Name

基于动量回踩策略Momentum-Pullback-Strategy

Author

ChaoZhang

Strategy Description

此策略旨在识别市场中的潜在回踪机会。该策略采用双均线系统:长期移动平均线(MA1)和短期移动平均线(MA2)。主要目标是当收盘价低于MA1但高于MA2时,表明一个潜在的在大趋势中的回踪机会,从而进行做多。

该策略使用两条移动平均线:MA1(长线)和MA2(短线)。其原理是,如果短期价格出现回落,测试长期趋势的支撑,那么这可能是一个做多的机会。具体来说,如果收盘价高于长期支撑(MA1),说明大趋势依然不错;而如果收盘价跌破短期均线(MA2)却依然站稳在长期均线(MA1)之上,那么这是一个典型的回踩机会。这时候买入并设立止损,等待价格重新回到短线上方。

该策略具有以下优势:

- 实现简单,容易理解,参数调整灵活

- 借助双均线系统识别大趋势,避免逆势交易

- 可定制的时间过滤器,避免特定时间段的市场异常

- 可调整仓位大小,满足不同风险偏好

- 采用止损机制来限制亏损风险

该策略也存在以下风险:

- 回踩失败,价格继续下跌,无法止损

- 大趋势发生转折,原来支撑位被打破

- 市场出现剧烈波动,移动平均线发生背离

- 时间段选择不当,错过交易机会

对应地,可以从以下几个方面来优化和改进:

- 优化移动平均线参数,改进交易信号质量

- 优化止损水平,在最大限度减少风险的前提下获取利润

- 调整时间过滤器,定位到最佳交易时段

- 测试不同品种和市场环境

该策略可从以下几个方面进行优化:

- 优化移动平均线参数,寻找最佳参数组合

- 测试不同的止损机制,如追踪止损、振荡止损等

- 增加其他过滤器,如交易量过滤、波动率过滤等

- 增加仓位管理机制,如金叉加仓、死叉减仓

- 增加自动止盈机制

- 进行回测并计算关键指标,确定最佳参数

本策略总的来说是一个简单实用的短线拉回策略。它使用双均线识别回踩机会,并设立移动止损来控制风险。该策略容易理解和实现,参数调整灵活,可满足不同风险偏好。下一步,可以从优化移动平均线参数、止损机制、过滤器等多个角度进行改进,使策略更加稳健。

||

This strategy aims to identify potential pullback opportunities in the market. It employs a dual moving average system with a long-term moving average (MA1) and a short-term moving average (MA2). The key goal is to go long when the closing price is below MA1 but above MA2, signaling a potential pullback within the overall trend.

The strategy utilizes two moving averages: MA1 (longer-term) and MA2 (shorter-term). The logic is that if prices pull back briefly to test support of the longer-term trend, it may present a long opportunity. Specifically, if the closing price remains above the long-term support (MA1), the major trend remains intact. But if the closing price breaks below the short-term MA (MA2) yet still holds above the long-term MA (MA1), it signals a textbook pullback setup. One can go long here with a stop-loss and aim for prices to move back above the short MA.

The advantages of this strategy include:

- Simple to implement and easy to understand with flexible parameter tuning

- Leverages dual MAs to identify major trend and avoid counter-trend trades

- Customizable time filters to avoid abnormal periods

- Adjustable position sizing to suit different risk preferences

- Stop-loss mechanism to limit downside risk

The risks to be aware of:

- Failed pullback if prices continue to decline and stop-loss is hit

- Major trend reversal if key support area is broken

- Whipsaws and divergence with volatile price action

- Missing trades from sub-optimal time filters

Some ways to optimize and mitigate risks:

- Optimize MA parameters to improve signal quality

- Fine-tune stop-loss levels to maximize profit while minimizing risks

- Adjust time filters to focus on best trading periods

- Test across different instruments and market environments

Some ways to enhance the strategy:

- Optimize MA parameters to find best combinations

- Test different stop-loss mechanisms like trailing or chandelier stops

- Add additional filters like volume or volatility

- Incorporate position sizing rules like adding on golden crosses and reducing on death crosses

- Build in an automated profit-taking mechanism

- Backtest to analyze key metrics and finalize parameters

In summary, this is a straightforward mean reversion pullback strategy. It identifies pullback setups with the dual MA approach and manages risk with adaptive stops. The strategy is easy to grasp and implement with flexible tuning. Next steps are further optimizations around elements like MA parameters, stop-losses, filters to make the strategy more robust.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 200 | (?Strategy Parameters)MA 1 Length |

| v_input_int_2 | 10 | MA 2 Length |

| v_input_float_1 | 0.1 | Stop Loss Percent |

| v_input_bool_1 | false | Exit On Lower Close |

| v_input_1 | timestamp(01 Jan 1995 13:30 +0000) | (?Time Filter)Start Filter |

| v_input_2 | timestamp(1 Jan 2099 19:30 +0000) | End Filter |

Source (PineScript)

