Name

基于布林带及VWAP的多头突破策略Bollinger-Band-Breakout-Strategy-Based-on-VWAP

Author

ChaoZhang

Strategy Description

本策略利用布林带指标跟踪VWAP,在VWAP向上突破布林带中轨时判断为多头突破,采取多头策略;而在VWAP向下跌破布林带下轨时判断为空头证实,平仓离场。同时,策略还引入主要支撑位Pivot Point作为进场信号的辅助判断条件,这样可以过滤掉一些假突破。

- 计算VWAP值。

- 计算VWAP的布林带,包含上轨、中轨、下轨。

- 判断VWAP是否向上突破布林带中轨,如果是并且价格高于主要支撑位Pivot Point,则采取多头策略进场。

- 止损设定为5%。

- 如果VWAP向下突破布林带下轨,则认为空头得到证实,平仓离场;如果止损被触发,也离场。

- VWAP具有很强的趋势跟踪能力,结合布林带能准确判断趋势的启动。

- 增加Pivot Point作为辅助条件,可以过滤掉许多假突破,避免不必要的损失。

- 采用部分离场策略,可以锁定部分利润,控制风险。

- 回测结果显示,该策略在牛市中表现优异,具有较高的稳定性。

- 在震荡行情中,容易出现假突破导致亏损。

- Pivot Point并不能完全避免假突破,需要结合更多指标过滤信号。

- 部分离场增加了操作频率,也增加了交易成本。

- 在熊市中效果并不理想,需要做好风险控制。

- 可以结合MACD、KDJ等其他指标来辅助过滤进出场信号。

- 可以通过优化布林带的长度和标准差来寻找最优参数组合。

- 可以引入机器学习算法来动态优化布林带参数。

- 可以测试不同的止损水平,找到最优的止损点。

- 可以加入自适应离场机制,根据市场波动程度调整目标利润。

本策略整体来说是一个稳定的突破系统。其标准化操作方式,参数优化空间大,适合量化交易。同时也需要注意控制风险,防范异常行情造成的亏损。总的来说,它是一个值得深入研究和持续优化的突破类策略。

||

This strategy uses Bollinger Bands to track VWAP. It adopts a long position when VWAP breaks above the middle band, and closes position when VWAP breaks below the lower band. Pivot Point is also used as an auxiliary signal for entry, to avoid false breakouts.

- Calculate VWAP.

- Calculate Bollinger Bands of VWAP, including upper, middle and lower bands.

- Take long position when VWAP breaks above middle band and price is above Pivot Point.

- Set stop loss at 5%.

- If VWAP breaks below lower band, close long position. If stop loss is triggered, also exit.

- VWAP has strong trend tracking ability. With BB, it accurately identifies trend start.

- Adding Pivot Point filters out false breakouts, avoiding unnecessary losses.

- Partial exit locks in some profits and controls risk.

- Backtests show great performance in bull market with good stability.

- Prone to losses from false breakouts in range-bound market.

- Pivot Points cannot fully avoid false signals. More filters needed.

- Increased trade frequency leads to higher transaction costs.

- Does not perform well in bear market. Good risk control required.

- Add indicators like MACD, KDJ to filter signals.

- Optimize BB parameters through backtests.

- Use machine learning to dynamically optimize BB parameters.

- Test different stop loss levels to find optimum.

- Add adaptive take profit based on market volatility.

