Name

基于ATR和RSI的自适应移动止损趋势跟踪策略Adaptive-ATR-and-RSI-Trend-Following-Strategy-with-Trailing-Stop-Loss

Author

ChaoZhang

Strategy Description

该策略综合运用平均真实波动范围(ATR)、相对强弱指数(RSI)以及移动止损来实现自适应的趋势跟踪。通过ATR来计算动态止损位,利用RSI判断市场趋势方向,移动止损跟踪价格波动实现利润最大化。这是一个非常典型的趋势跟踪策略。

-

计算ATR。ATR反映市场的波动性和风险水平。本策略通过ATR计算动态止损位,实现自适应止损。

-

计算RSI。RSI可以判断市场的超买超卖现象。当RSI大于50时为看涨,小于50时为看跌。本策略利用RSI判断价格趋势方向。

-

移动止损跟踪。本策略根据ATR计算的止损位以及RSI判断的趋势方向,实现移动止损不断跟踪价格波动,在保证止损的同时逐步拉大止盈位,实现利润最大化。

-

具体来说,当RSI大于50时开多仓,小于50时开空仓。之后利用ATR计算的止损价位移动止损,跟踪价格波动。

-

利用ATR实现自适应止损,可以根据市场波动性动态调整止损幅度,避免止损过大过小的缺点。

-

RSI判断趋势方向准确可靠,避免交易被困在震荡市中。

-

移动止损跟踪价格波动,可以拉大止盈位,充分跟踪趋势获利。

-

ATR和RSI参数设置需要经过回测优化,否则会影响策略效果。

-

虽然有止损保护,但大幅跳空难以避免会使止损被突破的风险。可以适当缩小仓位以控制风险。

-

策略对交易品种参数优化依赖性较大,需要针对不同品种调整参数。

-

可以考虑加入机器学习算法,实现参数的自适应优化。

-

增加仓位控制模块,可以根据市场情况动态调整仓位规模,降低突破止损的概率。

-

增加趋势判断指标,避免错过顶底反转点造成损失。

本策略整合运用ATR、RSI和移动止损等模块,形成一个典型的自适应趋势跟踪策略。通过参数优化可以非常灵活地适应不同交易品种,是一个值得推荐的通用趋势跟踪策略。加入更多指标判断和机器学习算法优化后,本策略的效果还可进一步提升。

||

This strategy combines Average True Range (ATR), Relative Strength Index (RSI) and trailing stop loss to achieve adaptive trend following. Dynamic stop loss is calculated by ATR to reflect market volatility, RSI identifies the trend direction, and trailing stop loss tracks price fluctuation to maximize profit. It is a very typical trend following strategy.

-

Calculate ATR. ATR shows market volatility and risk level. This strategy uses ATR to compute dynamic stop loss for adaptive risk control.

-

Calculate RSI. RSI judges overbought/oversold status. When RSI is above 50 it signals bullish outlook, when below 50 bearish outlook. This strategy utilizes RSI to determine trend direction.

-

Trailing stop loss tracking. According to stop loss level calculated by ATR and trend direction by RSI, this strategy keeps moving stop loss to track price fluctuation, to maximize profit while ensuring effective stop loss.

-

Specifically, long when RSI goes above 50, short when goes below 50. Then moving stop loss based on ATR to lock in profit along the trend.

-

ATR adaptive stop loss considers market volatility, avoids too wide or too tight stop loss.

-

RSI reliably identifies trend, avoids whipsaws.

-

Trailing stop loss tracks trend to expand profit target.

-

ATR and RSI parameters need backtest optimization, otherwise impact strategy performance.

-

Although with stop loss protection, risk still exists for sudden price jump to penetrate stop loss. Can consider position sizing to control risk.

-

Strategy performance relies much on parameter tuning for different products.

-

Consider machine learning algorithms for adaptive parameter optimization.

-

Add position sizing control for dynamic adjustment based on market condition, to reduce stop loss penetration probability.

-

Add more trend indicators to avoid missing major trend reversal points.

