Name

均线交叉跳空策略Moving-Average-Crossover-Breakout-Strategy

Author

ChaoZhang

Strategy Description

均线交叉跳空策略是一个利用均线交叉信号进行进入和退出的短线策略。该策略使用12周期和21周期的简单移动平均线构建交易信号。当12周期线从下方穿过21周期线时产生买入信号;当12周期线从上方穿过21周期线时产生卖出信号。本策略适用于高波动性市场的短线交易。

均线交叉跳空策略使用12周期和21周期两条移动平均线。这两条移动平均线能够有效地描绘市场短期趋势。当短期均线从下方穿过长期均线时,表示市场步入上涨行情;当短期均线从上方穿过长期均线时,表示市场步入下跌行情。策略在均线发生黄金交叉时做多,在死亡交叉时做空,通过捕捉短期趋势的转折来获利。

具体来说,该策略首先计算并绘制12周期和21周期的简单移动平均线。然后通过ta.crossover和ta.crossunder判断均线是否发生交叉。当12周期线从下方向上穿过21周期线时,表明市场行情由下跌转为上涨,这时策略会开一个做多单;当12周期线从上方向下穿过21周期线时,表明市场行情由上涨转为下跌,这时策略会开一个做空单。

通过这个方法,策略能够快速地捕捉短期趋势的转折点,在价格发生反转之前进入场内,并跟随趋势进行交易。当趋势再次反转时,则通过均线的再次交叉退出仓位。

均线交叉跳空策略具有如下优势:

-

操作简单,容易实施。该策略仅仅依靠均线交叉这一个指标就可以进行交易,非常简单。

-

系统性强,不受主观影响。策略完全依赖指定参数的均线交叉信号进行交易,不受人为情绪的影响。

-

响应迅速,捕捉短期趋势。通过比较短周期的均线,能够快速捕捉价格反转,抓住短期行情。

-

无需选股和深入研究。策略可以适用于各类股票和品种的短期交易,无需花费大量时间选股。

尽管均线交叉跳空策略有诸多优势,但也存在一些风险需要关注:

-

易受假突破影响。均线出现交叉不一定代表真正的趋势反转,有可能是短期的假突破。这会导致不必要的亏损。

-

未考虑仓位管理。本策略没有设置仓位管理规则,容易因为趋势行情而过度交易。

-

没有止损措施。极端行情下,没有止损会造成巨额亏损。

-

参数优化空间有限。移动平均线周期并不是唯一最佳的参数组合,参数调整空间有限。

针对以上风险,可以从以下几个方面进行优化:

-

加入成交量指标过滤假突破。

-

设置仓位和资金管理规则,避免过度交易。

-

加入移动止损或波动止损。

-

测试不同的参数组合,寻找最佳参数。

为减少误交易频率,可以考虑加入其他指标进行辅助过滤,例如MACD、RSI等指标发出同步信号时才入场。

为控制单笔亏损,可以设置移动止损或者波动止损。当价格向不利方向发生一定幅度移动时止损退出。

为使策略参数更具普适性,可以对主要参数如均线周期、仓位大小等进行优化,找到最优的参数组合。

此外,本策略还可以考虑加入自适应交易机制,当市场趋势性很强时,采用趋势跟踪机制,延长持仓时间;当市场进入盘整,波动加大时,缩短持仓周期,及时止损。

本策略整体来说非常适合短期捕捉市场的反转行情。仅仅使用两个均线的参数就构建了交易信号,简单易操作。同时快速响应价格变化,捕捉短期趋势。但存在一定的误交易风险和单边行情下的超量交易风险。通过加入辅助技术指标过滤信号、设置止损规则、优化参数组合等手段,可以有效改进该策略,使其成为非常实用的短线捕捉策略。

||

The moving average crossover breakout strategy is a short-term strategy that utilizes moving average crossover signals to enter and exit trades. This strategy constructs trading signals using the 12-period and 21-period simple moving averages. When the 12-period line crosses above the 21-period line, a buy signal is generated. When the 12-period line crosses below the 21-period line, a sell signal is generated. This strategy is suitable for short-term trading in high volatility markets.

