Name

多周期EMA交叉量化交易策略Multi-Period-EMA-Crossover-Quantitative-Trading-Strategy

Author

ChaoZhang

Strategy Description

本文介绍了一种基于三个不同周期的指数移动平均线(EMA)交叉点的量化交易策略。该策略旨在利用EMA交叉点来识别股票市场的长期和短期趋势,实现有效的交易决策。

策略使用三个不同周期的EMA:10天、100天和200天。当短周期EMA(10天)穿越长周期EMA(100天或200天)时,根据穿越方向生成买入或卖出信号。策略还结合了一个时间过滤器,确保只在特定时间段内进行交易。这种组合增加了策略的灵活性和适应性。

这种策略的优势在于其简单性和高适应性。多周期EMA提供了对市场趋势的多角度观察,增加了交易决策的准确性。同时,时间过滤器避免了市场特定时期的不稳定性,降低了潜在的风险。

尽管这种策略有效,但存在一定风险。主要风险是市场突发事件可能导致策略失败。此外,EMA指标可能存在滞后性,延迟反映市场变化。解决这些风险的方法包括实时市场监控和结合其他技术指标来提高决策的准确性。

策略的优化方向包括综合使用多种技术指标,如相对强弱指数(RSI)和布林带,以增强市场分析的深度和广度。此外,可以通过调整EMA周期来更好地适应不同市场条件。

总体而言,这种多周期EMA交叉量化交易策略是一种高效的工具,可以帮助交易者在多变的市场中做出更好的决策。通过不断优化和适应市场变化,这种策略有潜力在未来的交易中实现更高的收益。

||

This article introduces a quantitative trading strategy based on the crossover points of Exponential Moving Averages (EMA) over three different periods. The strategy aims to utilize EMA crossovers to identify long-term and short-term trends in the stock market for effective trading decisions.

The strategy employs EMAs of three different periods: 10-day, 100-day, and 200-day. Buy or sell signals are generated based on the direction of the crossover when the short-period EMA (10-day) crosses the longer-period EMAs (100-day or 200-day). The strategy also incorporates a time filter to ensure trades are executed only within specific time frames. This combination adds flexibility and adaptability to the strategy.

The strength of this strategy lies in its simplicity and high adaptability. Multi-period EMAs provide a multi-dimensional view of market trends, increasing the accuracy of trading decisions. Additionally, the time filter avoids instability during specific market periods, reducing potential risks.

Despite its effectiveness, the strategy carries certain risks. The primary risk is market volatility due to unforeseen events, which may lead to strategy failure. Additionally, EMAs can be lagging, delaying the reflection of market changes. Methods to mitigate these risks include real-time market monitoring and combining other technical indicators to enhance decision accuracy.

Optimization directions for the strategy include the integrated use of various technical indicators, such as the Relative Strength Index (RSI) and Bollinger Bands, to deepen and broaden market analysis. Additionally, adjusting the periods of EMAs to better suit different market conditions could be beneficial.

Overall, this

multi-period EMA crossover quantitative trading strategy is an effective tool that can help traders make better decisions in a volatile market. With continuous optimization and adaptation to market changes, this strategy has the potential to achieve higher returns in future trading endeavors.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 10 | Periodo_1 |

| v_input_2 | 100 | Periodo_2 |

| v_input_3 | 200 | Periodo_3 |

| v_input_4 | 2000 | Desde año |

| v_input_int_1 | true | Desde mes |

| v_input_int_2 | true | Desde dia |

| v_input_5 | 2030 | Hasta año |

| v_input_int_3 | true | Hasta mes |

| v_input_int_4 | true | Hasta dia |

Source (PineScript)

