Name

多时间框架移动平均线结合交易时间的量化交易策略Multi-Timeframe-Moving-Average-Combined-with-Trading-Hours-Quantitative-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略运用多种移动平均线指标,结合交易时间选择进入和退出的时机,实现量化交易。

该策略使用了9种移动平均线包括SMA、EMA、WMA等。根据用户选择,进入多仓时,收盘价上穿选定的移动平均线且前一根K线收盘价在移动平均线以下;做空时,收盘价下穿选定的移动平均线且前一根K线收盘价在移动平均线以上。所有交易只在周一开盘时发出。平仓条件为固定止盈止损或周日收盘前平仓。

本策略集多种移动平均线精华于一身,用户可以选择不同参数来适应不同市场环境。只有确定趋势出现才入场,避免了 '%失效交易' 的出现。同时,本策略只在周一开仓,周日前止盈止损或平仓,限制了单周最大开仓次数,有效控制了交易风险。

该策略主要依赖均线指标判断趋势,当趋势发生转折时,存在部分交易被套住的风险。此外,限定只有周一能够开仓,如果在周一之后出现较好的交易机会也无法入场,可能错过部分利润。

为控制这些风险,建议采用动态移动平均线参数,当市场进入震荡时,适当缩短参数;同时,也可以增加开仓时间,在周三或周四仍允许开新仓。

该策略可以从以下几个方面进行优化:

-

增加止盈止损Algerism算法,动态调整止盈止损点;

-

增加机器学习模型判断趋势年,避免在震荡市场入场;

-

优化开仓和平仓逻辑,允许更多的开仓机会出现。

本策略集成多种移动平均线指标判断趋势方向,以周一开仓周日平仓的方式有效控制了单周最大交易次数。同时,严格的止盈止损规则也限制了单笔交易的最大亏损。综合来看,本策略从趋势判断和风险控制两个维度进行优化设计,是一种较为稳健的量化交易策略。

||

This strategy utilizes multiple moving average indicators and combines entry and exit timing based on trading hours to implement quantitative trading.

This strategy incorporates 9 types of moving averages including SMA, EMA, WMA etc. For long entry, the close price crosses above the selected moving average while the previous close was below the moving average. For short entry, the close price crosses below the moving average while the previous close was above. All trades are entered on Monday open only. Exit rules are either fixed take profit/stop loss or close all positions before Sunday close.

This strategy combines the essence of multiple moving averages and users can pick different parameters based on varying market conditions. It only enters when a trend is confirmed, avoiding whipsaws. Also, it limits entries to Monday only and exits on Sunday close with stop loss/take profit, capping maximum trades per week and controlling trading risk.

The strategy relies mainly on moving averages to determine trend, thus faces the risk of being caught in reversals. Also, limiting entries to Monday only means missed profitable opportunities if a good setup appears later in the week.

To address these risks, dynamic average parameters could be used to shorten length during ranging periods. Also additional entry days could be allowed, like on Wednesday or Thursday.

The strategy can be improved in the following ways:

-

Add adaptive stop loss/take profit algorithms to dynamically adjust levels.

-

Incorporate machine learning models to better gauge trend in choppy markets.

-

Refine entry and exit logic to capture more trading opportunities.

This strategy combines multiple moving average indicators to determine trend direction and caps maximum weekly trades with Monday entry and Sunday exit rules. Strict stop loss/take profit further limits maximum loss per trade. In summary, it provides robust enhancements in both trend determination and risk control dimensions for quantitative trading. [/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_bool_1 | true | (?Type of Entries)longEntry |

| v_input_bool_2 | false | shortEntry |

| v_input_source_1_close | 0 | (?Parameters)Source: close |

| v_input_int_1 | 17 | Moving Averages |

| v_input_string_1 | 0 | MA Type: ALMA |

| v_input_float_1 | 10 | (?Fixed Risk Management)LONG Stop Loss % |

| v_input_float_2 | 30 | LONG Take Profit % |

| v_input_float_3 | 5 | SHORT Stop Loss % |

| v_input_float_4 | 10 | SHORT Take Profit % |

Source (PineScript)

