Name

基于多周期SMA指标的趋势跟踪策略Trend-Following-Strategy-Based-on-Multi-Period-SMA

Author

ChaoZhang

Strategy Description

本策略通过组合使用多种不同周期的SMA均线,实现对趋势的判断和跟踪。核心思路是:比较不同周期SMA的上涨和下跌方向,判断趋势;当短周期SMA上穿较长周期SMA时,做多;当短周期SMA下穿较长周期SMA时,做空。同时,结合ZeroLagEMA指标进行入场和出场的确认。

- 使用5个不同周期的SMA均线,分别是10周期、20周期、50周期、100周期和200周期。

- 比较这5条均线的上涨和下跌方向,判断趋势方向。例如,当10周期、20周期、100周期和200周期SMA均线同时上涨时,判断为上涨趋势;当均线同时下跌时,判断为下跌趋势。

- 比较不同周期SMA的数值,形成交易信号。例如,当10周期SMA上穿20周期SMA时做多,形成入场信号;当10周期SMA下穿20周期SMA时做空,形成入场信号。

- 使用ZeroLagEMA作为入场确认和出场信号。当快速周期ZeroLagEMA上穿慢速周期时做多;下穿时平多仓。做空信号的判断方式相反。

- 使用多种不同周期SMA均线组合,可以有效判断市场趋势方向。

- 周期SMA数值的比较可以产生交易信号,形成量化入场和出场规则。

- ZeroLagEMA滤波可以避免不必要的交易,提高策略稳定性。

- 结合趋势判断和交易信号,实现了趋势跟踪交易。

- 当市场进入震荡整理阶段时,SMA均线信号可能出现频繁交叉,带来较多无效交易和亏损的风险。

- 解决方法:增加ZeroLagEMA的滤波参数,避免无效信号的入场。

- 由于参考了较多周期的SMA,判断信号有一定滞后性,无法对短期剧烈价格变动做出及时反应。

- 解决方法:结合更加灵敏的指标,如MACD等,辅助判断。

- 优化SMA周期参数,找到最佳参数组合。

- 增加止损策略,如跟踪止损,进一步控制单笔亏损。

- 增加仓位数管理机制,让策略在趋势较强时加大头寸,在震荡时减小头寸。

- 结合更多辅助指标判断,如MACD,KDJ等,提高策略整体稳定性。

本策略通过组合多个周期SMA均线,实现了对市场趋势方向的有效判断,并产生了量化交易信号。同时,ZeroLagEMA的应用提高了策略的顺利率。总的来说,策略实现了基于趋势跟踪的量化交易思路,效果显著。通过进一步优化SMA周期参数、止损策略、头寸管理等,可以进一步增强策略效果,值得实盘验证与应用。

||

This strategy combines multiple SMA lines with different periods to identify and follow the trend. The core idea is: compare the rising/falling directions of SMAs with different periods to determine the trend; go long when short-period SMA crosses over long-period SMA, and go short when short SMA crosses below long SMA. ZeroLagEMA is also used to confirm entries and exits.

- Use 5 SMA lines with periods of 10, 20, 50, 100 and 200 respectively.

- Compare the directions of these 5 SMAs to determine the trend. For example, when 10-, 20-, 100- and 200-period SMAs are rising together, it indicates an upward trend; when they are all falling, it indicates a downward trend.

- Compare the values of SMAs with different periods to generate trading signals. For example, when 10-period SMA crosses over 20-period SMA, go long; when 10SMA crosses below 20SMA, go short.

- Use ZeroLagEMA for entry confirmation and exit signals. Go long when fast ZeroLagEMA crosses over slow ZeroLagEMA, exit long when it crosses below. Judgment logic for shorts is the opposite.

- Combining multiple SMAs with different periods can effectively determine the market trend.

- Comparing SMA values generates quantitative entry and exit rules.

- ZeroLagEMA filter avoids unnecessary trades and improves stability.

- Combining trend judgment and trading signals achieves trend following trading.

