Name

动态趋势追踪反转策略Dynamic-Trend-Tracking-Reversal-Strategy

Author

ChaoZhang

Strategy Description

动态趋势追踪反转策略是一种基于JD Sequential指标的短期量化交易策略。该策略通过实时追踪价格的高点和低点,判断当前趋势方向和力度,实现高效捕捉市场反转点,进行进入和退出的定时。相比传统的JD Sequential策略,该策略做出了如下改进:

- 使用高点和低点判断趋势,而不是收盘价,可以更快捕捉价格变化。

- 计数器最大数为7而不是9,可以更快产生交易信号。

- 增加了支持阻力线和5计数反转作为止损的选项。

该策略适合在短线时间周期如5分钟、15分钟使用,可以有效捕捉短期价格波动和反转机会。

动态趋势追踪反转策略的核心逻辑基于JD Sequential指标,该指标通过比较当前周期与之前两个周期的高点和低点,判断价格是否连续创出更高的高点或者更低的低点,从而给出1-7的顺序计数。当计数累计到7时产生交易信号。

具体来说,策略中定义了以下变量:

- sp_up:当高点价格超过之前第二个周期高点价格时为true

- sp_dn:当低点价格低于之前第二个周期低点价格时为true

- sp_ct: 记录当前计数,如果sp_up或sp_dn为true则+1计数,最大为7

- sp_com:计数等于7时为true

- sp_usr:计数为7且sp_up时的中价,作为上行阻力

- sp_dsr:计数为7且sp_dn时的中价,作为下行支持

交易信号的产生逻辑是:

- 长仓信号:sp_com为true且sp_dn为true,表示计数完成且处于下跌趋势

- 短仓信号:sp_com为true且sp_up为true,表示计数完成且处于上涨趋势

止损逻辑是:

- 长仓止损:计数反转为5(sp_up为true)或价格上穿sp_usr

- 短仓止损:计数反转为5(sp_dn为true)或价格下破sp_dsr

该策略通过实时比较高低点判定趋势方向和力度,计数器计时入场,可以有效捕捉短期反转机会。同时设置止损线来控制风险。

与传统的JD Sequential策略相比,动态趋势追踪反转策略具有以下优势:

- 更快速的信号产生。使用高低点比较可以比收盘价更快捕捉趋势,7计数可以比9计数更快产生信号。

- 增加止损机制。加入5计数反转和支持阻力止损可以更好控制风险。

- 可配置灵活。可选择是否加入止损以及显示部分计数。

- 适合短线。高频率信号配合适当止损,特别适合短线时间周期。

该策略主要优势是响应迅速,可以有效捕捉短期突发事件导致的大幅波动。同时,相比完全手动交易,算法信号产生和止损可以减少交易者情绪影响,从而提高稳定性。

动态趋势追踪反转策略也存在一定的风险:

- 高频交易增加交易成本。较高的交易频率会产生更多的手续费和滑点成本。

- 容易产生错误信号。在震荡市中,高低点的比较可能频繁触发交易信号,容易被套。

- 止损过于激进。硬止损容易被秒出,可以考虑及时移位止损。

为降低上述风险,可以从以下几个方面进行优化:

- 调整持仓规模,降低单笔交易占用资金量。

- 在震荡行情中暂停交易,避免无效交易。

- 采用移动止损或区间突破止损,减少被套盘概率。

动态趋势追踪反转策略还有很大的优化空间,主要方向包括:

-

多时间周期组合。可以在更高时间周期确定主趋势方向,避免与主趋势对抗交易。

-

与其他指标组合。可以与波动率指标、成交量指标等组合,提高信号的质量。

-

机器学习过滤。利用机器学习算法对交易信号进行辅助判断,减少错误交易。

-

参数优化。可以优化计数周期数、交易时间段、持仓比例等参数,拟合不同市场条件。

-

增加风控机制。加入移动止损、仓位控制等更丰富的风控手段,进一步限制风险。

-

回测积累数据。扩大回测样本量和时间跨度,测试参数稳定性。

动态趋势追踪反转策略通过实时比较高低点判断趋势方向和力度,使用JD Sequential指标的7计数规则产生交易信号,实现高频捕捉短期反转机会。相比传统JD策略,该策略做出了使用高低点判断、缩短计数周期、增加止损机制等改进,可以获得更及时的交易信号。

该策略主要优势是响应迅速,适合短线捕捉反转,同时也存在交易频繁、止损激进等风险。未来的优化方向包括参数调整、风控机制增强、多时间周期组合等。通过不断优化与迭代,该策略有望成为高效捕捉短期反转信号的有力工具。

||

The Dynamic Trend Tracking Reversal Strategy is a short-term quantitative trading strategy based on the JD Sequential indicator. By tracking price highs and lows in real-time, this strategy determines the current trend direction and momentum to efficiently capture market reversal points for entry and exit timing. Compared to traditional JD Sequential strategies, this strategy makes the following enhancements:

- Use price highs and lows instead of close prices to determine trends, which can capture price changes faster.

