Name

价格震荡辅助判断三因子模型Three-Factors-Model-for-Price-Oscillation-Detection

Author

ChaoZhang

Strategy Description

价格震荡辅助判断三因子模型是一个融合多因子判断的短线交易策略。该策略综合考虑成交量比、RSI指标、MACD指标、信号线指标的多因子判断,对价格震荡行为进行判断,以发现短线交易机会。

该策略的核心逻辑是:

-

计算快速移动平均线、慢速移动平均线、MACD曲线、信号线等技术指标;

-

判断成交量买卖比例、RSI指标、MACD指标、信号线指标的多因子条件;

-

综合多因子判断,确认当前为价格震荡阶段,出现买卖机会;

-

进入LONG或SHORT头寸,设置止盈止损;

-

当价格达到止盈或止损条件时,平仓头寸。

该策略灵活运用成交量比、RSI指标、MACD指标、信号线指标等多因子判断,对价格震荡行为进行判断,以捕捉短线交易机会。多因子组合判断可避免单一因子造成的错误信号,提高信号准确性。

该策略具有以下优势:

- 多因子判断,提高信号准确性,避免错误信号;

- 利用价格震荡特性,捕捉短线交易机会,获利空间大;

- 自动设置止盈止损,控制风险;

- 简单明了的交易逻辑,容易实施。

该策略也存在以下风险:

- 算法过于依赖历史数据,对市场变化敏感;

- 多因子组合方式可能还需进一步优化,存在误判的可能;

- 止损点设定合理与否直接影响策略稳定性。

针对以上风险,可从以下方面进行优化:

- 加大数据采样周期,降低市场数据变化的影响;

- 调整多因子权重,实现自适应优化;

- 测试不同的止损点,找到最佳止损位置。

该策略主要可从以下几个方面进行优化:

-

优化多因子权重,实现动态调整。可以根据不同行情对多因子判断进行权重调整,提高适应性;

-

结合机器学习算法,实现多因子的自适应优化。运用神经网络、遗传算法等算法训练多因子模型,实现参数自主优化;

-

优化止损策略。可以测试不同的跟踪止损、移动止损组合,找到最佳止损方案;

-

结合高级技术指标。可测试像波动率摆动、动量震荡等更多指标,丰富多因子组合。

《价格震荡辅助判断三因子模型》策略充分利用价格震荡区间的多因子特征,实现高效的短线交易策略。该策略运用成交量、RSI、MACD、信号线等多因子判断,确定最佳的买卖时机。多因子判断增强信号准确率,有利于获取稳定收益。后续可通过机器学习算法实现多因子自适应优化,从而获得更加卓越的策略表现。

||

The Three Factors Model for Price Oscillation Detection is a short-term trading strategy that integrates multiple factors for judgment. This strategy takes into account factors like volume ratio, RSI, MACD, and signal line to detect price oscillations and discover short-term trading opportunities.

The core logic of this strategy is:

-

Calculate technical indicators like fast MA, slow MA, MACD, and signal line;

-

Judge multiple factor conditions including volume ratio, RSI, MACD and signal line;

-

Confirm the current price oscillation stage and buy/sell opportunities based on multiple factors analysis;

-

Take LONG or SHORT positions and set take profit and stop loss;

-

Close positions when price reaches take profit or stop loss.

This strategy flexibly uses factors like volume ratio, RSI, MACD and signal line to detect price oscillations and capture short-term opportunities. The combination of multiple factors helps avoid false signals from a single factor and improves accuracy.

The advantages of this strategy:

- Multiple factors improve accuracy and avoid false signals;

- Capture short-term opportunities from price oscillations with large profit room;

- Automatically set take profit and stop loss to control risks;

- Simple and clear logic, easy to implement.

The risks of this strategy:

- Algorithm relies too much on historical data, sensitive to market changes;

- The combination approach of multiple factors may need further optimization, with possibility of misjudgment;

- The stop loss point directly affects the stability of the strategy.

To address the above risks, optimizations can be made in:

- Expand sample cycle to reduce impact from market data changes;

- Adjust weights between factors to achieve adaptive optimization;

- Test different stop loss points to find the optimal position.

The main optimization directions:

-

Optimize factor weights dynamically. Weights can be adjusted based on market conditions to improve adaptiveness;

-

Introduce machine learning algorithms to achieve adaptive optimization of factors. Algorithms like neural networks and genetic algorithms can be used to train the model and optimize parameters;

-

Optimize stop loss strategies. Different combinations of tracking stop loss and moving stop loss can be tested to find the best solution;

-

Incorporate advanced technical indicators. More indicators like volatility swing and momentum oscillation can enrich the factors.

