Name

快速响应型加密货币RSI趋势跟踪策略Crypto-RSI-Mini-Sniper-Quick-Response-Trend-Following-Strategy

Author

ChaoZhang

Strategy Description

[trans]

快速响应型加密货币RSI趋势跟踪策略是一种适用于高波动性加密货币交易的积极策略。它结合相对强度指数(RSI)指标和简单移动平均线,在5分钟时间周期内捕捉加密货币价格的重大变动。

该策略可以快速响应加密货币市场上的短期价格波动,适合喜欢高频交易环境且注重短期价格移动的交易者。

该策略使用以下指标和条件来生成交易信号:

-

RSI(14周期):识别超买(高于65)和超卖(低于35)条件,为可能的价格反转或趋势延续提供信号

-

SMA400: 400周期的简单移动平均线,用于判断长期趋势方向。只有与SMA400指示的趋势方向一致的交易才会考虑

-

做多条件: 当RSI低于超卖水平(35)且当前价格高于SMA400时,表示上涨动能,符合总体上涨趋势

-

做多退出条件: 当RSI达到极高值(表示超买)或预设的止损或止盈水平被触发时,平仓做多头寸

-

做空条件: 当RSI高于超买水平(65)且当前价格低于SMA400时,表示下跌动能,符合总体下跌趋势

-

做空退出条件: 当RSI达到极低值(表示超卖)或预设的止损或止盈水平被触发时,平仓做空头寸

该策略使用2%的初始止损来限制亏损,并使用5%的止盈来锁定利润。这些参数可以根据资产的波动性和交易者的风险偏好进行调整。

该策略具有以下优势:

-

快速响应: 5分钟周期使其可以快速响应加密货币市场的剧烈价格波动

-

效率: 只在趋势方向与长线一致时考虑交易,避免假突破

-

灵活: 可以通过调整止损,止盈,交易频率等参数进行优化

-

流动性强: 交易主流加密货币,不必担心流动性问题

-

风险控制: 使用止损来管理风险,最大程度减少单笔损失

该策略也存在以下风险:

-

止损被追究: 加密货币波动剧烈,止损有时会被突破触发

-

趋势反转风险: 趋势可能会在止损或止盈水平之前发生反转

-

交易成本: 较高的交易频率会产生更多的手续费和滑点成本

-

过度交易: 参数设置不当可能导致过度交易和资金锁定

-

假突破: 短期内价格可能出现不符合总体趋势方向的假突破

可以通过以下方法降低风险:

-

适当放宽止损范围

-

优化参数,降低交易频率

-

选择手续费更低的交易平台

-

在回测中充分验证参数,避免过度交易

-

结合其他指标识别假突破

该策略还可以从以下方面进行优化:

-

多时间框架验证: 结合更高时间框架的指标,避免被短期噪音误导

-

参数优化: 通过更多回测来找到最优参数组合

-

突破验证: 在突破后寻找其他指标的验证信号

-

趋势过滤: 结合趋势线,避免逆势交易

-

交易成本优化: 调整固定止盈止损设置,使用自适应止损

-

基于机器学习的入场: 使用神经网络等技术判断潜在入场时机

-

组合改进: 与其他非相关策略组合,提高整体稳定性

该快速响应型加密货币RSI趋势跟踪策略通过跟踪短期超买超卖现象,在长期趋势方向指引下,在加密货币市场的短期价格波动中捕捉利润。

它快速响应的特点使其非常适合那些有足够时间密切观察市场,并享受高频交易刺激的加密货币交易者。通过本文对该策略的深入解读,我们分析了其运作原理,概述了优势,剖析了风险并提出了多种优化思路。

总的来说,通过 parameter tuning, time frame confluence, risk management 和 composability 的改进,该策略可以成为一个非常强大的加密货币量化交易工具。

||

The Crypto RSI Mini-Sniper Quick Response Trend Following Strategy is an aggressive strategy tailored for active cryptocurrency traders focusing on high-volatility assets like Bitcoin. It combines the Relative Strength Index (RSI) indicator with Simple Moving Average to capture significant price movements on the 5-minute timeframe in the crypto markets.

The strategy is able to quickly respond to short-term price fluctuations in the cryptocurrency markets suitable for traders who prefer a fast-paced trading environment and pay close attention to short-term price action.

