Name

动量震荡Stochastic-RSI交易策略Stochastic-RSI-Momentum-Oscillation-Trading-Strategy

Author

ChaoZhang

Strategy Description

[trans]

本文主要阐述了一个基于Stochastic RSI指标的动量震荡交易策略。该策略采用了较短周期(如30分钟)的技术指标,根据Stochastic RSI是否进入超买超卖区域来进行交易决策。相比其他动量策略,该策略同时结合了RSI和Stochastic两个指标的优点,可以更加准确地捕捉市场的短期震荡。

该策略的核心指标是Stochastic RSI。Stochastic RSI指标的计算公式是:

Stochastic RSI = (RSI - 低点RSI) / (高点RSI - 低点RSI) * 100

其中RSI采用 lengthRSI参数(默认12)计算,Stochastic RSI采用 lengthStoch参数(默认12)计算。

当Stochastic RSI高于紫色填充区域时为超买区,这时做空;当Stochastic RSI低于紫色填充区域时为超卖区域,这时做多。

此外,策略还设置了均线过滤条件。只有当快速EMA高于慢速EMA时,才能开仓做多;只有当快速EMA低于慢速EMA时,才能开仓做空。这样可以避免逆势交易。

相比单一的RSI策略,该策略结合了Stochastic指标,可以更加清晰地识别超买超卖区域,从而提高信号的可靠性。

相比单一的Stochastic策略,该策略采用了RSI作为Stochastic的输入数据源,可以过滤掉部分噪音,使得信号更加可靠。

设置了均线过滤条件,可以有效避免逆势建仓,从而减少不必要的损失。

设置了持仓时间延迟,可以避免被假突破停止出。

该策略主要采用了短周期指标,所以只适合短线操作,长线效果可能不佳。

Stochastic RSI指标本身会产生一定的延迟,可能会错过短期价格剧烈变动后的信号。

在震荡行情中,Stochastic RSI指标会产生多次超买超卖区域穿越,可能会过度交易从而增加交易成本。

-

可以测试不同参数组合,进一步优化Stochastic RSI的长度、K值和D值。

-

可以测试不同的RSI长度参数,寻找更合适的RSI周期长度。

-

可以尝试结合其他指标进行组合,进一步提高信号的准确性。比如MACD, Bollinger Bands等。

-

可以测试不同的持仓时间延迟参数,找到更合适的出场时间。

本文详细介绍了基于Stochastic RSI指标的动量策略的构建原理、优势、风险和优化思路。相比单一指标策略,该策略同时利用了RSI和Stochastic的优势,可以更加清晰和可靠地识别市场的短期超买超卖现象,从而进行反转交易。通过参数优化和指标组合,有望进一步提升策略效果。

||

This article mainly explains a momentum oscillation trading strategy based on the Stochastic RSI indicator. The strategy adopts shorter cycle technical indicators (such as 30 minutes) to make trading decisions based on whether the Stochastic RSI enters the overbought/oversold region. Compared with other momentum strategies, this strategy combines the advantages of both RSI and Stochastic indicators to more accurately capture short-term market oscillations.

The core indicator of the strategy is Stochastic RSI. The calculation formula of Stochastic RSI is:

Stochastic RSI = (RSI - RSI Low) / (RSI High - RSI Low) * 100

Where RSI is calculated using the lengthRSI parameter (default 12), and Stochastic RSI is calculated using the lengthStoch parameter (default 12).

When Stochastic RSI is higher than the purple filled area, it is the overbought area, then go short; when Stochastic RSI is lower than the purple filled area, it is the oversold area, then go long.

In addition, the strategy also sets the moving average filter condition. Only when the fast EMA is higher than the slow EMA can you open a long position; only when the fast EMA is lower than the slow EMA can you open a short position. This avoids counter-trend trading.

Compared with a single RSI strategy, this strategy combines the Stochastic indicator to more clearly identify overbought/oversold areas, thereby improving the reliability of signals.

Compared with a single Stochastic strategy, this strategy uses RSI as the input data source of Stochastic, which can filter out some noise and make the signal more reliable.

The moving average filter condition is set to effectively avoid counter-trend positions building, thereby reducing unnecessary losses.

The position holding time delay is set to avoid being stopped out by false breakouts.

