Name

基于均线的回撤交易策略Trend-Reversal-Strategy-Based-on-Moving-Averages

Author

ChaoZhang

Strategy Description

该策略的主要思想是在长期趋势方向上交易短期回撤。具体来说,使用200日简单移动均线判断长期趋势方向,使用10日简单移动均线判断短期趋势方向。当价格高于200日线时为多头市场,当价格低于200日线时为空头市场。在多头市场中,当价格下跌到10日线时,做多;在空头市场中,当价格上涨到10日线时,做空。

该策略使用200日简单移动均线和10日简单移动均线判断市场趋势。当价格上穿200日线时认为进入多头市场,当价格下穿200日线时认为进入空头市场。在多头市场中,如果价格下跌到10日线附近,说明遇到了短期调整,这时做多,目标是追随长期多头趋势的继续上涨。在空头市场中,如果价格上涨到10日线附近,说明遇到了短期反弹,这时做空,目标是追随长期空头趋势的继续下跌。

具体来说,当满足以下条件时,做多进入场内:价格高于200日线,价格低于10日线,此前没有持仓。当满足以下条件时,平仓退出场内:价格高于10日线,此前持有多头仓位。为了防止巨大亏损,设置了FAILSAFE止损,如果从最高点回撤幅度超过10%,直接止损退出。

可以看出,该策略的交易逻辑主要基于均线的金叉死叉,在长短均线判断后的趋势方向上进行回撤买入和趋势追踪止盈,属于典型的趋势跟踪策略。

该策略最大的优势在于以低资金成本进行趋势跟踪,追求超额收益。具体优势如下:

-

使用长短期均线组合判断主次级别的趋势方向,可以有效锁定中长线趋势机会,避免被短期行情误导。

-

采用短期回撤切入的方式,可以最大限度地降低买入成本,从而获得较高的盈利空间。

-

设置FAILSAFE止损机制,可以有效控制单笔亏损,保护账户资金安全。

-

允许追踪止盈退出,充分挖掘中长线趋势机会,获得超额Alpha。

-

采用纯机械化交易方式,避免主观情绪影响,使策略更易于实施。

该策略主要存在以下风险:

-

回测数据拟合风险。实际市场条件可能与历史数据存在差异,从而导致实盘交易效果打折。

-

假突破风险。价格仅触及均线附近就反转回调的概率较大,容易造成小额亏损累积。

-

趋势反转风险。中长线趋势突然反转是常见情况,这时持仓容易造成较大亏损。

对策如下:

-

增加样本量,使用更多历史数据进行稳健性验证,确保结果可靠。

-

优化参数,调整均线系统参数组合,确保交易信号质量。

-

适当放宽止损线,给予价格一定回调空间,避免过于敏感止损。

该策略可以从以下方面进行进一步优化:

-

增加过滤条件,如交易量过滤,可以有效减少假突破引发的不必要交易。

-

结合其他指标,如KDJ、MACD等,形成指标组合,可以提高交易信号的质量。

-

测试不同持仓时间,优化止盈和止损策略,进一步提高夏普率等指标。

-

根据市场情况动态调整参数,形成自适应参数优化机制,使策略更具鲁棒性。

-

增加算法交易模块,利用机器学习等方法自动生成交易信号,减少人为干预。

本策略整体思路清晰、易于实现,以低成本追踪中长线趋势,可以获得稳定的Alpha。但也存在一定概率被套利的风险,需要进一步优化以提高稳定性。总的来说,本策略从趋势跟踪的角度进行设计,值得进一步研究与应用。如果参数调整得当,应能获得良好的实盘效果。

||

The main idea of this strategy is to trade short-term pullbacks along the direction of the long-term trend. Specifically, the 200-day simple moving average is used to determine the direction of the long-term trend, and the 10-day simple moving average is used to determine the direction of the short-term trend. When the price is above the 200-day line, it is a bull market. When the price is below the 200-day line, it is a bear market. In a bull market, go long when the price drops to the 10-day line. In a bear market, go short when the price rises to the 10-day line.

This strategy uses the 200-day simple moving average and the 10-day simple moving average to determine market trend. When the price crosses above the 200-day line, it is considered entering a bull market. When the price crosses below the 200-day line, it is considered entering a bear market. In a bull market, if the price drops to around the 10-day line, it means encountering a short-term correction. At this time, go long, targeting the continuation of the long-term bullish trend. In a bear market, if the price rises to around the 10-day line, it means encountering a short-term rebound. At this time, go short, targeting the continuation of the long-term bearish trend.

Specifically, when the following conditions are met, go long to enter the market: price is above the 200-day line, price is below the 10-day line, and there was no previous position. When the following conditions are met, close the position to exit the market: price is above the 10-day line, and there was a previous long position. To prevent huge losses, a FAILSAFE stop loss is set. If the retracement from the highest point exceeds 10%, directly stop loss to exit.