The strategy generates trading signals based on the following indicators and conditions:

-

RSI (14 periods): Identifies overbought (above 65) and oversold (below 35) conditions to signal potential price reversals or trend continuations

-

SMA400: 400-period Simple Moving Average used to determine overall trend direction. Trades are only considered if they align with the trend indicated by SMA400

-

Long Condition: When RSI is below oversold level (35) and close is above SMA400, indicating potential upward momentum within an uptrend

-

Long Exit Condition: When RSI reaches extremely high level (overbought) or predefined stop loss or take profit triggers are hit

-

Short Condition: When RSI is above overbought level (65) and close is below SMA400, indicating potential downward momentum within a downtrend

-

Short Exit Condition: When RSI reaches extremely low level (oversold) or predefined stop loss or take profit triggers are hit

The strategy utilizes a 2% initial stop loss to control risk and 5% take profit to lock in gains. These parameters can be adjusted based on asset volatility and trader risk tolerance.

The strategy has the following advantages:

-

Fast Response: The 5-minute timeframe allows fast reaction to extreme crypto price moves

-

Efficiency: Only considers trades aligning with the long-term trend, avoiding false breakouts

-

Flexibility: Parameters like stop loss, take profit, trade frequency can be optimized

-

Liquidity: Trading major crypto assets ensures sufficient liquidity

-

Risk Control: Uses stop loss to control risk and limit losses on individual trades

The strategy also has the following risks:

-

Stop Loss Hunting: Crypto volatility could cause stop loss triggers to be hit

-

Trend Reversals: Trends could reverse before stop or take profit triggers are hit

-

Transaction Costs: Higher trade frequency leads to more commission and slippage costs

-

Over Trading: Poor parameter tuning could cause over trading and capital lock up

-

False Breakouts: Short-term price action could false breakout against the overall trend

The risks can be mitigated by:

-

Allowing wider stop loss ranges

-

Optimizing parameters and reduce trade frequency

-

Choosing trading platforms with lower commission fees

-

Thoroughly backtesting to avoid over trading

-

Using other indicators to identify false breakouts

The strategy can also be improved on the following dimensions:

-

Multi Timeframe Confluence: Incorporate higher timeframe indicators to avoid short-term noise

-

Parameter Optimization: Discover optimal parameters through more backtesting

-

Breakout Validation: Seek confirmation signals from other indicators after breakouts

-

Trend Filtering: Implement trend lines to avoid countertrend trades

-

Transaction Costs: Adapt stop loss instead of fixed $ values

-

Machine Learning Entry: Use neural networks to detect potential entries

-

Ensemble models: Combine with non-correlated strategies to improve stability

The Crypto RSI Mini-Sniper Quick Response Trend Following Strategy aims to capture profits from short-term price swings in the crypto markets by tracking short-term overbought/oversold extremes within the context of the prevailing long-term trend.

Its quick response characteristic makes it well-suited for crypto traders who have sufficient time to watch the markets closely and enjoy the excitement of high-frequency trading. Through our deep dive analysis of this strategy, we examined its logic, summarized its strengths, deconstructed its weaknesses, and proposed multiple optimization techniques.

Overall, with refinements in parameter tuning, time frame confluence, risk management and composability, this strategy can evolve into a very robust crypto algorithmic trading system.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | RSI Length |

| v_input_2 | 35 | Oversold Level |

| v_input_3 | 65 | Overbought Level |

| v_input_float_1 | 5 | Take Profit 1 (%) |

| v_input_float_2 | 2 | Stop Loss (%) |

Source (PineScript)