The strategy mainly uses short-cycle indicators, so it is only suitable for short-term operations and may not perform well in the long run.

The Stochastic RSI indicator itself has a certain lag and may miss signals after drastic price changes in the short term.

In oscillating markets, Stochastic RSI may produce multiple penetrations of overbought/oversold areas, which may lead to overtrading and increased transaction costs.

-

Different parameter combinations can be tested to further optimize the length, K and D values of Stochastic RSI.

-

Different RSI length parameters can be tested to find a more appropriate RSI cycle.

-

Try combining with other indicators to further improve signal accuracy, such as MACD, Bollinger Bands, etc.

-

Test different position holding delay parameters to find a more appropriate exit timing.

This article details the construction principles, advantages, risks and optimization ideas of a momentum strategy based on the Stochastic RSI indicator. Compared with single indicator strategies, this strategy utilizes the strengths of both RSI and Stochastic to more clearly and reliably identify short-term overbought/oversold phenomena in the market for reversal trading. Further performance improvements can be expected through parameter optimization and indicator combinations.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | false | ------------------------Backtest Period------------------------ |

| v_input_2 | 2020 | start year |

| v_input_3 | true | start month |

| v_input_4 | true | start day |

| v_input_5 | false | end year |

| v_input_6 | false | end month |

| v_input_7 | false | end day |

| v_input_8 | false | ------------------------Basic Parameters------------------------ |

| v_input_9 | 3 | smoothK |

| v_input_10 | 6 | smoothD |

| v_input_11 | 12 | lengthRSI |

| v_input_12_close | 0 | RSI Source: close |

| v_input_13 | 12 | lengthStoch |

| v_input_14 | 85.29 | Overbought Height |

| v_input_15 | 30.6 | Oversold Height |

| v_input_16 | 6 | Bars delay |

| v_input_17 | true | Gamble Sizing? |

| v_input_18 | deltaSize | Gamble Add (%) |

| v_input_19 | sizeLimite | Gamble MAX (%) |

| v_input_20 | true | Fast EMA length |

| v_input_21 | 60 | Slow EMA length |

| v_input_22 | true | ------------------------LONG------------------------ |

| v_input_23 | 10 | Stop Loss LONG % |

| v_input_24 | 8 | Take Profit LONG % |

| v_input_25 | true | TREND FILTER LONG? |

| v_input_26 | false | ------------------------SHORT------------------------ |

| v_input_27 | 20 | Stop Loss SHORT % |

| v_input_28 | 35 | Take Profit SHORT % |

| v_input_29 | true | TREND FILTER SHORT? |

Source (PineScript)

