Name

基于双EMA策略分析The-Double-EMA-Strategy-Analysis

Author

ChaoZhang

Strategy Description

双EMA策略是一种趋势追踪策略,它通过计算不同周期的EMA,识别价格的趋势方向,以此来决定建仓或平仓。该策略简单实用,适用于趋势性较强的市场。

该策略主要基于两个EMA指标,一个是短周期9日EMA,另一个是较长周期的21日EMA。它们的交叉为建仓和平仓信号。

当短期EMA上穿长期EMA时,被视为价格进入上升趋势,该策略会在此时开多单,追踪价格上涨。当短期EMA下穿长期EMA时,被视为价格进入下降趋势,该策略会在此时开空单,追踪价格下跌。

EMA指标能够有效过滤价格数据中的噪声,识别出价格趋势的主要方向。因此,该策略使用双EMA指标作为建仓和平仓的依据,以期望能够抓住较长的价格趋势周期。

该策略具有以下优势:

- 策略思路简单清晰,易于理解和实施。

- 能够有效识别价格趋势,及时建仓追踪趋势。

- 使用EMA指标过滤噪声,避免被短期价格震荡干扰。

- 可配置EMA参数,调整策略的敏感度。

该策略也存在一些风险:

- 在趋势反转时,EMA指标的滞后特性可能导致损失加大。

- EMA参数设置不当时,会提高假信号率。

- 本策略更适合强趋势市,在盘整时易受损。

该策略可以从以下方面进行优化:

- 结合其他指标判断趋势反转,降低损失。例如MACD、KDJ等。

- 添加止损逻辑,好的止损策略可以大幅降低策略最大回撤。

- 优化EMA参数,使之更加契合不同品种的价格特性。

- 结合机器学习算法实现EMA参数的自动优化。

双EMA策略整体而言是一个非常实用的趋势追踪策略。它操作简便,易于理解,在强趋势市场中表现优异。同时该策略也存在一些风险,可以从多种维度进行优化提高策略稳定性。总的来说,双EMA策略是量化交易的一个重要参考模板。

||

The double EMA strategy is a trend following strategy that identifies the trend direction of prices by calculating EMAs of different cycles and uses that to determine entries and exits. This simple and practical strategy works well in trending markets.

The strategy is mainly based on two EMA indicators, a short-term 9-day EMA and a longer 21-day EMA. Their crossovers generate entry and exit signals.

When the short EMA crosses above the long EMA, it is viewed as prices entering an uptrend. The strategy will go long to follow the rising trend. When the short EMA crosses below the long EMA, it is viewed as prices entering a downtrend. The strategy will go short to follow the falling trend.

The EMA indicators can effectively filter out noise from price data and identify the main direction of the trend. Therefore, the strategy uses dual EMAs as the basis for entries and exits in order to capture longer price trends.

The strategy has the following advantages:

- The strategy idea is simple and easy to understand and implement.

- It can effectively identify price trends and timely enter positions to follow trends.

- Using EMAs filters noise and avoids interference from short-term price fluctuations.

- The EMA parameters can be configured to adjust the sensitivity of the strategy.

There are also some risks with this strategy:

- The lagging characteristic of EMAs may increase losses when trends reverse.

- Improper EMA parameter settings increase false signal rates.

- The strategy is more suitable for strong trending markets and vulnerable in range-bound periods.

The strategy can be optimized in the following aspects:

- Incorporate other indicators to identify trend reversals and reduce losses, e.g. MACD, KDJ, etc.

- Add stop loss logic. Good stop loss strategies can greatly reduce maximum drawdown.

- Optimize the EMA parameters to make them fit better with the price characteristics of different products.

- Use machine learning algorithms to automate EMA parameter optimization.