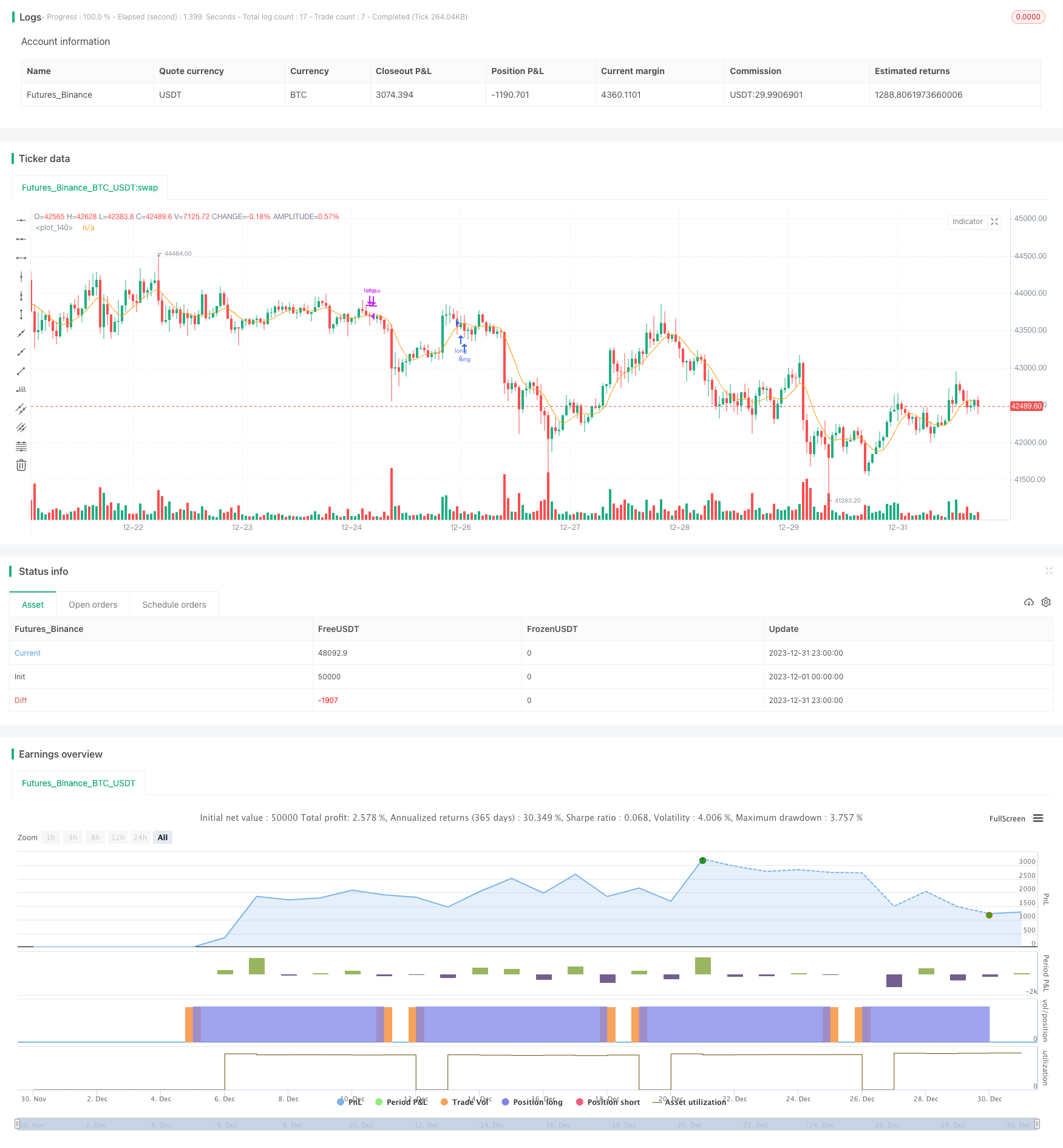

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=5

strategy('Time MA strategy ', overlay=true)

longEntry = input.bool(true, group="Type of Entries")

shortEntry = input.bool(false, group="Type of Entries")