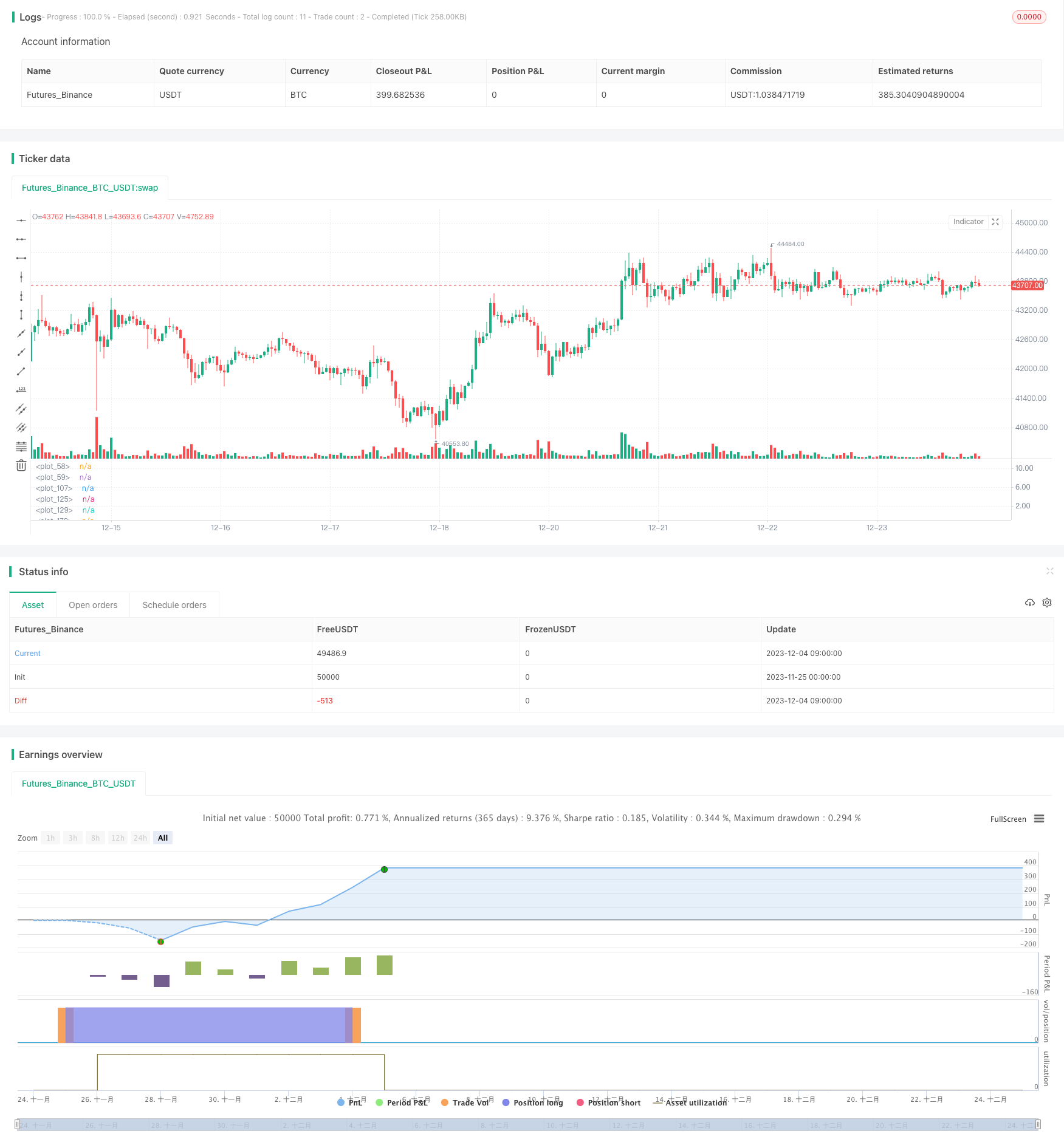

/*backtest

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Drun30 (Federico Magnani)

//@version=4

//STRATEGIA PRINCIPALE

capitaleIniziale=10000

var sizeordineInit= 50 // → % di capitale investita per ogni trade

var deltaSize = 25 // → delta% di capitale investito se trade precedente è stato in perdita

var sizeLimite = 100 //il trade non userà mai questa percentuale di capitale investito

var sizeordine = sizeordineInit

//Parametri ottimali 30 min

usiShort=false

usiLong=true

ipercomprato=85.29

ipervenduto=30.6

//

strategy("Momentum Strategy (V7.B.4)", initial_capital=capitaleIniziale, currency="USD", default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.1, slippage = 5, default_qty_value=sizeordineInit, overlay=false, pyramiding=0)

backtest = input(title="------------------------Backtest Period------------------------", defval = false)

start = timestamp(input(2020, "start year"), input(1, "start month"), input(1, "start day"), 00, 00)

end = timestamp(input(0, "end year"), input(0, "end month"), input(0, "end day"), 00, 00)

siamoindata=time > start?true:false

if end > 0

siamoindata:=time > start and time <= end?true:false

basicParameters = input(title="------------------------Basic Parameters------------------------", defval = false)

smoothK = input(3, minval=1)

smoothD = input(6, minval=1)

lengthRSI = input(12, minval=1)

src = input(close, title="RSI Source")

rsi1 = rsi(src, lengthRSI)

lengthStoch = input(12, minval=1)

k = ema(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ema(k, smoothD)

altezzaipercomprato= input(ipercomprato, title="Overbought Height", minval=1, type=input.float)

altezzaipervenduto= input(ipervenduto, title="Oversold Height", minval=1,type=input.float)

BarsDelay = input(6,title="Bars delay",minval=0)