- When market enters consolidation, frequent SMA crossovers may cause redundant losses.

- Solution: Increase ZeroLagEMA filter to avoid invalid signal entries.

- Judging from multiple-period SMAs has some lagging, failing to respond swiftly to sharp short-term price changes.

- Solution: Add faster indicators like MACD to assist judgment.

- Optimize SMA period parameters to find best combination.

- Add stop loss strategies like trailing stop to further limit losses.

- Add position sizing mechanism to increase bets in strong trends and decrease bets in consolidations.

- Incorporate more assisting indicators like MACD and KDJ to improve overall stability.

This strategy effectively determines the market trend by combining multiple-period SMAs, and generates quantified trading signals. ZeroLagEMA improves win rate. In summary, the strategy achieved quantitative trend following trading, with remarkable results. Further optimizing periods, stop loss, position sizing etc. can strengthen the strategy for live trading.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | === SERIES INPUTS === |

| v_input_2_close | 0 | SMA Source: close |

| v_input_3 | 10 | SMA 1 Length |

| v_input_4 | 20 | SMA 2 Length |

| v_input_5 | 50 | SMA 3 Length |

| v_input_6 | 100 | SMA 4 Length |

| v_input_7 | 200 | SMA 5 Length |

| v_input_8 | 4 | SMA Direction Span |

| v_input_9_close | 0 | ZeroLag EMA Source: close |

| v_input_10 | 9 | ZeroLag EMA Fast Length |

| v_input_11 | 21 | ZeroLag EMA Slow Length |

| v_input_12 | true | === PLOT TIME LIMITER === |

| v_input_13 | true | Use Start Time Limiter? |

| v_input_14 | 2018 | Start From Year |

| v_input_15 | 2 | Start From Month |

| v_input_16 | true | Start From Day |

| v_input_17 | false | Start From Hour |

| v_input_18 | false | Start From Minute |

| v_input_19 | true | === TRAILING STOP === |

| v_input_20 | false | Use Trailing Stop? |

| v_input_21 | 200 | Stop Loss Trail Points |

| v_input_22 | 400 | Stop Loss Trail Offset |

Source (PineScript)

