Name

三重确认趋势追踪策略Triple-Confirmation-Trend-Tracking-Strategy

Author

ChaoZhang

Strategy Description

三重确认趋势追踪策略通过组合使用均线、意忆线和超级趋势等三大指标的信号,实现对趋势的高概率捕捉。当三大指标同时发出买入或卖出信号时,策略会及时入场,追踪趋势;当趋势反转时,策略会快速止损、反手做空。

策略使用长度为52周期的均线判断主趋势方向。当价格上穿均线时,判断为上升趋势;当价格下穿均线时,判断为下降趋势。

策略同时使用意忘线来识别短期的次级反转。意忘线的计算方式与均线类似,但CLOSE价用开盘价替代,能更快速地反映价格反转信息。当价格上穿下跌的意忘线时,预示着Prices短线企稳反弹的信号;当价格下穿上升的意忘线时,预示着价格短线回落的信号。

策略还同时结合超级趋势指标判断关键的反转点。超级趋势指标结合ATR指标的窗口期和价格 datos,动态调整通道上下轨,从而判断反转的时机。

当均线、意忘线、超级趋势三个指标同时发出买入信号时,策略才会做多;当三个指标同时发出卖出信号时,策略才会做空。通过三重指标确认,可有效过滤假信号,提高入场的概率。

策略通过组合均线、意忘线、超级趋势三个指标,从不同维度判断趋势和关键点,确保高概率入场。

意忘线的引入,保证了策略可以快速反应价格的短线反转;ATR自适应通道的超级趋势指标,也可实时跟踪价格变化。

策略内置自动止盈止损逻辑,可根据ATR动态调整止盈止损点,有效控制单笔亏损。

由于策略交易信号频繁,容易造成过度交易。可适当调大均线周期参数,减少交易频率。

意忘线和超级趋势指标判断反转点的效果并不确定,可能出现误判风险。可增加指标参数的过滤条件,确保更高概率的反转信号。

震荡行情中,由于反复交叉,策略会频繁开仓又止损,造成亏损风险。可识别震荡行情,在此阶段暂停策略交易。

可考虑结合波动率类指标,比如布林带。当价格接近布林带上下轨时,避免新开仓,可有效规避震荡市的风险。

可尝试增加其他辅助判断指标,如KDJ、MACD等,当它们也同时发出信号时,才入场。这可进一步过滤假信号,减少不必要的交易。

可优化止盈止损策略,比如移动止盈、指数移动止盈、半仓间隔止盈等方式,使盈利更多更稳定。

三重确认趋势追踪策略充分利用均线、意忘线、超级趋势三大指标的优势,实现对趋势的高概率判断和捕捉。同时设置自动止盈止损机制有效控制单笔亏损。值得进一步优化的是,可结合其他辅助指标过滤入场,以及改进止盈止损策略,使策略更实用。

||

The Triple Confirmation Trend Tracking strategy captures trend signals with high probability by combining signals from three major indicators - Moving Average, Heiken Ashi and Supertrend. When all three indicators give buy or sell signals simultaneously, the strategy will enter trades timely to track trends. When trend reverses, the strategy will quickly stop loss and even open reverse positions.

The strategy uses a Moving Average of 52 periods to determine the main trend direction. When price crosses above MA, it indicates an upward trend. When price crosses below MA, it indicates a downward trend.

The strategy also uses Heiken Ashi to identify secondary short-term reversals. Heiken Ashi is calculated similarly to Moving Average but with open prices instead of close prices, thus able to reflect reversal signals faster. When price crosses above a falling Heiken Ashi line, it signals stabilizing rebound. When price crosses below a rising Heiken Ashi line, it signals short-term pullback.

Additionally, the strategy incorporates Supertrend indicator to spot key reversal points. Supertrend combines ATR and price data to dynamically adjust upper/lower channel bands and hence effectively judge reversals.