GambleSizing = input(true, title = "Gamble Sizing?",type=input.bool)

gambleAdd = input(deltaSize,title="Gamble Add (%)",minval=0,type=input.integer)

gambleLimit = input(sizeLimite,title="Gamble MAX (%)",minval=0,type=input.integer)

if GambleSizing and strategy.closedtrades[0]>strategy.closedtrades[1]

if strategy.losstrades[0]>strategy.losstrades[1] and sizeordine<gambleLimit

sizeordine:=sizeordine+gambleAdd

if strategy.wintrades[0]>strategy.wintrades[1]

sizeordine:=sizeordineInit

periodomediamobile_fast = input(1, title="Fast EMA length",minval=1)

periodomediamobile_slow = input(60, title="Slow EMA length",minval=1)

plot(k, color=color.blue)

plot(d, color=color.orange)

h0 = hline(altezzaipercomprato)

h1 = hline(altezzaipervenduto)

fill(h0, h1, color=color.purple, transp=80)

// n=input(Vicinanzadalcentro,title="Vicinanza dal centro",minval=0)

//sarebbe il livello di D in cui si acquista o si vende, maggiore è la vicinanza maggiore sarà la frequenza dei trades, SE 0 è DISABILITATO

// siamoinipervenduto= d<=altezzaipervenduto and d<=d[n] and d>d[1]?true:false //and d<d[3] and d>d[1]

// siamoinipercomprato= d>=altezzaipercomprato and d>=d[n] and d<d[1]?true:false //and d>d[3] and d<d[1]

goldencross = crossover(k,d)

deathcross = crossunder(k,d)

// METTI VARIABILE IN CUI AVVIENE CROSSOVER O CROSSUNDER

valoreoro = valuewhen(goldencross,d,0)

valoremorte = valuewhen(deathcross,d,0)

siamoinipervenduto = goldencross and valoreoro<=altezzaipervenduto?true:false//d<=altezzaipervenduto?true:false

siamoinipercomprato = deathcross and valoremorte>=altezzaipercomprato?true:false//d>=altezzaipercomprato?true:false

long_separator = input(title="------------------------LONG------------------------", defval = usiLong)

sl_long_inp = input(10, title="Stop Loss LONG %", type=input.float)

tp_long_inp = input(8, title="Take Profit LONG %",type=input.float)

stop_level_long = strategy.position_avg_price * (1 - (sl_long_inp/100)) //strategy.position_avg_price corrisponde al prezzo con cui si è aperta la posizione

take_level_long = strategy.position_avg_price * (1 + (tp_long_inp/100))

//BINANCE

JSON_long = 'OPEN LONG: PUT THE JSON HERE FOR THE API CALL'

JSON_chiusura = 'CLOSE POSITION: PUT THE JSON HERE FOR THE API CALL'

webhookLong = JSON_long

webhookClose= JSON_chiusura

trendFilterL = input(title="TREND FILTER LONG?", defval = true)

EMAfast=ema(close,periodomediamobile_fast)

EMAslow=ema(close,periodomediamobile_slow)

siamoinuptrend_ema=EMAfast>EMAslow?true:false //close>=EMAfast and EMAfast>EMAslow

siamoinuptrend = siamoinuptrend_ema

// CondizioneAperturaLong = siamoinipervenduto and siamoindata // and siamoinuptrend

CondizioneAperturaLong = siamoinipervenduto and siamoindata and long_separator

if trendFilterL

CondizioneAperturaLong := siamoinipervenduto and siamoindata and long_separator and siamoinuptrend

CondizioneChiusuraLong = siamoinipercomprato and siamoindata

possiamoAprireLong=0

if trendFilterL and siamoinuptrend

possiamoAprireLong:=5

plot(possiamoAprireLong,color=color.green)

sonPassateLeBarreG = barssince(CondizioneAperturaLong) == BarsDelay?true:false

sonPassateLeBarreD = barssince(CondizioneChiusuraLong) == BarsDelay?true:false

haiUnLongAncoraAperto = false

haiUnLongAncoraAperto := strategy.position_size>0?true:false

// Se l'ultimo valore della serie "CondizioneAperturaLong" è TRUE, allora hai un long ancora aperto

// Se l'ultimo valore della serie "CondizioneAperturaLong" è FALSE, allora:

