Name

基于RSI指标和移动平均线的量化交易策略Quantitative-Trading-Strategy-Based-on-RSI-Indicator-and-Moving-Average

Author

ChaoZhang

Strategy Description

本策略名称为“RSI指标结合移动平均线的量化交易策略”。该策略运用RSI指标和移动平均线作为交易信号,实现在趋势背景下进行反转操作的量化交易策略。其核心思想是在股价出现反转信号时打开仓位,在超买超卖时进行止盈。

该策略主要使用RSI指标和快慢移动平均线来判断股价趋势和反转时机。具体来说,策略首先计算快速移动平均线(SMA)和慢速移动平均线,当快速移动平均线上穿慢速移动平均线时产生买入信号;当快速移动平均线下穿慢速移动平均线时产生卖出信号。这表示股价趋势发生转变的迹象。

同时,本策略计算RSI指标来判断股价是否处于超买或者超卖状态。在开仓之前,会判断RSI指标是否正常,如果RSI超过设定的阈值,则暂缓开仓等待RSI回落后再开仓。这可以避免在超买超卖的不利时机建仓。另一方面,当已经持仓之后,如果RSI超过设定的止盈阈值则会平仓止盈。这可以锁定交易获利。

通过RSI指标和移动平均线的配合,可以在股价产生反转信号时打开仓位;并在超买超卖时进行止盈,实现在股价趋势背景下进行反转操作获利的量化交易策略。

本策略具有以下优势:

-

可在股价反转时准确打开仓位。运用移动平均线金叉作为买入信号、死叉作为卖出信号,可准确抓住股价趋势反转机会。

-

可避免不利时机开仓。通过RSI指标判断超买超卖情况,可有效防止在股价短期震荡过度时建立头寸,避免不必要的浮亏。

-

可很好控制风险。RSI止盈可以将头寸控制在合理盈利范围,有效控制交易风险。

-

易于参数调优。SMA周期、RSI参数等都可以灵活调整,适应不同市场环境。

-

资金利用效率高。可在趋势盘整震荡阶段进行频繁交易,有效利用资金。

本策略也存在以下风险:

-

跟踪误差风险。移动平均线作为趋势判断指标存在一定滞后,可能导致头寸开启时机不准确。

-

频繁交易风险。在震荡行情中,可能导致过于频繁地进行建仓平仓。

-

参数调优风险。SMA周期和RSI参数需要反复测试调整才能适应市场,不当设置可能影响策略表现。

-

止盈风险。RSI止盈设置不当也可能导致头寸过早离场或止盈离场后继续上涨。

本策略的优化方向如下:

-

尝试运用MACD、布林线等其他指标与RSI结合,使信号更加准确可靠。

-

增加机器学习算法,使参数可根据历史数据自动调整,降低参数调优风险。

-

增加止盈策略优化机制,使止盈更加智能化,适应市场变化。

-

优化仓位管理策略,通过动态调整仓位规模,降低单笔交易的风险。

-

结合高频数据,使用 tick 级别的实时数据进行高频交易,提高策略频率。

总的来说,本策略运用RSI指标和移动平均线产生交易信号,实现了一种在趋势运行过程中进行反转运算的量化策略。相比单一使用移动平均线,本策略加入RSI指标判断可有效防止不利时机开仓,并通过RSI止盈来控制交易风险,在一定程度上提高了策略稳定性。当然,本策略也存在一定改进空间,未来可从更多指标组合、参数自动优化、仓位管理等方面进行优化,使策略表现更加出色。

||

The strategy is named "Quantitative Trading Strategy Based on RSI Indicator and Moving Average". It utilizes RSI indicator and moving averages as trading signals to implement a quantitative trading strategy that makes reversal operations under trend background. Its core idea is to open positions when price reversal signals occur and take profit when overbought or oversold.

The strategy mainly uses RSI indicator and fast/slow moving averages to determine price trends and reversal timing. Specifically, it firstly calculates the fast moving average (SMA) and slow moving average. When the fast SMA crosses over the slow SMA, a buy signal is generated. When the fast SMA crosses below the slow SMA, a sell signal is generated. This indicates the trend of the price is changing.

