Name

基于动量均线反转策略Momentum-Moving-Average-Reversal-Strategy

Author

ChaoZhang

Strategy Description

本策略的核心思想是结合RSI指标和移动平均线,寻找股票价格反转机会,实现低买高卖。当RSI指标显示股票处于超卖状态,且短期移动平均线下穿价格时,作为买入信号;设置止损和止盈后,等待价格反转上涨。

该策略主要利用RSI指标判断超卖超买,及移动平均线的金叉死叉判断价格趋势。具体来说,RSI指标可以有效判断股票是否超卖或超买。当RSI低于30时,属于超卖范围。而当短期移动平均线(该策略中设置为9日线)下穿价格时,说明价格在下跌。

所以,当RSI指标低于40,即接近超卖状态,且9日移动平均线下穿价格时,可以判断为股票价格可能反转的时机,做多买入。随后设置止损和止盈退出,等待股票价格反转上涨后套现获得利润。

该策略结合RSI指标和移动平均线,可以有效判断买入时机。相比单一判断超卖,增加了移动平均线的条件判定,避免超卖区域波动。止损止盈设置灵活,可以因人而异。

该策略依赖参数设置,如RSI judgment阈值,移动平均线时间窗口等,不同参数可能带来不同结果。且在特定市场情况下,仍有可能出现止损。

此外,交易费用也会对利润产生一定影响。后期可以考虑加入交易量或资金管理模块,进行优化。

可以考虑动态调整移动平均线参数,不同周期选择不同的参数;或引入其他指标判断,如KDJ、MACD等,形成多种条件综合判定。

另外也可以建立交易量或资金管理模块,以控制单笔交易占用资金比例,减少单笔损失的影响。

该策略整体来说,利用RSI指标和移动平均线判定买入时机,可以有效判断价格反转,在超卖时买入,获得比较高的成功率。结合止损止盈来锁定利润,可以获取较好的效果。后期优化的方向,可以考虑加入更多指标或建立额外的交易/资金管理模块,使策略更加强大。

||

The core idea of this strategy is to combine the RSI indicator and moving average to find opportunities for stock price reversals and achieve buying low and selling high. When the RSI indicator shows that the stock is oversold and the short-term moving average crosses below the price, it serves as a buy signal. After setting the stop loss and take profit, wait for the price to reverse upward.

This strategy mainly uses the RSI indicator to judge oversold and overbought conditions, and the golden cross and dead cross of the moving average to determine price trends. Specifically, the RSI indicator can effectively judge whether a stock is oversold or overbought. When the RSI is below 30, it is in the oversold range. And when the short-term moving average (set to 9-day in this strategy) crosses below the price, it means the price is falling.

So when the RSI indicator is below 40, nearing the oversold state, and the 9-day moving average crosses below the price, it can be judged as a possible timing for the stock price to reverse, going long to buy. Then set the stop loss and take profit to exit, waiting for the stock price to reverse upward before selling to take profits.

This strategy combines the RSI indicator and moving average, which can effectively determine the timing of buying. Compared with a single judgment of oversold, the added condition judgment of the moving average avoids fluctuation in the oversold area. The setting of stop loss and take profit is flexible and can vary from person to person.

This strategy relies on parameter settings such as RSI judgment threshold, moving average time window, etc. Different parameters may lead to different results. And under certain market conditions, stop loss is still possible.

In addition, transaction fees will also have a certain impact on profits. It is worth considering incorporating trading volume or fund management modules later for optimization.

Consider dynamically adjusting moving average parameters, selecting different parameters for different cycle; or introducing other indicators to judge, such as KDJ, MACD, etc., to form a comprehensive judgment based on multiple conditions.

It is also possible to establish a trading volume or capital management module to control the proportion of funds occupied by a single trade and reduce the impact of a single loss.

In general, this strategy uses RSI indicators and moving averages to determine buy timing and can effectively determine price reversals. Buying in oversold and locking in profits with stop loss and take profit can yield good results. For future optimizations, it is worth considering incorporating more Indicators or adding additional trading/fund management modules to make the strategy more robust.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | From Month |

| v_input_2 | true | From Day |

| v_input_3 | 2020 | From Year |

| v_input_4 | true | Thru Month |

| v_input_5 | true | Thru Day |

| v_input_6 | 2112 | Thru Year |

| v_input_7 | true | Show Date Range |

| v_input_8 | 9 | MA short period |

| v_input_9 | 14 | RSI period |

| v_input_10 | 1.5 | Long Stop Loss (%) |

| v_input_11 | 3 | Long Take Profit (%) |

Source (PineScript)