- The maximum counter number is 7 instead of 9, enabling faster trade signal generation.

- Add options for support/resistance lines and 5-count reversals as stop loss.

This strategy is suitable for short-term time frames such as 5-min and 15-min charts, which can effectively capture short-term price fluctuations and reversal opportunities.

The core logic of the Dynamic Trend Tracking Reversal Strategy is based on the JD Sequential indicator. By comparing the current period's high and low prices with those of the previous two periods, this indicator determines if successive higher highs or lower lows have occurred, and generates a sequential count from 1 to 7. When the count accumulates to 7, trading signals are generated.

Specifically, the following variables are defined in the strategy:

- sp_up: true when the current high price exceeds the high price 2 periods ago

- sp_dn: true when the current low price drops below the low price 2 periods ago

- sp_ct: the current count, increments by 1 each time sp_up or sp_dn is true, with a maximum of 7

- sp_com: true when count equals 7

- sp_usr: the mid-price at count 7 and sp_up, serving as upside resistance

- sp_dsr: the mid-price at count 7 and sp_dn, serving as downside support

The logic for trade signal generation is:

- Long signal: sp_com is true and sp_dn is true, indicating count completion and a downtrend

- Short signal: sp_com is true and sp_up is true, indicating count completion and an uptrend

The stop loss logic is:

- Long SL: count reversal to 5 (sp_up true) or price crossing above sp_usr

- Short SL: count reversal to 5 (sp_dn true) or price crossing below sp_dsr

By comparing highs/lows in real-time to determine trend direction and strength, alongside count-based timing for entry, this strategy can effectively capture short-term reversal opportunities. Stop loss lines are also configured to control risks.

Compared to traditional JD Sequential strategies, the Dynamic Trend Tracking Reversal Strategy has the following advantages:

- Faster signal generation. Using high/low comparison is faster than close prices in capturing trends, and a 7 count generates signals faster than 9 counts.

- Enhanced stop loss mechanism. The additions of 5-count reversals and support/resistance stop loss allows better risk control.

- Flexible configurations. Options to include stop loss and display partial counts add flexibility.

- Suitable for short-term trading. The high-frequency signals combined with proper stop loss fit short-term time frames well.

The key advantage of this strategy is its swift response, which can effectively capture large fluctuations caused by short-term events. Also, algorithmic signal generation and stop loss mechanization can reduce emotional interference from traders, improving consistency.

The Dynamic Trend Tracking Reversal Strategy also carries some risks:

- Increased trading costs from high frequency trading. More trades lead to higher commission fees and slippage costs.

- Prone to false signals. Comparing highs and lows in ranging markets may frequently trigger unwarranted trades and losses.

- Potentially aggressive stops. Hard stops are vulnerable to spikes and must be adjusted in a timely manner.

To mitigate the above risks, the strategy can be optimized in the following aspects:

- Reduce position sizing to lower capital usage per trade.

- Halt trading during choppy/ranging markets to avoid ineffective trades.

- Employ trailing stops or breakout stops to reduce chances of being trapped.

There is ample room for the Dynamic Trend Tracking Reversal Strategy to be further optimized, mainly in the following directions:

-

Multi-timeframe combinations. Determine the major trend direction on higher timeframes to avoid trading against it.

-

Combinations with other indicators. Incorporate volatility metrics, volume data etc. to improve signal quality.

-

Machine learning for additional validation. Utilize AI/ML algorithms as auxiliary judgment on trade signals to reduce erroneous trades.

-

Parameter tuning. Optimize parameters like count periods, trading sessions, position sizing etc. to fit different market conditions.

-

Expand risk control mechanisms. Introduce more sophisticated risk management techniques like adaptive stops, position sizing etc. to further restrict risks.

-

Strategy evaluation through backtesting. Expand sample sizes and timeframes for backtests to gauge parameter robustness.

