考量,在风险和收益间找到平衡

-

停损点设置需要经验和技巧

- 停损点过近则容易被突破,过远又无法及时止损

- 需要通过反复测试取得平衡

该策略还具有进一步优化的空间:

-

增加动态调整每日投入金额

- 可以根据特定指标,动态调整每日投入

- 在看好行情时增加投入,看淡时减少

-

结合更多指标判断入场

- 除了EMA,还可以引入KD、BOLL等指标判定

- 提高对极端行情的判断能力

-

采用指数移动平均

- EMA对突发事件反应迟缓,可以考虑采用DEMA、TEMA等

- 更快捕捉新的趋势方向

-

动态调整最大仓位

- 可以根据策略盈利情况,动态调整最大仓位

- 在估值合理时适当加大仓位

-

采用渐进式止损

- 现有策略为直接清仓止损,可以采用渐进清仓

- 防止止损点被「抄底」的风险

总的来说,该每日均成本策略结合EMA触碰信号,实现了长期分批投资的思路。相比单次大手开仓,可以分散风险,避免在高点狂欢。EMA的加入也在一定程度上避让了短期调整带来的风险,采取止损措施控制最大亏损。同时,仍需要注意黑天鹅风险,以及固定投入金额无法充分抓住机会带来的遗憾等问题。这些都为策略进一步的优化提供了方向。通过参数调整与指标组合,可以逐步优化并实现既高效又稳定的量化交易策略。

||

This Pine script strategy implements a daily dollar-cost averaging approach on the TradingView platform, incorporating EMA touch signals to determine entry points. It follows the dollar-cost averaging methodology to make fixed-amount investments every day, spreading purchases over time to mitigate risk. The EMA crossovers then serve as the specific trigger for entries.

The strategy has the following key features:

-

Daily Dollar-Cost Averaging

- Fixed daily investment regardless of market ups and downs

- Long-term batch investments to reduce single-trade risk

-

EMAs for Entry Signals

- Buy signal triggered when closing price crosses above EMA 5, 10, 20 etc.

- EMA lines serve as support to avoid short-term pullbacks

-

Dynamic Stop Loss

- Sell all positions if closing price falls below 20-day SMA

- Avoid further losses

-

Trade Count Limit

- Caps max trades at 300 to control position sizing

- Prevents over-investment beyond asset capacity

Specifically, every day the strategy invests a fixed amount and calculates the shares to buy based on the closing price. If the closing price crosses above any of the 5-, 10-, 20-day EMA etc., a buy signal is triggered. Once the accumulated trade count hits the 300 limit, no further buys will occur. Additionally, if the price closes below the 20-day SMA or reaches the preset exit date, all positions are cleared. The script also plots the EMAs on the price chart for visual analysis.

The advantages of this strategy include:

-

Risk Diversification

- Small fixed-amount daily investments regardless of market trends

- Avoids chasing highs

-

EMA Combination Avoids Pullbacks

- EMA crossovers prevent buying into pullback periods

- Continued buying during pullbacks diversifies risk

-

Dynamic Stop Loss Controls Losses

- Stop loss allows timely exits

- Prevents heavy losses

-

Trade Limit Controls Risks

- Max position size is preset to prevent over-investment

- Keeps investment within asset capacity

-

Intuitive EMA Visualization

- EMAs plotted on price chart

- Allows easy monitoring by operator

-

Highly Customizable

- Custom inputs for investment amount, EMA periods, stops etc.

