Name

威廉双指数移动平均线与一目均衡图策略Williams-Double-Exponential-Moving-Average-and-Ichimoku-Kinkou-Hyo-Strategy

Author

ChaoZhang

Strategy Description

该策略结合了威廉双指数移动平均线和一目均衡图两个技术指标,以发挥各自的优势,提高交易决策的准确性。其中,威廉双指数移动平均线可充分反映价格变化趋势,一目均衡图则可提前判断趋势反转。

威廉双指数移动平均线包含快线和慢线。快线计算公式为:2∗(n/2周期加权移动平均线),慢线计算公式为:n周期加权移动平均线。当快线从下方向上突破慢线时,为买入信号;从上方向下跌破时,为卖出信号。

一目均衡图包含换手线、基准线、先行线及云图四个组成部分。其中,换手线和基准线的黄金交叉为买入信号,死亡交叉为卖出信号。价格突破云图上沿为买入信号,下跌破云图下沿为卖出信号。

该策略结合两种指标优势,第一重判定为威廉指标发出信号,第二重判定为一目均衡图指标确认,可有效过滤假信号,提高决策准确性。

- 威廉双指数移动平均线反应灵敏,可确定较强趋势方向。

- 一目均衡图判断先行,可提前判断趋势反转。

- 结合两种指标,可互相验证,减少假信号。

- 通过参数优化,可自适应不同周期和品种。

- 非趋势市场中可能产生频繁信号。可适当调整参数,过滤掉部分信号。

- 快线和慢线交叉过程中,会有一定滞后。可结合云图判断,避免错过最佳买卖点位。

- 建议与趋势指标或波动指标组合使用,可进一步避免假信号。

该策略充分利用威廉指标判断趋势方向和一目均衡图提前看反转的优势,可显著提升交易决策的准确性。通过参数调整和组合其他指标,可持续优化策略,使之更适应市场的变化。

||

This strategy combines the Williams Double Exponential Moving Average and Ichimoku Kinkou Hyo, two technical indicators, in order to utilize their respective advantages and improve the accuracy of trading decisions. The Williams Double Exponential Moving Average can fully reflect trends in price changes, while Ichimoku Kinkou Hyo can provide early warnings of trend reversals.

The Williams Double Exponential Moving Average contains a fast line and a slow line. The fast line is calculated with the formula: 2*(n/2 period Weighted Moving Average), and the slow line is calculated with: n period Weighted Moving Average. When the fast line crosses above the slow line from below, it is a buy signal; when it crosses below from above, it is a sell signal.

Ichimoku Kinkou Hyo consists of four components: the tenkan sen, kijun sen, leading line and cloud layers. A golden cross between the tenkan sen and kijun sen is a buy signal, while a death cross is a sell signal. When prices break above or below the upper or lower edges of the cloud layers, it signals a buy or sell, respectively.

This strategy combines the strengths of both indicators. The first determinant is a signal from the Williams Indicator, and the second is confirmation from Ichimoku Kinkou Hyo, effectively filtering out false signals and improving decision accuracy.

- The Williams Double Exponential Moving Average reacts sensitively and can determine a strong trend direction.

- Ichimoku Kinkou Hyo provides leading judgments and early warnings of trend reversals.

- Combining the two indicators allows them to validate each other and reduce false signals.

- Parameters can be optimized for adaption to different cycle lengths and products.

- Frequent signals may occur in non-trending markets. Parameters can be adjusted to filter out some signals.

- There may be some lag in crossovers between the fast and slow lines. Cloud layers can be referenced to avoid missing optimal entry and exit points.

- It is recommended to combine with trend or volatility indicators to further avoid false signals.

