Name

双边突破K线波动通道策略Dual-Breakout-Volatility-Channel-Strategy

Author

ChaoZhang

Strategy Description

双边突破K线波动通道策略通过计算通道中轨、上轨和下轨,结合趋向指标和量价指标判断行情方向和力度,在通道两边同时设置突破信号,实现低买高卖的主要目的。

该策略的核心指标是基于统计学的K线波动通道。通道中轨采用平均线算法,上下轨采用平均真实波幅的计算方法,能动态捕捉价格波动的边界。与此同时,策略加入DMI和交易量的判断规则,避免虚假突破带来损失。

具体来说,当价格从下轨突破进入通道,DMI的+DI线超过-DI线和设定的ADX基准线,且成交量放大时产生买入信号。反之,价格从上轨往下突破通道时,判断规则与上述相反,产生卖出信号。

该策略最大的优势是捕捉价格的主要突破方向,采用双边突破判断可以有效避开盘整和震荡的行情,减小止损次数。与简单移动平均线策略相比,K线通道突破判断对价格波动的适应性更强。

此外,辅助指标DMI和成交量的引入也起到良好的过滤作用,避免出现虚假信号。所以从胜率和盈亏比角度来看,该策略都有一定的优势。

双边突破策略最大的风险在于无法判断行情反转,如果行情出现V型反转,止损点有可能会被轻易触发。此外,参数设置不当也会对交易系统产生负面影响。

针对风险,我们可以通过进一步优化指标参数,缩小止损幅度来降低风险。当然,交易系统永远不可能完全避免亏损,关键是要控制风险。

该策略还具有很强的优化潜力,主要可以从以下几个方面进行改进:

-

优化参数,如DMI的DI和ADX长度、K线通道的周期和倍数设置等参数细调

-

增加过滤条件,如结合MACD等其他指标避免虚假突破

-

实现止盈止损自动跟踪,从而进一步控制风险

-

针对不同品种参数设置和过滤规则进行优化

双边突破K线波动通道策略总的来说是一种行之有效的突破系统。它能有效判断主要趋势方向和力度,在优化和风险控制方面也有很大的潜力。如果系统性地进行改进与优化,该策略可以长期稳定盈利。

||

The dual breakout volatility channel strategy calculates the middle, upper and lower bands of the channel and uses trend and volume indicators to determine market direction and momentum. It sets breakout signals on both sides of the channel to achieve the goal of buying low and selling high.

The core indicator of this strategy is the statistically-based volatility channel of candlestick lines. The middle band adopts the moving average algorithm and the upper and lower bands adopt the average true range method to dynamically capture the boundaries of price fluctuations. At the same time, the strategy incorporates DMI and volume criteria to avoid false breakouts.

Specifically, when the price breaks out of the lower rail into the channel, the +DI line of the DMI exceeds the -DI line and the set ADX benchmark, and the trading volume increases, a buy signal is generated. Conversely, when the price breaks through the channel downward from the upper rail, the judgment rules are opposite to the above, generating a sell signal.

The biggest advantage of this strategy is capturing the major breakthrough direction of prices. The dual breakout judgment can effectively avoid sideways and shock markets and reduce the number of stop losses. Compared with simple moving average strategies, the volatility channel breakout judgment is more adaptive to price fluctuations.

In addition, the introduction of auxiliary indicators DMI and volume also plays a good filtering role, avoiding false signals. So from the win rate and profit-loss ratio point of view, the strategy has some advantages.

The biggest risk of the dual breakout strategy is that it cannot judge market reversals. If a V-shaped reversal occurs in the market, the stop loss point may be easily triggered. In addition, improper parameter settings can also negatively impact the trading system.

To address the risks, we can further optimize parameter settings and narrow down stop losses to reduce risks. Of course, trading systems can never completely avoid losses, the key is to control risks.

The strategy also has great potential for optimization, which can be improved in the following aspects:

-

Parameter optimization, such as fine tuning of DMI’s DI and ADX lengths, period and multiplier settings of volatility channels, etc.

-

Increase filtering conditions, such as combining MACD and other indicators to avoid false breakouts

-

Implement automatic tracking of take profit and stop loss to further control risks

-

Optimize parameter settings and filtering rules for different products

In general, the dual breakout volatility channel strategy is an effective breakout system. It can effectively determine the main trend direction and momentum, and has great potential in optimization and risk control. If improved and optimized systematically, the strategy can profit steadily in the long run.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 46 | Period |

| v_input_1 | true | useTrueRange |

| v_input_int_2 | 81 | length |

| v_input_float_1 | 2.5 | mult |

| v_input_2 | 19 | DI Length |

| v_input_int_3 | 27 | DMI Benchmark |

| v_input_3 | 2019 | Backtest Start Year |

| v_input_4 | true | Backtest Start Month |

| v_input_5 | true | Backtest Start Day |

| v_input_6 | 9999 | Backtest Stop Year |

| v_input_7 | 12 | Backtest Stop Month |

| v_input_8 | 31 | Backtest Stop Day |

| v_input_float_2 | 4.5 | Long Take Profit 1 % |

| v_input_int_4 | 15 | Long Take Profit 1 Qty |

| v_input_float_3 | 20 | Long Take Profit 2% |

| v_input_int_5 | 100 | Long Take Profit 2 Qty |

| v_input_float_4 | 4 | Long Stop Loss % |

Source (PineScript)

