Name

基于短期和长期移动平均线交叉策略MA-Crossover-Trading-Strategy-Based-on-Short-term-and-Long-term-Moving-Average-Crossovers

Author

ChaoZhang

Strategy Description

该策略是一个基于短期和长期移动平均线交叉的简单移动平均线穿越交易策略。它使用34周期和89周期的移动平均线,在早盘时间段观察它们的交叉作为买入和卖出信号。当短期移动平均线从下方向上突破长期移动平均线时生成买入信号;当从上方向下突破时生成卖出信号。

该策略的核心逻辑是基于短期和长期移动平均线的交叉作为交易信号。具体来说,策略定义了34周期和89周期的短期和长期简单移动平均线(SMA)。只在早盘时间段(08:00 - 10:00)观察这两个SMA的交叉情况。当短期SMA从下方向上突破长期SMA时,认为市场处于上涨趋势,因此生成买入信号;当短期SMA从上方向下突破长期SMA时,认为市场处于下跌趋势,因此生成卖出信号。

接收到买入或卖出信号后,策略会进入仓位,并设置一个退出仓位的条件,即入场后持有指定根K线数量(默认为3根)后主动止损退出。这样可以锁定部分利润,避免亏损进一步扩大。

需要注意的是,策略仅在早盘时间段识别交叉信号。这是因为这段时间段市场交易量较大,趋势转换信号的可靠性更高。而其他时间段则市场波动性较大,容易产生错乱信号。

该策略具有以下几个优势:

-

使用简单普适的移动平均线交叉法则,容易理解,适合初学者使用

-

仅在高质量信号较多的早盘时间段识别信号,可以过滤掉其他时间段的假信号

-

设置了止损条件,可以及时止损,锁定部分利润,降低亏损风险

-

可自定义的参数较多,可以根据市场和个人风格进行调整

-

容易扩展,可以基于该框架结合其他指标设计更复杂的策略

该策略也存在一些风险,主要来自以下几个方面:

-

移动平均线本身滞后性较强,可能错过短期的价格反转点

-

仅依赖简单指标,容易在特定市场环境下失效(趋势震荡,区间整理等)

-

止损位置设置不当可能造成不必要的亏损

-

参数设置(移动平均线周期,持仓周期等)不当也会影响策略表现

对应解决方法:

-

结合其他先行指标,提升对短期变化的敏感性

-

增加过滤条件,避免在震荡和区间市场受假信号影响

-

优化止损逻辑,根据市场波动率动态调整止损范围

-

多组合参数优化,寻找最优参数设置

该策略还具有很大的优化空间,主要可以从以下几个方面进行:

-

增加其他过滤条件,避免在震荡和区间市场受假信号影响

-

结合动量类指标策略,识别更有力的突破信号

-

优化移动平均线的周期参数,寻找最佳参数组合

-

根据市场波动率自动优化止损幅度

-

尝试基于机器学习技术自动优化整个策略

-

尝试与其他策略组合,设计更复杂的多策略系统

该策略整体来说较为简单和实用,适合初学者参考学习。它体现了移动平均线交叉类策略的典型模式,通过设置止损来控制风险。但该策略可以进一步优化,使其操盘效果更佳,适应更多市场环境。投资者可以在这个基础上发挥创造力,设计出更先进的量化交易策略。

||

This strategy is a simple moving average crossover trading strategy based on short-term and long-term moving average crossovers. It uses 34-period and 89-period moving averages to observe their crossovers during the morning session as buy and sell signals. When the short-term moving average crosses above the long-term moving average from below, a buy signal is generated. When it crosses below from above, a sell signal is generated.

The core logic of this strategy is based on crossovers between short-term and long-term moving averages as trading signals. Specifically, the strategy defines 34-period and 89-period short-term and long-term simple moving averages (SMAs). It only observes the crossovers between these two SMAs during the morning session (08:00 - 10:00). When the short-term SMA crosses above the long-term SMA from below, the market is considered to be in an upward trend, hence generating a buy signal. When the short-term SMA crosses below the long-term SMA from above, the market is considered to be in a downward trend, thus generating a sell signal.

