Name

基于多重指标的加密货币高低位策略High-Low-Cryptocurrency-Strategy-Based-on-Multiple-Indicators

Author

ChaoZhang

Strategy Description

本策略是一个适用于加密货币市场的高低位策略。它综合运用了MACD、PSAR、ATR、 Elliott波等多个指标,在1小时、4小时或1天等较高时间周期进行交易。策略的优势在于风险回报率高,平均盈利因子可达1.5-2.5。

该策略的交易信号来自价格的高低位点和多个指标的综合判断。具体逻辑是:

-

判断K线是否出现价格高低位区间,即高点连续创新高、低点连续创新低。

-

检查MACD的直方图水平。

-

检查PSAR指标判断趋势方向。

-

检查ATR和MA制成的趋势指标判断趋势方向。

-

检查Elliott波指标确认趋势方向。

如果上述5个条件都指向同一方向,产生做多或做空信号。

-

风险回报率高,可达1:30。

-

平均盈利因子高,一般在1.5-2.5之间。

-

多重指标组合,可以有效过滤假突破。

-

获胜率较低,只有10%-20%。

-

存在一定的回撤和拉锯盘的风险。

-

指标效果会受市场环境影响。

-

需要较强的心理承受能力。

对应措施:

-

加大交易资金规模以平衡获胜率。

-

严格控制单笔止损。

-

根据不同市场调整指标参数。

-

做好心理建设,控制好位置规模。

-

根据不同加密货币和市场环境测试指标参数。

-

增加止损、止盈策略优化资金管理。

-

结合机器学习方法提高获胜率。

-

增加社交情绪指标过滤交易信号。

-

考虑多时间周期指标确认。

本策略整体来说是一个适合加密货币的高风险高收益交易策略。它的优势在于风险回报率高,可以获得较高的平均盈利因子。风险主要在于获胜率较低,需要有较强的心理承受能力。下一步的优化方向可以从调整参数、优化资金管理、提高获胜率等多个维度进行。总体而言,本策略对于寻求高收益的加密货币交易者具有一定的实用价值。

||

This strategy is a high/low level strategy suitable for cryptocurrency markets. It integrates MACD, PSAR, ATR, Elliott Wave and other multiple indicators for trading at higher timeframes like 1 hour, 4 hours or 1 day. The advantage of this strategy lies in the high risk reward ratio with average profit factor ranging from 1.5 to 2.5.

The trading signals of this strategy come from the price high/low levels and composite judgments of multiple indicators. The specific logic is:

-

Judge if there is a high/low level range formed by successive higher highs or lower lows on the price chart.

-

Check the histogram level of MACD.

-

Check PSAR indicator for trend direction.

-

Check trend direction based on ATR and MA.

-

Confirm trend direction with Elliott Wave indicator.

If all the 5 conditions point to the same direction, long or short signals are generated.

-

High risk reward ratio up to 1:30.

-

High average profit factor, usually between 1.5-2.5.

-

Combination of multiple indicators helps filter false breakouts effectively.

-

Relatively low win rate around 10%-20%.

-

Potential drawdown and whipsaw risks exist.

-

Indicator performance could be impacted by market regimes.

-

Need decent psychological endurance.

Corresponding Measures:

-

Increase capital to balance the win rate.

-

Set strict stop loss for each trade.

-

Adjust parameters based on different markets.

-

Strengthen psychology and control position sizing.

-

Test parameters based on different cryptos and markets.

-

Add stop loss and take profit to optimize money management.

-

Increase win rate with machine learning methods.

-

Add social sentiment filter for trading signals.

-

Consider confirmation across multiple timeframes.

In conclusion, this is an aggressive high risk high return cryptocurrency trading strategy. Its advantage lies in the high risk reward ratio and profit factor. The main risks come from the relatively low win rate which requires strong psychology. The future optimization directions could be parameter tuning, money management, increasing win rate and so on. Overall this strategy has practical value for cryptocurrency traders seeking high profits.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 12 | Fast Length |

| v_input_2 | 26 | Slow Length |

| v_input_3_close | 0 | Source: close |

| v_input_4 | 9 | Signal Smoothing |

| v_input_5 | true | Simple MA(Oscillator) |

| v_input_6 | false | Simple MA(Signal Line) |

| v_input_7 | 0.02 | start |

| v_input_8 | 0.02 | increment |

| v_input_9 | 0.2 | maximum |

| v_input_10 | 20 | CCI |

| v_input_11 | 5 | ATR |

| v_input_12 | true | ATR Multiplier |

| v_input_13 | true | original coloring |

| v_input_14_close | 0 | source: close |

| v_input_15 | 5 | sma1length |

| v_input_16 | 35 | sma2length |

| v_input_17 | true | Show Dif as percent of current Candle |

| v_input_18 | 0.15 | tp |

| v_input_19 | 0.005 | sl |

Source (PineScript)

