Name

双移动平均线与Williams平均线组合策略Dual-Moving-Average-and-Williams-Average-Combination-Strategy

Author

ChaoZhang

Strategy Description

本策略通过组合双指数移动平均线和三条Williams平均线,形成一个综合的趋势跟踪和趋势反转信号产生系统。它具有优异的持仓效率,可以有效过滤假信号。

本策略主要由两个子策略组成:

-

双指数移动平均线(Double Exponential Moving Average,DEMA)。该指标结合了单指数移动平均线的趋势跟踪性能,以及双指数移动平均线的滞后性。当价格上涨时,它可以更快地做多;当价格下跌时,它也可以更快地平仓。

-

Williams三条平均线。该指标由长线、中线和短线组成。它利用不同周期平均线的交叉来判断趋势的变化,以产生交易信号。当短线上穿中线和中线上穿长线时为做多信号。当短线下穿中线和中线下穿长线时为做空信号。

本策略的交易信号是将上述两个子策略的结果进行“与”运算。也就是说,只有当两个子策略同时发出信号时,本策略才会出发订单。这可以有效地减少假信号,提高持仓的稳定性。

本策略最大的优势在于可以有效地过滤假信号,这是由其策略结构所决定的。虽然双移动平均线和Williams平均线各有其缺点,但把两者组合在一起,就可以发挥各自的优势,互相补偿。这使得本策略可以在趋势行情中实现高效的持仓,而在盘整行情中可以及时止损。

此外,本策略参数优化空间大,可以通过调整双移动平均线的参数和Williams三条平均线的参数,来适应不同品种和周期的行情特点,具有较强的适应性。

本策略的主要风险在于当行情陷入剧烈波动时,止损点可能会被突破,造成较大的亏损。这是移动平均线策略普遍存在的问题。此外,在震荡行情中,本策略可能会频繁开仓平仓,增加交易费用的损耗。

为了控制这些风险,建议优化参数时采用Walk Forward Analysis方法,并设置合理的止损点。同时,也可以引入附加指标判断行情状态,在震荡行情中暂停交易。

本策略有以下几个优化方向:

-

调整双移动平均线的参数,适应不同品种和周期。

-

调整Williams平均线的三条线周期,适应市场波动频率。

-

增加开仓条件,在特定行情阶段过滤交易信号。例如在剧烈波动中不交易。

-

增加止损指标以控制亏损。可以试验追踪止损、平均止损等方法。

-

引入机器学习算法自动优化参数。

本策略通过组合双移动平均线和Williams平均线的优势,实现了交易信号的有效过滤,可以减少假信号,提高持仓效率。它可根据市场行情通过参数优化获得更好的绩效,具有很大的应用潜力。同时也需要注意风险管理,控制行情剧烈波动带来的亏损。

||

This strategy combines dual exponential moving averages and three Williams moving averages to form a comprehensive trend tracking and trend reversal signal generation system. It has excellent holding efficiency and can effectively filter out false signals.

This strategy consists of two sub-strategies:

-

Dual Exponential Moving Average (DEMA). This indicator combines the trend tracking capability of single exponential moving averages and the lagging feature of double exponential moving averages. It can go long faster when prices rise and can flatten positions faster when prices fall.

-

Williams Three Moving Averages. This indicator consists of long, medium and short lines. It uses the crossover of moving averages of different periods to determine trend changes and generate trading signals. When the short line crosses above the medium line and the medium line crosses above the long line, it is a long signal. When the short line crosses below the medium line and the medium line crosses below the long line, it is a short signal.

The trading signals of this strategy are the "AND" operation of the results of the two sub-strategies. That is, only when both sub-strategies issue signals at the same time, orders will be triggered for this strategy. This can effectively reduce false signals and improve the stability of holding positions.