This strategy fully utilizes the abilities of the Williams Indicator to judge trend directions and Ichimoku Kinkou Hyo to provide early warnings of reversals, significantly improving the accuracy of trading decisions. Further optimizations such as parameter tuning and combining with other indicators will allow sustainable enhancements for adapting to market changes.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 12 | Double HullMA |

| v_input_2 | 9 | Tenkan Sen Periods |

| v_input_3 | 24 | Kijun Sen Periods |

| v_input_4 | 51 | Senkou Span B Periods |

| v_input_5 | 24 | Displacement |

Source (PineScript)

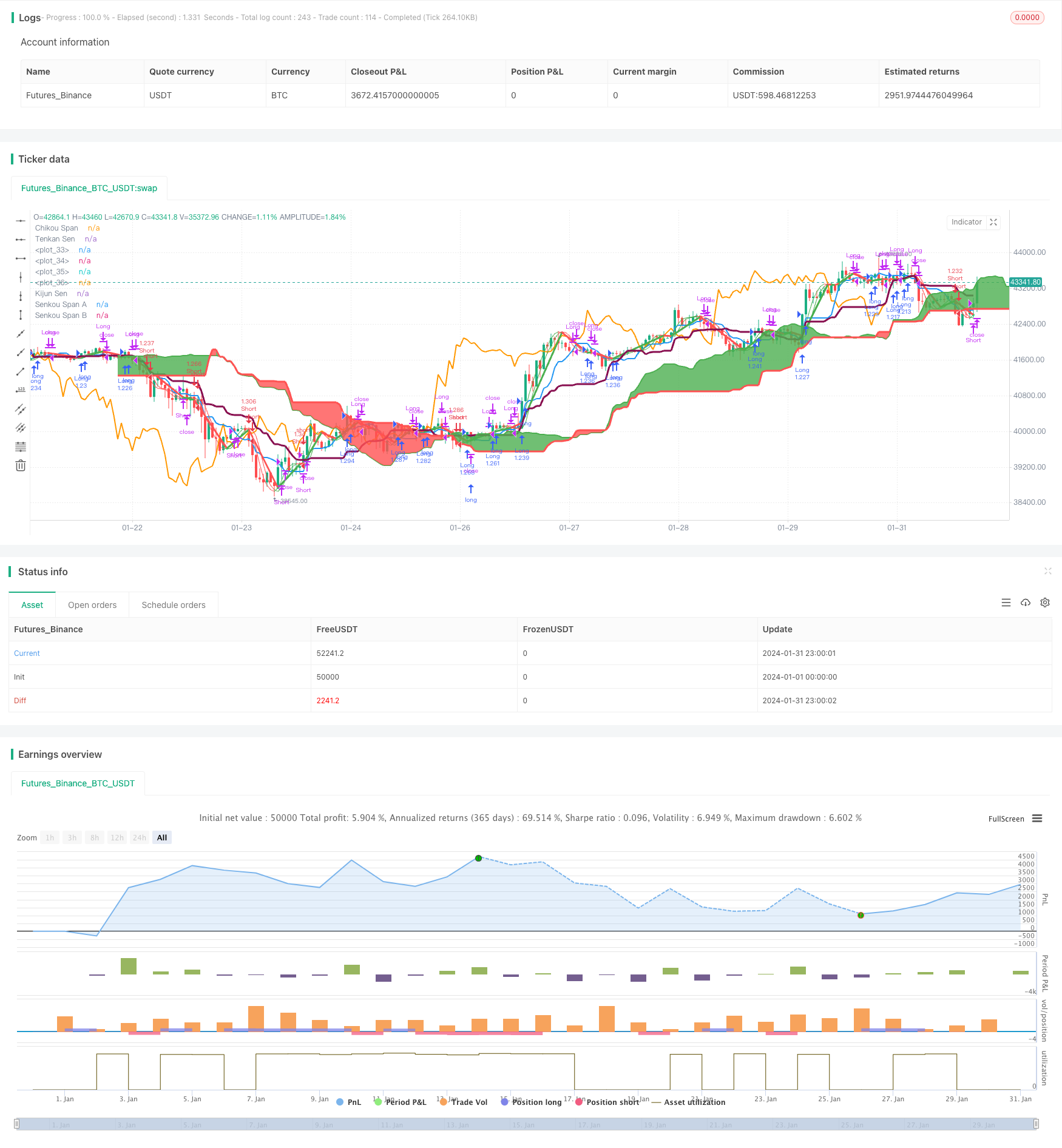

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Hull MA-X + Ichimoku Kinko Hyo", shorttitle="Hi", overlay=true, default_qty_type=strategy.percent_of_equity, max_bars_back=1000, default_qty_value=100, calc_on_order_fills= true, calc_on_every_tick=true, pyramiding=0)

keh=input(title="Double HullMA",defval=12, minval=1)

n2ma=2*wma(close,round(keh/2))

nma=wma(close,keh)

diff=n2ma-nma

sqn=round(sqrt(keh))

n2ma1=2*wma(close[1],round(keh/2))

nma1=wma(close[1],keh)

diff1=n2ma1-nma1

sqn1=round(sqrt(keh))

n1=wma(diff,sqn)

n2=wma(diff1,sqn)

b=n1>n2?lime:red

c=n1>n2?green:red

d=n1>n2?red:green

TenkanSenPeriods = input(9, minval=1, title="Tenkan Sen Periods")

KijunSenPeriods = input(24, minval=1, title="Kijun Sen Periods")

SenkouSpanBPeriods = input(51, minval=1, title="Senkou Span B Periods")

displacement = input(24, minval=1, title="Displacement")

donchian(len) => avg(lowest(len), highest(len))

TenkanSen = donchian(TenkanSenPeriods)

KijunSen = donchian(KijunSenPeriods)