At the same time, this strategy calculates the RSI indicator to determine whether the price is in an overbought or oversold state. Before opening positions, it will judge whether the RSI indicator is normal. If the RSI exceeds the set threshold, it will suspend opening positions and wait for the RSI to fall back before opening positions. This can avoid establishing positions at unfavorable overbought and oversold timing. On the other hand, after taking positions, if the RSI exceeds the set take profit threshold, it will close positions to take profits. This can lock trading gains.

By collaborating RSI indicator with moving averages, positions can be opened when price reversal signals occur. And by taking profit when overbought or oversold, a quantitative trading strategy that makes reversal operations for profits under price trend background can be implemented.

The strategy has the following advantages:

-

Accurately open positions when price reversal occurs. Using moving average golden cross as buy signal and death cross as sell signal can accurately capture price trend reversal opportunities.

-

Avoid unfavorable opening positions timing. By judging overbought and oversold conditions through RSI indicator, it can effectively prevent establishing positions when price fluctuates excessively in the short term, avoiding unnecessary floating losses.

-

Risks can be well controlled. RSI take profit can keep positions within reasonable profit range and effectively control trading risks.

-

Easy to optimize parameters. SMA periods, RSI parameters etc. can be flexibly adjusted to adapt to different market environments.

-

High capital utilization efficiency. Frequent trading can be carried out during trend consolidation and shock stages, making efficient use of capital.

The strategy also has the following risks:

-

Tracking error risk. Moving averages as trend judgment indicators have certain lags, which may lead to inaccurate timing of opening positions.

-

Frequent trading risk. In oscillating markets, it may lead to excessively frequent openings and closings of positions.

-

Parameter tuning risk. SMA periods and RSI parameters need repeated testing and adjustment to adapt to markets. Improper settings may affect strategy performance.

-

Take profit risk. Improper RSI take profit settings may also lead to premature exit of positions or continued rise after take profit exit.

The optimization directions are as follows:

-

Try using MACD, Bollinger Bands and other indicators combined with RSI to make signals more accurate and reliable.

-

Increase machine learning algorithms to automatically adjust parameters based on historical data, reducing parameter tuning risks.

-

Increase optimization mechanisms for take profit strategies to make take profit more intelligent and adaptable to market changes.

-

Optimize position management strategies by dynamically adjusting position sizes to reduce risks of single trades.

-

Combine high-frequency data and use tick-level real-time data for high-frequency trading to improve strategy frequency.

In summary, this strategy uses trading signals generated by RSI indicator and moving averages to implement a quantitative strategy that makes reversal operations during trend runs. Compared to using moving averages alone, by adding RSI indicator judgments, this strategy can effectively prevent unfavorable opening positions timing and control trading risks through RSI take profit. To some extent, it improves the stability of the strategy. Of course, there are still room for improvements for this strategy. In the future, it can be optimized in aspects like more indicator combinations, automatic parameter optimization, position management, etc. to make strategy performance even better.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 11 | fastLength |

| v_input_2 | 82 | slowLength |

| v_input_3 | 14 | 长度 |

| v_input_4 | 80 | rsi超过上轨平多获利 |

| v_input_5 | 20 | rsi超过下轨平空获利 |

| v_input_6 | 75 | rsi低于该阈值时才开多 |

| v_input_7 | 25 | rsi高于该阈值时才开空仓 |

Source (PineScript)