Only when signs of all three indicators line up, the strategy will go long. When all three give sell signals, the strategy will open short positions. The triple confirmation mechanism filters out false signals substantially and ensures high-probability setups.

The combinted signals of Moving Average, Heiken Ashi and Supertren from different dimensions ensure high-probability entry.

The introduction of Heiken Ashi ensures fast response to short-term reversals. The adaptive Supertrend channel also tracks price changes timely.

The inbuilt auto profit-taking and stop-loss mechanism dynamically adjusts profit/loss levels based on ATR, effectively capping losses per trade.

The abundance of trading signals may incur over-trading. Moderately increasing the MA period helps to limit trade frequency.

Heiken Ashi and Supertrend may falsely identiy key reversals. Additional filter conditions on indicator parameters can enhance reversal reliability.

In raging markets, repetitive crossover signals may trigger frequent opening and stop loss of positions, causing losses. Recognizing and sidelining ranging mode will avoid such losses.

Volatility indicators like Bollinger Bands could help avoid opening new trades when price stretches near the bands. This effectively prevents whipsaw loss risks.

Extra auxiliary indicators like KDJ and MACD can provide additional layers of confirmation signals, allowing only qualified setups to pass through. This further screens out false signals.

The profit-taking mechanism can be upgraded in various ways, like trail stop, exponential trail stop, partial exit at interval etc., to harvest profit as much as possible in a steady manner.

The Triple Confirmation Trend Tracking Strategy fully leverages the strengths of Moving Average, Heiken Ashi and Supertrend to determine trend signals with high accuracy. The embedded automated profit-taking and stop-loss mechanism also effectively limits per trade loss. Potential areas for further enhancements include incorporating other filters before entry, as well as innovating the profit-taking techniques, in order to make the strategy more practical.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_string_1 | 0 | MA Type: EMA |

| v_input_int_1 | 52 | MA Period (Length) |

| v_input_int_2 | 10 | MA Period smoothing (Length) |

| v_input_1 | #26A69A | Positive color (Bullish) |

| v_input_2 | #EF5350 | Negative color (Bearish) |

| v_input_3 | #808080 | High & Low cloud color |

| v_input_4 | false | Show (lines) |

| v_input_5 | true | Show (High & Low cloud) |

| v_input_6 | true | Show (Open & Close cloud) |

| v_input_7 | 9 | ATR Period |

| v_input_8_hl2 | 0 | Source: hl2 |

| v_input_float_1 | 3.9 | ATR Multiplier |

| v_input_9 | true | Change ATR Calculation Method ? |

| v_input_10 | true | Show Buy/Sell Signals ? |

| v_input_11 | true | Highlighter On/Off ? |

| v_input_12 | 6 | RSI Length |

| v_input_13 | 5 | RSI Smoothing |

| v_input_14 | 3 | Fast QQE Factor |

| v_input_15 | 3 | Thresh-hold |

| v_input_16_close | 0 | RSI Source: close |

| v_input_int_3 | 50 | Bollinger Length |

| v_input_float_2 | 0.35 | BB Multiplier |

| v_input_17 | 6 | RSI Length |

| v_input_18 | 5 | RSI Smoothing |

| v_input_19 | 1.61 | Fast QQE2 Factor |

| v_input_20 | 3 | Thresh-hold |

| v_input_21_close | 0 | RSI Source: close |

| v_input_22 | 0916-1200 | time for reversals!! |

| v_input_float_3 | true | enter the reward..def is 3 |

| v_input_bool_1 | false | daybreak ? true means day end close |

| v_input_bool_2 | true | do u want time for reversal? |

| v_input_int_4 | 2 | train(0) test(1) all(2)? |

Source (PineScript)

