Name

基于RSI指标的双轨突破策略RSI-Dual-track-Breakthrough-Strategy

Author

ChaoZhang

Strategy Description

本策略名称为“基于RSI指标的双轨突破策略”。该策略利用RSI指标的双轨配合进行判断,实现低买高卖的目的。当RSI指标低于设置的低轨(默认40)时视为买入信号,此时若RSI10小于RSI14则进一步确认买入;当RSI指标高于设置的高轨(默认70)时视为卖出信号,此时若RSI10高于RSI14则进一步确认卖出。该策略同时设置了移动止损和止盈退出机制。

本策略的核心逻辑是利用RSI指标的双轨进行判断。RSI指标一般设置为14周期,代表了近14天的股票强弱情况。本策略则添加了RSI10作为辅助判断指标。

当RSI14下破40轨时,认为股价跌破弱势面,有可能形成支撑反弹的机会。此时若RSI10小于RSI14,说明短期趋势依然向下,可以进一步确认看跌信号。所以满足“RSI14 <= 40且RSI10 < RSI14”时则产生买入信号。

当RSI14上破70轨时,认为股价进入短期的强势区域,有可能出现回落调整的机会。此时若RSI10大于RSI14,说明短期趋势继续向上,可以进一步确认看涨信号。所以满足“RSI14 >= 70且RSI10 > RSI14”时则产生卖出信号。

这样,RSI14和RSI10的配合判断,构成了双轨策略的核心逻辑。

- 使用双RSI指标组合判断,可以更准确捕捉买卖点位

- 采用移动止损机制,可以及时止损,控制最大亏损

- 设置止盈退出机制,可以在达到目标利润后退出,避免盈利回吐

- RSI指标容易产生虚假信号,无法完全避免亏损的发生

- 止损点设置过于接近可能会被秒出,设置过大又难以控制风险

- 如果行情异常,如快速跳空,也会招致相应损失

要充分利用该策略,可以适当调整RSI参数,严格控制止损位置,避免操作过于密集,追求稳定持久的盈利能力。

- 可以考虑结合其他指标进行组合,如KDJ、MACD等,实现多指标验证

- 可以针对不同品种分别设置RSI参数,使参数更贴近该品种特点

- 可以设置动态止损,根据ATR等指标实时调整止损位

- 可以通过机器学习技术自动优化RSI参数

本策略基于RSI的双轨思路进行判断,在一定程度上过滤了部分噪音信号。但任何单一指标策略都无法完美,RSI指标容易产生误导,应谨慎看待。本策略中加入了移动止损和止盈机制来控制风险,这是非常必要的。未来可继续优化,使策略参数和止损方式更加智能化、动态化。

||

The strategy is named "RSI Dual-track Breakthrough Strategy". It utilizes the dual tracks of the RSI indicator for judgment to achieve the goal of buy low and sell high. When the RSI indicator falls below the set lower track (default 40), it is considered as a buy signal. At this time, if RSI10 is less than RSI14, it further confirms the buy; When the RSI indicator rises above the set upper track (default 70), it is considered as a sell signal. At this time, if RSI10 is greater than RSI14, it further confirms the sell. The strategy also sets the mechanisms of moving stop loss and take profit.

The core logic of this strategy is to use the dual tracks of the RSI indicator for judgment. The RSI indicator is generally set to 14 periods, representing the strength and weakness of the stock in recent 14 days. This strategy adds RSI10 as an auxiliary judgment indicator.

When the RSI14 breaks below the 40 track, it is believed that the stock price has broken through the weak side and there may be a chance of support rebound. At this time, if RSI10 is less than RSI14, it means that the short-term trend is still downward, which can further confirm the sell signal. So when "RSI14 <= 40 and RSI10 <RSI14" is met, a buy signal is generated.

When RSI14 breaks above the 70 track, it is believed that the stock price has entered a short-term strong area and there may be a chance for a pullback adjustment. At this time, if RSI10 is greater than RSI14, it means the short-term trend continues upward, which can further confirm the buy signal. So when "RSI14 >= 70 and RSI10> RSI14" is met, a sell signal is generated.

Thus, the combination judgment of RSI14 and RSI10 constitutes the core logic of the dual-track strategy.