- Adjusts based on personal risk preferences

The strategy also carries some risks to note:

-

Systemic Risks Still Exist

- Black swan events can lead to heavy losses

- Diversification only reduces but don't eliminate risks

-

Fixed Investment Amount

- Fixed daily investments could miss out on upside if prices surge

- Dynamic amount adjustment could help

-

EMAs Cannot React to Extreme Moves

- EMAs have slower reaction to sudden events and fails to stop loss in time

- Combining with KD, BOLL may help identify extremes

-

Trade Limit Caps Profit Potential

- Upper limit on trades caps possible gains

- Need to balance risks and rewards

-

Stop Loss Placement Requires Care

- Stops too close tend to get taken out prematurely while stops too loose fails to protect in time

- Extensive testing needed to find the right balance

Further optimizations:

-

Dynamic Daily Investment Amount

- Base daily investments on indicators

- Increase when bullish, decrease when bearish

-

Additional Entry Signals

- Complement EMA with other indicators like KD, BOLL

- Improve identification of extreme moves

-

Exponential Moving Averages

- EMAs react slowly to sudden events, DEMA, TEMA may help

- Faster capture of new trends

-

Dynamic Position Limit

- Increase limit based on strategy profitability

- Allows higher exposure at fair valuations

-

Trailing Stop Loss

- Current strategy market sells all, trailing stops could help avoid gaps down

- Reduce risk of stops being "run"

In summary, this EMA-combined daily DCA strategy realizes the concept of long-term periodic investments, spreading risks across multiple small entries compared to large one-time purchases. The EMAs help avoid short-term pullback risks to a certain extent, while the stop loss controls max loss. Still, black swan risks and the limitations of fixed investment size need to be kept in mind. These aspects provide future enhancement directions through parameter tuning and indicator combinations for building efficient yet stable quant strategies.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 50000 | Daily Investment |

| v_input_2 | 2022 | Start Year |

| v_input_3 | true | Start Month |

| v_input_4 | true | Start Day |

| v_input_5 | 2023 | End Year |

| v_input_6 | 12 | End Month |

| v_input_7 | true | End Day |

| v_input_8 | 10000 | Pyramiding Limit |

| v_input_9 | true | Enable Sell |

Source (PineScript)