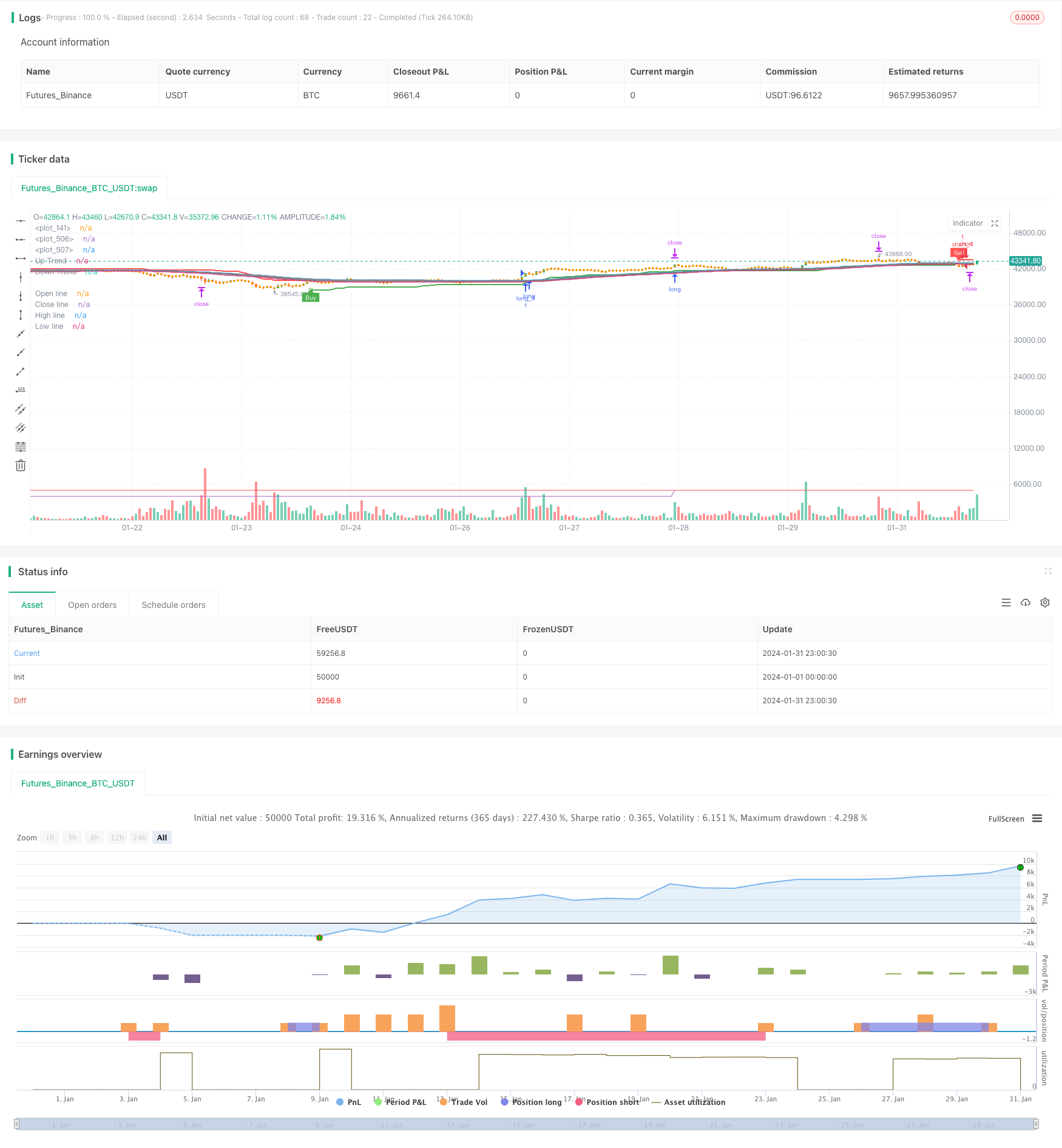

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//custom variables

hei_col = 0 //1 for green 0 for red

qqe_col = 0 //1 for blue 0 for red

supa_col = 0 //1 for buy 0 for sell

float upratr=0

float lwratr=0

//end

strategy(title='Death_star', overlay=true,calc_on_every_tick = true)