A stable breakout system suitable for algorithm trading. Attention is needed on risk control. With further research and optimization, it could become an excellent breakout strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 50 | BB Length |

| v_input_2 | 2 | StdDev |

| v_input_3 | false | Offset |

| v_input_4 | 0 | Pivot Period: Week |

| v_input_5 | 10 | Risk % of capital |

| v_input_6 | 5 | Stop Loss |

Source (PineScript)

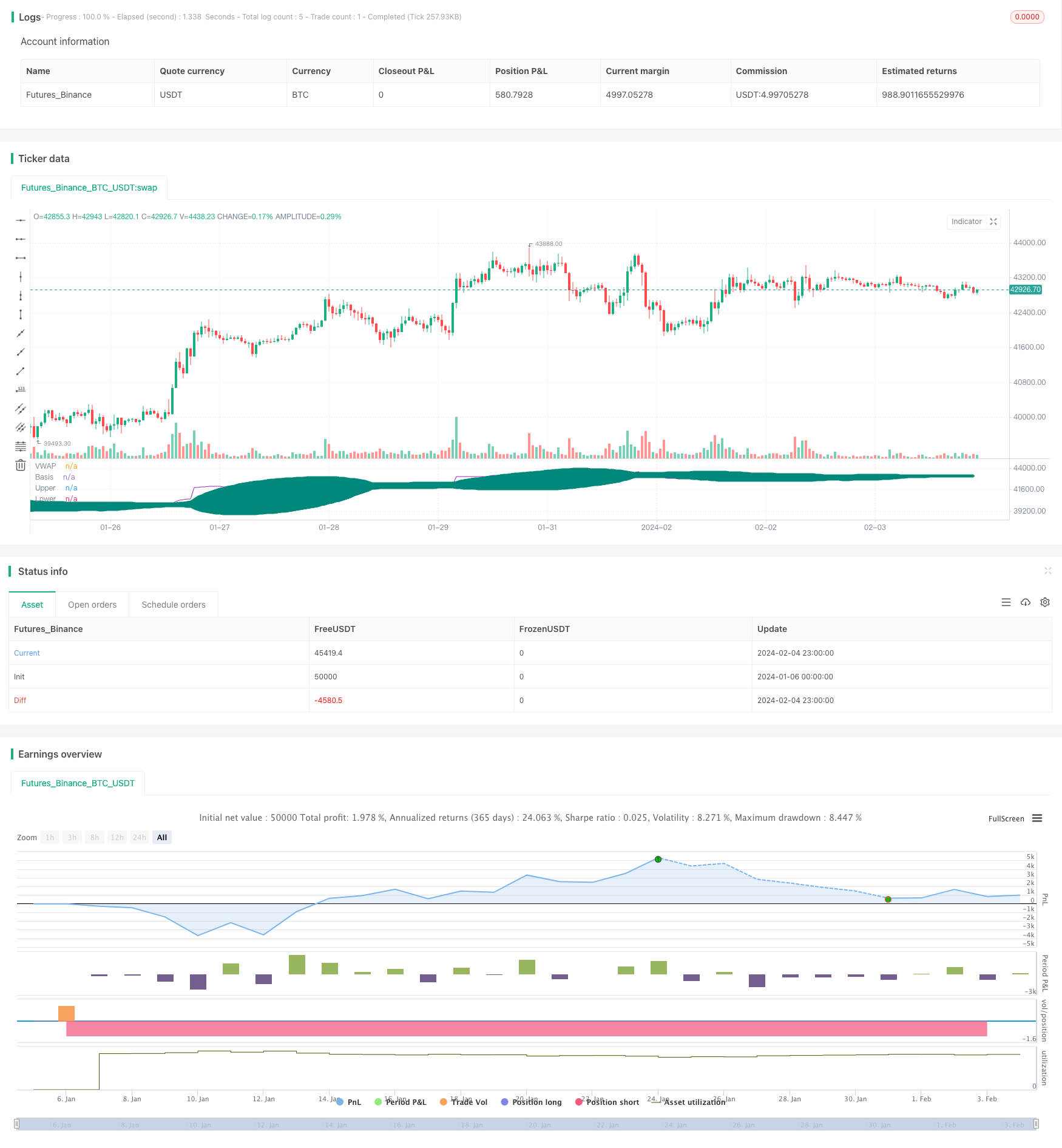

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ediks123

//@version=4

strategy("BBofVWAP with entry at Pivot Point", overlay=false, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=20, initial_capital=10000, currency=currency.USD) //default_qty_value=10, default_qty_type=strategy.fixed,