This strategy integrates ATR, RSI and trailing stop loss for a typical adaptive trend following system. Through parameter tuning it can be flexibly adapted to different trading products, a recommended universal trend following strategy. With more judgements and machine learning optimization it can achieve even better performance.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 2019 | BACKTEST START YEAR |

| v_input_2 | true | BACKTEST START MONTH |

| v_input_3 | true | BACKTEST START DAY |

| v_input_4 | 2222 | BACKTEST STOP YEAR |

| v_input_5 | 12 | BACKTEST STOP MONTH |

| v_input_6 | 31 | BACKTEST STOP DAY |

| v_input_7_hlc3 | 0 | SOURCE: hlc3 |

| v_input_8 | 14 | RSI LENGTH |

| v_input_9 | 52 | RSI CENTER LINE |

| v_input_10 | 7 | MACD FAST LENGTH |

| v_input_11 | 12 | MACD SLOW LENGTH |

| v_input_12 | 12 | MACD SIGNAL SMOOTHING |

| v_input_13 | 10 | Key Vaule. 'This changes the sensitivity' |

| v_input_14 | 3 | SmoothK |

| v_input_15 | 3 | SmoothD |

| v_input_16 | 14 | LengthRSI |

| v_input_17 | 14 | LengthStoch |

| v_input_18_close | 0 | RSISource: close |

| v_input_19 | 10 | ATR Period |

Source (PineScript)

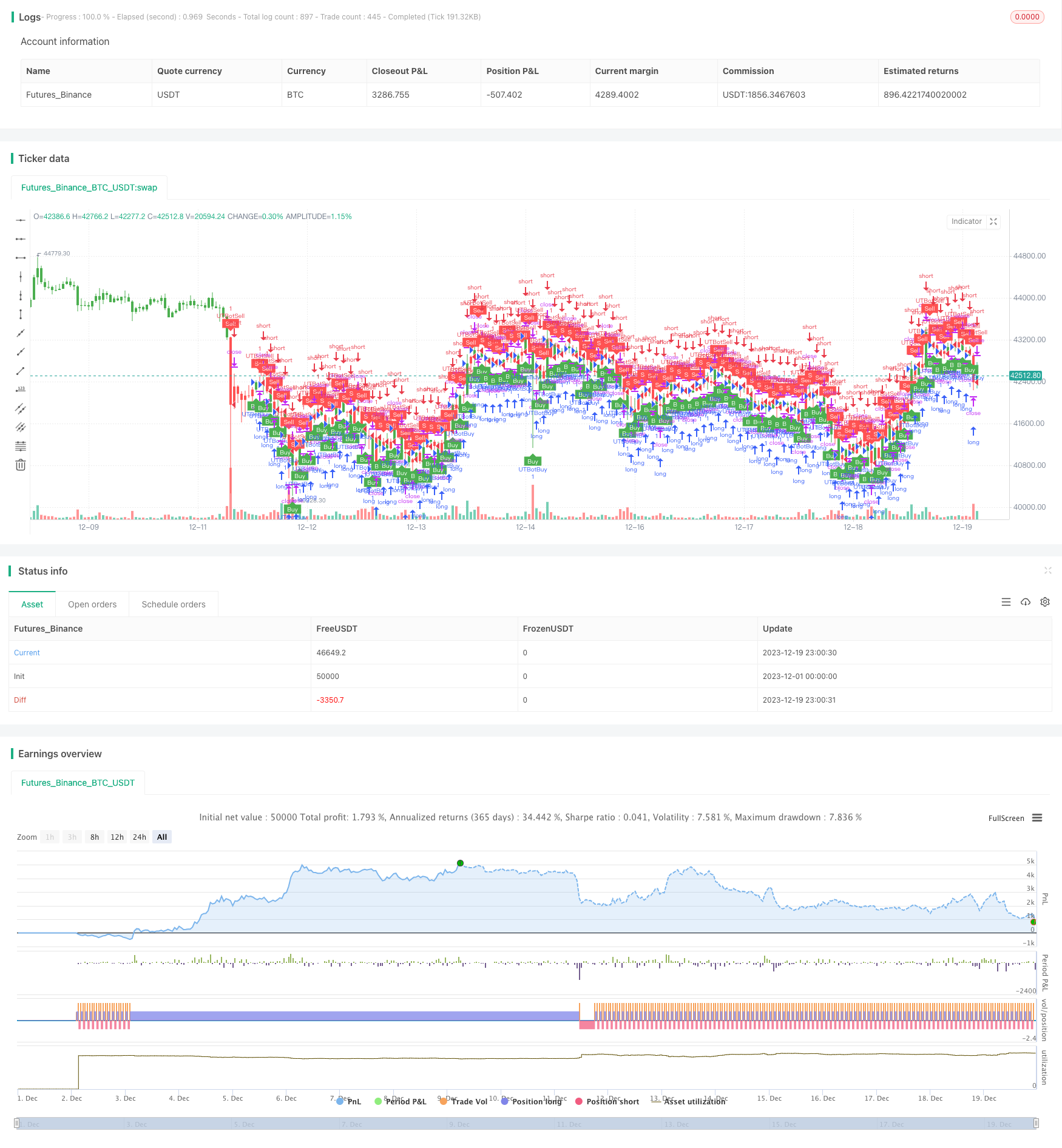

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-19 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="UTBot Strategy", overlay = true )

// CREDITS to @HPotter for the orginal code.