ma_type = input.string(title='MA Type', defval='EMA', options=['EMA', 'SMA', 'SWMA', 'VWMA', 'WMA'])

ma_period = input.int(title='MA Period (Length)', defval=52, minval=1)

ma_period_smoothing = input.int(title='MA Period smoothing (Length)', defval=10, minval=1)

color_positive = input(title='Positive color (Bullish)', defval=color.new(#26A69A, 50))

color_negative = input(title='Negative color (Bearish)', defval=color.new(#EF5350, 50))

color_hl = input(title='High & Low cloud color', defval=color.new(#808080, 80))

show_line = input(title='Show (lines)', defval=false)

show_hl_cloud = input(title='Show (High & Low cloud)', defval=true)

show_oc_cloud = input(title='Show (Open & Close cloud)', defval=true)

//————————————————————————————————————————————————————————————————————————————————

// I.2. Settings, Function definition — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

f_ma_type(input_ma_type, input_source, input_ma_period) =>

result = float(na)

if input_ma_type == 'EMA'

result := ta.ema(input_source, input_ma_period)

result

if input_ma_type == 'SMA'

result := ta.sma(input_source, input_ma_period)

result

if input_ma_type == 'SWMA'

result := ta.swma(input_source)

result

if input_ma_type == 'VWMA'

result := ta.vwma(input_source, input_ma_period)

result

if input_ma_type == 'WMA'

result := ta.wma(input_source, input_ma_period)

result

result

//————————————————————————————————————————————————————————————————————————————————

// II.1. Calculations, MA — — — — — — — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

o = f_ma_type(ma_type, open, ma_period)

c = f_ma_type(ma_type, close, ma_period)

h = f_ma_type(ma_type, high, ma_period)

l = f_ma_type(ma_type, low, ma_period)

//————————————————————————————————————————————————————————————————————————————————

// II.2. Calculations, Heikin Ashi — — — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

ha = ticker.heikinashi(syminfo.tickerid)

ha_o = request.security(ha, timeframe.period, o)

ha_c = request.security(ha, timeframe.period, c)

ha_h = request.security(ha, timeframe.period, h)

ha_l = request.security(ha, timeframe.period, l)

//————————————————————————————————————————————————————————————————————————————————

// II.3. Calculations, MA (Smoothing) — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

ha_o_smooth = f_ma_type(ma_type, ha_o, ma_period_smoothing)

ha_c_smooth = f_ma_type(ma_type, ha_c, ma_period_smoothing)

ha_h_smooth = f_ma_type(ma_type, ha_h, ma_period_smoothing)

ha_l_smooth = f_ma_type(ma_type, ha_l, ma_period_smoothing)

//————————————————————————————————————————————————————————————————————————————————

// III.1. Display, Colors — — — — — — — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

tren = ha_c_smooth >= ha_o_smooth

color_trend = tren ? color_positive : color_negative

hei_col := tren ? 1 : 0

color_show_line_positive = show_line ? color_positive : na

color_show_line_negative = show_line ? color_negative : na

color_show_hl_cloud = show_hl_cloud ? color_hl : na

color_show_oc_cloud = show_oc_cloud ? color_trend : na

//————————————————————————————————————————————————————————————————————————————————

// III.2. Display, Plotting & Filling — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

o_line = plot(ha_o_smooth, color=color_show_line_positive, title='Open line')

c_line = plot(ha_c_smooth, color=color_show_line_negative, title='Close line')

h_line = plot(ha_h_smooth, color=color_show_line_positive, title='High line')

l_line = plot(ha_l_smooth, color=color_show_line_negative, title='Low line')

fill(o_line, c_line, color=color_show_oc_cloud, title='Open & Close Trendcloud', transp=90)

fill(h_line, l_line, color=color_show_hl_cloud, title='High & Low Trendcloud', transp=90)

upratr:=(ha_h_smooth)

lwratr:=(ha_l_smooth)