// Function outputs 1 when it's the first bar of the D/W/M/Y

is_newbar(res) =>

ch = 0

if(res == 'Y')

t = year(time('D'))

ch := change(t) != 0 ? 1 : 0

else

t = time(res)

ch := change(t) != 0 ? 1 : 0

ch

//variables BEGIN

//smaLength=input(200,title="Slow MA Length")

bbLength=input(50,title="BB Length")

//bbsrc = input(close, title="BB Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

pp_period = input(title = "Pivot Period", type=input.string, defval="Week", options = ['Day', 'Week'])

pp_res = pp_period == 'Day' ? 'D' : pp_period == 'Week' ? 'W' : pp_period == 'Month' ? 'M' : 'Y'

riskCapital = input(title="Risk % of capital", defval=10, minval=1)

stopLoss=input(5,title="Stop Loss",minval=1)

//sma200=sma(close,smaLength)

//plot(sma200, title="SMA 200", color=color.orange)

myVwap=vwap(hlc3)

//bollinger calculation

basis = sma(myVwap, bbLength)

dev = mult * stdev(myVwap, bbLength)

upperBand = basis + dev

lowerBand = basis - dev

//plot bb

plot(basis, "Basis", color=color.teal, style=plot.style_circles , offset = offset)

p1 = plot(upperBand, "Upper", color=color.teal, offset = offset)

p2 = plot(lowerBand, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=color.teal, transp=95)

plot(myVwap, title="VWAP", color=color.purple)

//pivot points

// Calc High

high_cur = 0.0

high_cur := is_newbar(pp_res) ? high : max(high_cur[1], high)

phigh = 0.0

phigh := is_newbar(pp_res) ? high_cur[1] : phigh[1]

// Calc Low

low_cur = 0.0

low_cur := is_newbar(pp_res) ? low : min(low_cur[1], low)

plow = 0.0

plow := is_newbar(pp_res) ? low_cur[1] : plow[1]

// Calc Close

pclose = 0.0

pclose := is_newbar(pp_res) ? close[1] : pclose[1]

vPP = (phigh + plow + pclose) / 3

//pivot points

//Entry--

//Echeck how many units can be purchased based on risk manage ment and stop loss

qty1 = (strategy.equity * riskCapital / 100 ) / (close*stopLoss/100)

//check if cash is sufficient to buy qty1 , if capital not available use the available capital only

qty1:= (qty1 * close >= strategy.equity ) ? (strategy.equity / close) : qty1

strategy.entry(id="BB_VWAP_PP",long=true, qty=qty1, when= crossover(myVwap,basis) and close>=vPP )

bgcolor(strategy.position_size>=1?color.blue:na, transp=75)

barcolor(strategy.position_size>=1?color.green:na)

stopLossVal= strategy.position_size>=1 ? close * (1 - (stopLoss*0.01) ) : 0.00

//partial exit

//strategy.close(id="BBofVwap", qty=strategy.position_size/3, when=crossunder(myVwap,upperBand) and strategy.position_size>=1 ) //and close>strategy.position_avg_price)

//exit on lowerband or stoploss

strategy.close(id="BB_VWAP_PP", comment="P" , qty=strategy.position_size/3, when= crossunder(myVwap,upperBand) and strategy.position_size>=1 and close>strategy.position_avg_price) //

strategy.close(id="BB_VWAP_PP", comment="Exit All", when=crossunder(myVwap,lowerBand) and strategy.position_size>=1 )

//strategy.close(id="BBofVwapWithFibPivot", comment="Exit All", when=crossunder(close,vPP) and strategy.position_size>=1 )

strategy.close(id="BB_VWAP_PP", comment="Stop Loss Exit", when=crossunder(close,stopLossVal) and strategy.position_size>=1 )

Detail

https://www.fmz.com/strategy/441176

Last Modified

2024-02-06 14:36:26