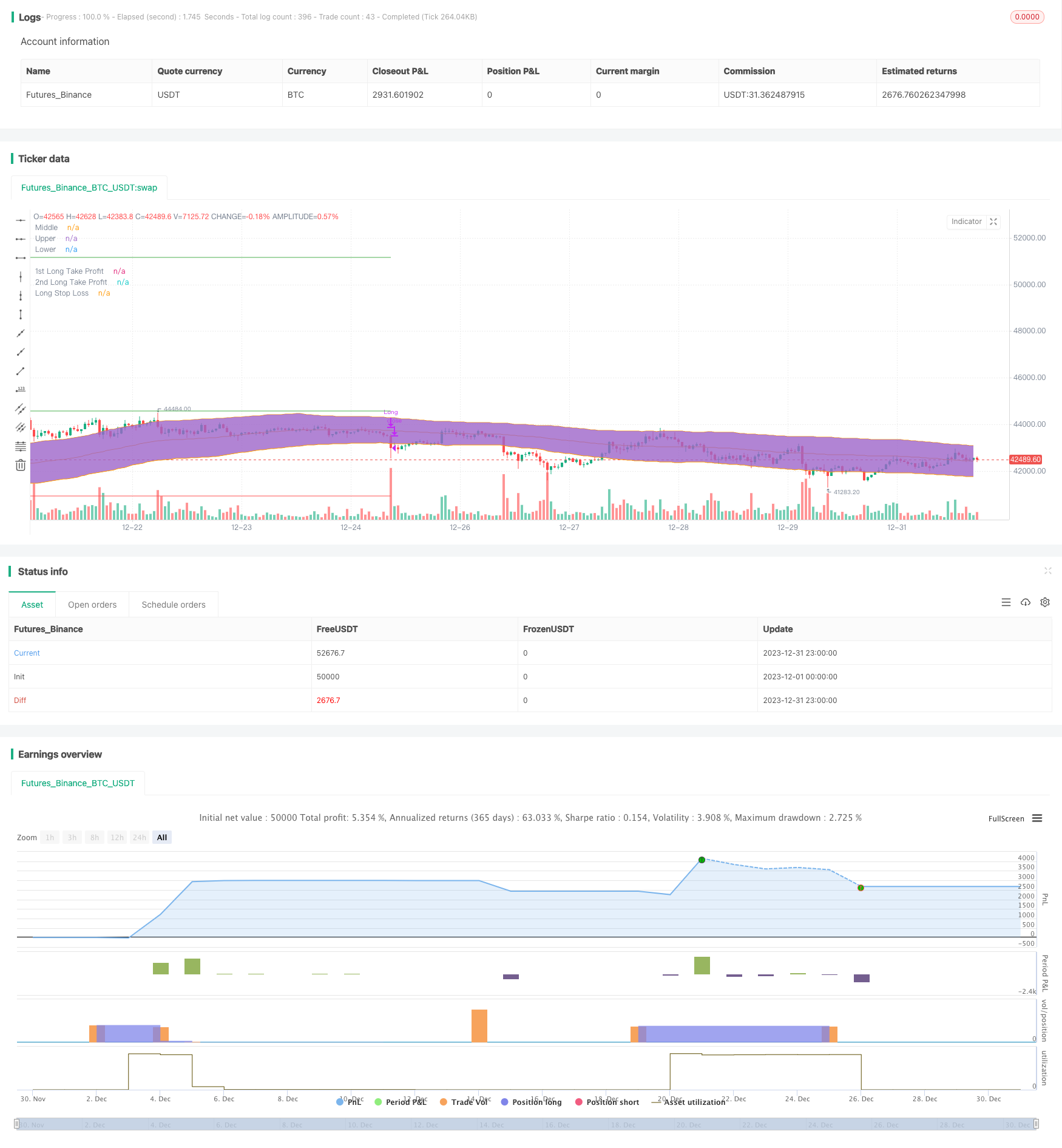

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Original Idea by: Wunderbit Trading

//@version=5

strategy('Keltner Channel ETH/USDT 1H', overlay=true, initial_capital=1000, pyramiding=0, currency='USD', default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.07)

/// TREND

ribbon_period = input.int(46, 'Period', step=1)

leadLine1 = ta.ema(close, ribbon_period)

leadLine2 = ta.sma(close, ribbon_period)

// p3 = plot(leadLine1, color= #53b987, title="EMA", transp = 50, linewidth = 1)