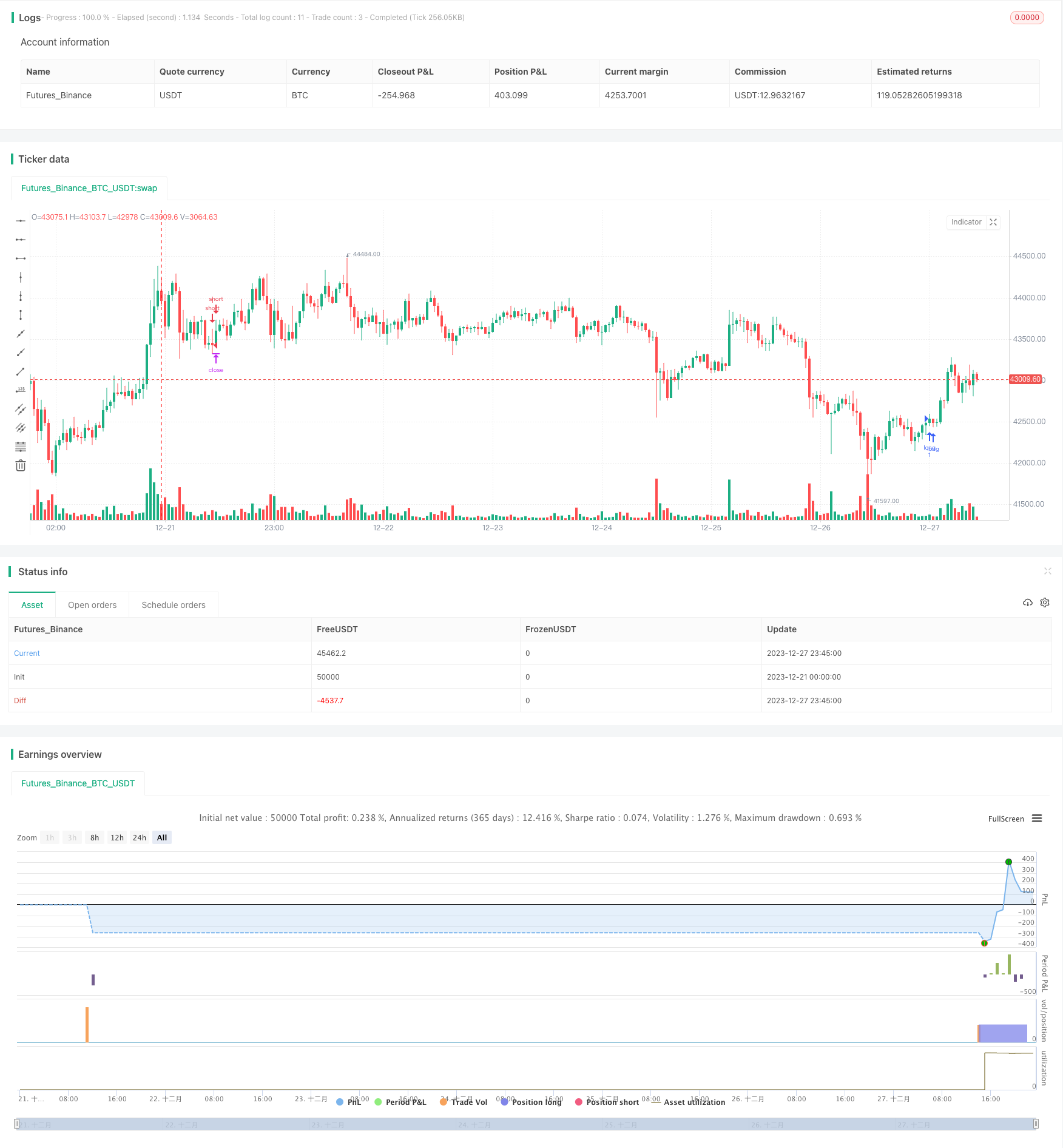

/*backtest

start: 2023-12-21 00:00:00

end: 2023-12-28 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy("Crypto strategy high/low", overlay=true)

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=true)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

//sar

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := min(AF + increment, maximum)

else

if low < EP

EP := low

AF := min(AF + increment, maximum)

if uptrend

SAR := min(SAR, low[1])

if bar_index > 1

SAR := min(SAR, low[2])

else

SAR := max(SAR, high[1])

if bar_index > 1

SAR := max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

CCI = input(20)

ATR = input(5)

Multiplier=input(1,title='ATR Multiplier')

original=input(true,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x=0.0

x:=thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

swap=0.0

swap:=x>x[1]?1:x<x[1]?-1:swap[1]

swap2=swap==1?color.lime:color.red

swap3=thisCCI >=0 ?color.lime:color.red

swap4=original?swap3:swap2

//elliot wave

srce = input(close, title="source")

sma1length = input(5)

sma2length = input(35)

UsePercent = input(title="Show Dif as percent of current Candle", type=input.bool, defval=true)

smadif=iff(UsePercent,(sma(srce, sma1length) - sma(srce, sma2length)) / srce * 100, sma(srce, sma1length) - sma(srce, sma2length))

col=smadif <= 0 ? color.red : color.green

longC = high > high[1] and high[1] > high[2] and close[2] > high[3] and hist > 0 and uptrend and smadif < 0 and swap4==color.lime

//longC = high > high[1] and high[1] > high[2] and high[2] > high[3] and high[3] > high[4] and close[4] > high[5]

shortC = low < low[1] and low[1] < low[2] and close[2] < low[3] and hist < 0 and not uptrend and smadif > 0 and swap4==color.red

//shortC = low < low[1] and low[1] < low[2] and low[2] < low[3] and low[3] < low[4] and close[4] < low[5]

tp=input(0.15, title="tp")

sl=input(0.005, title="sl")

strategy.entry("long",1,when=longC)

strategy.entry("short",0,when=shortC)

strategy.exit("x_long", "long" ,loss = close * sl / syminfo.mintick, profit = close * tp / syminfo.mintick , alert_message = "closelong")

//strategy.entry("short",0, when= loss = close * sl / syminfo.mintick)

strategy.exit("x_short", "short" , loss = close * sl / syminfo.mintick, profit = close * tp / syminfo.mintick,alert_message = "closeshort")

//strategy.entry("long",1, when = loss = close * sl / syminfo.mintick)

//strategy.close("long",when= hist < 0)

//strategy.close("short", when= hist > 0)

Detail

https://www.fmz.com/strategy/437004

Last Modified

2023-12-29 14:16:16