The moving average crossover breakout strategy employs two moving averages, the 12-period and 21-period lines. These two moving averages can effectively depict short-term market trends. When the shorter term moving average crosses above the longer term line, it indicates the market is entering an uptrend. When the shorter term line crosses below the longer term line, it signals the start of a downtrend. The strategy goes long when a golden cross happens and goes short when a death cross happens, profiting by capturing turns in short-term trends.

Specifically, the strategy first calculates and plots the 12-period and 21-period simple moving averages. It then uses ta.crossover and ta.crossunder to determine if a crossover happens. When the 12-period line crosses above the 21-period line, it signals the market trend has changed from down to up. The strategy will then open a long position. When the 12-period line crosses below the 21-period line, the market has changed from an uptrend to a downtrend. The strategy will open a short position.

Through this method, the strategy can quickly capture reversal points in short-term trends, entering the market before prices reverse, and trading along the trend. When the trend reverses again, the strategy exits its position after another moving average crossover.

The moving average crossover breakout strategy has the following advantages:

-

Simple to implement. The strategy relies solely on moving average crossovers for trading signals, which is very straightforward.

-

Systematic with low subjective influence. Strategy signals are completely based on specified parameter moving average crosses, not emotions.

-

Quick response to capture short-term trends. The use of faster moving averages can swiftly capture trend reversals and capitalize on short-term moves.

-

No need for stock picking or in-depth research. The strategy can be applied for short-term trading on all kinds of stocks and products without spending lots of time picking stocks.

Although the moving average crossover breakout strategy has many advantages, there are still some risks to consider:

-

Susceptible to false breakouts. Moving average crossovers don't necessarily represent real trend reversals. False breakouts can cause unnecessary losses.

-

No position sizing rules. The strategy does not have rules around position sizing which can lead to overtrading in trending markets.

-

No stop loss in place. Not having stops can lead to huge losses in extreme market conditions.

-

Limited optimization space. Moving average periods are not the only optimal parameter setting. Parameter tuning space is constrained.

Some ways to address the above risks are:

-

Add volume indicators to filter out false breakouts.

-

Implement position sizing and capital management rules to prevent overtrading.

-

Add moving or volatility stops.

-

Test different parameter combinations to find optimal parameters.

To reduce false signals, consider adding other indicators like MACD and RSI to provide additional signal confirmation before entering trades.

To control single trade loss, set up moving or volatility stops. When prices move a certain amount against the position, the stops will trigger trade exits.

To make strategy parameters more robust, optimize key inputs like moving average periods and position sizing to find the best performing combinations.

In addition, the strategy can also incorporate adaptive trading mechanisms. Use trend following techniques and longer holding periods when the market trends strongly. Revert to shorter holding times and timely stop losses when markets oscillate and volatility rises.

Overall this is an excellent strategy for short-term trend reversals. It uses just two moving averages to construct simple and fast trading signals that respond swiftly to price changes and capture shorter-term moves. However, there are risks around mistrades and overtrading in persistent trending markets. By adding filters, stops, robust parameters, and adaptive mechanisms, the strategy can be significantly enhanced to become a very practical tool for short-term breakout trading.

[/trans]

Source (PineScript)

