Name

动量讨价还价策略Momentum-Pullback-Strategy

Author

ChaoZhang

Strategy Description

动量讨价还价策略是一种中短线交易策略,它结合了移动平均线指标和K线形态模型,通过识别突破点和回调点来发现交易机会。该策略适用于看涨期权、看跌期权、期货等高杠杆金融产品的交易。

该策略的核心逻辑基于5日简单移动平均线。当价格要突破该平均线时,会形成一个跳空的最高点或最低点K线,此时就是一个潜在的做多或做空信号。在价格突破平均线的第二根K线收盘时,若不破坏前一跳空K线的最低价或最高价,则形成入场信号。随后根据止损点和止盈目标设置风险敞口。

当价格向上突破5日均线而收盘时,前一跳空K线的最高价为止损点,最低价减去一定回调范围乘以风险回报比作为止盈目标。当价格向下突破5日均线而收盘时,前一跳空K线的最低价为止损点,最高价加上一定回调范围乘以风险回报比作为止盈目标。

该策略还提供了一个可选的过滤条件,即当前K线的收盘价相对于跳空K线要稍低或稍高,这样可以避免部分错误信号。

- 策略思路清晰简洁,容易理解和实现

- 基于移动平均线,可以识别趋势和回调

- 结合K线形态,可以发现更精确的交易时点

- 风险和回报匹配,符合理性交易原则

- 可根据自己的交易品种和周期进行参数调整

- 提供可选过滤条件,可以减少错误信号

- 如其他技术指标策略,也可能出现被套、止损追击等风险

- 移动平均线指标有滞后性,可能错过短线大行情

- 在震荡趋势中,容易出现较多错误信号

- 策略参数设置不当可能导致过度交易

可以通过合理止损,适当宽松持仓,选择低频交易等方法降低风险。也可以考虑结合其他指标进行信号过滤。

- 可以测试不同的参数组合,选择最佳参数

- 可以结合其他指标或图形进行信号过滤优化

- 可以考虑动态止损、移动止损等方法

- 可以结合机器学习模型自动优化参数

- 可以开发自动止损、止盈插件

- 可以尝试跨品种、跨周期验证策略健壮性

本策略整体来说是一个易于理解和实现的中短线交易策略。它利用移动平均线和跳空K线形态识别趋势转折点,在理性的风险控制框架下进行操作。虽然仍存在一些改进空间,但其核心思路具有普适性,值得学习和应用。通过参数调整、信号过滤等优化措施,可以将该策略运用到更广泛的交易实践中。

||

The Momentum Pullback Strategy is a medium-term trading strategy that combines moving averages and candlestick patterns to identify trading opportunities by detecting breakouts and pullbacks. It is suitable for trading highly leveraged financial products like options and futures.

The core logic of this strategy is based on the 5-day simple moving average. When the price is about to break through this average line, it will form a gap high or low candlestick, which signals a potential long or short opportunity. The entry signal is triggered when the second candle closing beyond the moving average does not break the previous gap candle's low or high. Stop loss and profit target levels are then set based on the risk-reward ratio.

When the price breaks above the 5-day MA and closes, the previous gap candle's high is the stop loss level. The profit target is set by subtracting a certain retracement range from the low, multiplied by the desired risk-reward ratio. Similarly for a downside breakout, the previous gap candle's low is the stop loss, while the take profit level is above the high plus a retracement range factored by the risk-reward ratio.

An optional filter is provided where the current candle's close should be slightly lower or higher than the gap candle's close for additional confirmation, avoiding false signals.

- Clear and simple strategy logic, easy to understand and implement

- Identifies trends and pullbacks using moving averages

- More precise trade timing combining candlestick patterns

- Matches risk and reward, aligns with prudent trading

- Adjustable parameters for different products and timeframes

- Optional filter avoids some false signals

- Common technical analysis risks like being caught in trends, stop run-throughs

- Lagging nature of moving averages may miss quick reversals

- More false signals likely in range-bound markets

- Excessive trading from poor parameter tuning

Risks can be reduced via sensible stop losses, position sizing, less frequent trading etc. Combining other indicators to filter signals is also an option.