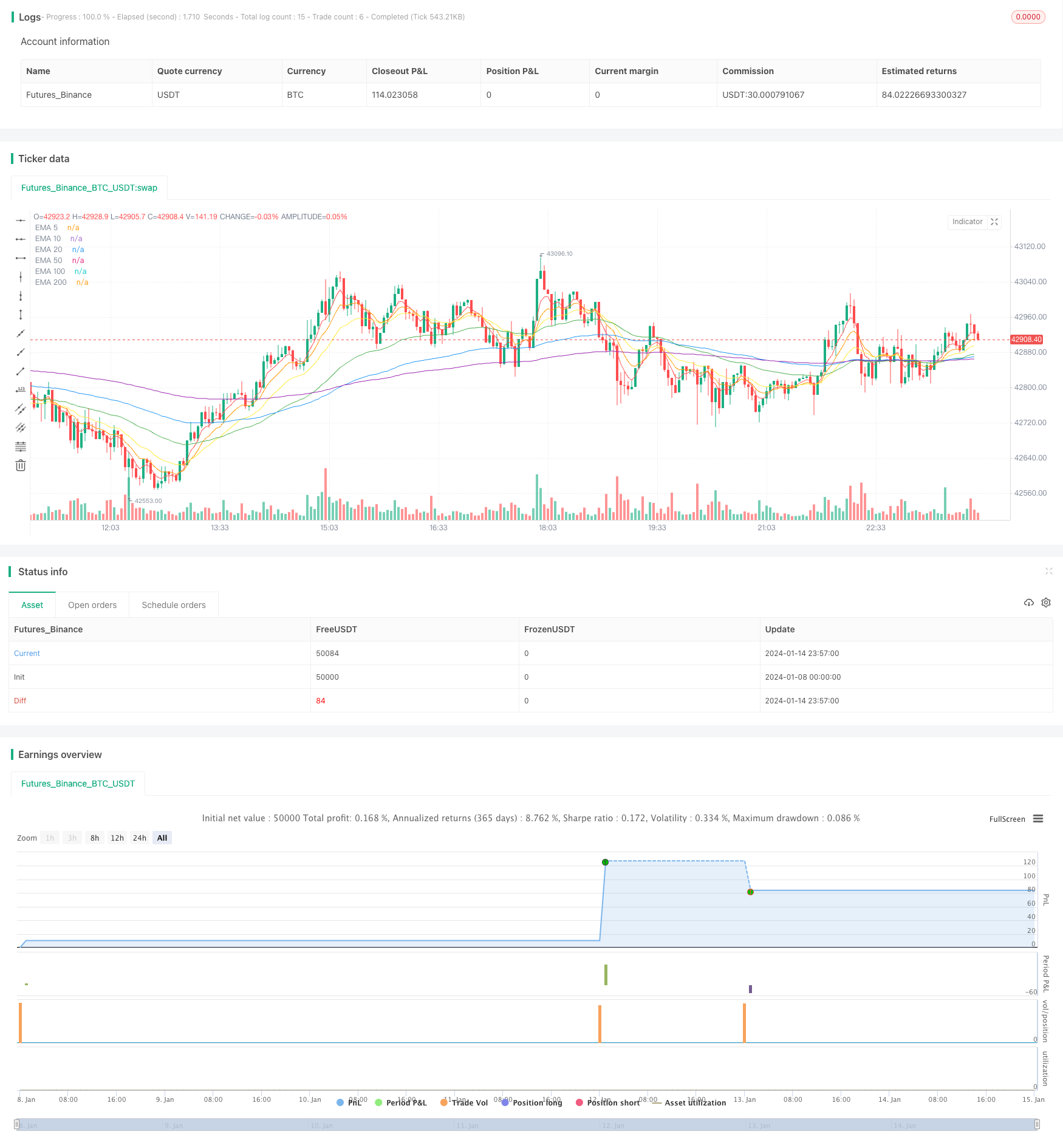

/*backtest

start: 2024-01-08 00:00:00

end: 2024-01-15 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Daily DCA Strategy with Touching EMAs", overlay=true, pyramiding=10000)

// Customizable Parameters

daily_investment = input(50000, title="Daily Investment")

start_year = input(2022, title="Start Year")

start_month = input(1, title="Start Month")

start_day = input(1, title="Start Day")

end_year = input(2023, title="End Year")

end_month = input(12, title="End Month")

end_day = input(1, title="End Day")

trade_count_limit = input(10000, title="Pyramiding Limit")

enable_sell = input(true, title="Enable Sell")

start_date = timestamp(start_year, start_month, start_day)

var int trade_count = 0

// Calculate the number of shares to buy based on the current closing price

shares_to_buy = daily_investment / close

// Check if a new day has started and after the start date

isNewDay = dayofmonth != dayofmonth[1] and time >= start_date

// Buy conditions based on EMA crossovers

ema5_cross_above = crossover(close, ema(close, 5))

ema10_cross_above = crossover(close, ema(close, 10))

ema20_cross_above = crossover(close, ema(close, 20))

ema50_cross_above = crossover(close, ema(close, 50))

ema100_cross_above = crossover(close, ema(close, 100))

ema200_cross_above = crossover(close, ema(close, 200))

if isNewDay and (ema5_cross_above or ema10_cross_above or ema20_cross_above or ema50_cross_above or ema100_cross_above or ema200_cross_above) and trade_count < trade_count_limit

strategy.entry("Buy", strategy.long, qty=shares_to_buy)

trade_count := trade_count + 1

// Dynamic sell conditions (optional)

sell_condition = true

if enable_sell and sell_condition

strategy.close_all()

// EMA Ribbon for visualization

plot(ema(close, 5), color=color.red, title="EMA 5")

plot(ema(close, 10), color=color.orange, title="EMA 10")

plot(ema(close, 20), color=color.yellow, title="EMA 20")

plot(ema(close, 50), color=color.green, title="EMA 50")

plot(ema(close, 100), color=color.blue, title="EMA 100")

plot(ema(close, 200), color=color.purple, title="EMA 200")

Detail

https://www.fmz.com/strategy/438947

Last Modified

2024-01-16 15:30:17