Name

开箱即用的机器学习交易策略Out-of-the-box-Machine-Learning-Trading-Strategy

Author

ChaoZhang

Strategy Description

这个策略利用机器学习的方法,实现了一个开箱即用的自动化交易策略。它整合了多个指标和模型,可以自动生成交易信号,并根据信号进行买入和卖出操作。

这个策略主要基于以下几个要点:

- 使用hull均线判断市场趋势方向

- 使用EMA判断短期和中期趋势

- 利用K线实体通道判断关键 SUPPORT/RESISTANCE 位置

- 利用多周期SECURITY开盘价和收盘价交叉做决策

具体来说,策略会绘制出hull均线、13周期EMA和21周期EMA。通过EMA的多空状态判断短期和中期趋势方向。再结合hull均线判断更长周期的趋势。这为后续交易信号提供了大方向的指引。

在调整仓位前,策略会参考实体通道内最高价和最低价对应的支撑和阻力位。这可以避免在关键价格区域产生交易信号。

最后,策略会调用60周期开盘价和收盘价,当收盘价上穿开盘价时产生买入信号,下穿时产生卖出信号。这样就完成了整个交易逻辑。

这个策略最大的优势在于结合了机器学习和技术分析指标,实现了一个逻辑清晰、参数可调、易于操作的自动化交易方案。

-

多指标组合,提高信号准确性

策略没有单纯依赖一两个指标,而是综合考虑了趋势、支撑阻力、价格突破等多个因素,大大提高了信号的可靠性和准确性。

-

灵活的参数设置

hull均线长度、EMA周期数、开盘收盘交叉周期数都可以通过参数进行调整,使策略可以灵活适应不同市场环境。

-

自动化交易信号

基于指标和价格交叉的交易信号可以自动触发买入卖出,无需人工判断,降低了操作难度。

-

可视化的展示

策略中的图表可以清晰展示市场结构、趋势状态和关键价格,直观地显示策略判断依据。

尽管这个策略进行了多方位优化,但仍有一些可能存在的风险:

-

大幅度行情无法跟踪

在价格剧烈波动的行情中,指标可能会失效或者延迟,导致策略无法及时跟踪价格变化。需要优化参数以适应这种行情。

-

信号误差率存在

基于指标和模型的交易信号,多多少少会存在一些误报或漏报的情况。这需要通过组合更多auxiliary signals来提高信号质量。

-

多空MIX风险

策略同时做多做空,如果判断错误,会面临双向亏损的风险。这需要严格的截断损失或降低仓位来控制。

-

过优化风险

参数设置过于复杂,会面临过优化的风险。这需要简化系统,控制参数组合数量。

这个策略还有一定的优化空间,主要可以从以下几个方面进行:

-

添加更多指标信号

除了已有的指标,还可以引入更多辅助指标,如BOLL通道、KD指标等,丰富系统判断依据。

-

应用深度学习模型

将simple indicators作为特征,训练LSTM等深度学习模型,以提高信号质量。

-

结合基本面数据

添加宏观经济数据、政策面信息等基本面因素,优化大周期决策。

-

风险与仓位管理

引入止损策略,按照策略收益波动率动态调整仓位规模,严格控制风险。

这个策略整合了趋势、支撑阻力、突破等多个指标,利用机器学习方法实现了自动化的开箱即用的量化交易方案。它有着指标组合多样、参数可调、信号自动化等优势,也面临一定的跟踪偏差、信号误差、多空MIX等问题。未来仍有引入更多辅助指标与模型、结合基本面因素、动态调整仓位等方向可以深入优化,从而达到更稳定、准确、智能的量化交易效果。

||

This strategy utilizes machine learning methods to implement an out-of-the-box automated trading strategy. It integrates multiple indicators and models to automatically generate trading signals and make buy and sell decisions accordingly.

