Name

单均点横盘突破策略Single-Point-Moving-Average-Breakout-Strategy

Author

ChaoZhang

Strategy Description

单均点横盘突破策略是一种基于Chande动量指标的量化交易策略。该策略通过计算价格的动量变化,判断市场是否处于横盘整理阶段。当Chande动量指标线突破设定的买入线或卖出线时,进行相应的买入或卖出操作。

该策略首先计算价格的动量变化momm,然后将其分为正动量m1和负动量m2。接着计算一定周期内的正负动量之和sm1和sm2,最后得到Chande动量指标chandeMO。该指标以0为中轴,当指标大于0时表示上涨力量大于下跌力量,小于0时则相反。

当Chande动量指标从低位突破买入线时,表示价格脱离下跌期,进入盘整准备上涨阶段,这时策略进行买入操作。当指标从高位跌破卖出线时,则进行卖出操作。

- 该策略能够捕捉价格从下跌到盘整再到上涨的转折点,实现低买高卖。

- Chande动量指标考虑了价格变化速度和力度,是一种很好的趋势判断工具。

- 策略操作简单,容易实现。

- Chande动量指标对参数敏感,不同周期参数设置会导致交易信号和结果差异很大。

- 买入线和卖出线静态设置也可能导致过多错误信号。

- 策略没有考虑止损,可能导致亏损扩大。

可以设置动态买入线和卖出线,或者结合其他指标过滤信号。同时也应该设置止损来控制风险。

- 尝试不同周期的参数来获得最佳效果

- 设置动态的买入卖出线

- 结合其他指标进行信号过滤

- 加入止损逻辑控制风险

单均点横盘突破策略通过Chande动量指标判断价格从下跌到盘整再到上涨的转折点,实现低买高卖。该策略简单实用,能够有效捕捉趋势转折。但参数设置和止损控制等方面还需要进一步优化,以减少错误信号和控制风险。总体来说,该策略为量化交易提供了一种有效判断趋势转折的工具。

||

The single point moving average breakout strategy is a quantitative trading strategy based on the Chande Momentum Oscillator. It detects when the market is in a consolidation phase by calculating the momentum changes of price. When the Chande Momentum line crosses above the buy line or falls below the sell line, long or short trades will be executed accordingly.

The strategy first calculates the price momentum change momm, then separates it into positive momentum m1 and negative momentum m2. Next, it sums the positive and negative momentum over a lookback period into sm1 and sm2. Finally, the Chande Momentum Oscillator chandeMO is derived. The indicator oscillates around the zero line. Readings above zero indicate stronger upward momentum, while readings below zero indicate stronger downward momentum.

When the Chande Momentum line crosses above the buy line from lower levels, it signals that price is breaking out of a downtrend and ready to start an uptrend. The strategy will go long. When the line falls below the sell line from higher levels, short positions will be initiated.

- The strategy is able to identify turning points from downtrend to consolidation to uptrend, allowing entries at low prices and exits at high prices.

- The Chande Momentum Oscillator considers both magnitude and rate of price changes, making it very effective for trend detection.

- The strategy logic is simple and easy to implement.

- The Chande Momentum Oscillator is sensitive to input parameters. Different parameter tuning can lead to vastly different trading signals and results.

- Static buy and sell line settings may also introduce excessive false signals.

- The lack of stop loss means that losing trades can accumulate large losses.

Some ways to improve include using dynamic buy/sell lines, filtering signals with other indicators, and implementing stop loss to control risks.

- Test different parameter settings to find optimal values

- Adopt dynamic buy and sell lines

- Add additional filters with other indicators

- Incorporate stop loss logic to cut losses

The single point moving average breakout strategy identifies trend turning points from downtrend to consolidation to uptrend using the Chande Momentum Oscillator, allowing low buy high sell trading. Despite being simple and intuitive, enhancements in parameter tuning, signal filtering and risk control can further improve performance. Overall, it serves as an effective tool for quantitative traders to determine trend reversals.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 2021 | Backtest Start Year |

| v_input_2 | true | Backtest Start Month |

| v_input_3 | 10 | Backtest Start Day |

| v_input_4 | 999999 | Backtest Stop Year |

| v_input_5 | 9 | Backtest Stop Month |

| v_input_6 | 26 | Backtest Stop Day |

| v_input_7 | 9 | length |

| v_input_8_close | 0 | Price: close |

| v_input_9 | -80 | buyline |

| v_input_10 | 80 | sellline |

Source (PineScript)