It can be seen that the trading logic of this strategy is mainly based on the golden cross and death cross of moving averages. It enters based on pullbacks and exits based on trend tracking in the direction determined by long and short moving averages, which belongs to a typical trend tracking strategy.

The biggest advantage of this strategy is low-cost trend tracking to pursue excess returns. The specific advantages are as follows:

-

Using a combination of long-term and short-term moving averages to determine the direction of primary and secondary trends can effectively lock in medium and long-term trend opportunities and avoid being misled by short-term market movements.

-

By entering based on short-term pullbacks, the entry cost can be minimized to obtain relatively high profit potential.

-

The FAILSAFE stop loss mechanism can effectively control single losses to protect account funds.

-

Allowing trend tracking exits can fully tap medium and long-term trend opportunities for alpha excess returns.

-

The adoption of a fully automated trading method avoids subjective emotional impact and makes the strategy easier to implement.

The main risks of this strategy are:

-

Backtest overfitting risk. Actual market conditions may differ from historical data, resulting in reduced actual trading performance.

-

Risk of false breakouts. The probability of prices reversing near the moving averages is relatively large, which can easily lead to small accumulated losses.

-

Risk of trend reversal. Sudden reversals in medium and long-term trends are common, which can easily lead to relatively large losses when holding positions.

The counter measures are:

-

Increase sample size and use more historical data for robustness testing to ensure reliable results.

-

Optimize parameters by adjusting the combination of moving average system parameters to ensure signal quality.

-

Widen stop loss lines appropriately to allow some price retracements to avoid oversensitive stop losses.

This strategy can be further optimized in the following aspects:

-

Add filtering conditions such as volume filtering to effectively reduce unnecessary trading caused by false breakouts.

-

Incorporate other indicators such as KDJ and MACD to form combo signals to improve trade signal quality.

-

Test different holding periods and optimize take profit and stop loss strategies to further improve Sharpe ratio etc.

-

Dynamically adjust parameters based on market conditions to form an adaptive parameter optimization mechanism to make the strategy more robust.

-

Add algorithmic trading modules using machine learning etc to automatically generate trading signals to reduce human intervention.

The overall logic of this strategy is clear and easy to implement for low-cost tracking of medium and long-term trends to achieve steady alpha. But there are also risks of getting caught on the wrong side of the trend which requires further optimization to improve robustness. In general, this strategy is designed from a trend tracking perspective and is worth further research and application. With proper parameter tuning, it should produce good live trading results.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 200 | (?Strategy Parameters)MA 1 Length |

| v_input_int_2 | 10 | MA 2 Length |

| v_input_float_1 | 0.1 | Stop Loss Percent |

| v_input_bool_1 | false | Exit On Lower Close |

| v_input_1 | timestamp(01 Jan 1995 13:30 +0000) | (?Time Filter)Start Filter |

| v_input_2 | timestamp(1 Jan 2099 19:30 +0000) | End Filter |

Source (PineScript)