This strategy is mainly based on the following key points:

- Use Hull Moving Average to determine market trend direction

- Use EMA to judge short-term and medium-term trends

- Use candle body channel to locate key SUPPORT/RESISTANCE levels

- Make decisions based on crossover between open and close prices from multi-timeframe SECURITY

Specifically, the strategy will plot the Hull MA, 13-period EMA, and 21-period EMA. Judging short-term and medium-term trend directions based on the long and short status of EMAs. Combined with Hull MA to determine longer cycle trends. This provides guidance on the general direction for subsequent trading signals.

Before adjusting positions, the strategy will refer to the highest and lowest prices in the entity channel corresponding to support and resistance levels. This avoids generating trading signals in key price areas.

Finally, the strategy invokes the 60-period open and close prices. When the close price crosses above the open price, a buy signal is generated. When it crosses below, a sell signal is generated. This completes the entire trading logic.

The biggest advantage of this strategy is that it combines machine learning and technical analysis indicators to achieve a logical, adjustable and easy-to-use automated trading solution.

-

Multi-indicator combo improves signal accuracy

The strategy does not rely solely on one or two indicators, but takes into account multiple factors such as trends, support/resistance, and price breakthroughs. This greatly improves the reliability and accuracy of the signals.

-

Flexible parameter settings

The lengths of Hull MA, EMA periods, open/close crossover periods can be adjusted through parameters, making the strategy adaptable to different market environments.

-

Automated trading signals

The trading signals based on indicators and crossovers can automatically trigger buys and sells without manual judgment, reducing difficulty.

-

Visualized display

The charts in the strategy can clearly show market structure, trend status and key prices, intuitively displaying the basis for strategy judgment.

Although this strategy has been optimized in multiple aspects, there are still some potential risks:

-

Failure to track drastic price movements

In volatile markets, indicators may become ineffective or delayed, causing the strategy to fail to track price changes in time. Parameters need to be optimized to adapt to such markets.

-

Existence of signal error rate

Trading signals based on indicators and models, more or less, will have some false signals or missing signals. This needs to be improved by combining more auxiliary signals.

-

Long/Short mix risk

The strategy making both long and short positions simultaneously has the risk of losses on both sides if judgments went wrong. Strict stop loss or lower position sizing is required to control for this.

-

Overfit risk

Overly complex parameter settings run the risk of overfitting. The system needs to be simplified with constrained number of parameter combinations.

There is still some room for optimizing this strategy, mainly in the following aspects:

-

Add more indicator signals

In addition to existing indicators, more auxiliary indicators can be introduced, such as BOLL channels, KD indicators, etc, to enrich system reference.

-

Apply deep learning models

Use simple indicators as features to train LSTM and other deep learning models to improve signal quality.

-

Incorporate fundamental data

Add macroeconomic data, policy information and other fundamental factors to optimize long-cycle decisions.

-

Risk & position sizing

Introduce stop loss strategies, dynamically adjust position sizing based on strategy return volatility to strictly control risks.

This strategy integrates trends, support/resistance levels, breakouts and multiple other indicators, utilizing machine learning methods to achieve automated, ready-to-use quantitative trading solutions. It has the advantages of diverse indicator combos, tunable parameters and automated signals, while also facing tracking deviations, signal errors, long/short mix risks to some extent. There are still directions for further optimizations by incorporating more auxiliary indicators and models, combining fundamental factors, dynamically adjusting positions and so on, in order to achieve more stable, accurate and intelligent quantitative trading performance.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | Candle body resistance channel: close |

| v_input_2 | false | Bar Channel On/Off |

| v_input_3 | 10 | Support / Resistance length: |

| v_input_4 | 13 | EMA 1 |

| v_input_5 | 21 | EMA 2 |

| v_input_6 | false | Display Hull MA Set: |

| v_input_7_close | 0 | Hull MA's Source:: close |

| v_input_8 | 8 | Hull MA's Base Length: |

| v_input_9 | 5 | Hull MA's Length Scalar: |

| v_input_10 | 60 | Period |

Source (PineScript)