The biggest advantage of this strategy is that it can effectively filter out false signals, which is determined by its strategy structure. Although double moving averages and Williams moving averages have their own disadvantages, combining them together can give full play to their respective advantages and compensate for each other. This enables the strategy to achieve efficient holdings in trending markets, and to stop losses in time during range-bound markets.

In addition, this strategy has large parameter optimization space. By adjusting the parameters of dual moving averages and three Williams moving averages, it can adapt to the characteristics of different varieties and cycles, and has strong adaptability.

The main risk of this strategy is that when the market enters violent fluctuations, the stop loss point may be broken, resulting in greater losses. This is a common problem with moving average strategies. In addition, in oscillating markets, this strategy may frequently open and close positions, increasing the cost of trading fees.

To control these risks, it is recommended to use the Walk Forward Analysis method for parameter optimization, and set reasonable stop loss points. At the same time, additional indicators can also be introduced to determine the market status and suspend trading during oscillating markets.

This strategy has the following optimization directions:

-

Adjust the parameters of dual moving averages to adapt to different varieties and cycles.

-

Adjust the cycles of the three Williams moving average lines to adapt to market volatility frequencies.

-

Increase opening conditions to filter trading signals during specific market stages. For example, do not trade during violent fluctuations.

-

Increase stop loss indicators to control losses. Methods like trailing stop loss and average stop loss can be tried.

-

Introduce machine learning algorithms to automatically optimize parameters.

This strategy realizes effective filtering of trading signals by combining the advantages of dual moving averages and Williams moving averages, which can reduce false signals and improve holding efficiency. It can obtain better performance through parameter optimization according to market conditions, and has great application potential. At the same time, risk management is also required to control losses caused by drastic market fluctuations.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 14 | (?●═════ 2/20 EMA ═════●)Length |

| v_input_int_2 | 13 | (?●═════ 3Lines ═════●)LLength |

| v_input_int_3 | 8 | MLength |

| v_input_int_4 | 5 | SLength |

| v_input_int_5 | 8 | LOffset |

| v_input_int_6 | 5 | MOffset |

| v_input_int_7 | 3 | SOffset |

| v_input_bool_1 | false | (?●═════ MISC ═════●)Trade reverse |

| v_input_int_8 | true | (?●═════ Time Start ═════●)From Day |

| v_input_int_9 | true | From Month |

| v_input_int_10 | 2005 | From Year |

Source (PineScript)