// supa

Periods = input(title='ATR Period', defval=9)

src = input(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3.9)

changeATR = input(title='Change ATR Calculation Method ?', defval=true)

showsignals = input(title='Show Buy/Sell Signals ?', defval=true)

highlighting = input(title='Highlighter On/Off ?', defval=true)

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

plotshape(buySignal and showsignals ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

plotshape(sellSignal and showsignals ? dn : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? trend == 1 ? color.green : color.white : color.white

shortFillColor = highlighting ? trend == -1 ? color.red : color.white : color.white

supa_col := trend == 1 ? 1 : 0

fill(mPlot, upPlot, title='UpTrend Highligter', color=longFillColor, transp=90)

fill(mPlot, dnPlot, title='DownTrend Highligter', color=shortFillColor, transp=90)

alertcondition(buySignal, title='SuperTrend Buy', message='SuperTrend Buy!')

alertcondition(sellSignal, title='SuperTrend Sell', message='SuperTrend Sell!')

changeCond = trend != trend[1]

alertcondition(changeCond, title='SuperTrend Direction Change', message='SuperTrend has changed direction!')

//QQE

//By Glaz, Modified

//study("QQE MOD")

RSI_Period = input(6, title='RSI Length')

SF = input(5, title='RSI Smoothing')

QQE = input(3, title='Fast QQE Factor')

ThreshHold = input(3, title='Thresh-hold')

//

srctt = input(close, title='RSI Source')

//

//

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(srctt, RSI_Period)

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trenda = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trenda := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trenda[1], 1)

FastAtrRsiTL = trenda == 1 ? longband : shortband

////////////////////

length = input.int(50, minval=1, title='Bollinger Length')

mult = input.float(0.35, minval=0.001, maxval=5, step=0.1, title='BB Multiplier')

basis = ta.sma(FastAtrRsiTL - 50, length)

dev = mult * ta.stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

//

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

//

//Zero = hline(0, color=color.rgb(116, 26, 26), linestyle=hline.style_dotted, linewidth=1)

////////////////////////////////////////////////////////////////

RSI_Period2 = input(6, title='RSI Length')

SF2 = input(5, title='RSI Smoothing')

QQE2 = input(1.61, title='Fast QQE2 Factor')

ThreshHold2 = input(3, title='Thresh-hold')

src2 = input(close, title='RSI Source')

//

//

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = ta.rsi(src2, RSI_Period2)

RsiMa2 = ta.ema(Rsi2, SF2)

AtrRsi2 = math.abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ta.ema(AtrRsi2, Wilders_Period2)

dar2 = ta.ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ? math.max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ? math.min(shortband2[1], newshortband2) : newshortband2

cross_2 = ta.cross(longband2[1], RSIndex2)

trend2 := ta.cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

//

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

//

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver : RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

// plot(FastAtrRsi2TL - 50, title='QQE Line', color=color.new(color.white, 0), linewidth=2)

// plot(RsiMa2 - 50, color=hcolor2, title='Histo2', style=plot.style_columns, transp=50)

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

// plot(Greenbar1 and Greenbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Up', style=plot.style_columns, color=color.new(#00c3ff, 0))

// plot(Redbar1 and Redbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Down', style=plot.style_columns, color=color.new(#ff0062, 0))

qqe_col:=Greenbar1 and Greenbar2 == 1 ?1:(Redbar1 and Redbar2 == 1 ?0:-1)

//lab=label.new(bar_index,50,str.tostring(qqe_col))

// ////////////////////////////////////////////////////////////////

// //custom code

// ////////////////////////////////////////////////////////////////

// sma=((lhitt+shitt)/cnt)

// plot(sma*1000)

// plot(250,color=color.red)

//begin

sess=input("0916-1200","time for reversals!!")

v=time(timeframe.period,sess)

rr=input.float(1,"enter the reward..def is 3")

on=na(v)?false:true

bool daybreak=input.bool(false,"daybreak ? true means day end close")

bool apply_on=input.bool(true,"do u want time for reversal?")

apply_on:=not apply_on

test=input.int(2,"train(0) test(1) all(2)?")