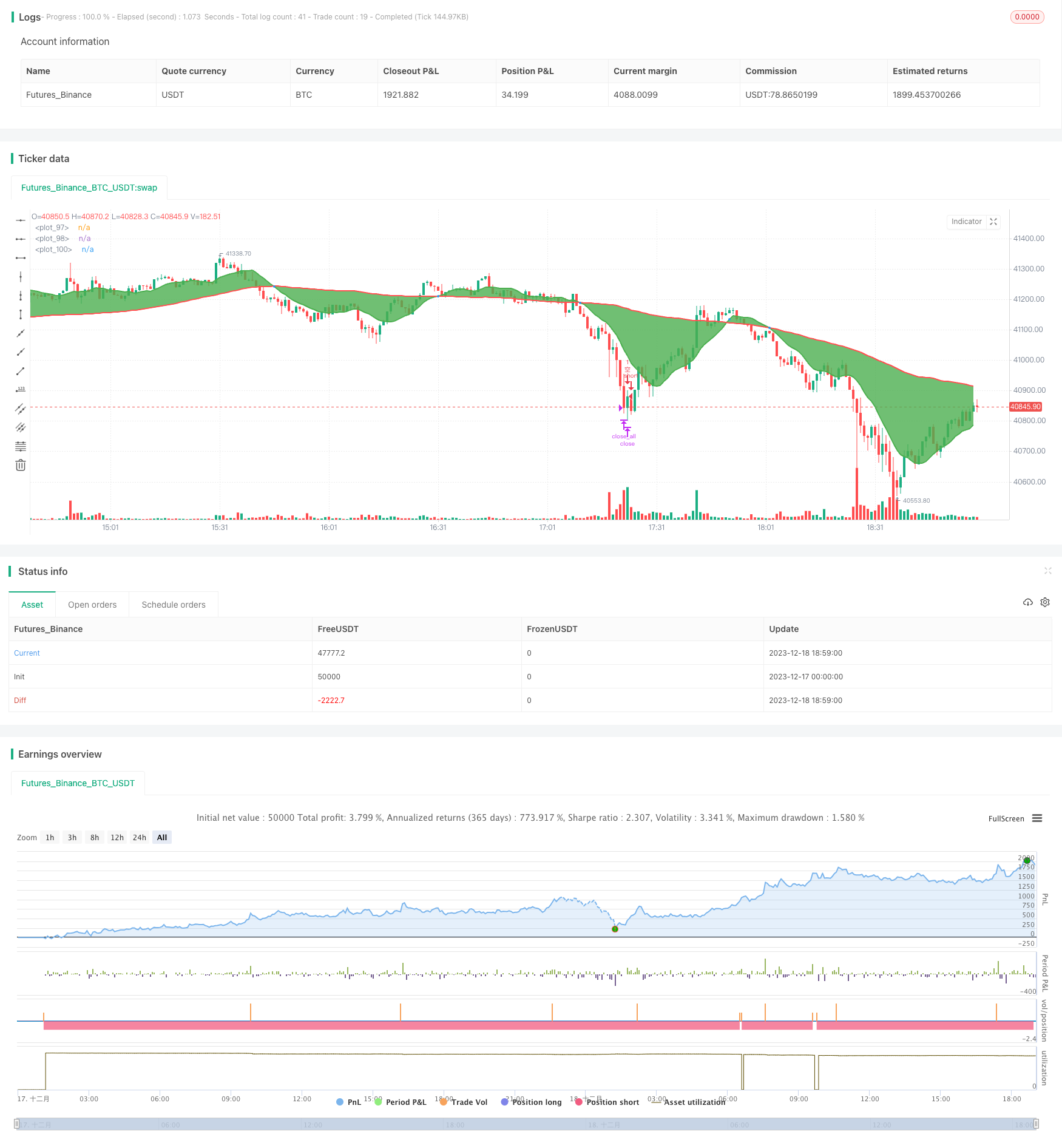

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-18 19:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//1. 做多

// a. RSI在超买区间时不开单,直到RSI回落一点再开单

// b. 已经有多仓,如果RSI超买,则平多获利,当RSI回落一点之后,再次开多,直到有交叉信号反转做空

//2. 做空

// a. RSI在超卖区间时不开单,直到RSI回落一点之后再开多单

// b. 已经有空仓,如果RSI超卖,则平空获利,当RSI回落一点之后,再开空单,直到有交叉信号反转做多

//@version=4

strategy("策略_RSI+移动揉搓线_", overlay=true)