The Three Factors Model for Price Oscillation Detection fully utilizes the characteristics of price oscillations to implement an efficient short-term trading strategy. It judges the best entry and exit points based on multiple factors like volume, RSI, MACD and signal line. The multiple factors enhance accuracy and lead to steady returns. Further optimizations can be done through machine learning for adaptive optimization, resulting in even better strategy performance. [/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 0.26 | Signal Bias |

| v_input_2 | 0.7 | MACD Bias |

| v_input_3 | 3 | Short LookBack |

| v_input_4 | 6 | Long LookBack |

| v_input_5 | 2 | Take Profit |

| v_input_6 | 0.7 | Stop Loss |

Source (PineScript)

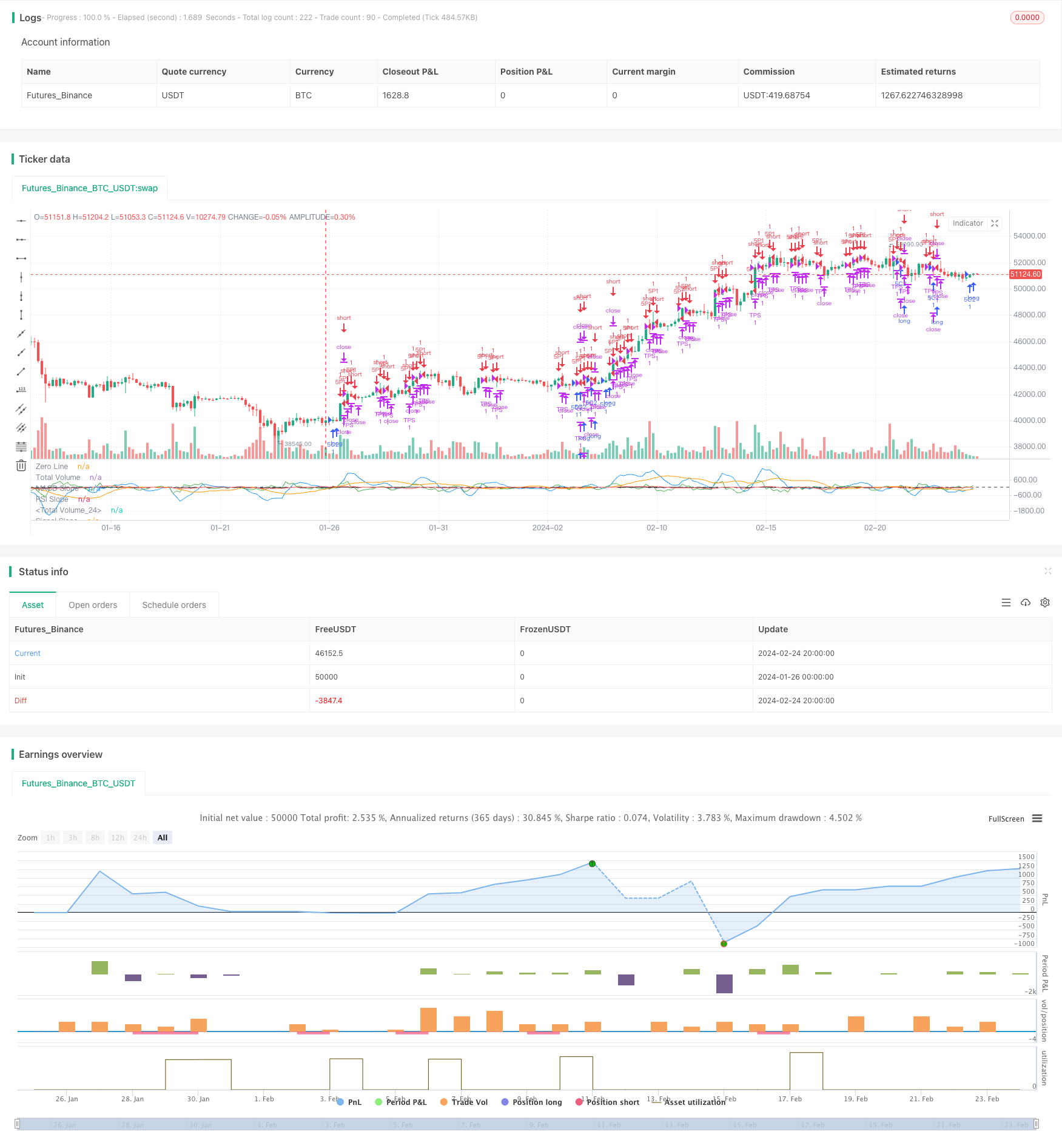

/*backtest

start: 2024-01-26 00:00:00

end: 2024-02-25 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("3 10.0 Oscillator Profile Flagging", shorttitle="3 10.0 Oscillator Profile Flagging", overlay=false)

signalBiasValue = input(title="Signal Bias", defval=0.26)

macdBiasValue = input(title="MACD Bias", defval=0.7)

shortLookBack = input( title="Short LookBack", defval=3)

longLookBack = input( title="Long LookBack", defval=6)

takeProfit = input( title="Take Profit", defval=2)

stopLoss = input( title="Stop Loss", defval=0.7)

fast_ma = ta.sma(close, 3)

slow_ma = ta.sma(close, 10)

macd = fast_ma - slow_ma

signal = ta.sma(macd, 16)

hline(0, "Zero Line", color = color.black)

buyVolume = volume*((close-low)/(high-low))

sellVolume = volume*((high-close)/(high-low))