// p4 = plot(leadLine2, color= #eb4d5c, title="SMA", transp = 50, linewidth = 1)

// fill(p3, p4, transp = 60, color = leadLine1 > leadLine2 ? #53b987 : #eb4d5c)

//Upward Trend

UT = leadLine2 < leadLine1

DT = leadLine2 > leadLine1

///////////////////////////////////////INDICATORS

// KELTNER //

source = close

useTrueRange = input(true)

length = input.int(81, step=1, minval=1)

mult = input.float(2.5, step=0.1)

// Calculate Keltner Channel

ma = ta.sma(source, length)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.sma(range_1, length)

upper = ma + rangema * mult

lower = ma - rangema * mult

plot(ma, title='Middle', color=color.new(color.orange, 0))

p1 = plot(upper, title='Upper', color=color.new(color.orange, 0))

p2 = plot(lower, title='Lower', color=color.new(color.orange, 0))

fill(p1, p2, transp=90)

// DMI INDICATOR //

adxlen = 10 // input(10, title="ADX Smoothing")

dilen = input(19, title='DI Length')

keyLevel = 23 // input(23, title="key level for ADX")

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(up > down and up > 0 ? up : 0, len) / truerange)

minus = fixnan(100 * ta.rma(down > up and down > 0 ? down : 0, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

[adx, plus, minus]

[sig, up, down] = adx(dilen, adxlen)

benchmark = input.int(title='DMI Benchmark', defval=27, minval=1, step=1)

// plot(sig, color=color.red, title="ADX")

// plot(up, style=plot.style_histogram, color=color.green, title="+DI")

// plot(down, style=plot.style_histogram, color=color.red, title="-DI")

// plot(keyLevel, color=color.white, title="Key Level")

///////////////////////////////////////////////////////////

////////////////////////////////////////////////////Component Code Start

testStartYear = input(2019, 'Backtest Start Year')

testStartMonth = input(1, 'Backtest Start Month')

testStartDay = input(1, 'Backtest Start Day')

testPeriodStart = timestamp(testStartYear, testStartMonth, testStartDay, 0, 0)

testStopYear = input(9999, 'Backtest Stop Year')

testStopMonth = input(12, 'Backtest Stop Month')

testStopDay = input(31, 'Backtest Stop Day')

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, 0, 0)

testPeriod() => true

///// Component Code Stop //////////////////////////////////////////

//////////////// STRATEGY EXECUTION //////////////////////////

//LONG SET UP

// Take Profit / Stop Loss

long_tp1_inp = input.float(4.5, title='Long Take Profit 1 %', step=0.1) / 100

long_tp1_qty = input.int(15, title='Long Take Profit 1 Qty', step=1)

long_tp2_inp = input.float(20, title='Long Take Profit 2%', step=0.1) / 100

long_tp2_qty = input.int(100, title='Long Take Profit 2 Qty', step=1)

long_take_level_1 = strategy.position_avg_price * (1 + long_tp1_inp)

long_take_level_2 = strategy.position_avg_price * (1 + long_tp2_inp)

long_sl_inp = input.float(4, title='Long Stop Loss %', step=0.1) / 100

long_stop_level = strategy.position_avg_price * (1 - long_sl_inp)

// STRATEGY CONDITION

// LONG

entry_long = open > lower and open < upper and close > upper and up > down and up > benchmark // and volume[0] > volume[1]

entry_price_long = ta.valuewhen(entry_long, close, 0)

SL_long = entry_price_long * (1 - long_sl_inp)

exit_long = close < lower or low < SL_long

// STRATEGY EXECUTION

if testPeriod()

// LONG

if UT

strategy.entry(id='Long', direction=strategy.long, when=entry_long, comment='INSERT ENTER LONG COMMAND')

strategy.exit('TP1', 'Long', qty_percent=long_tp1_qty, limit=long_take_level_1) // PLACE TAKE PROFIT IN WBT BOT SETTINGS

strategy.exit('TP2', 'Long', qty_percent=long_tp2_qty, limit=long_take_level_2) // PLACE TAKE PROFIT IN WBT BOT SETTINGS

strategy.close(id='Long', when=exit_long, comment='INSERT EXIT LONG COMMAND')

//PLOT FIXED SLTP LINE

// LONG POSITION

plot(strategy.position_size > 0 ? long_take_level_1 : na, style=plot.style_linebr, color=color.new(color.green, 0), linewidth=1, title='1st Long Take Profit')

plot(strategy.position_size > 0 ? long_take_level_2 : na, style=plot.style_linebr, color=color.new(color.green, 0), linewidth=1, title='2nd Long Take Profit')

plot(strategy.position_size > 0 ? long_stop_level : na, style=plot.style_linebr, color=color.new(color.red, 0), linewidth=1, title='Long Stop Loss')

Detail

https://www.fmz.com/strategy/440502

Last Modified

2024-01-31 10:24:00