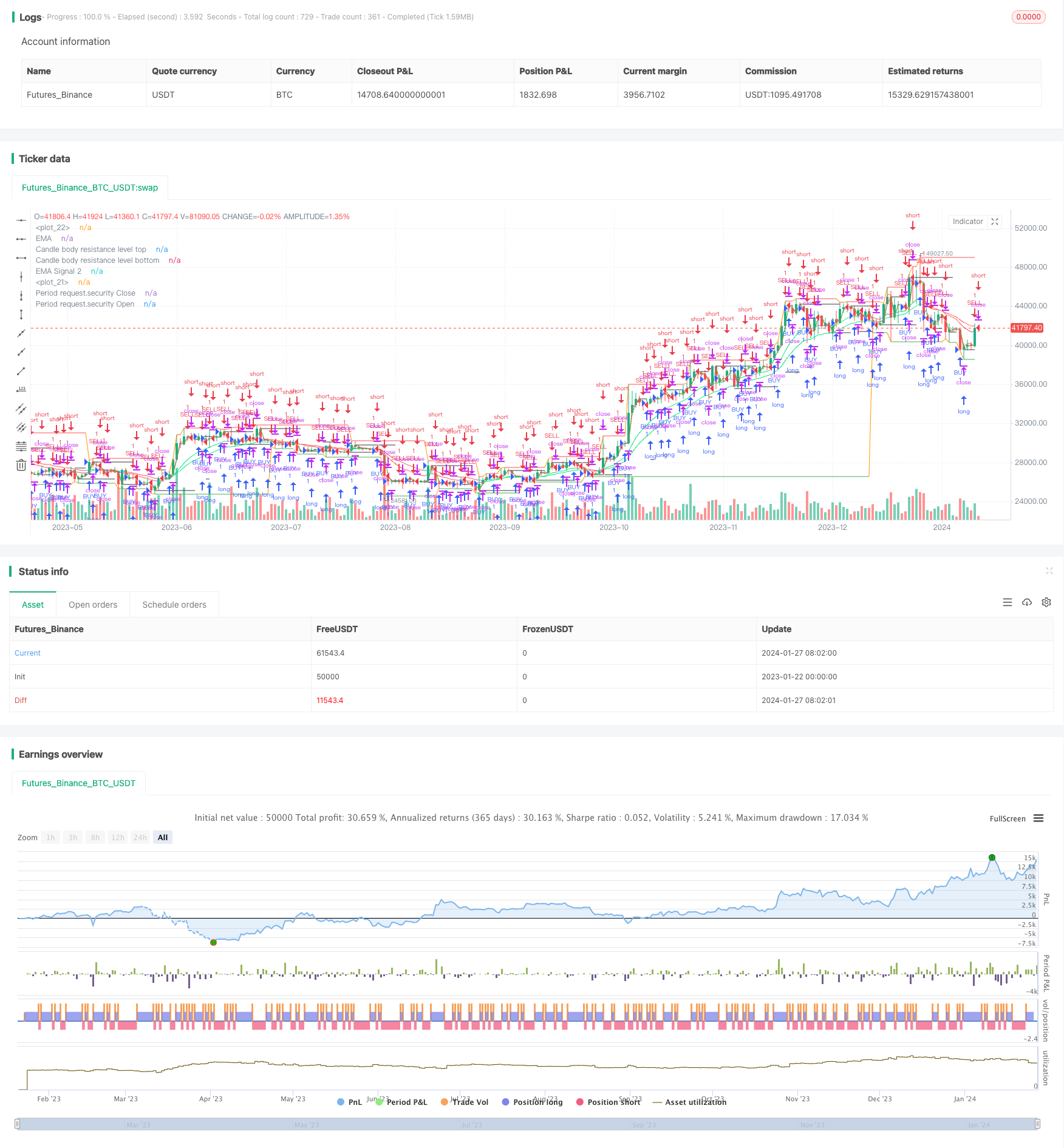

/*backtest

start: 2023-01-22 00:00:00

end: 2024-01-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title='Ali Jitu Abus', shorttitle='Ali_Jitu_Abis_Strategy', overlay=true, pyramiding=0, initial_capital=1000, currency=currency.USD)