- Test different parameter sets for best performance

- Add other indicators or chart patterns to filter signals

- Explore dynamic, trailing stop loss enhancements

- Apply machine learning to auto-optimize parameters

- Develop auto stop loss / take profit plugins

- Robustness checks across products and timeframes

Overall this is an easy to understand and implement medium-term trading strategy. It capitalizes on trend reversals identified by moving averages and gap candles, with a rational risk control framework. While further improvements are possible, the core logic is versatile for wider application via parameter tuning, signal filtering etc.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_bool_1 | false | Enable the Extra SL shown below |

| v_input_int_1 | 5 | Value to set SL number of points below-low or above-high |

| v_input_int_2 | 3 | Risk to Reward Ratio |

| v_input_bool_2 | true | Show Sell Signals |

| v_input_bool_3 | false | Show Buy Signals |

| v_input_bool_4 | false | Buy/Sell with Extra Condition - candle close |

Source (PineScript)

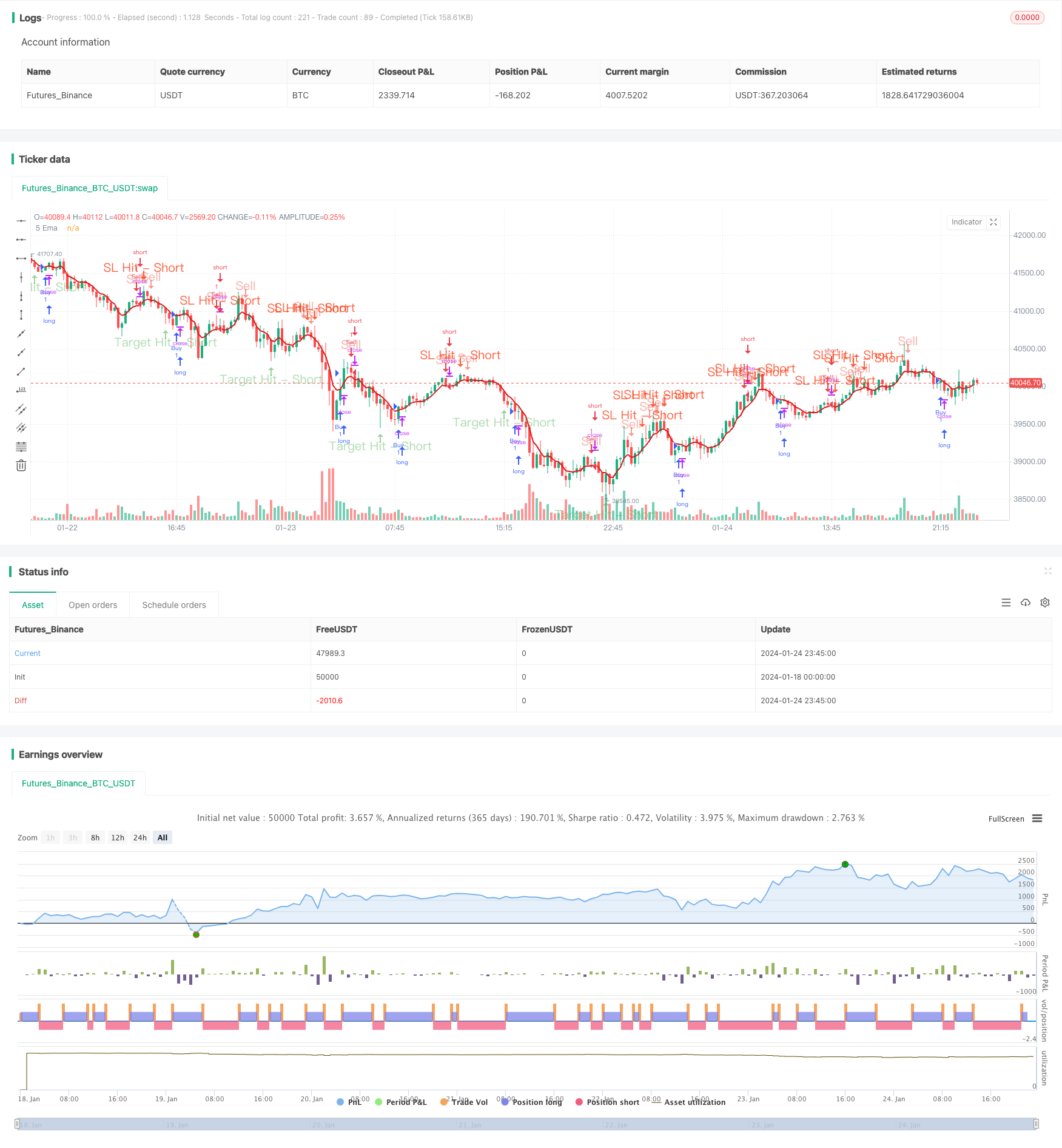

/*backtest

start: 2024-01-18 00:00:00

end: 2024-01-25 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingInsights2