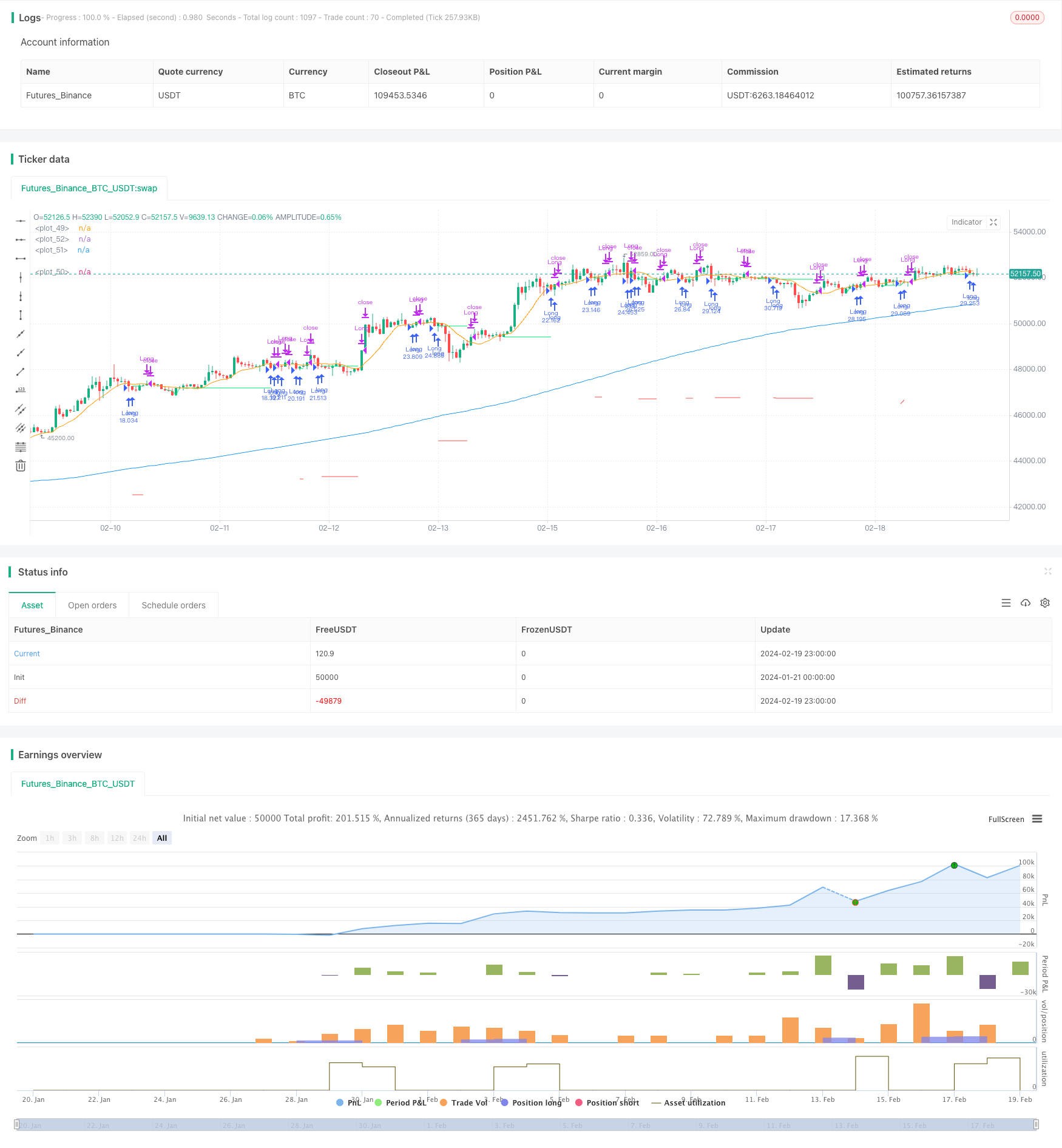

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © irfanp056

// @version=5

strategy("Simple Pullback Strategy",

overlay=true,

initial_capital=100000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=1000, // 100% of balance invested on each trade

commission_type=strategy.commission.cash_per_contract,

commission_value=0.005) // Interactive Brokers rate

// Get user input

i_ma1 = input.int(title="MA 1 Length", defval=200, step=10, group="Strategy Parameters", tooltip="Long-term MA")

i_ma2 = input.int(title="MA 2 Length", defval=10, step=10, group="Strategy Parameters", tooltip="Short-term MA")

i_stopPercent = input.float(title="Stop Loss Percent", defval=0.10, step=0.1, group="Strategy Parameters", tooltip="Failsafe Stop Loss Percent Decline")

i_lowerClose = input.bool(title="Exit On Lower Close", defval=false, group="Strategy Parameters", tooltip="Wait for a lower-close before exiting above MA2")

i_startTime = input(title="Start Filter", defval=timestamp("01 Jan 1995 13:30 +0000"), group="Time Filter", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="End Filter", defval=timestamp("1 Jan 2099 19:30 +0000"), group="Time Filter", tooltip="End date & time to stop searching for setups")

// Get indicator values

ma1 = ta.sma(close, i_ma1)

ma2 = ta.sma(close, i_ma2)

// Check filter(s)

f_dateFilter = true

// Check buy/sell conditions

var float buyPrice = 0

buyCondition = close > ma1 and close < ma2 and strategy.position_size == 0 and f_dateFilter

sellCondition = close > ma2 and strategy.position_size > 0 and (not i_lowerClose or close < low[1])

stopDistance = strategy.position_size > 0 ? ((buyPrice - close) / close) : na

stopPrice = strategy.position_size > 0 ? buyPrice - (buyPrice * i_stopPercent) : na

stopCondition = strategy.position_size > 0 and stopDistance > i_stopPercent

// Enter positions

if buyCondition

strategy.entry(id="Long", direction=strategy.long)

if buyCondition[1]

buyPrice := open

// Exit positions

if sellCondition or stopCondition

strategy.close(id="Long", comment="Exit" + (stopCondition ? "SL=true" : ""))

buyPrice := na

// Draw pretty colors

plot(buyPrice, color=color.lime, style=plot.style_linebr)

plot(stopPrice, color=color.red, style=plot.style_linebr, offset=-1)

plot(ma1, color=color.blue)

plot(ma2, color=color.orange)

Detail

https://www.fmz.com/strategy/442417

Last Modified

2024-02-21 17:03:31