//==========DEMA

getDEMA(src, len) =>

dema = 2 * ta.ema(src, len) - ta.ema(ta.ema(src, len), len)

dema

//==========HMA

getHULLMA(src, len) =>

hullma = ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

hullma

//==========KAMA

getKAMA(src, len, k1, k2) =>

change = math.abs(ta.change(src, len))

volatility = math.sum(math.abs(ta.change(src)), len)

efficiency_ratio = volatility != 0 ? change / volatility : 0

kama = 0.0

fast = 2 / (k1 + 1)

slow = 2 / (k2 + 1)

smooth_const = math.pow(efficiency_ratio * (fast - slow) + slow, 2)

kama := nz(kama[1]) + smooth_const * (src - nz(kama[1]))

kama

//==========TEMA

getTEMA(src, len) =>

e = ta.ema(src, len)

tema = 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

tema

//==========ZLEMA

getZLEMA(src, len) =>

zlemalag_1 = (len - 1) / 2

zlemadata_1 = src + src - src[zlemalag_1]

zlema = ta.ema(zlemadata_1, len)

zlema

//==========FRAMA

getFRAMA(src, len) =>

Price = src

N = len

if N % 2 != 0

N := N + 1

N

N1 = 0.0

N2 = 0.0

N3 = 0.0

HH = 0.0

LL = 0.0

Dimen = 0.0

alpha = 0.0

Filt = 0.0

N3 := (ta.highest(N) - ta.lowest(N)) / N

HH := ta.highest(N / 2 - 1)

LL := ta.lowest(N / 2 - 1)

N1 := (HH - LL) / (N / 2)

HH := high[N / 2]

LL := low[N / 2]

for i = N / 2 to N - 1 by 1

if high[i] > HH

HH := high[i]

HH

if low[i] < LL

LL := low[i]

LL

N2 := (HH - LL) / (N / 2)

if N1 > 0 and N2 > 0 and N3 > 0

Dimen := (math.log(N1 + N2) - math.log(N3)) / math.log(2)

Dimen

alpha := math.exp(-4.6 * (Dimen - 1))

if alpha < .01

alpha := .01

alpha

if alpha > 1

alpha := 1

alpha

Filt := alpha * Price + (1 - alpha) * nz(Filt[1], 1)

if bar_index < N + 1

Filt := Price

Filt

Filt

//==========VIDYA

getVIDYA(src, len) =>

mom = ta.change(src)

upSum = math.sum(math.max(mom, 0), len)

downSum = math.sum(-math.min(mom, 0), len)

out = (upSum - downSum) / (upSum + downSum)

cmo = math.abs(out)

alpha = 2 / (len + 1)

vidya = 0.0

vidya := src * alpha * cmo + nz(vidya[1]) * (1 - alpha * cmo)

vidya

//==========JMA

getJMA(src, len, power, phase) =>

phase_ratio = phase < -100 ? 0.5 : phase > 100 ? 2.5 : phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, power)

MA1 = 0.0

Det0 = 0.0

MA2 = 0.0

Det1 = 0.0

JMA = 0.0

MA1 := (1 - alpha) * src + alpha * nz(MA1[1])

Det0 := (src - MA1) * (1 - beta) + beta * nz(Det0[1])

MA2 := MA1 + phase_ratio * Det0

Det1 := (MA2 - nz(JMA[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(Det1[1])

JMA := nz(JMA[1]) + Det1

JMA

//==========T3

getT3(src, len, vFactor) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

ema4 = ta.ema(ema3, len)

ema5 = ta.ema(ema4, len)

ema6 = ta.ema(ema5, len)

c1 = -1 * math.pow(vFactor, 3)

c2 = 3 * math.pow(vFactor, 2) + 3 * math.pow(vFactor, 3)

c3 = -6 * math.pow(vFactor, 2) - 3 * vFactor - 3 * math.pow(vFactor, 3)

c4 = 1 + 3 * vFactor + math.pow(vFactor, 3) + 3 * math.pow(vFactor, 2)