SenkouSpanA = avg(TenkanSen, KijunSen)

SenkouSpanB = donchian(SenkouSpanBPeriods)

SenkouSpanH = max(SenkouSpanA[displacement - 1], SenkouSpanB[displacement - 1])

SenkouSpanL = min(SenkouSpanA[displacement - 1], SenkouSpanB[displacement - 1])

ChikouSpan = close[displacement-1]

Hullfast=plot(n1,color=c)

Hullslow=plot(n2,color=c)

plot(cross(n1, n2) ? n1:na, style = circles, color=b, linewidth = 4)

plot(cross(n1, n2) ? n1:na, style = line, color=d, linewidth = 3)

plot(TenkanSen, color=blue, title="Tenkan Sen", linewidth = 2)

plot(KijunSen, color=maroon, title="Kijun Sen", linewidth = 3)

plot(close, offset = -displacement, color=orange, title="Chikou Span", linewidth = 2)

sa=plot (SenkouSpanA, offset = displacement, color=green, title="Senkou Span A", linewidth = 2)

sb=plot (SenkouSpanB, offset = displacement, color=red, title="Senkou Span B", linewidth = 3)

fill(sa, sb, color = SenkouSpanA > SenkouSpanB ? green : red)

longCondition = n1>n2 and close>n2 and close>ChikouSpan and close>SenkouSpanH and (TenkanSen>KijunSen or close>KijunSen)

if (longCondition)

strategy.entry("Long",strategy.long)

shortCondition = n1<n2 and close<n2 and close<ChikouSpan and close<SenkouSpanL and (TenkanSen<KijunSen or close<KijunSen)

if (shortCondition)

strategy.entry("Short",strategy.short)

closelong = n1<n2 and close<n2 and (TenkanSen<KijunSen or close<TenkanSen or close<KijunSen or close<SenkouSpanL)

if (closelong)

strategy.close("Long")

closeshort = n1>n2 and close>n2 and (TenkanSen>KijunSen or close>TenkanSen or close>KijunSen or close>SenkouSpanH)

if (closeshort)

strategy.close("Short")

Detail

https://www.fmz.com/strategy/442018

Last Modified

2024-02-18 16:20:12