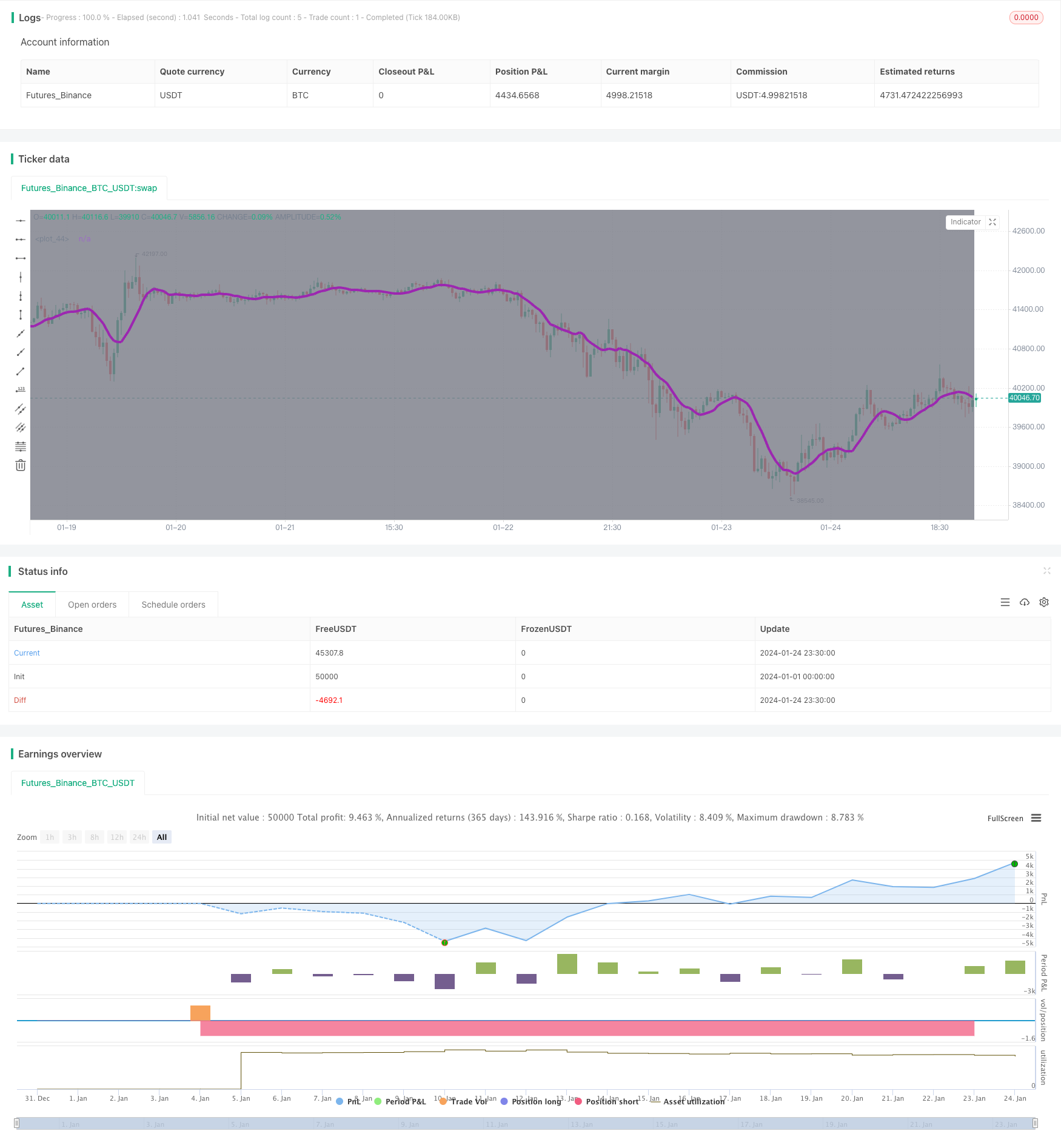

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 23:59:59

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

//@version=4

strategy(shorttitle='MARSI',title='Moving Average', overlay=true, initial_capital=1000, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

//Backtest dates

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2020, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

//MA inputs and calculations

inshort=input(9, title='MA short period')

MAshort= sma(close, inshort)

// RSI inputs and calculations

lengthRSI = input(14, title = 'RSI period', minval=1)

RSI = rsi(close, lengthRSI)

//Entry

strategy.entry(id="long", long = true, when = MAshort<close and RSI<40 and window())

//Exit

longLossPerc = input(title="Long Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=1.5) * 0.01

longTakePerc = input(title="Long Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=3) * 0.01

longSL = strategy.position_avg_price * (1 - longLossPerc)

longTP = strategy.position_avg_price * (1 + longTakePerc)

if (strategy.position_size > 0 and window())

strategy.exit(id="TP/SL", stop=longSL, limit=longTP)

bgcolor(color = showDate and window() ? color.gray : na, transp = 90)

plot(MAshort, color=color.purple, linewidth=4)

Detail

https://www.fmz.com/strategy/442119

Last Modified

2024-02-19 14:59:10