The Dynamic Trend Tracking Reversal Strategy captures short-term reversal opportunities through real-time comparison of price highs and lows to determine trend direction and strength, alongside the 7-count rules within the JD Sequential indicator for trade timing. Compared to traditional JD strategies, this strategy makes enhancements like using highs/lows instead of close prices, shortened count periods, additional stop loss mechanisms etc., enabling faster signal generation.

The key strength of this strategy lies in its swift response suitable for short-term reversal trading. At the same time, risks like high trading frequencies and aggressive stops do exist. Future optimization directions include parameter tuning, enhancement of risk controls, multi-timeframe combinations etc. Through continual optimizations and iterations, this strategy has the potential to become a powerful tool for efficiently capturing short-term reversal signals.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Include S/R Crosses Into Stop Loss |

| v_input_2 | true | Show Count 1-4 |

Source (PineScript)

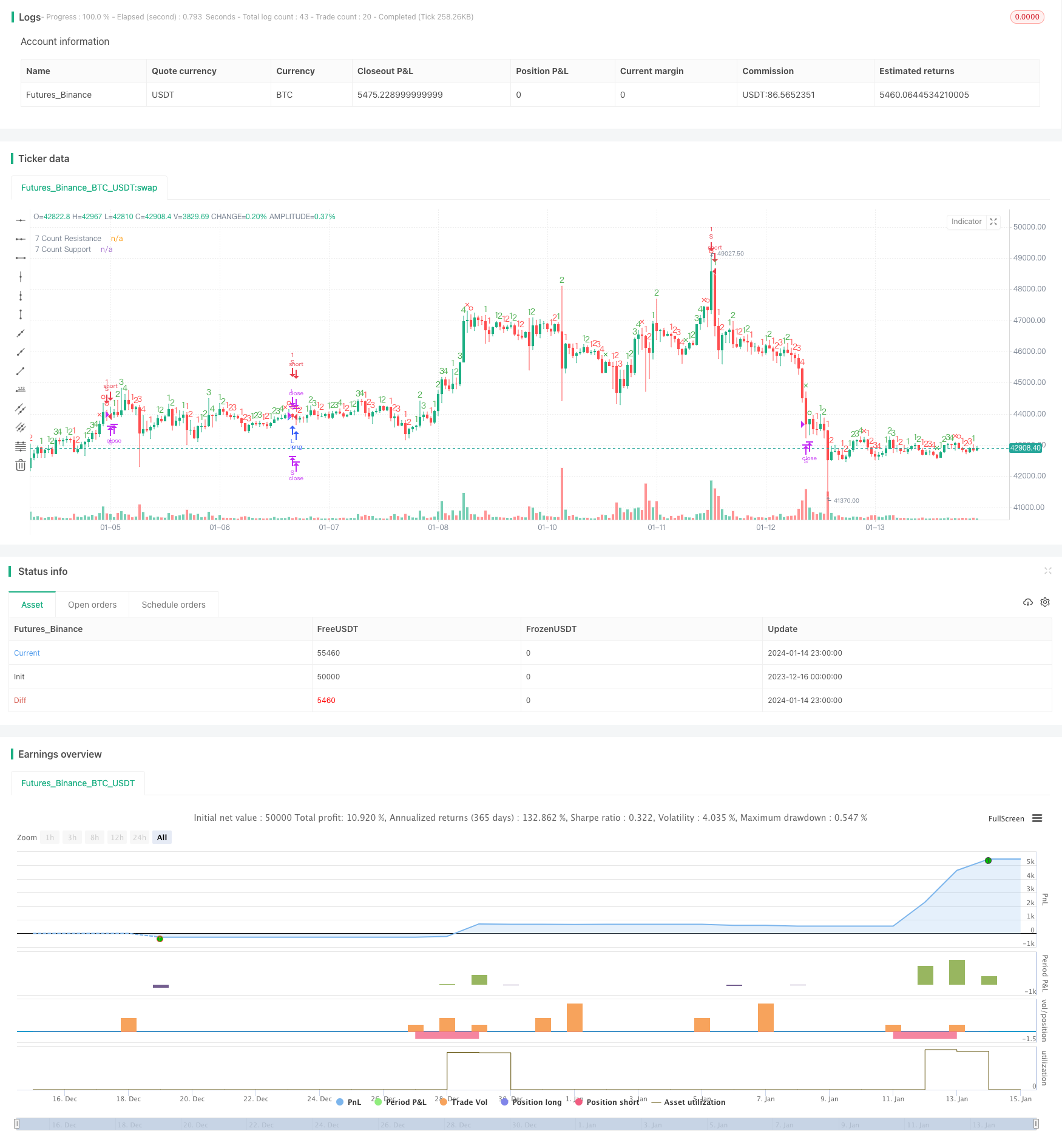

/*backtest

start: 2023-12-16 00:00:00

end: 2024-01-15 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @NeoButane 7 Dec. 2018