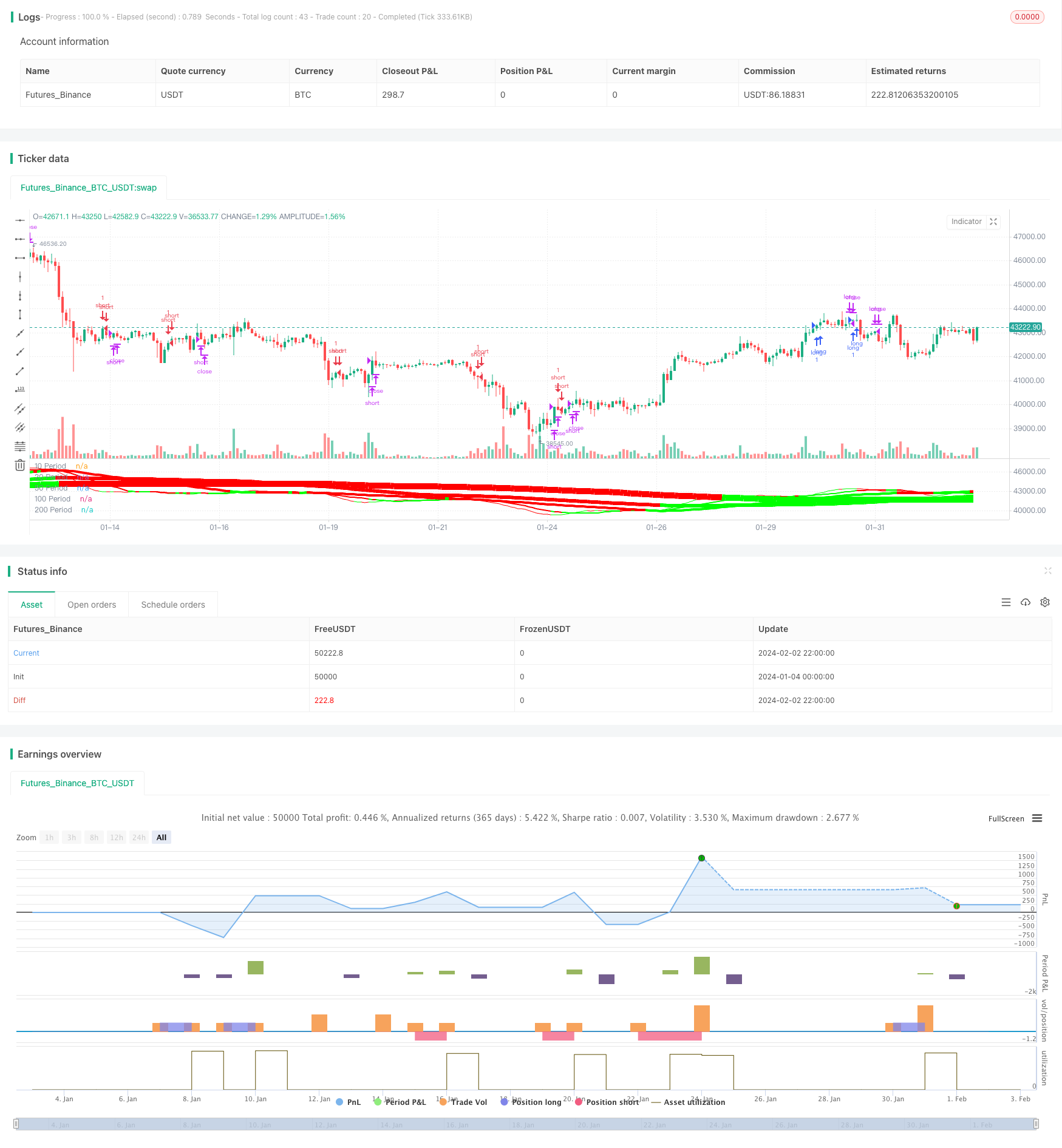

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Forex MA Racer - SMA Performance /w ZeroLag EMA Trigger", shorttitle = "FX MA Racer (5x SMA, 2x zlEMA)", overlay=false )

// === INPUTS ===

hr0 = input(defval = true, title = "=== SERIES INPUTS ===")

smaSource = input(defval = close, title = "SMA Source")

sma1Length = input(defval = 10, title = "SMA 1 Length")

sma2Length = input(defval = 20, title = "SMA 2 Length")

sma3Length = input(defval = 50, title = "SMA 3 Length")

sma4Length = input(defval = 100, title = "SMA 4 Length")

sma5Length = input(defval = 200, title = "SMA 5 Length")

smaDirSpan = input(defval = 4, title = "SMA Direction Span")

zlmaSource = input(defval = close, title = "ZeroLag EMA Source")

zlmaFastLength = input(defval = 9, title = "ZeroLag EMA Fast Length")

zlmaSlowLength = input(defval = 21, title = "ZeroLag EMA Slow Length")

hr1 = input(defval = true, title = "=== PLOT TIME LIMITER ===")

useTimeLimit = input(defval = true, title = "Use Start Time Limiter?")

// set up where we want to run from

startYear = input(defval = 2018, title = "Start From Year", minval = 0, step = 1)

startMonth = input(defval = 02, title = "Start From Month", minval = 0,step = 1)

startDay = input(defval = 01, title = "Start From Day", minval = 0,step = 1)

startHour = input(defval = 00, title = "Start From Hour", minval = 0,step = 1)

startMinute = input(defval = 00, title = "Start From Minute", minval = 0,step = 1)

hr2 = input(defval = true, title = "=== TRAILING STOP ===")

useStop = input(defval = false, title = "Use Trailing Stop?")

slPoints = input(defval = 200, title = "Stop Loss Trail Points", minval = 1)

slOffset = input(defval = 400, title = "Stop Loss Trail Offset", minval = 1)