buyVolSlope = buyVolume - buyVolume[1]

sellVolSlope = sellVolume - sellVolume[1]

signalSlope = ( signal - signal[1] )

macdSlope = ( macd - macd[1] )

plot(macd, color=color.blue, title="Total Volume")

plot(signal, color=color.orange, title="Total Volume")

plot(macdSlope, color=color.green, title="MACD Slope")

plot(signalSlope, color=color.red, title="Signal Slope")

intrabarRange = high - low

rsi = ta.rsi(close, 14)

rsiSlope = rsi - rsi[1]

plot(rsiSlope, color=color.black, title="RSI Slope")

getRSISlopeChange(lookBack) =>

j = 0

for i = 0 to lookBack

if ( rsi[i] - rsi[ i + 1 ] ) > -5

j += 1

j

getBuyerVolBias(lookBack) =>

j = 0

for i = 1 to lookBack

if buyVolume[i] > sellVolume[i]

j += 1

j

getSellerVolBias(lookBack) =>

j = 0

for i = 1 to lookBack

if sellVolume[i] > buyVolume[i]

j += 1

j

getVolBias(lookBack) =>

float b = 0.0

float s = 0.0

for i = 1 to lookBack

b += buyVolume[i]

s += sellVolume[i]

b > s

getSignalBuyerBias(lookBack) =>

j = 0

for i = 1 to lookBack

if signal[i] > signalBiasValue

j += 1

j

getSignalSellerBias(lookBack) =>

j = 0

for i = 1 to lookBack

if signal[i] < ( 0.0 - signalBiasValue )

j += 1

j

getSignalNoBias(lookBack) =>

j = 0

for i = 1 to lookBack

if signal[i] < signalBiasValue and signal[i] > ( 0.0 - signalBiasValue )

j += 1

j

getPriceRising(lookBack) =>

j = 0

for i = 1 to lookBack

if close[i] > close[i + 1]

j += 1

j

getPriceFalling(lookBack) =>

j = 0

for i = 1 to lookBack

if close[i] < close[i + 1]

j += 1

j

getRangeNarrowing(lookBack) =>

j = 0

for i = 1 to lookBack

if intrabarRange[i] < intrabarRange[i + 1]

j+= 1

j

getRangeBroadening(lookBack) =>

j = 0

for i = 1 to lookBack

if intrabarRange[i] > intrabarRange[i + 1]

j+= 1

j

bool isNegativeSignalReversal = signalSlope < 0.0 and signalSlope[1] > 0.0

bool isNegativeMacdReversal = macdSlope < 0.0 and macdSlope[1] > 0.0

bool isPositiveSignalReversal = signalSlope > 0.0 and signalSlope[1] < 0.0

bool isPositiveMacdReversal = macdSlope > 0.0 and macdSlope[1] < 0.0

bool hasBearInversion = signalSlope > 0.0 and macdSlope < 0.0

bool hasBullInversion = signalSlope < 0.0 and macdSlope > 0.0

bool hasSignalBias = math.abs(signal) >= signalBiasValue

bool hasNoSignalBias = signal < signalBiasValue and signal > ( 0.0 - signalBiasValue )

bool hasSignalBuyerBias = hasSignalBias and signal > 0.0

bool hasSignalSellerBias = hasSignalBias and signal < 0.0

bool hasPositiveMACDBias = macd > macdBiasValue

bool hasNegativeMACDBias = macd < ( 0.0 - macdBiasValue )

bool hasBullAntiPattern = ta.crossunder(macd, signal)

bool hasBearAntiPattern = ta.crossover(macd, signal)

bool hasSignificantBuyerVolBias = buyVolume > ( sellVolume * 1.5 )

bool hasSignificantSellerVolBias = sellVolume > ( buyVolume * 1.5 )

// 202.30 Profit 55.29% 5m

if ( ( getVolBias(longLookBack) == false ) and rsi <= 41 and math.abs(rsi - rsi[shortLookBack]) > 1 and hasNoSignalBias and rsiSlope > 1.5 and close > open)

strategy.entry("5C1", strategy.long, qty=1.0)

strategy.exit("TPS", "5C1", limit=strategy.position_avg_price + takeProfit, stop=strategy.position_avg_price - stopLoss)

// 171.70 Profit 50.22% 5m

if ( getVolBias(longLookBack) == true and rsi > 45 and rsi < 55 and macdSlope > 0 and signalSlope > 0)

strategy.entry("5C2", strategy.long, qty=1.0)

strategy.exit("TPS", "5C2", limit=strategy.position_avg_price + takeProfit, stop=strategy.position_avg_price - stopLoss)

// 309.50 Profit 30.8% 5m 2 tp .7 sl 289 trades

if ( macd > macdBiasValue and macdSlope > 0)

strategy.entry("5P1", strategy.short, qty=1.0)

strategy.exit("TPS", "5P1", limit=strategy.position_avg_price - takeProfit, stop=strategy.position_avg_price + stopLoss)

Detail

https://www.fmz.com/strategy/442853

Last Modified

2024-02-26 15:32:27