//Candle body resistance Channel-----------------------------//

len = 34

src = input(close, title="Candle body resistance channel")

out = sma(src, len)

last8h = highest(close, 13)

lastl8 = lowest(close, 13)

bearish = cross(close,out) == 1 and falling(close, 1)

bullish = cross(close,out) == 1 and rising(close, 1)

channel2=input(false, title="Bar Channel On/Off")

ul2=plot(channel2?last8h:last8h==nz(last8h[1])?last8h:na, color=black, linewidth=1, style=linebr, title="Candle body resistance level top", offset=0)

ll2=plot(channel2?lastl8:lastl8==nz(lastl8[1])?lastl8:na, color=black, linewidth=1, style=linebr, title="Candle body resistance level bottom", offset=0)

//fill(ul2, ll2, color=black, transp=95, title="Candle body resistance Channel")

//-----------------Support and Resistance

RST = input(title='Support / Resistance length:', defval=10)

RSTT = valuewhen(high >= highest(high, RST), high, 0)

RSTB = valuewhen(low <= lowest(low, RST), low, 0)

RT2 = plot(RSTT, color=RSTT != RSTT[1] ? na : red, linewidth=1, offset=+0)

RB2 = plot(RSTB, color=RSTB != RSTB[1] ? na : green, linewidth=1, offset=0)

//--------------------Trend colour ema------------------------------------------------//

src0 = close, len0 = input(13, minval=1, title="EMA 1")

ema0 = ema(src0, len0)

direction = rising(ema0, 2) ? +1 : falling(ema0, 2) ? -1 : 0

plot_color = direction > 0 ? lime: direction < 0 ? red : na

plot(ema0, title="EMA", style=line, linewidth=1, color = plot_color)

//-------------------- ema 2------------------------------------------------//

src02 = close, len02 = input(21, minval=1, title="EMA 2")

ema02 = ema(src02, len02)

direction2 = rising(ema02, 2) ? +1 : falling(ema02, 2) ? -1 : 0

plot_color2 = direction2 > 0 ? lime: direction2 < 0 ? red : na

plot(ema02, title="EMA Signal 2", style=line, linewidth=1, color = plot_color2)

//=============Hull MA//

show_hma = input(false, title="Display Hull MA Set:")

hma_src = input(close, title="Hull MA's Source:")

hma_base_length = input(8, minval=1, title="Hull MA's Base Length:")

hma_length_scalar = input(5, minval=0, title="Hull MA's Length Scalar:")

hullma(src, length)=>wma(2*wma(src, length/2)-wma(src, length), round(sqrt(length)))

plot(not show_hma ? na : hullma(hma_src, hma_base_length+hma_length_scalar*6), color=black, linewidth=2, title="Hull MA")

//============ signal Generator ==================================//

Period=input('60')

ch1 = request.security(syminfo.tickerid, Period, open)

ch2 = request.security(syminfo.tickerid, Period, close)

longCondition = crossover(request.security(syminfo.tickerid, Period, close),request.security(syminfo.tickerid, Period, open))

if (longCondition)

strategy.entry("BUY", strategy.long)

shortCondition = crossunder(request.security(syminfo.tickerid, Period, close),request.security(syminfo.tickerid, Period, open))

if (shortCondition)

strategy.entry("SELL", strategy.short)

plot(request.security(syminfo.tickerid, Period, close), color=red, title="Period request.security Close")

plot(request.security(syminfo.tickerid, Period, open), color=green, title="Period request.security Open")

///////////////////////////////////////////////////////////////////////////////////////////

Detail

https://www.fmz.com/strategy/440311

Last Modified

2024-01-29 11:20:42