T3 = c1 * ema6 + c2 * ema5 + c3 * ema4 + c4 * ema3

T3

//==========TRIMA

getTRIMA(src, len) =>

N = len + 1

Nm = math.round(N / 2)

TRIMA = ta.sma(ta.sma(src, Nm), Nm)

TRIMA

src = input.source(close, title='Source', group='Parameters')

len = input.int(17, minval=1, title='Moving Averages', group='Parameters')

out_ma_source = input.string(title='MA Type', defval='ALMA', options=['SMA', 'EMA', 'WMA', 'ALMA', 'SMMA', 'LSMA', 'VWMA', 'DEMA', 'HULL', 'KAMA', 'FRAMA', 'VIDYA', 'JMA', 'TEMA', 'ZLEMA', 'T3', 'TRIM'], group='Parameters')

out_ma = out_ma_source == 'SMA' ? ta.sma(src, len) : out_ma_source == 'EMA' ? ta.ema(src, len) : out_ma_source == 'WMA' ? ta.wma(src, len) : out_ma_source == 'ALMA' ? ta.alma(src, len, 0.85, 6) : out_ma_source == 'SMMA' ? ta.rma(src, len) : out_ma_source == 'LSMA' ? ta.linreg(src, len, 0) : out_ma_source == 'VWMA' ? ta.vwma(src, len) : out_ma_source == 'DEMA' ? getDEMA(src, len) : out_ma_source == 'HULL' ? ta.hma(src, len) : out_ma_source == 'KAMA' ? getKAMA(src, len, 2, 30) : out_ma_source == 'FRAMA' ? getFRAMA(src, len) : out_ma_source == 'VIDYA' ? getVIDYA(src, len) : out_ma_source == 'JMA' ? getJMA(src, len, 2, 50) : out_ma_source == 'TEMA' ? getTEMA(src, len) : out_ma_source == 'ZLEMA' ? getZLEMA(src, len) : out_ma_source == 'T3' ? getT3(src, len, 0.7) : out_ma_source == 'TRIM' ? getTRIMA(src, len) : na

plot(out_ma)

long = close> out_ma and close[1] < out_ma and dayofweek==dayofweek.monday

short = close< out_ma and close[1] > out_ma and dayofweek==dayofweek.monday

stopPer = input.float(10.0, title='LONG Stop Loss % ', group='Fixed Risk Management') / 100

takePer = input.float(30.0, title='LONG Take Profit %', group='Fixed Risk Management') / 100

stopPerShort = input.float(5.0, title='SHORT Stop Loss % ', group='Fixed Risk Management') / 100

takePerShort = input.float(10.0, title='SHORT Take Profit %', group='Fixed Risk Management') / 100

longStop = strategy.position_avg_price * (1 - stopPer)

longTake = strategy.position_avg_price * (1 + takePer)

shortStop = strategy.position_avg_price * (1 + stopPerShort)

shortTake = strategy.position_avg_price * (1 - takePerShort)

// strategy.risk.max_intraday_filled_orders(2) // After 10 orders are filled, no more strategy orders will be placed (except for a market order to exit current open market position, if there is any).

if(longEntry)

strategy.entry("long",strategy.long,when=long )

strategy.exit('LONG EXIT', "long", limit=longTake, stop=longStop)

strategy.close("long",when=dayofweek==dayofweek.sunday)

if(shortEntry)

strategy.entry("short",strategy.short,when=short )

strategy.exit('SHORT EXIT', "short", limit=shortTake, stop=shortStop)

strategy.close("short",when=dayofweek==dayofweek.sunday)

Detail

https://www.fmz.com/strategy/438465

Last Modified

2024-01-12 11:50:37