Name

双MA交叉趋势追踪策略Dual-MA-Crossover-Trend-Tracking-Strategy

Author

ChaoZhang

Strategy Description

本策略采用双均线交叉的典型趋势追踪方法,同时结合止损、止盈、追踪止损等风险管理机制,旨在捕捉趋势行情带来的较大利润。

- 计算快速期间n天的EMA均线,作为短期均线;

- 计算慢速期间m天的EMA均线,作为长期均线;

- 当短期均线从下向上突破长期均线时,做多;当从上向下突破时,做空;

- 平仓条件:反向突破(如做多突破时,反向突破则平仓)。

- 采用止损、止盈、追踪止损等方式管理风险。

- 采用双EMA均线,能较好地判断价格趋势转折点,捕捉趋势行情。

- 结合止损、止盈和追踪止损,可以有效控制单笔损失,锁定盈利,降低回撤。

- 可自定义的参数较多,可以根据不同品种和行情环境进行调整优化。

- 策略逻辑简单清晰,易于理解和修改。

- 支持做多做空操作,可以适应不同类型的行情。

- 双均线策略对假突破非常敏感,容易被套住。

- 参数设置不当可能导致交易频繁,增加交易成本和滑点损失。

- 策略本身无法确定趋势转折点,需要结合其他指标判断效果更佳。

- 震荡行情中容易产生交易信号,但实际盈利能力较差。

- 需要优化参数以适应不同品种和行情环境。

可以通过以下方式降低风险:

- 结合其他指标过滤假突破。

- 优化参数设置,降低交易频率。

- 增加趋势判断指标,避免震荡行情交易。

- 调整仓位管理,降低单笔风险。

本策略可以从以下几个方面进行优化:

- 优化快慢均线的周期参数,适应不同品种和行情环境。

- 增加其他指标判断趋势和过滤假突破信号。典型的可以加入MACD、KDJ等。

- 可以考虑将EMA改为SMA或加权移动平均线WMA。

- 基于ATR动态调整止损距离。

- 基于仓位管理方式,可以灵活调整单笔仓位。

- 基于相关性和波动率指标的组合,进行参数自适应优化。

本策略整体来说是一个典型的双EMA均线趋势跟踪策略。具有捕捉趋势行情的优势,同时结合了止损、止盈、追踪止损等风险管理手段。但也存在一些典型的问题,如对噪音和震荡行情的敏感性较高,容易被套住。通过引入其他辅助指标、参数优化、动态调整以及组合运用,可以进一步增强该策略的效果。总的来说,如果参数设置得当,与品种行情契合,本策略可以获得不错的效果。

||

This strategy adopts the typical trend tracking method of dual moving average crossover, combined with risk management mechanisms such as stop loss, take profit, and trailing stop loss, aiming to capture large profits from trending markets.

- Calculate the n-day EMA as the fast line for short term;

- Calculate the m-day EMA as the slow line for long term;

- Go long when the fast line breaks through the slow line upwards, and go short when breaks downwards;

- Exit signal: reverse crossover (e.g. exit long when long crossover occurs).

- Use stop loss, take profit, trailing stop loss to manage risks.

- Adopting dual EMA lines can better determine price trend reversal points and capture trending moves.

- Combining stop loss, take profit and trailing stop helps limit single trade loss, lock in profits and reduce drawdown.

- There are many customizable parameters to adjust and optimize for different products and market environments.

- The strategy logic is simple and clear, easy to understand and modify.

- Support both long and short operations, adaptable to different market conditions.

- Dual MA strategies are very sensitive to false breakouts and prone to being trapped.

- Improper parameter settings may lead to frequent trading, increasing trading costs and slippage losses.

- The strategy itself cannot determine trend reversal points, needs to be combined with other indicators.

- It’s easy to generate trading signals in ranging markets, but actual profitability tends to be low.

- Parameters need to be optimized for different products and market environments.

Risks can be reduced by:

- Filtering false signals with other indicators.

- Optimizing parameters to lower trading frequency.

- Adding trend-judging indicators to avoid range-bound market trades.

- Adjusting position sizing to lower single trade risks.

The strategy can be optimized in the following aspects:

- Optimize fast and slow MA periods for different products and markets.

- Add other indicators to determine trends and filter false signals, e.g MACD, KDJ etc.

- Consider replacing EMA with SMA or WMA.

- Dynamically adjust stop loss based on ATR.

- Flexibly adjust single position sizes based on position sizing methodology.

- Parameter self-adaptive optimization based on correlation and volatility metrics.

In summary, this is a typical dual EMA crossover trend tracking strategy. It has the advantage of capturing trending moves, integrated with risk management mechanisms like stop loss, take profit and trailing stop loss. But it also has some typical weaknesses, like high sensitivity toward noise and range-bound markets, prone to being trapped. Further improvements can be made by introducing additional indicators, parameters optimization, dynamic adjustments and portfolio usage to enhance the strategy's performance. Overall speaking, with proper parameter tuning and good fitness with product and market conditions, this strategy can achieve decent results.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_open | 0 | Fast MA Source: open |

| v_input_2 | 14 | Fast MA Period |

| v_input_3_open | 0 | Slow MA Source: open |

| v_input_4 | 21 | Slow MA Period |

| v_input_5 | false | Invert Trade Direction? |

| v_input_6 | 1000 | Take Profit |

| v_input_7 | 200 | Stop Loss |

| v_input_8 | 200 | Trailing Stop Loss |

| v_input_9 | false | Trailing Stop Loss Offset |

Source (PineScript)