- The combination judgment of dual RSI indicators can capture trading signals more accurately

- The adoption of moving stop loss mechanism can cut the loss timely and control the maximum drawdown

- The setting of take profit exit mechanism allows exiting when reaching the target profit, avoiding profiteering retracement

- RSI indicator is prone to generate false signals and losses can not be completely avoided

- If stop loss point is set too close it may be taken out soon, if set too big it’s hard to control risks

- In abnormal market conditions like gap, it may also lead to losses

To fully utilize this strategy, RSI parameters can be adjusted properly, stop loss position should be strictly controlled, avoid over-frequent operations, and pursue steady profitability.

- Consider incorporating other indicators for combination validation, like KDJ, MACD etc.

- Set RSI parameters respectively based on the characteristics of different products

- Set dynamic stop loss based on indicators like ATR to adjust stop position timely

- Optimize RSI parameters automatically through machine learning techniques

This strategy makes judgment based on the dual-track idea of RSI and filters out some noisy signals to some extent. But no single indicator strategies can be perfect, RSI indicator is prone to mislead and should be viewed cautiously. This strategy incorporates moving stop loss and take profit mechanisms to control risks, which is essential. Future optimizations could be continued to make strategy parameters and stop loss methods more intelligent and dynamic.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | timestamp(01 Jan 2015 13:30 +0000) | Backtest Start Time |

| v_input_2 | false | Exit when Risk:Reward met |

| v_input_3 | 3 | Risk:[Reward] (i.e. 3) for exit |

| v_input_4 | true | Use trailing stop loss |

| v_input_5 | 2 | ATR multiplier for stop loss |

| v_input_6 | 40 | RSI entry |

| v_input_7 | 70 | RSI exit |

Source (PineScript)