In summary, the double EMA strategy is a very useful trend following strategy. It is easy to operate, understand, and performs excellently in strong trending markets. The strategy also has some risks that can be mitigated through various enhancements to improve its stability. Overall, double EMAs serve as an important reference template for quantitative trading.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 9 | Short EMA Length |

| v_input_2 | 21 | Long EMA Length |

| v_input_color_1 | close[1]>openLPrice?LongWColor:LongLColor,.rgb(0,255,0,0) | (?Strategy Lines)Long Win Color |

| v_input_color_2 | close[1]>openLPrice?LongWColor:LongLColor,.rgb(0,0,255,0) | Long Loss Color |

| v_input_color_3 | close[1]>openLPrice?LongWColor:LongLColor,.rgb(255,255,0,0) | Short Win Color |

| v_input_color_4 | close[1]>openLPrice?LongWColor:LongLColor,.rgb(255,0,0,0) | Short Loss Color |

| v_input_color_5 | close[1]>openLPrice?LongWColor:LongLColor,.rgb(0,0,0,0) | Win Font Color |

| v_input_color_6 | close[1]>openLPrice?LongWColor:LongLColor,.rgb(255,255,255,0) | Loss Font Color |

| v_input_3 | false | Show Labels? |

Source (PineScript)

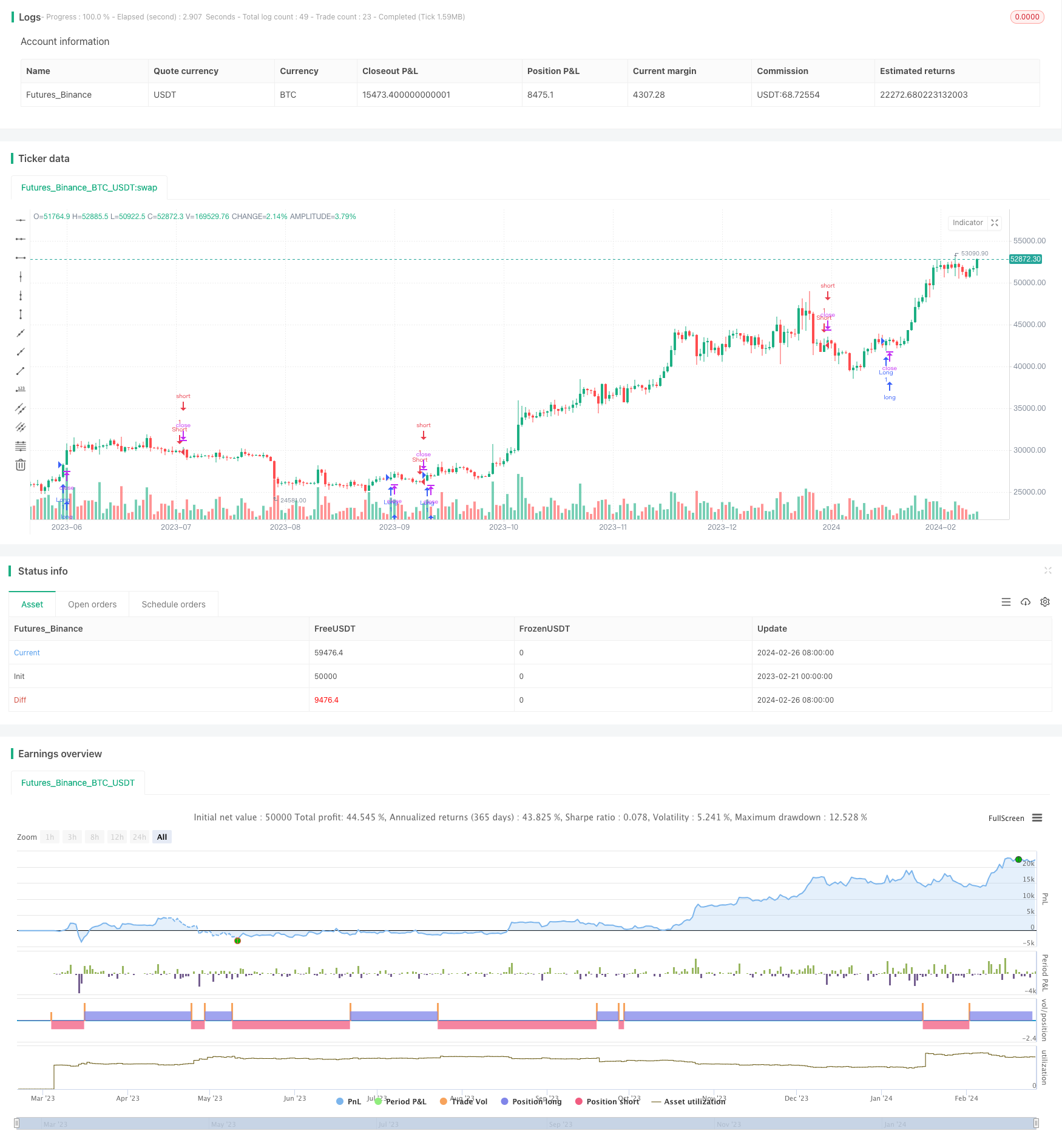

/*backtest

start: 2023-02-21 00:00:00

end: 2024-02-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This can only draw so many lines. Use bar replay to go back further

strategy("Strategy Lines", shorttitle="Strategy Lines", overlay=true, max_lines_count=500)

//###########################################################################################################################################

// Replace your strategy here

//###########################################################################################################################################

shortEMA = ta.ema(close, input(9, title="Short EMA Length"))

longEMA = ta.ema(close, input(21, title="Long EMA Length"))

// Entry conditions for long and short positions

longCondition = ta.crossover(shortEMA, longEMA)

shortCondition = ta.crossunder(shortEMA, longEMA)

//###########################################################################################################################################

// Strategy Lines

//###########################################################################################################################################

var timeLow = bar_index

var line li = na

var openLPrice = 0.0000

var openSPrice = 0.0000

LongWColor = input.color(color.rgb(0,255,0,0),"Long Win Color", group="Strategy Lines")

LongLColor = input.color(color.rgb(0,0,255,0),"Long Loss Color", group="Strategy Lines")