//@version=5

strategy("Ultimate 5EMA Strategy By PowerOfStocks", overlay=true)

Eusl = input.bool(false, title="Enable the Extra SL shown below")

usl = input.int(defval=5, title='Value to set SL number of points below-low or above-high', minval=1, maxval=100)

RiRe = input.int(defval=3, title='Risk to Reward Ratio', minval=1, maxval=25)

ShowSell = input.bool(true, 'Show Sell Signals')

ShowBuy = input.bool(false, 'Show Buy Signals')

BSWCon = input.bool(defval=false, title='Buy/Sell with Extra Condition - candle close')

// Moving Average

ema5 = ta.ema(close, 5)

pema5 = plot(ema5, '5 Ema', color=color.new(#da1a1a, 0), linewidth=2)

var bool Short = na

var bool Long = na

var shortC = 0

var sslhitC = 0

var starhitC = 0

var float ssl = na

var float starl = na

var float star = na

var float sellat = na

var float alert_shorthigh = na

var float alert_shortlow = na

var line lssl = na

var line lstar = na

var line lsell = na

var label lssllbl = na

var label lstarlbl = na

var label lselllbl = na

var longC = 0

var lslhitC = 0

var ltarhitC = 0

var float lsl = na

var float ltarl = na

var float ltar = na

var float buyat = na

var float alert_longhigh = na

var float alert_longlow = na

var line llsl = na

var line lltar = na

var line lbuy = na

var label llsllbl = na

var label lltarlbl = na

var label lbuylbl = na

ShortWC = low[1] > ema5[1] and low[1] > low and shortC == 0 and close < close[1]

ShortWOC = low[1] > ema5[1] and low[1] > low and shortC == 0

Short := BSWCon ? ShortWC : ShortWOC

sslhit = high > ssl and shortC > 0 and sslhitC == 0

starhit = low < star and shortC > 0 and starhitC == 0

LongWC = high[1] < ema5[1] and high[1] < high and longC == 0 and close > close[1]

LongWOC = high[1] < ema5[1] and high[1] < high and longC == 0

Long := BSWCon ? LongWC : LongWOC

lslhit = low < lsl and longC > 0 and lslhitC == 0

ltarhit = high > ltar and longC > 0 and ltarhitC == 0

if Short and ShowSell

shortC := shortC + 1

sslhitC := 0

starhitC := 0

alert_shorthigh := high[1]

if Eusl

ssl := high[1] + usl

starl := BSWCon ? ((high[1] - close) + usl) * RiRe : ((high[1] - low[1]) + usl) * RiRe

else

ssl := high[1]

starl := BSWCon ? (high[1] - close) * RiRe : (high[1] - low[1]) * RiRe

star := BSWCon ? close - starl : low[1] - starl

sellat := BSWCon ? close : low[1]

// lssl := line.new(bar_index, ssl, bar_index, ssl, color=color.new(#fc2d01, 45), style=line.style_dashed)

// lstar := line.new(bar_index, star, bar_index, star, color=color.new(color.green, 45), style=line.style_dashed)

// lsell := line.new(bar_index, sellat, bar_index, sellat, color=color.new(color.orange, 45), style=line.style_dashed)

// lssllbl := label.new(bar_index, ssl, style=label.style_none, text='Stop Loss - Short' + ' (' + str.tostring(ssl) + ')', textcolor=color.new(#fc2d01, 35), color=color.new(#fc2d01, 35))

// lstarlbl := label.new(bar_index, star, style=label.style_none, text='Target - Short' + ' (' + str.tostring(star) + ')', textcolor=color.new(color.green, 35), color=color.new(color.green, 35))

// lselllbl := label.new(bar_index, sellat, style=label.style_none, text='Sell at' + ' (' + str.tostring(sellat) + ')', textcolor=color.new(color.orange, 35), color=color.new(color.orange, 35))

if sslhit == false and starhit == false and shortC > 0

// line.set_x2(lssl, bar_index)

// line.set_x2(lstar, bar_index)