// Se l'ultimo valore della serie "CondizioneChiusuraLong" è TRUE, allora NON hai un long ancora aperto

// Se l'ultimo valore della serie "CondizioneChiusuraLong" è FALSE, allora restituisce l'ultimo valore della serie "haiUnLongAncoraAperto"

haiUnLongAncoraAperto_float = if(haiUnLongAncoraAperto==true)

10

else

0

plot(haiUnLongAncoraAperto_float,color=color.red) //FInché la linea rossa si trova a livello "1" allora c'è un ordine long in corso

quantita = (sizeordine/100*(capitaleIniziale+strategy.netprofit))/valuewhen(haiUnLongAncoraAperto==false and CondizioneAperturaLong,close,0)

plot(sizeordine,color=color.purple, linewidth=3)

if strategy.position_size<=0 and CondizioneAperturaLong //and sonPassateLeBarreG and haiUnLongAncoraAperto==false strategy.opentrades==0

strategy.entry("Vamonos",strategy.long, alert_message=webhookLong, comment="OPEN LONG", qty=quantita)

if strategy.position_size>0 //and sonPassateLeBarreD // and CondizioneChiusuraLong

if siamoinuptrend == true and sonPassateLeBarreD

strategy.close("Vamonos", alert_message=webhookClose, comment="CLOSE LONG")

else if siamoinuptrend == false and CondizioneChiusuraLong

strategy.close("Vamonos", alert_message=webhookClose, comment="CLOSE LONG")

if strategy.position_size>0 and siamoindata

strategy.exit("Vamonos", stop=stop_level_long, limit=take_level_long, comment="CLOSE LONG (LIMIT/STOP)")

short_separator = input(title="------------------------SHORT------------------------", defval = usiShort)

sl_short_inp = input(20, title="Stop Loss SHORT %")

tp_short_inp = input(35, title="Take Profit SHORT %")

stop_level_short = strategy.position_avg_price * (1 + (sl_short_inp/100))

take_level_short= strategy.position_avg_price * (1 - (tp_short_inp/100))

// BINANCE

JSON_short = 'OPEN SHORT: PUT THE JSON HERE FOR THE API CALL'

webhookShort = JSON_short

trendFilterS = input(title="TREND FILTER SHORT?", defval = true)

siamoindowntrend_ema=EMAfast<EMAslow?true:false //close<=EMAfast and EMAfast<EMAslow

siamoindowntrend=siamoindowntrend_ema

CondizioneAperturaShort = short_separator and siamoinipercomprato and siamoindata

if trendFilterS

CondizioneAperturaShort:=short_separator and siamoinipercomprato and siamoindata and siamoindowntrend

CondizioneChiusuraShort = siamoinipervenduto and siamoindata

sonPassateLeBarreGs = barssince(CondizioneAperturaShort) == BarsDelay?true:false

sonPassateLeBarreDs = barssince(CondizioneChiusuraShort) == BarsDelay?true:false

haiUnoShortAncoraAperto = false

haiUnoShortAncoraAperto := strategy.position_size<0?true:false

haiUnoShortAncoraAperto_float = if(haiUnoShortAncoraAperto==true)

15

else

0

plot(haiUnoShortAncoraAperto_float,color=color.purple) //FInché la linea viola si trova a livello "2" allora c'è un ordine short in corso

if CondizioneAperturaShort and strategy.position_size>=0 //and haiUnoShortAncoraAperto==false

strategy.entry("Andale",strategy.short,alert_message=webhookShort, comment="OPEN SHORT")

if strategy.position_size<0 //and sonPassateLeBarreD // and CondizioneChiusuraLong

if siamoindowntrend == true and sonPassateLeBarreDs

strategy.close("Andale",alert_message=webhookClose, comment="CLOSE SHORT")

else if siamoindowntrend == false and CondizioneChiusuraShort

strategy.close("Andale",alert_message=webhookClose, comment="CLOSE SHORT")

if strategy.position_size<0 and siamoindata

strategy.exit("Andale", stop=stop_level_short, limit=take_level_short, comment="CLOSE SHORT (LIMIT/STOP)")

Detail

https://www.fmz.com/strategy/436619

Last Modified

2023-12-26 12:11:21