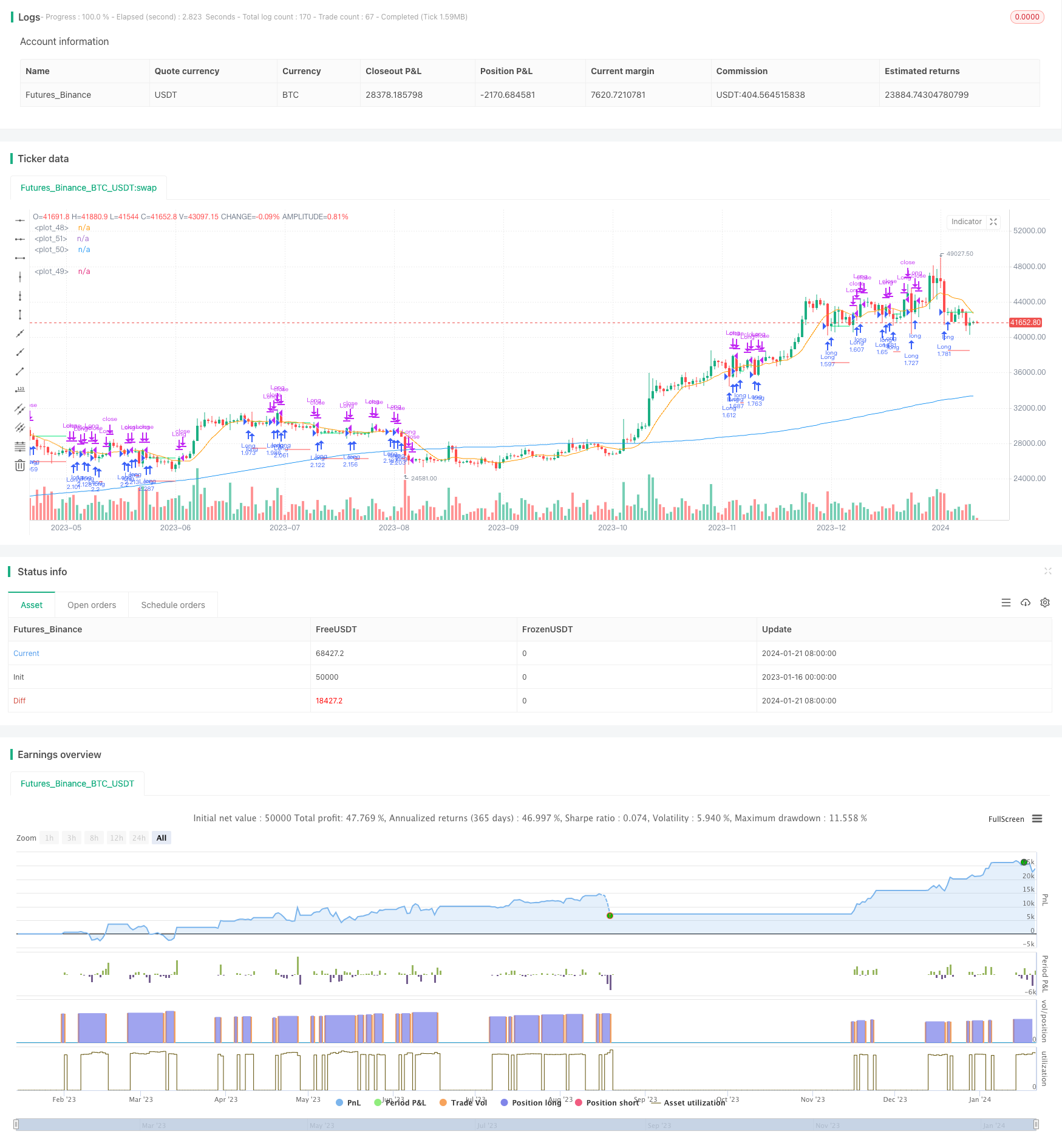

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ZenAndTheArtOfTrading / www.PineScriptMastery.com

// @version=5

strategy("Simple Pullback Strategy",

overlay=true,

initial_capital=50000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100, // 100% of balance invested on each trade

commission_type=strategy.commission.cash_per_contract,

commission_value=0.005) // Interactive Brokers rate

// Get user input

i_ma1 = input.int(title="MA 1 Length", defval=200, step=10, group="Strategy Parameters", tooltip="Long-term MA")

i_ma2 = input.int(title="MA 2 Length", defval=10, step=10, group="Strategy Parameters", tooltip="Short-term MA")

i_stopPercent = input.float(title="Stop Loss Percent", defval=0.10, step=0.1, group="Strategy Parameters", tooltip="Failsafe Stop Loss Percent Decline")

i_lowerClose = input.bool(title="Exit On Lower Close", defval=false, group="Strategy Parameters", tooltip="Wait for a lower-close before exiting above MA2")

i_startTime = input(title="Start Filter", defval=timestamp("01 Jan 1995 13:30 +0000"), group="Time Filter", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="End Filter", defval=timestamp("1 Jan 2099 19:30 +0000"), group="Time Filter", tooltip="End date & time to stop searching for setups")

// Get indicator values

ma1 = ta.sma(close, i_ma1)

ma2 = ta.sma(close, i_ma2)

// Check filter(s)

f_dateFilter =true

// Check buy/sell conditions

var float buyPrice = 0

buyCondition = close > ma1 and close < ma2 and strategy.position_size == 0 and f_dateFilter

sellCondition = close > ma2 and strategy.position_size > 0 and (not i_lowerClose or close < low[1])

stopDistance = strategy.position_size > 0 ? ((buyPrice - close) / close) : na

stopPrice = strategy.position_size > 0 ? buyPrice - (buyPrice * i_stopPercent) : na

stopCondition = strategy.position_size > 0 and stopDistance > i_stopPercent

// Enter positions

if buyCondition

strategy.entry(id="Long", direction=strategy.long)

if buyCondition[1]

buyPrice := open

// Exit positions

if sellCondition or stopCondition

strategy.close(id="Long", comment="Exit" + (stopCondition ? "SL=true" : ""))

buyPrice := na

// Draw pretty colors

plot(buyPrice, color=color.lime, style=plot.style_linebr)

plot(stopPrice, color=color.red, style=plot.style_linebr, offset=-1)

plot(ma1, color=color.blue)

plot(ma2, color=color.orange)

Detail

https://www.fmz.com/strategy/439757

Last Modified

2024-01-23 15:23:14