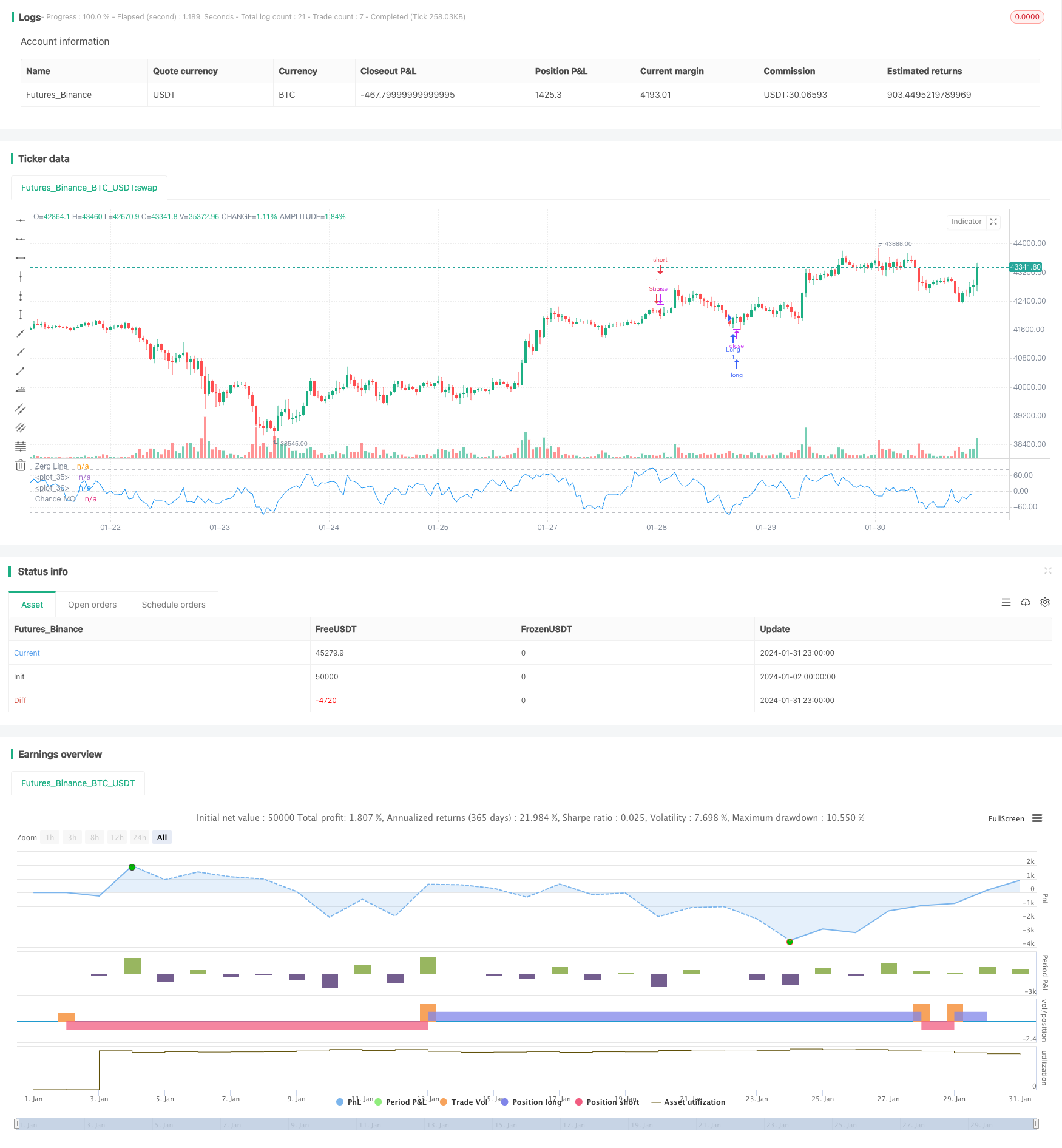

/*backtest

start: 2024-01-02 00:00:00

end: 2024-02-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//* Backtesting Period Selector | Component *//

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made *//

testStartYear = input(2021, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(10, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(999999, "Backtest Stop Year")

testStopMonth = input(9, "Backtest Stop Month")

testStopDay = input(26, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

/////////////// END - Backtesting Period Selector | Component ///////////////

strategy(title="Chande Momentum Strat", shorttitle="ChandeMO Strat", format=format.price, precision=2)

length = input(9, minval=1)

src = input(close, "Price", type = input.source)

momm = change(src)

f1(m) => m >= 0.0 ? m : 0.0

f2(m) => m >= 0.0 ? 0.0 : -m

m1 = f1(momm)

m2 = f2(momm)

sm1 = sum(m1, length)

sm2 = sum(m2, length)

percent(nom, div) => 100 * nom / div

chandeMO = percent(sm1-sm2, sm1+sm2)

plot(chandeMO, "Chande MO", color=color.blue)

hline(0, color=#C0C0C0, linestyle=hline.style_dashed, title="Zero Line")

buyline= input(-80)

sellline= input(80)

hline(buyline, color=color.gray)

hline(sellline, color=color.gray)

if testPeriod()

if crossover(chandeMO, buyline)

strategy.entry("Long", strategy.long, alert_message="a=ABCD b=buy e=binanceus q=1.2 s=uniusd")

// strategy.exit(id="Long Stop Loss", stop=strategy.position_avg_price*0.8) //20% stop loss

if crossunder(chandeMO, sellline)

strategy.entry("Short", strategy.short, alert_message="a=ABCD b=sell e=binanceus q=1.2 s=uniusd")

// strategy.exit(id="Short Stop Loss", stop=strategy.position_avg_price*1.2) //20% stop loss

// remember to alert as {{strategy.order.alert_message}}

Detail

https://www.fmz.com/strategy/440800

Last Modified

2024-02-02 11:19:19