// if str.tonumber(timeframe.period)!=5

// runtime.error("backtests and stocks only valid for 5 min tf!!")

on:=apply_on or on

pts=1/syminfo.mintick

var float sl=0

var float profit=0

// var dud=0

// var counter=0

var con_win=0

var con_lose=0

var tempwin=0

var templose=0

//adding analytics variables

var float[] stararr=array.new_float(10,-1)

var float[] sslarr=array.new_float(10,-1)

var float skipper=-1

var float[] ltararr=array.new_float(10,-1)

var float[] lslarr=array.new_float(10,-1)

var float lhit=0

var float shit=0

var float miss=0

var float cnt=0

var lflag=0

var sflag=0

var i=0

var dud=0

var gap=0

float begin=0

float end=0

// ei_col = 0 //1 for green 0 for red

// qqe_col = 0 //1 for blue 0 for red

// supa_col = 0

//plot(i)

//code begins here

if test==0

begin:=0

end:=5500/2

else if test==1

begin:=5500/2

end:=bar_index

else if test==2

begin:=0

end:=bar_index

if hei_col==1 and qqe_col==1 and supa_col==1 and lflag==0 and low>upratr and bar_index>=begin and bar_index<=end and on

lflag:=1

sflag:=0

if array.get(lslarr,i)!=-1

dud:=dud+1

array.set(lslarr,i,upratr)

array.set(ltararr,i,(close+rr*(close-upratr)))

cnt:=cnt+1

skipper:=i

// lab=label.new(bar_index,close+100,str.tostring(array.get(lslarr,i)) +"\n"+ str.tostring(array.get(ltararr,i)) +"\n"+str.tostring(i))

i:=(i+1)%9

strategy.order("long_"+str.tostring(i-1),strategy.long,1)

strategy.order("sl_l"+str.tostring(i-1),strategy.short,stop=upratr,oca_name = "exit"+str.tostring(i-1))

strategy.order("target_l"+str.tostring(i-1),strategy.short,limit=((close+rr*(close-upratr))),oca_name = "exit"+str.tostring(i-1))

if hei_col==0 and qqe_col==0 and supa_col==0 and sflag==0 and high<lwratr and bar_index>=begin and bar_index<=end and on

sflag:=1

lflag:=0

if array.get(sslarr,i)!=-1

dud:=dud+1

array.set(sslarr,i,lwratr)

array.set(stararr,i,(close-rr*(lwratr-close)))

skipper:=i

// lab=label.new(bar_index,close+100,str.tostring(array.get(sslarr,i)) +"\n"+ str.tostring(array.get(stararr,i)) +"\n"+str.tostring(i))

i:=(i+1)%9

cnt:=cnt+1

strategy.order("short_"+str.tostring(i-1),strategy.short,1)

strategy.order("sl_s"+str.tostring(i-1),strategy.long,stop=lwratr,oca_name = "exit"+str.tostring(i-1))

strategy.order("target_s"+str.tostring(i-1),strategy.long,limit=((close-rr*(lwratr-close))),oca_name = "exit"+str.tostring(i-1))

for j=0 to 9

if array.get(lslarr,j)!=-1 and j!=skipper

if low < array.get(lslarr,j) and array.get(lslarr,j)!=-1// and open>array.get(lslarr,j)

miss:=miss+1

array.set(ltararr,j,-1)

array.set(lslarr,j,-1)

else if high > array.get(ltararr,j) and array.get(lslarr,j)!=-1 //and open<array.get(ltararr,j)

lhit:=lhit+1

array.set(ltararr,j,-1)

array.set(lslarr,j,-1)