// JD Aggressive Sequential Setup

// Not based off official Tom DeMarke documentation. As such, I have named the indicator JD instead oF TD to reflect this, and as a joke.

//

// Difference vs. TD Sequential: faster trade exits and a unique entry. Made for low timeframes.

// - Highs or lows are compared instead of close.

// - Mirrors only the Setup aspect of TD Sequential (1-9, not to 13)

// - Count maxes out at 7 instead of 9. Also part of the joke if I'm going to be honest here

// v1 - Release - Made as a strategy, 7 count

// . S/R on 7 count

// .. Entry on 7 count

// ... Exit on 5 count or S/R cross

//@version=3

title = "JD Aggressive Sequential Setup"

vers = " 1.0 [NeoButane]"

total = title + vers

strategy(total, total, 1, 0)

xx = input(true, "Include S/R Crosses Into Stop Loss")

show_sp = input(true, "Show Count 1-4")

sp_ct = 0

inc_sp(x) => nz(x) == 7 ? 1 : nz(x) + 1

sp_up = high > high[2]

sp_dn = low < low[2]

sp_col = sp_up ? green : red

sp_comCol = sp_up ? red : green

sp_ct := sp_up ? (nz(sp_up[1]) and sp_col == sp_col[1] ? inc_sp(sp_ct[1]) : 1) : sp_dn ? (nz(sp_dn[1]) and sp_col == sp_col[1] ? inc_sp(sp_ct[1]) : 1) : na

sp_com = sp_ct == 7

sp_sr = valuewhen(sp_ct == 5, close, 0)

sp_usr = valuewhen(sp_ct == 7 and sp_up, sma(hlc3, 2), 0)

sp_usr := sp_usr <= sp_usr[1] * 1.0042 and sp_usr >= sp_usr[1] * 0.9958 ? sp_usr[1] : sp_usr

sp_dsr = valuewhen(sp_ct == 7 and sp_dn, sma(hlc3, 2), 0)

sp_dsr := sp_dsr <= sp_dsr[1] * 1.0042 and sp_dsr >= sp_dsr[1] * 0.9958 ? sp_dsr[1] : sp_dsr

locc = location.abovebar

plotchar(show_sp and sp_ct == 1, 'Setup: 1', '1', locc, sp_col, editable=false)

plotchar(show_sp and sp_ct == 2, 'Setup: 2', '2', locc, sp_col, editable=false)

plotchar(show_sp and sp_ct == 3, 'Setup: 3', '3', locc, sp_col, editable=false)

plotchar(show_sp and sp_ct == 4, 'Setup: 4', '4', locc, sp_col, editable=false)

plotshape(sp_ct == 5, 'Setup: 5', shape.xcross, locc, sp_comCol, 0, 0, '5', sp_col)

plotshape(sp_ct == 6, 'Setup: 6', shape.circle, locc, sp_comCol, 0, 0, '6', sp_col)

plotshape(sp_ct == 7, 'Setup: 7', shape.circle, locc, sp_comCol, 0, 0, '7', sp_col)

// plot(sp_sr, "5 Count Support/Resistance", gray, 2, 6)

plot(sp_usr, "7 Count Resistance", maroon, 2, 6)

plot(sp_dsr, "7 Count Support", green, 2, 6)

long = (sp_com and sp_dn)

short = (sp_com and sp_up)

sl_l = xx ? crossunder(close, sp_dsr) or (sp_ct == 5 and sp_up) or short : (sp_ct == 5 and sp_up) or short

sl_s = xx ? crossover(close, sp_usr) or (sp_ct == 5 and sp_dn) or long : (sp_ct == 5 and sp_dn) or long

strategy.entry('L', 1, when = long)

strategy.close('L', when = sl_l)

strategy.entry('S', 0, when = short)

strategy.close('S', when = sl_s)

Detail

https://www.fmz.com/strategy/438948

Last Modified

2024-01-16 15:35:18