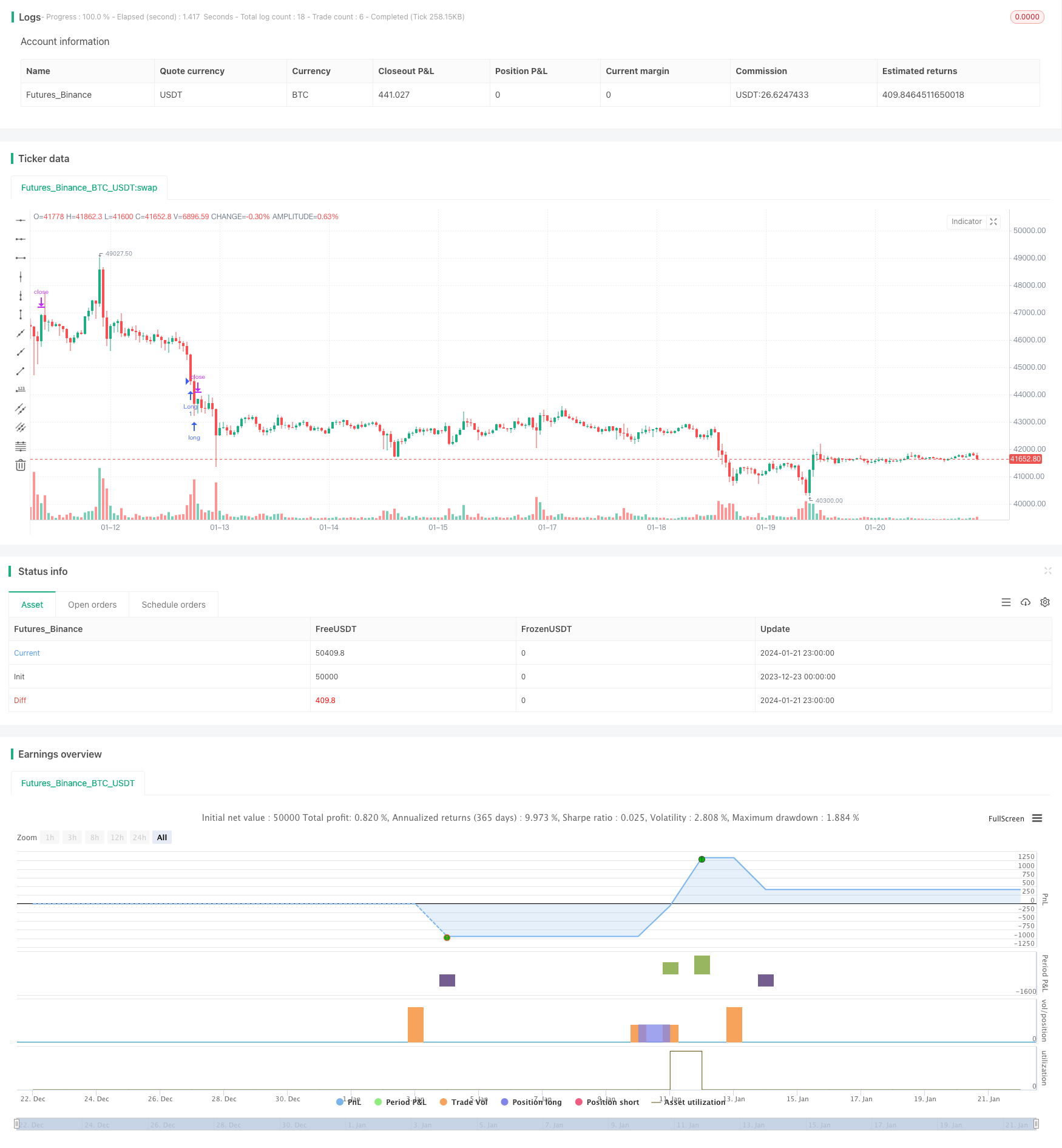

/*backtest

start: 2023-12-23 00:00:00

end: 2024-01-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Wielkieef

//@version=5

strategy("Crypto RSI mini-Sniper [5min]", shorttitle="RSI Strategy", overlay=true)

// Inputs

rsiLength = input(14, title="RSI Length")

oversoldLevel = input(35, title="Oversold Level")

overboughtLevel = input(65, title="Overbought Level")

sma400 = ta.sma(close, 400)

tp_1 = input.float(5.0, title="Take Profit 1 (%)")

sl = input.float(2.0, title="Stop Loss (%)")

// Longs Logic

rsi = ta.rsi(close, rsiLength)

longCondition = rsi < oversoldLevel and close > sma400

longExitCondition = rsi > 80 and close > sma400

longStopPrice = strategy.position_avg_price * (1 - sl / 100)

longTargetPrice = strategy.position_avg_price * (1 + tp_1 / 100)

//

strategy.entry("Long", strategy.long, when=longCondition)

strategy.close("Long", when=longExitCondition)

strategy.exit("Exit Long", "Long", stop=longStopPrice, limit=longTargetPrice)

// Shorts Logic

shortCondition = rsi > overboughtLevel and close < sma400

shortExitCondition = rsi < 20 and close < sma400

shortStopPrice = strategy.position_avg_price * (1 + sl / 100)

shortTargetPrice = strategy.position_avg_price * (1 - tp_1 / 100)

//

strategy.entry("Short", strategy.short, when=shortCondition)

strategy.close("Short", when=shortExitCondition)

strategy.exit("Exit Short", "Short", stop=shortStopPrice, limit=shortTargetPrice)

//by wielkieef

Detail

https://www.fmz.com/strategy/439695

Last Modified

2024-01-23 10:46:17