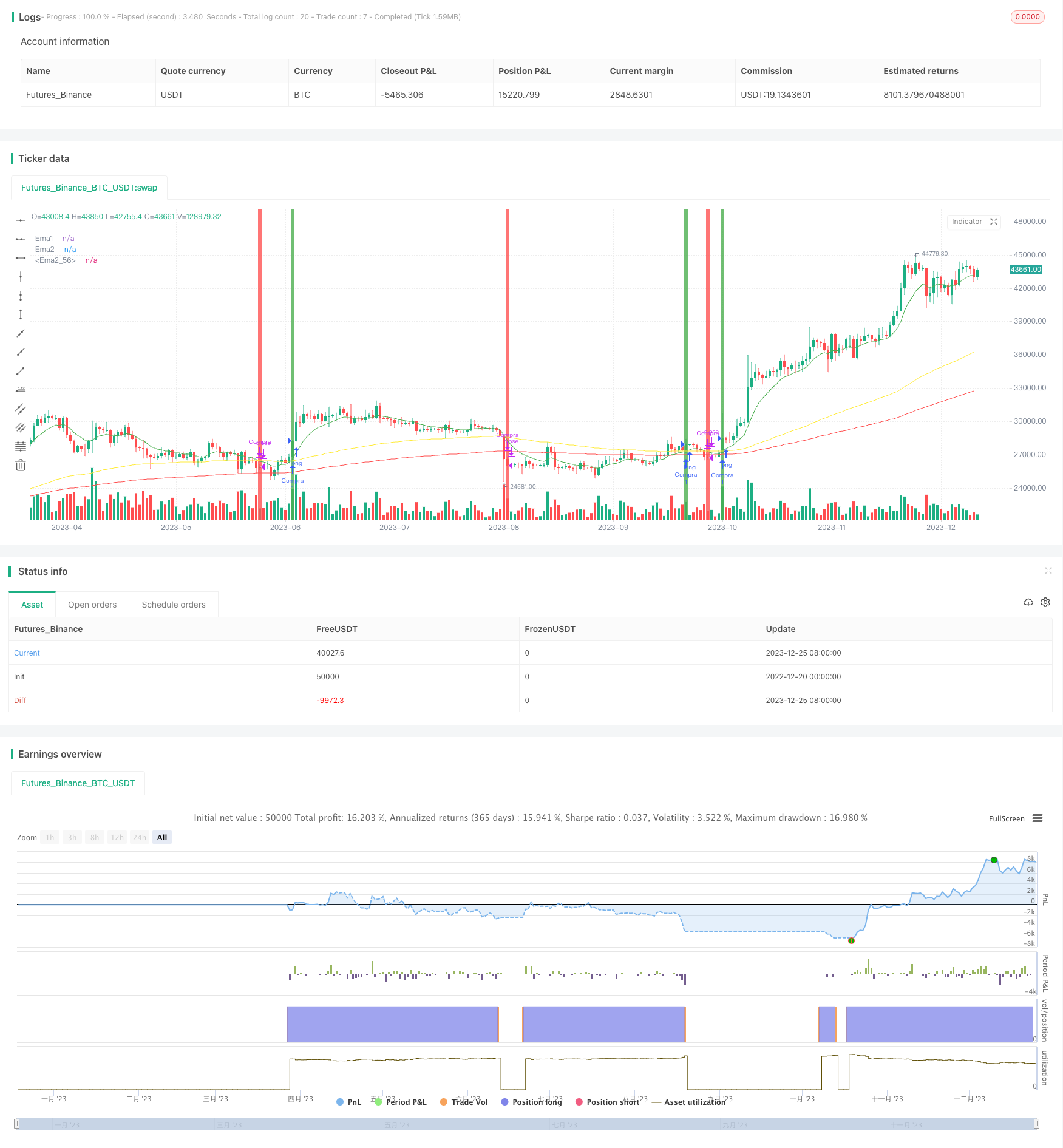

/*backtest

start: 2022-12-20 00:00:00

end: 2023-12-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

start = timestamp(2023,1,1,0,0)

end = timestamp(2024,1,1,0,0)

strategy("Tester Emas", overlay = true)

periodo1 = input(10,"Periodo_1")

periodo2 = input(100,"Periodo_2")

periodo3 = input(200,"Periodo_3")

//definir media moviles

ema1 = ta.ema(close,periodo1)

ema2 = ta.ema(close,periodo2)

ema3 = ta.ema(close,periodo3)

//Desde

desde_a = input(2000, title = "Desde año")

desde_m = input.int( 1, title = "Desde mes", minval=1, maxval = 12)

desde_d = input.int( 1, title = "Desde dia", minval=1, maxval = 31)

//Hasta

hasta_a = input(2030, title = "Hasta año")

hasta_m = input.int( 1, title = "Hasta mes", minval=1, maxval = 12)

hasta_d = input.int( 1, title = "Hasta dia", minval=1, maxval = 31)

FechaValida() => true

//Condicion de entradas

longCondition = ta.crossover(ema1, ema2)

shortCondition = ta.crossunder(ema1,ema2)

alcista = (ema1 > ema2) and (ema2 > ema3)

comprado =strategy.position_size > 0

//Comprar o vender segun las condiciones de entradas

//if (longCondition)

if (not comprado and alcista and FechaValida())

// Round redondea mi capital para comprar las acciones en cantidades enteras

cantidad = math.round(strategy.equity/ close)

strategy.entry("Compra", strategy.long, cantidad)

//if (shortCondition)

if (comprado and not alcista and FechaValida())

//strategy.entry("Venta", strategy.short)

strategy.close("Compra" , comment = "Venta")

if (comprado and not FechaValida())

//Cierre x finalizacion de periodo

//strategy.entry("Venta", strategy.short)

strategy.close("Compra" , comment = "Venta x fin")

//Graficar las medias moviles

plot(ema1, color = color.green, title = "Ema1")

plot(ema2, color = color.yellow, title = "Ema2")

plot(ema3, color = color.red, title = "Ema2")

//GMarca los cruces de medias

bgcolor(longCondition ? color.green : na)

bgcolor(shortCondition ? color.red : na)

Detail

https://www.fmz.com/strategy/436788

Last Modified

2023-12-27 17:09:23