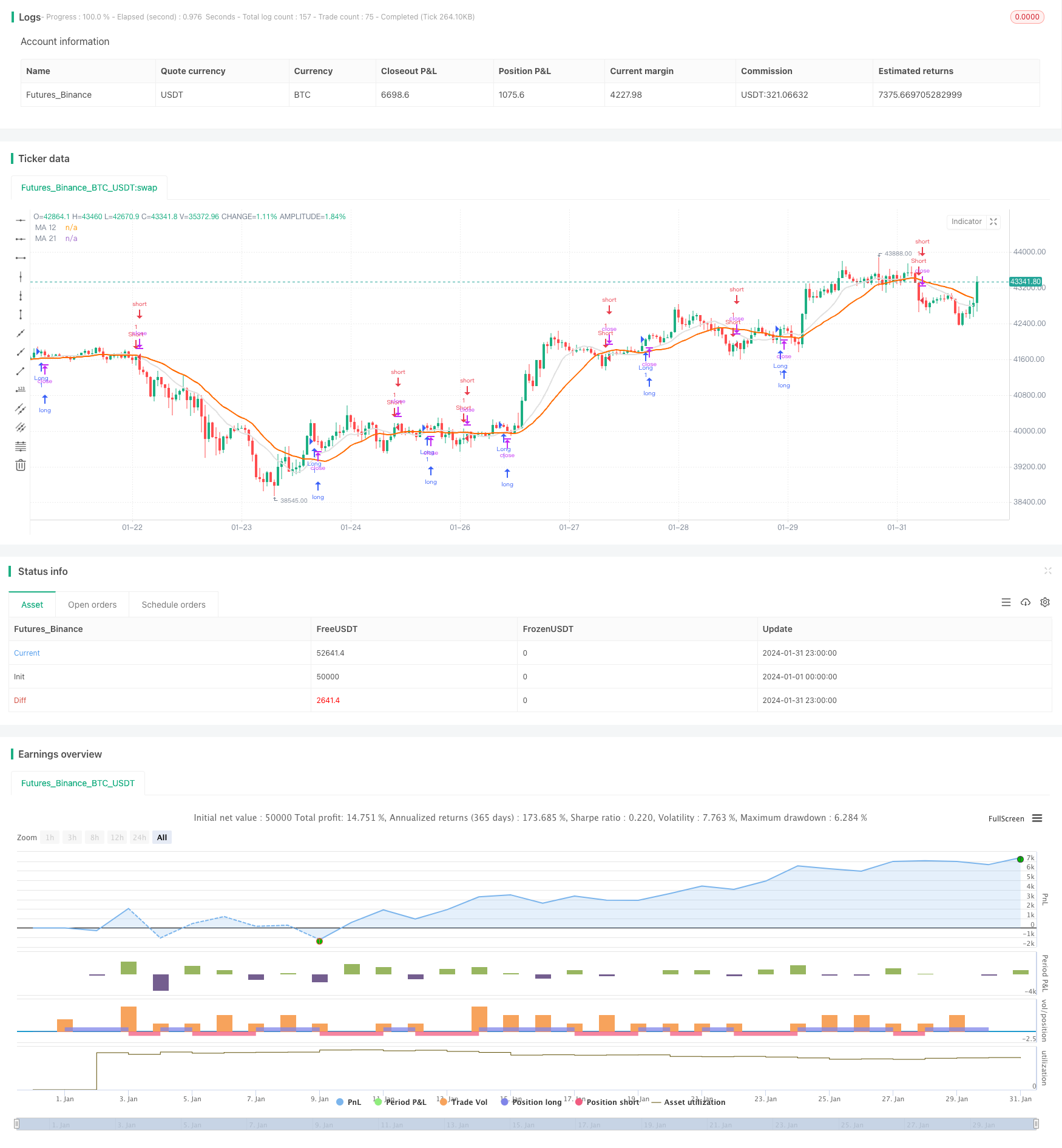

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rodrigofveras

//@version=5

strategy("BOT Bitget 12/21", overlay=true)

// Variáveis para armazenar as médias móveis

ma12 = ta.sma(close, 12)

ma21 = ta.sma(close, 21)

// Adicionar média móvel de 12 períodos ao gráfico

plot(ma12, color=color.rgb(224, 224, 224), linewidth=2, title="MA 12")

// Adicionar média móvel de 21 períodos ao gráfico

plot(ma21, color=color.rgb(255, 106, 0), linewidth=2, title="MA 21")

// Variáveis para armazenar o estado da estratégia

isLong = false

isShort = false

// Verifica se a média móvel de 12 períodos está cruzando acima da média móvel de 21 períodos

if ta.crossover(ma12, ma21)

// Entra em uma posição longa

isLong := true

isShort := false

strategy.entry("Long", strategy.long)

// Verifica se a média móvel de 12 períodos está cruzando abaixo da média móvel de 21 períodos

if ta.crossunder(ma12, ma21)

// Entra em uma posição curta

isLong := false

isShort := true

strategy.entry("Short", strategy.short)

Detail

https://www.fmz.com/strategy/442532

Last Modified

2024-02-22 16:11:42