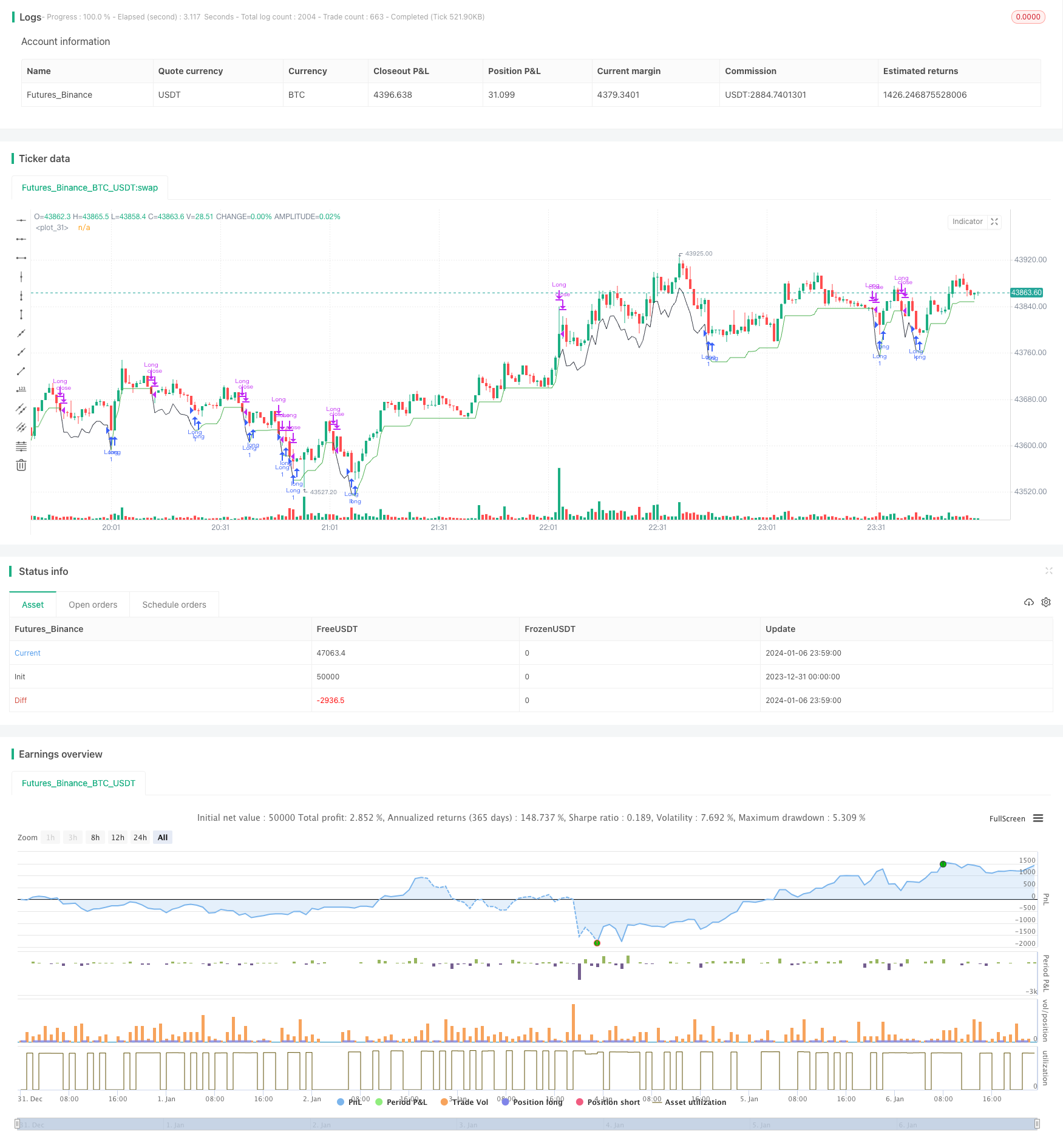

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-07 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DojiEmoji

//@version=4

strategy("[KL] RSI 14 + 10 Strategy",overlay=true)

backtest_timeframe_start = input(defval = timestamp("01 Jan 2015 13:30 +0000"), title = "Backtest Start Time", type = input.time)

//backtest_timeframe_end = input(defval = timestamp("19 Mar 2021 19:30 +0000"), title = "Backtest End Time", type = input.time)

TARGET_PROFIT_MODE = input(false,title="Exit when Risk:Reward met")

REWARD_RATIO = input(3,title="Risk:[Reward] (i.e. 3) for exit")

// Trailing stop loss {

TSL_ON = input(true,title="Use trailing stop loss")

var entry_price = float(0)

ATR_multi_len = 26

ATR_multi = input(2, "ATR multiplier for stop loss")

ATR_buffer = atr(ATR_multi_len) * ATR_multi

plotchar(ATR_buffer, "ATR Buffer", "", location = location.top)

risk_reward_buffer = (atr(ATR_multi_len) * ATR_multi) * REWARD_RATIO

take_profit_long = low > entry_price + risk_reward_buffer

take_profit_short = low < entry_price - risk_reward_buffer

var bar_count = 0 //number of bars since entry

var trailing_SL_buffer = float(0)

var stop_loss_price = float(0)

stop_loss_price := max(stop_loss_price, close - trailing_SL_buffer)

// plot TSL line

trail_profit_line_color = color.green

showLine = strategy.position_size == 0

if showLine

trail_profit_line_color := color.black

stop_loss_price := close - trailing_SL_buffer

plot(stop_loss_price,color=trail_profit_line_color)

// }

// RSI

RSI_LOW = input(40,title="RSI entry")

RSI_HIGH = input(70,title="RSI exit")

rsi14 = rsi(close, 14)

rsi10 = rsi(close, 10)

if true// and time <= backtest_timeframe_end

buy_condition = rsi14 <= RSI_LOW and rsi10 < rsi14

exit_condition = rsi14 >= RSI_HIGH and rsi10 > rsi14

//ENTRY:

if strategy.position_size == 0 and buy_condition

entry_price := close

trailing_SL_buffer := ATR_buffer

stop_loss_price := close - ATR_buffer

strategy.entry("Long",strategy.long, comment="buy")

bar_count := 0

else if strategy.position_size > 0

bar_count := bar_count + 1

//EXIT:

// Case (A) hits trailing stop

if TSL_ON and strategy.position_size > 0 and close <= stop_loss_price

if close > entry_price

strategy.close("Long", comment="take profit [trailing]")

stop_loss_price := 0

else if close <= entry_price and bar_count

strategy.close("Long", comment="stop loss")

stop_loss_price := 0

bar_count := 0

// Case (B) take targeted profit relative to risk

if strategy.position_size > 0 and TARGET_PROFIT_MODE

if take_profit_long

strategy.close("Long", comment="take profits [risk:reward]")

stop_loss_price := 0

bar_count := 0

// Case (C)

if strategy.position_size > 0 and exit_condition

if take_profit_long

strategy.close("Long", comment="exit[rsi]")

stop_loss_price := 0

bar_count := 0

Detail

https://www.fmz.com/strategy/438011

Last Modified

2024-01-08 10:28:26