ShortWColor = input.color(color.rgb(255,255,0,0),"Short Win Color", group="Strategy Lines")

ShortLColor = input.color(color.rgb(255,0,0,0),"Short Loss Color", group="Strategy Lines")

WinFontColor = input.color(color.rgb(0,0,0,0),"Win Font Color", group="Strategy Lines")

LossFontColor = input.color(color.rgb(255,255,255,0),"Loss Font Color", group="Strategy Lines")

LinesShowLabel = input(false,"Show Labels?",group = "Strategy Lines")

// // Start new line when we go long

// if strategy.position_size >0

// line.delete(li)

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close>openLPrice?LongWColor:LongLColor)

// // Start new line when we go short

// if strategy.position_size <0

// line.delete(li)

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close<openSPrice?ShortWColor:ShortLColor)

// //Delete Lines if we don't have a position open

// if strategy.position_size ==0

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=color.rgb(0,0,0,100))

// line.delete(li)

if LinesShowLabel

// Short Label

if strategy.position_size>=0 and strategy.position_size[1] <0

label.new(

timeLow, na,

text=str.tostring((openSPrice-close[1])/(syminfo.mintick*10)),

color=close[1]<openSPrice?ShortWColor:ShortLColor,

textcolor=close[1]<openSPrice?WinFontColor:LossFontColor,

size=size.small,

style=label.style_label_down, yloc=yloc.abovebar)

// Long Label

if strategy.position_size<=0 and strategy.position_size[1] >0

label.new(

timeLow, na,

text=str.tostring((close[1]-openLPrice)/(syminfo.mintick*10)),

color=close[1]>openLPrice?LongWColor:LongLColor,

textcolor=close[1]>openLPrice?WinFontColor:LossFontColor,

size=size.small,

style=label.style_label_down, yloc=yloc.abovebar)

// Open long position and draw line

if (longCondition)

//strategy.entry("Long", strategy.long)

// timeLow := bar_index

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close>openLPrice?LongWColor:LongLColor)

openLPrice := close

// Open short position and draw line

if (shortCondition)

//strategy.entry("Short", strategy.short)

// timeLow := bar_index

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close<openSPrice?ShortWColor:ShortLColor)

openSPrice := close

//###########################################################################################################################################

// Strategy Execution (Replace this as well)

//###########################################################################################################################################

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

Detail

https://www.fmz.com/strategy/443043

Last Modified

2024-02-28 18:07:59