Upon receiving a buy or sell signal, the strategy will enter a position and set a condition to exit the position, which is to take profit after holding for a specified number of candles (default is 3 candles) since entry. This allows locking in partial profits and avoids further losses.

It should be noted that the strategy only identifies crossover signals during the morning session. This is because this time frame has higher trading volumes and trend change signals are more reliable. Other time frames have larger price fluctuations and are easier to generate false signals.

The strategy has the following advantages:

-

Using simple and universal moving average crossover rules, easy to understand, suitable for beginners

-

Only identifying signals during morning session where quality signals are abundant, which filters out false signals during other time frames

-

Has stop loss conditions that allow timely stop loss, locking in partial profits, and reducing risk of loss

-

Many customizable parameters that can be adjusted based on market conditions and personal trading style

-

Easily extensible to combine with other indicators to design more complex strategies

The strategy also has some risks, mainly from the following aspects:

-

Moving averages themselves have greater lagging attributes, may miss short-term price reversal points

-

Relies solely on simple indicators, prone to failure in certain market environments (trend shocks, range-bound, etc.)

-

Improper stop loss positioning may cause unnecessary losses

-

Improper parameter settings (moving average periods, holding periods, etc.) may also affect strategy performance

Corresponding solutions:

-

Incorporate other leading indicators to improve sensitivity to short-term changes

-

Add filtering conditions to avoid being affected by false signals during shocks and range-bound markets

-

Optimize stop loss logic and dynamically adjust stop loss range based on market volatility

-

Multi-parameter optimization to find optimal parameter settings

The strategy also has great potential for optimization, mainly from the following aspects:

-

Add other filtering conditions to avoid false signals during shocks and range-bound markets

-

Incorporate momentum indicators to identify stronger breakout signals

-

Optimize the moving average period parameters to find the best parameter combination

-

Automatically optimize the stop loss range based on market volatility

-

Attempt to automatically optimize the entire strategy based on machine learning techniques

-

Attempt to combine with other strategies to design more complex multi-strategy systems

In general, this strategy is relatively simple and practical, suitable for beginners to learn from. It embodies the typical pattern of moving average crossover strategies and uses stops to control risks. However, further optimizations can be made to improve performance for more market conditions. Investors can leverage this basic framework to design more advanced quantitative trading strategies.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 34 | Short SMA Length |

| v_input_2 | 89 | Long SMA Length |

| v_input_3 | 3 | Exit after how many candles? |

| v_input_4 | true | Exit at Open? |

| v_input_5 | 0800-1000 | Morning Session |

Source (PineScript)