if array.get(sslarr,j)!=-1 and j!=skipper

if high > array.get(sslarr,j) and array.get(sslarr,j)!=-1 //and open<array.get(sslarr,j)

miss:=miss+1

array.set(stararr,j,-1)

array.set(sslarr,j,-1)

else if low < array.get(stararr,j) and array.get(sslarr,j)!=-1 //and open>array.get(stararr,j)

shit:=shit+1

array.set(stararr,j,-1)

array.set(sslarr,j,-1)

skipper:=-1

var day_miss=0

string ender=""

if (timeframe.period)=="1"

ender:="1528-1529"

else if (timeframe.period)=="5"

ender:="1520-1525"

else if (timeframe.period)=="15"

ender:="1500-1515"

else if (timeframe.period)=="60"

ender:="1330-1430"

else

//runtime.error("not accounted tf!!")

daybreak:=false

if time(timeframe.period,ender) and daybreak

if strategy.position_size!=0

day_miss+=1

strategy.cancel_all()

strategy.close_all("day_end_close")

for k=0 to (array.size(stararr)==0?na:(array.size(stararr)-1))

array.set(stararr,k,-1)

array.set(sslarr,k,-1)

array.set(ltararr,k,-1)

array.set(lslarr,k,-1)

i:=0

if (lhit+shit)>(lhit[1]+shit[1])

tempwin:=tempwin+1

templose:=0

else if (miss)>(miss[1])

templose:=templose+1

tempwin:=0

if tempwin>con_win

con_win:=tempwin

if templose>con_lose

con_lose:=templose

// //*********************adding randomness indicator************

var float nhit=0,var float nphit=0

if cnt%10==0 and cnt>0

nhit:=(lhit+shit)-nphit

nphit:=(lhit+shit)

t=table.new(position.top_right,1,6,bgcolor = color.rgb(236, 172, 172))

table.cell(t,0,0,str.tostring(((lhit+shit)/cnt)*100))

table.cell(t,0,1,str.tostring(((lhit+shit)/(lhit+shit+miss))*100))

table.cell(t,0,2,"daymiss "+str.tostring(day_miss))

//table.cell(t,0,1,str.tostring(((lhit)/cnt)*100))

//table.cell(t,0,2,str.tostring(((shit)/cnt)*100))

table.cell(t,0,3,str.tostring(con_win))

// table.cell(t,0,4,str.tostring(gap))

table.cell(t,0,4,str.tostring(con_lose))

table.cell(t,0,5,str.tostring(cnt))

//plot(1000*cnt,color =color.rgb(105, 28, 28))

// // plot(40000+lhit+shit,color=strategy.closedtrades%10==0?color.green:color.white,style=plot.style_circles)

//plot(1000*(lhit+shit),color=color.green)

//plot(1000*miss,color=color.red)

// // hitrate=strategy.wintrades/strategy.closedtrades

// // plot(hitrate*100)

// // plot(strategy.wintrades)

//plot(nhit*10000)

//dud is overwritten trades whereas day_miss are the trades closed at days end

// sma=(lhit+shit)/(lhit+shit+miss)

// plot(sma*100000)

// plot(50000,color=color.red)

// plot(con_win*1000,color=color.green)

// plot(con_lose*1000,color=color.red)

var float[] dat=array.new_float(10,-1)

var dati=0

var float datp=0

if miss>miss[1]

for cd=0 to ((miss-miss[1])-1)

array.set(dat,dati,0)

dati:=(dati+1)%10

if (lhit+shit)>(lhit[1]+shit[1])

for cd=0 to ( ((lhit+shit)-(lhit[1]+shit[1])) -1)

array.set(dat,dati,1)

dati:=(dati+1)%10

if array.get(dat,9)!=-1

for cd=0 to 9

datp:=datp+array.get(dat,cd)

plot((datp/10)*10000)

plot(5000,color = color.red)

datp:=0

Detail

https://www.fmz.com/strategy/443134

Last Modified

2024-02-29 14:38:06