// 输入

fastLength = input(11, minval=1)

slowLength = input(82,minval=1)

length = input(title="长度", type=input.integer, defval=14, minval=1, maxval=100)

hight_rsi = input(title="rsi超过上轨平多获利", type=input.integer, defval=80, minval=1, maxval=100)

low_rsi = input(title="rsi超过下轨平空获利", type=input.integer, defval=20, minval=1, maxval=100)

open_long_rsi_threshold = input(title="rsi低于该阈值时才开多", type=input.integer, defval=75, minval=1, maxval=100)

open_short_rsi_threshold = input(title="rsi高于该阈值时才开空仓", type=input.integer, defval=25, minval=1, maxval=100)

// 均线

sma_fast = sma(close, fastLength)

sma_slow = sma(close, slowLength)

// RSI

rsi = rsi(close, length)

//**********变量*start*******//

var long_f = false // 标记是否是均线交叉多头

var short_f = false // 标记是否是均线交叉空头

var long_open_pending = false // 标记开仓时rsi是否处于超买状态

var short_open_pending = false // 标记开仓时rsi是否处于超卖

var long_rsi_over_buy = false // 标记 多仓时 是否发生超买平多获利

var short_rsi_over_sell = false // 标记 空仓时 是否发生超卖平空获利

//**********逻辑*start*******//

// 买入

longCondition = crossover(sma_fast, sma_slow)

if (longCondition)

short_rsi_over_sell := false // 清空该标记,防止再次开空仓

long_f := true

short_f := false

if (rsi < hight_rsi)

// 并且没有超买

strategy.entry("多", long=strategy.long)

if (rsi > hight_rsi)

// 开仓时发生超买,等待rsi小于hight_rsi

long_open_pending := true

// 卖出

shortCondition = crossunder(sma_fast, sma_slow)

if (shortCondition)

long_rsi_over_buy := false //清空该标记,防止再次开多仓

long_f := false

short_f := true

if (rsi > low_rsi)

strategy.entry("空", long=strategy.short)

if (rsi < low_rsi)

// 开仓时发生超卖,等待rsi大于low_rsi

short_open_pending := true

// 等待RSI合理,买入开仓

if (long_f and long_open_pending and strategy.position_size == 0 and rsi < open_long_rsi_threshold)

strategy.entry("多", long=strategy.long)

long_open_pending := false

// 等待RSI合理,卖出开仓

if (short_f and short_open_pending and strategy.position_size == 0 and rsi > open_short_rsi_threshold)

strategy.entry("空", long=strategy.short)

short_open_pending := false

//RSI止盈(RSI超买平多)

if (strategy.position_size > 0 and long_f and rsi > hight_rsi)

strategy.close_all()

long_rsi_over_buy := true

//RSI止盈(RSI超卖平空)

if (strategy.position_size < 0 and short_f and rsi < low_rsi)

strategy.close_all()

short_rsi_over_sell := true

//RSI止盈之后,再次开多

if (long_f and long_rsi_over_buy and strategy.position_size == 0 and rsi < hight_rsi)

long_rsi_over_buy := false

strategy.entry("多", long=strategy.long)

//RSI止盈之后,再次开空

if (short_f and short_rsi_over_sell and strategy.position_size == 0 and rsi > low_rsi)

short_rsi_over_sell := false

strategy.entry("空", long=strategy.short)

//**********绘图*start*******//

p1 = plot(sma_fast, linewidth=2, color=color.green)

p2 = plot(sma_slow, linewidth=2, color=color.red)

fill(p1, p2, color=color.green)

plot(cross(sma_fast, sma_slow) ? sma_fast : na, style = plot.style_circles, linewidth = 4)

// 绘制rsi线

//plot(rsi, color=color.green, editable=true, style=plot.style_circles, linewidth=2)

// 绘制上下轨

//high_ = hline(80, title="上轨")

//low_ = hline(20, title="下轨")

//fill(high_, low_, transp=80, editable=true, title="背景")

Detail

https://www.fmz.com/strategy/436485

Last Modified

2023-12-25 11:40:36