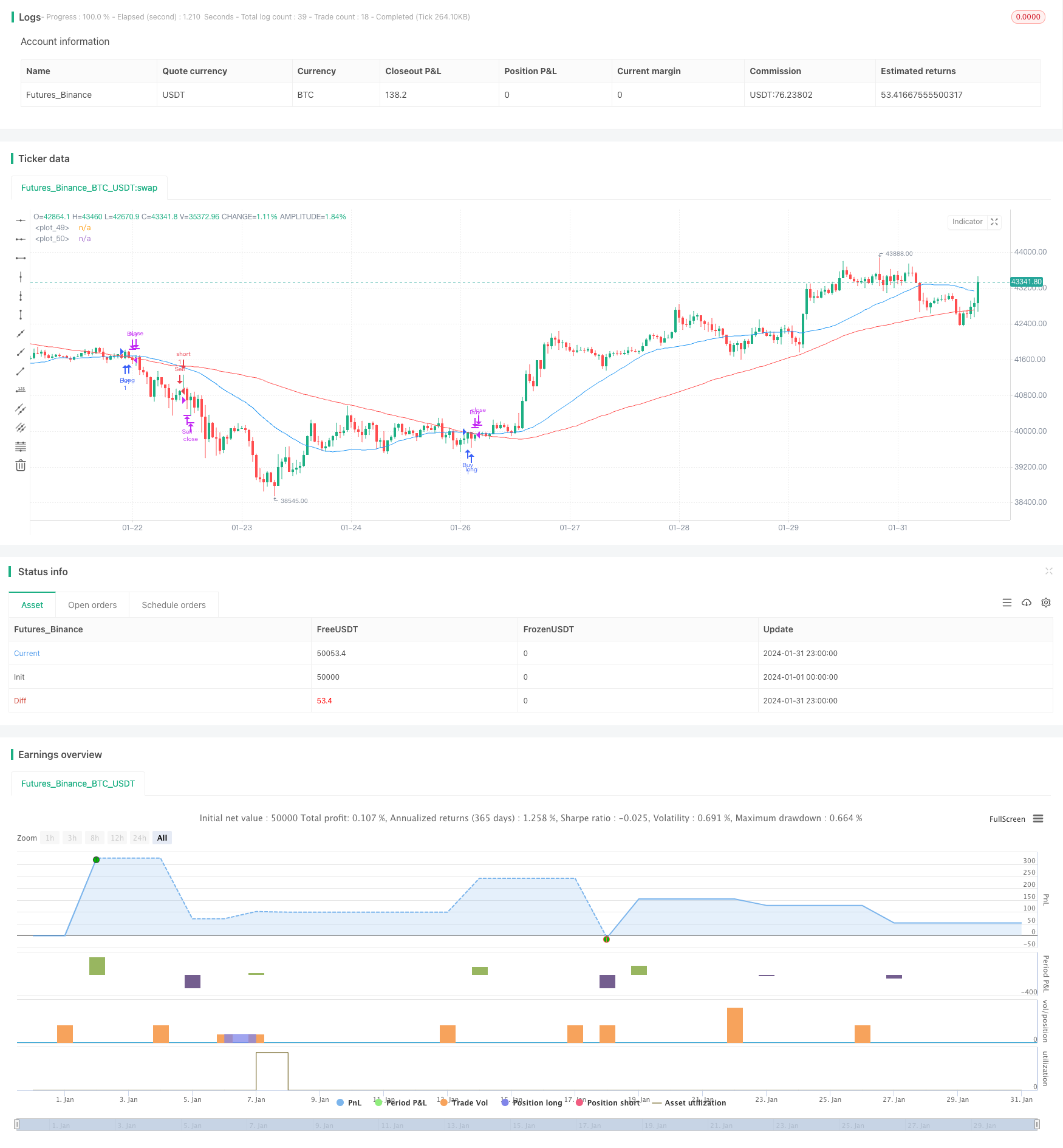

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("34 89 SMA Crossover Strategy", overlay=true)

// Define the length for the SMAs

short_length = input(34, title="Short SMA Length")

long_length = input(89, title="Long SMA Length")

exit_candles = input(3, title="Exit after how many candles?")

exit_at_open = input(true, title="Exit at Open?")

// Define morning session

morning_session = input("0800-1000", "Morning Session")

// Calculate SMAs

short_sma = ta.sma(close, short_length)

long_sma = ta.sma(close, long_length)

// Function to check if current time is within specified session

in_session(session) =>

session_start = na(time(timeframe.period, "0800-1000")) ? na : true

session_start

// Condition for buy signal (short SMA crosses over long SMA) within specified trading hours

buy_signal = ta.crossover(short_sma, long_sma)

// Condition for sell signal (short SMA crosses under long SMA) within specified trading hours

sell_signal = ta.crossunder(short_sma, long_sma)

// Function to exit the trade after specified number of candles

var int trade_entry_bar = na

var int trade_exit_bar = na

if (buy_signal or sell_signal)

trade_entry_bar := bar_index

if (not na(trade_entry_bar))

trade_exit_bar := trade_entry_bar + exit_candles

// Exit condition

exit_condition = (not na(trade_exit_bar) and (exit_at_open ? bar_index + 1 >= trade_exit_bar : bar_index >= trade_exit_bar))

// Execute trades

if (buy_signal)

strategy.entry("Buy", strategy.long)

if (sell_signal)

strategy.entry("Sell", strategy.short)

if (exit_condition)

strategy.close("Buy")

strategy.close("Sell")

// Plot SMAs on the chart

plot(short_sma, color=color.blue, linewidth=1)

plot(long_sma, color=color.red, linewidth=1)

Detail

https://www.fmz.com/strategy/442517

Last Modified

2024-02-22 15:36:49