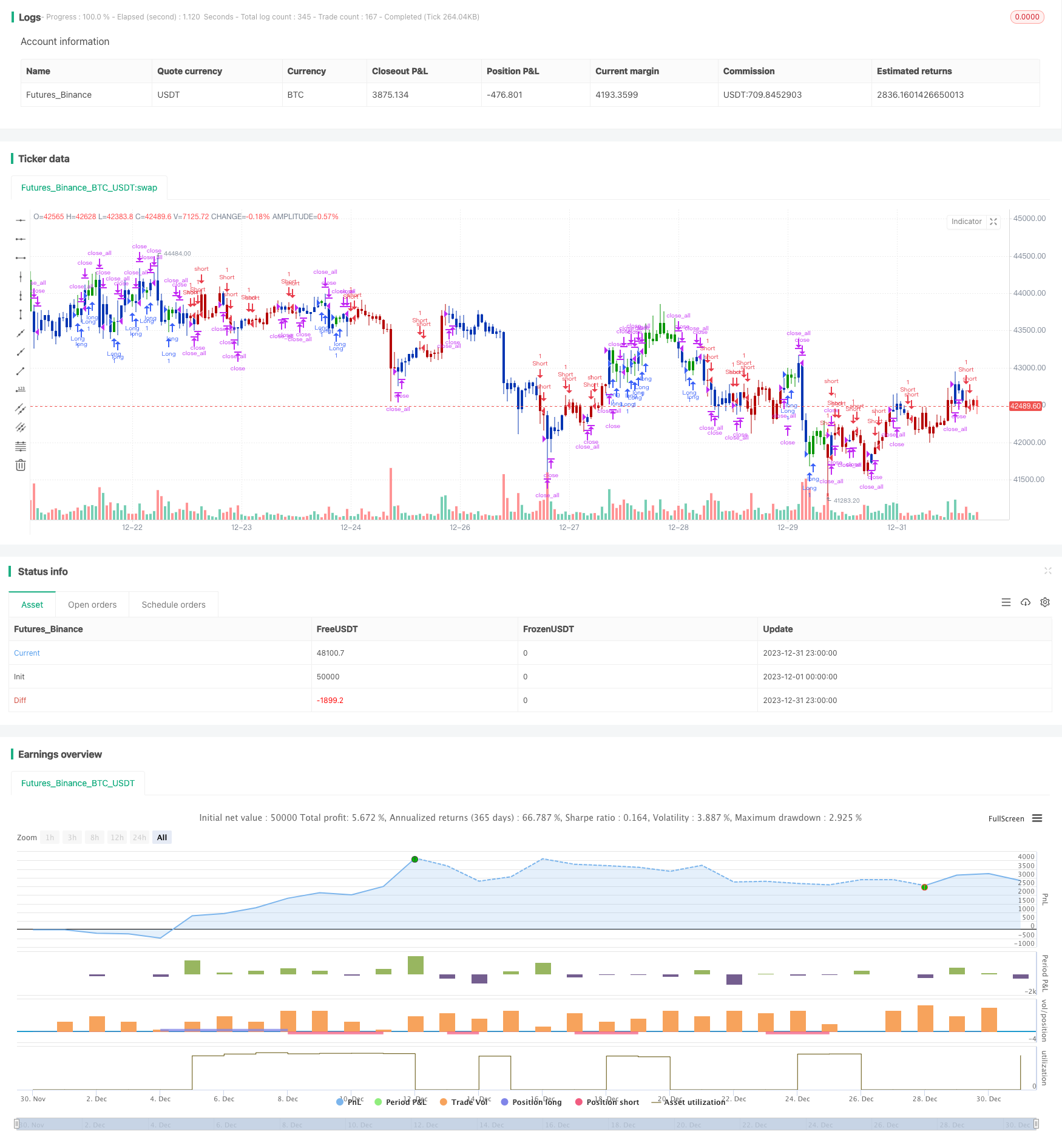

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/04/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// This indicator calculates 3 Moving Averages for default values of

// 13, 8 and 5 days, with displacement 8, 5 and 3 days: Median Price (High+Low/2).

// The most popular method of interpreting a moving average is to compare

// the relationship between a moving average of the security's price with

// the security's price itself (or between several moving averages).

//

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

BWA3Lines(LLength,MLength,SLength,LOffset,MOffset,SOffset) =>

pos = 0.0

xLSma = ta.sma(hl2, LLength)[LOffset]

xMSma = ta.sma(hl2, MLength)[MOffset]

xSSma = ta.sma(hl2, SLength)[SOffset]

pos := close < xSSma and xSSma < xMSma and xMSma < xLSma ? -1 :

close > xSSma and xSSma > xMSma and xMSma > xLSma ? 1 : nz(pos[1], 0)

pos

strategy(title='Combo 2/20 EMA & Bill Williams Averages. 3Lines', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ 3Lines ═════●'

LLength = input.int(13, minval=1, group=I2)

MLength = input.int(8,minval=1, group=I2)

SLength = input.int(5,minval=1, group=I2)

LOffset = input.int(8,minval=1, group=I2)

MOffset = input.int(5,minval=1, group=I2)

SOffset = input.int(3,minval=1, group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosBWA3Lines = BWA3Lines(LLength,MLength,SLength,LOffset,MOffset,SOffset)

iff_1 = posEMA20 == -1 and prePosBWA3Lines == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosBWA3Lines == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)

Detail

https://www.fmz.com/strategy/440110

Last Modified

2024-01-26 16:36:27