// === /INPUTS ===

// === SERIES SETUP ===

// Fast ZeroLag EMA

zema1=ema(zlmaSource, zlmaFastLength)

zema2=ema(zema1, zlmaFastLength)

d1=zema1-zema2

zlemaFast=zema1+d1

// Slow ZeroLag EMA

zema3=ema(zlmaSource, zlmaSlowLength)

zema4=ema(zema3, zlmaSlowLength)

d2=zema3-zema4

zlemaSlow=zema3+d2

// Simple Moving Averages

period10 = sma(close, sma1Length)

period20 = sma(close, sma2Length)

period50 = sma(close, sma3Length)

period100 = sma(close, sma4Length)

period200 = sma(close, sma5Length)

// === /SERIES SETUP ===

// === PLOT ===

// colors of plotted MAs

p1 = (close < period10) ? #FF0000 : #00FF00

p2 = (close < period20) ? #FF0000 : #00FF00

p3 = (close < period50) ? #FF0000 : #00FF00

p4 = (close < period100) ? #FF0000 : #00FF00

p5 = (close < period200) ? #FF0000 : #00FF00

plot(period10, title='10 Period', color = p1, linewidth=1)

plot(period20, title='20 Period', color = p2, linewidth=2)

plot(period50, title='50 Period', color = p3, linewidth=4)

plot(period100, title='100 Period', color = p4, linewidth=6)

plot(period200, title='200 Period', color = p5, linewidth=10)

// === /PLOT ===

//BFR = BRFIB ? (maFast+maSlow)/2 : abs(maFast - maSlow)

// === STRATEGY ===

// calculate SMA directions

direction10 = rising(period10, smaDirSpan) ? +1 : falling(period10, smaDirSpan) ? -1 : 0

direction20 = rising(period20, smaDirSpan) ? +1 : falling(period20, smaDirSpan) ? -1 : 0

direction50 = rising(period50, smaDirSpan) ? +1 : falling(period50, smaDirSpan) ? -1 : 0

direction100 = rising(period100, smaDirSpan) ? +1 : falling(period100, smaDirSpan) ? -1 : 0

direction200 = rising(period200, smaDirSpan) ? +1 : falling(period200, smaDirSpan) ? -1 : 0

// conditions

// SMA Direction Trigger

dirUp = direction10 > 0 and direction20 > 0 and direction100 > 0 and direction200 > 0

dirDn = direction10 < 0 and direction20 < 0 and direction100 < 0 and direction200 < 0

longCond = (period10>period20) and (period20>period50) and (period50>period100) and dirUp//and (close > period10) and (period50>period100) //and (period100>period200)

shortCond = (period10<period20) and (period20<period50) and dirDn//and (period50<period100) and (period100>period200)

longExit = crossunder(zlemaFast, zlemaSlow) or crossunder(period10, period20)

shortExit = crossover(zlemaFast, zlemaSlow) or crossover(period10, period20)

// entries and exits

startTimeOk() =>

// get our input time together

inputTime = timestamp(syminfo.timezone, startYear, startMonth, startDay, startHour, startMinute)

// check the current time is greater than the input time and assign true or false

timeOk = time > inputTime ? true : false

// last line is the return value, we want the strategy to execute if..

// ..we are using the limiter, and the time is ok -OR- we are not using the limiter

r = (useTimeLimit and timeOk) or not useTimeLimit

if( true )

// entries

strategy.entry("long", strategy.long, when = longCond)

strategy.entry("short", strategy.short, when = shortCond)

// trailing stop

if (useStop)

strategy.exit("XL", from_entry = "long", trail_points = slPoints, trail_offset = slOffset)

strategy.exit("XS", from_entry = "short", trail_points = slPoints, trail_offset = slOffset)

// exits

strategy.close("long", when = longExit)

strategy.close("short", when = shortExit)

// === /STRATEGY ===

Detail

https://www.fmz.com/strategy/440976

Last Modified

2024-02-04 14:50:24