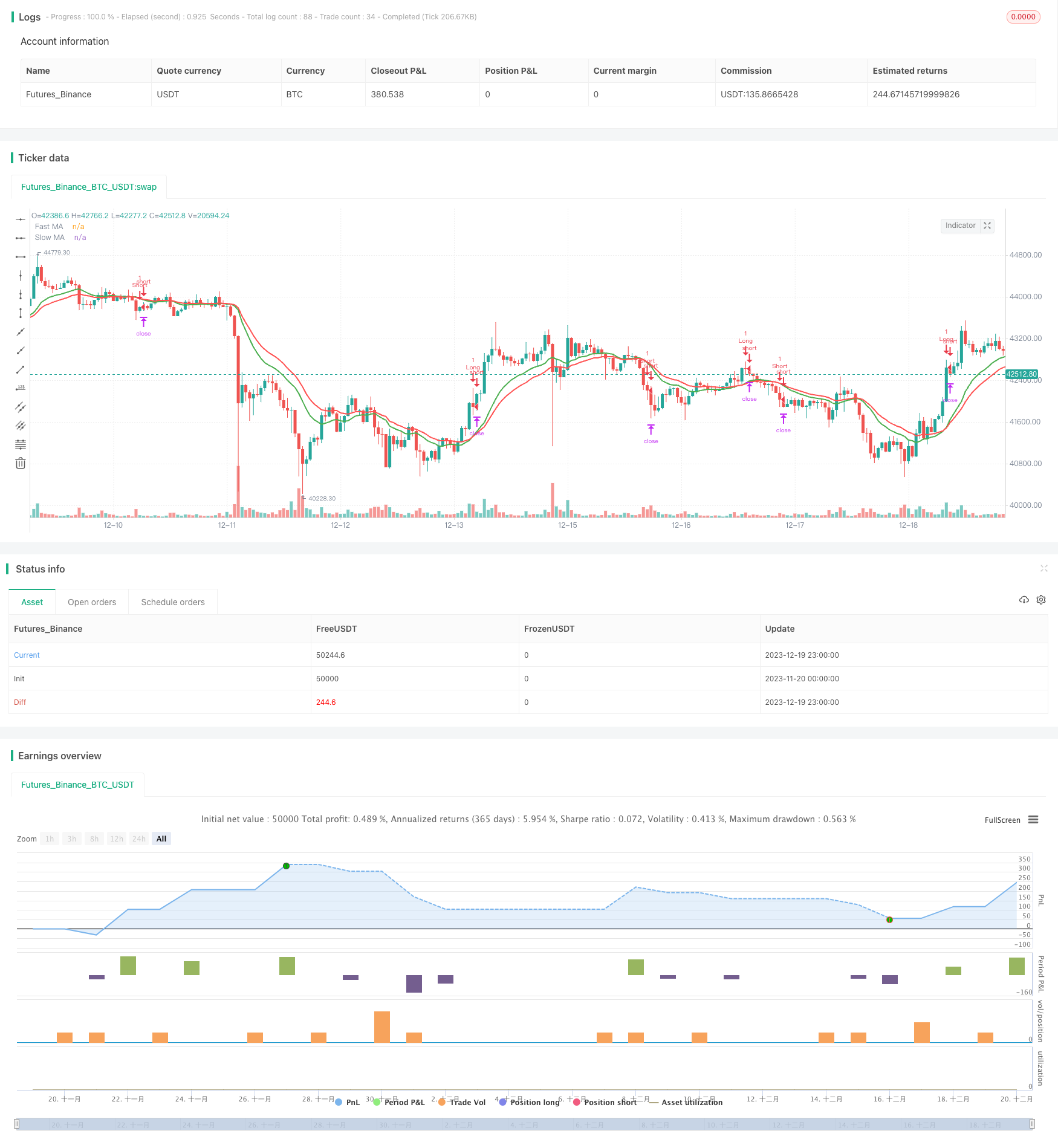

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "Strategy Code Example", shorttitle = "Strategy Code Example", overlay = true)

// Revision: 1

// Author: @JayRogers

//

// *** THIS IS JUST AN EXAMPLE OF STRATEGY RISK MANAGEMENT CODE IMPLEMENTATION ***

// === GENERAL INPUTS ===

// short ma

maFastSource = input(defval = open, title = "Fast MA Source")

maFastLength = input(defval = 14, title = "Fast MA Period", minval = 1)

// long ma

maSlowSource = input(defval = open, title = "Slow MA Source")

maSlowLength = input(defval = 21, title = "Slow MA Period", minval = 1)

// === STRATEGY RELATED INPUTS ===

tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval = 1000, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 200, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 200, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === SERIES SETUP ===

/// a couple of ma's..

maFast = ema(maFastSource, maFastLength)

maSlow = ema(maSlowSource, maSlowLength)

// === PLOTTING ===

fast = plot(maFast, title = "Fast MA", color = green, linewidth = 2, style = line, transp = 50)

slow = plot(maSlow, title = "Slow MA", color = red, linewidth = 2, style = line, transp = 50)

// === LOGIC ===

// is fast ma above slow ma?

aboveBelow = maFast >= maSlow ? true : false

// are we inverting our trade direction?

tradeDirection = tradeInvert ? aboveBelow ? false : true : aboveBelow ? true : false

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => not tradeDirection[1] and tradeDirection // functions can be used to wrap up and work out complex conditions

exitLong() => tradeDirection[1] and not tradeDirection

strategy.entry(id = "Long", long = true, when = enterLong()) // use function or simple condition to decide when to get in

strategy.close(id = "Long", when = exitLong()) // ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() => tradeDirection[1] and not tradeDirection

exitShort() => not tradeDirection[1] and tradeDirection

strategy.entry(id = "Short", long = false, when = enterShort())

strategy.close(id = "Short", when = exitShort())

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

Detail

https://www.fmz.com/strategy/436145

Last Modified

2023-12-21 16:10:22