// CREDITS to @Yo_adriiiiaan for recently publishing the UT Bot study based on the original code -

// CREDITS to @TradersAITradingPlans for making this Strategy.

// Strategy fixed with Time period by Kirk65.

// I am using this UT bot with 2 hours time frame with god resultss. Alert with "Once per bar" and stoploss 1.5%. If Alerts triggered and price goes against Alert. Stoploss will catch it. Wait until next Alert.

// While @Yo_adriiiiaan mentions it works best on a 4-hour timeframe or above, witch is a lot less risky, but less profitable.

testStartYear = input(2019, "BACKTEST START YEAR", minval = 1980, maxval = 2222)

testStartMonth = input(01, "BACKTEST START MONTH", minval = 1, maxval = 12)

testStartDay = input(01, "BACKTEST START DAY", minval = 1, maxval = 31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2222, "BACKTEST STOP YEAR", minval=1980, maxval = 2222)

testStopMonth = input(12, "BACKTEST STOP MONTH", minval=1, maxval=12)

testStopDay = input(31, "BACKTEST STOP DAY", minval=1, maxval=31)

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, 0, 0)

testPeriod = true

SOURCE = input(hlc3)

RSILENGTH = input(14, title = "RSI LENGTH")

RSICENTERLINE = input(52, title = "RSI CENTER LINE")

MACDFASTLENGTH = input(7, title = "MACD FAST LENGTH")

MACDSLOWLENGTH = input(12, title = "MACD SLOW LENGTH")

MACDSIGNALSMOOTHING = input(12, title = "MACD SIGNAL SMOOTHING")

a = input(10, title = "Key Vaule. 'This changes the sensitivity'")

SmoothK = input(3)

SmoothD = input(3)

LengthRSI = input(14)

LengthStoch = input(14)

RSISource = input(close)

c = input(10, title="ATR Period")

xATR = atr(c)

nLoss = a * xATR

xATRTrailingStop = iff(close > nz(xATRTrailingStop[1], 0) and close[1] > nz(xATRTrailingStop[1], 0), max(nz(xATRTrailingStop[1]), close - nLoss),

iff(close < nz(xATRTrailingStop[1], 0) and close[1] < nz(xATRTrailingStop[1], 0), min(nz(xATRTrailingStop[1]), close + nLoss),

iff(close > nz(xATRTrailingStop[1], 0), close - nLoss, close + nLoss)))

pos = iff(close[1] < nz(xATRTrailingStop[1], 0) and close > nz(xATRTrailingStop[1], 0), 1,

iff(close[1] > nz(xATRTrailingStop[1], 0) and close < nz(xATRTrailingStop[1], 0), -1, nz(pos[1], 0)))

color = pos == -1 ? red: pos == 1 ? green : blue

ema= ema(close,1)

above = crossover(ema,xATRTrailingStop )

below = crossover(xATRTrailingStop,ema)

buy = close > xATRTrailingStop and above

sell = close < xATRTrailingStop and below

barbuy = close > xATRTrailingStop

barsell = close < xATRTrailingStop

plotshape(buy, title = "Buy", text = 'Buy', style = shape.labelup, location = location.belowbar, color= green,textcolor = white, transp = 0, size = size.tiny)

plotshape(sell, title = "Sell", text = 'Sell', style = shape.labeldown, location = location.abovebar, color= red,textcolor = white, transp = 0, size = size.tiny)

barcolor(barbuy? green:na)

barcolor(barsell? red:na)

//alertcondition(buy, title='Buy', message='Buy')

//alertcondition(sell, title='Sell', message='Sell')

if (buy)

strategy.entry("UTBotBuy",strategy.long, when=testPeriod)

if (sell)

strategy.entry("UTBotSell",strategy.short, when=testPeriod)

Detail

https://www.fmz.com/strategy/439710

Last Modified

2024-01-23 11:31:14