// line.set_x2(lsell, bar_index)

sslhitC := 0

starhitC := 0

else

if sslhit

shortC := 0

sslhitC := sslhitC + 1

else

if starhit

shortC := 0

starhitC := starhitC + 1

if Long and ShowBuy

longC := longC + 1

lslhitC := 0

ltarhitC := 0

alert_longlow := low[1]

if Eusl

lsl := low[1] - usl

ltarl := BSWCon ? ((close - low[1]) + usl) * RiRe : ((high[1] - low[1]) + usl) * RiRe

else

lsl := low[1]

ltarl := BSWCon ? (close - low[1]) * RiRe : (high[1] - low[1]) * RiRe

ltar := BSWCon ? close + ltarl : high[1] + ltarl

buyat := BSWCon ? close : high[1]

llsl := line.new(bar_index, lsl, bar_index, lsl, color=color.new(#fc2d01, 45), style=line.style_dotted)

lltar := line.new(bar_index, ltar, bar_index, ltar, color=color.new(color.green, 45), style=line.style_dotted)

lbuy := line.new(bar_index, buyat, bar_index, buyat, color=color.new(color.orange, 45), style=line.style_dotted)

llsllbl := label.new(bar_index, lsl, style=label.style_none, text='Stop Loss - Long' + ' (' + str.tostring(lsl) + ')', textcolor=color.new(#fc2d01, 35), color=color.new(#fc2d01, 35))

lltarlbl := label.new(bar_index, ltar, style=label.style_none, text='Target - Long' + ' (' + str.tostring(ltar) + ')', textcolor=color.new(color.green, 35), color=color.new(color.green, 35))

lbuylbl := label.new(bar_index, buyat, style=label.style_none, text='Buy at' + ' (' + str.tostring(buyat) + ')', textcolor=color.new(color.orange, 35), color=color.new(color.orange, 35))

if lslhit == false and ltarhit == false and longC > 0

// line.set_x2(llsl, bar_index)

// line.set_x2(lltar, bar_index)

// line.set_x2(lbuy, bar_index)

lslhitC := 0

ltarhitC := 0

else

if lslhit

longC := 0

lslhitC := lslhitC + 1

else

if ltarhit

longC := 0

ltarhitC := ltarhitC + 1

strategy.entry("Buy", strategy.long, when=Long)

strategy.entry("Sell", strategy.short, when=Short)

strategy.close("ExitBuy", when=sslhit or starhit)

strategy.close("ExitSell", when=lslhit or ltarhit)

plotshape(ShowSell and Short, title='Sell', location=location.abovebar, offset=0, color=color.new(#e74c3c, 45), style=shape.arrowdown, size=size.normal, text='Sell', textcolor=color.new(#e74c3c, 55))

plotshape(ShowSell and sslhit, title='SL Hit - Short', location=location.abovebar, offset=0, color=color.new(#fc2d01, 25), style=shape.arrowdown, size=size.normal, text='SL Hit - Short', textcolor=color.new(#fc2d01, 25))

plotshape(ShowSell and starhit, title='Target Hit - Short', location=location.belowbar, offset=0, color=color.new(color.green, 45), style=shape.arrowup, size=size.normal, text='Target Hit - Short', textcolor=color.new(color.green, 55))

plotshape(ShowBuy and Long, title='Buy', location=location.belowbar, offset=0, color=color.new(#2ecc71, 45), style=shape.arrowup, size=size.normal, text='Buy', textcolor=color.new(#2ecc71, 55))

plotshape(ShowBuy and lslhit, title='SL Hit - Long', location=location.belowbar, offset=0, color=color.new(#fc2d01, 25), style=shape.arrowdown, size=size.normal, text='SL Hit - Long', textcolor=color.new(#fc2d01, 25))

plotshape(ShowBuy and ltarhit, title='Target Hit - Long', location=location.abovebar, offset=0, color=color.new(color.green, 45), style=shape.arrowup, size=size.normal, text='Target Hit - Long', textcolor=color.new(color.green, 55))

if ShowSell and Short

alert("Go Short@ " + str.tostring(sellat) + " : SL@ " + str.tostring(ssl) + " : Target@ " + str.tostring(star) + " ", alert.freq_once_per_bar )

if ShowBuy and Long

alert("Go Long@ " + str.tostring(buyat) + " : SL@ " + str.tostring(lsl) + " : Target@ " + str.tostring(ltar) + " ", alert.freq_once_per_bar )

///// End of code

Detail

https://www.fmz.com/strategy/440057

Last Modified

2024-01-26 11:07:47